Category Archive: 4.) Marc to Market

Will What the Fed Says be More Important than What it Does?

Overview: The focus is squarely on the Federal Reserve today. There is nearly universal agreement that it will lift the target by 25 bp. The market is inclined to see the shift as a sign that the Fed is nearing the end of its tightening cycle, and sees, at most, one more quarter-point hike. Despite the Fed's warnings, including in the December FOMC minutes, about the premature easing of financial conditions, the market has done precisely that.

Read More »

Read More »

Position Adjustments at Month-End and Ahead of FOMC Outcome Lifts the Greeenback

Overview: A combination of month-end adjustments and

positioning ahead of the outcome of tomorrow's FOMC meeting has taken the shine

off equities and has helped lift the dollar. On the heels of yesterday's sharp

decline on Wall Street, several large markets in the Asia Pacific region,

including China's CSI 300, the Hang Seng, and both South Korea's Kospi and

Taiwan's Taiex fell by more than 1%. Although the eurozone eked out a small

expansion in Q4...

Read More »

Read More »

Anti-Climactic Return of China

Overview: The re-opening

of China's mainland market amid reports of strong activity during the holiday,

was relatively subdued. The CSI 300 rose less than 0.5% and the Shanghai

Composite eked out less than a 0.2% gain. The 0.5% gain in the yuan was largely

in line with the performance of the offshore yuan. Indeed, it seems like a bit

like "buy the rumor sell the fact" type of activity as Hong Kong's

Hang Seng tumbled 2.75%, to give back...

Read More »

Read More »

Week Ahead Alchemy: Can Powell Turn a Quarter-Point Move into a Hawkish Hike?

The new year is still

young, but the week ahead may be one of the most important weeks of

the year. The divergence that the market has been anticipating will

materialize. The Federal Reserve will most likely hike by 25 bp on Wednesday,

followed by half-point moves by the European Central Bank and the Bank of

England the following day. On Friday, February 3, the US will report its

January employment situation. It could be the slowest job creation...

Read More »

Read More »

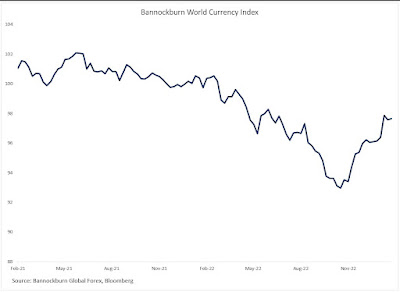

Bannockburn World Currency Index Recoups 50% of Loss since June 2021 High, with Golden Cross

The Bannockburn’s World Currency Index (BWCI) is a

GDP-weighted currency basket representing the currencies of the top 12

economies, with the eurozone counted as one.

The US is the world’s largest economy and the dollar’s share

of the index is almost 31%. China is the second-largest economy and has a

nearly 22% weight.

The euro is next with a 19% weight, followed by Japan with

about a 7.5% weight. After that, the weights drop off to less than 5%...

Read More »

Read More »

Subdued Ending to a Quiet Week, Ahead of Next Week’s Fireworks

Overview: Leaving aside the Australian dollar, which

is benefiting from the optimism over China's re-opening and a reassessment of

the trajectory of monetary policy after a stronger than expected inflation

report, the other G10 currencies traded quietly this week and are +/- less than

0.5%. The risk-on honeymoon to start the year remains intact. The MSCI Asia

Pacific Index has risen every day this week and index of mainland shares that

trade in...

Read More »

Read More »

Euro Closed above $1.09 but Follow-Through Buying Limited

Overview: After

some intraday penetration, the euro finally settled above $1.09 yesterday. However,

follow-through buying has been limited and technical and option-related

resistance is seen in the $1.0940-50 area. The dollar is more broadly mixed

today, with the dollar-bloc and Norwegian krone leading the advancers. The

euro, yen, and sterling are nursing small losses near midday in Europe. The

recovery of US equity indices yesterday after gap...

Read More »

Read More »

Bank of Canada may say Pause, but the Market Hears Finished

Overview: Amid sharp losses in the US equity futures, the US dollar is mostly firmer against the G10 currencies. The notable exception is the Australian dollar, where high-than-expected inflation boosts the risk of a more aggressive central bank.

Read More »

Read More »

No Follow-Through Euro Buying while S&P Holds Yesterday’s Breakout

Overview: A quiet consolidative session has been recorded

so far today as North American leadership is awaited. The preliminary PMI

readings are mixed. Japan and the eurozone look somewhat better, but Australia

and the UK disappointed. The dollar is trading with a mostly firmer bias,

but largely confined to yesterday's ranges. The markets seem to be looked

ahead toward next week's Fed, ECB, and BOE meetings, and the return of China

from this...

Read More »

Read More »

Euro Pokes Above $1.09. Will it be Sustained?

Overview: The Lunar New Year holiday has shut many centers in Asia until the middle of the week, though China's mainland is on holiday all week. The signaling of a downshift in the pace of Fed tightening by some notable hawks helped lift risk appetites ahead of the weekend and saw the

S&P 500 snap a four-day decline.

Read More »

Read More »

Are We Still on the New Year Honeymoon? A Look at the Week Ahead

There are several macro

highlights in the week ahead, during which Chinese markets are closed for the

Lunar New Year celebration. The preliminary January purchasing managers surveys

pose headline risk. However, the survey data, for example, had the US composite below the 50 boom/bust level every month in H2 22, which likely overstates the case, as the first look at Q4 22 US GDP will probably show. While some improvement is expected, composite PMI...

Read More »

Read More »

Dismal UK Retail Sales Weigh on Sterling, While the Yen Softens

Overview: The US dollar is mostly softer today against the G10

currencies, with the notable exception, yen, Swiss franc, and sterling. The

risk-on mood is seen in the foreign exchange market with the Antipodean and

Scandi currencies leading the move against the greenback. The yen has fallen by

about 1.3% this week, leading losers, while sterling's 1.1% gain puts it at the

top. Despite the poor showing of US equities yesterday, risk appetites...

Read More »

Read More »

Poor US Data Cast Doubts on New Found Hopes of a Soft-Landing

Overview: Yesterday's string of dismal US economic

data delivered a material blow to those still thinking that a soft-landing was

possible. Retail sales by the most in the a year. Manufacturing output fell by nearly 2.5% in the last two months of 2022. Bad

economic news weighed on US stocks. The honeymoon of New Year may have ended

yesterday. The US 10-year yield fell below 3.40% for the first time since the

middle of last September. The Atlanta...

Read More »

Read More »

The BOJ Surprises by Standing Pat

Overview: The BOJ defied speculation and stuck to its

current policy, which saw the yen sell-off sharply. The dollar rallied about

3.4 yen before falling back. The greenback is broadly lower against the other

G10 currencies. However, for the fifth consecutive session, the euro has

stalled around $1.0870. While UK headline inflation softened, mostly due to fuel,

core prices were unchanged, and this may have helped sterling extend its recent

gains to...

Read More »

Read More »

With Trepidation, the Market Awaits the BOJ

With the market nearly ruling out a 50 bp hike by the Federal Reserve on February 1, the interest rate adjustment appears to have largely run its course. This may be helping to ease the selling pressure on the greenback.

Read More »

Read More »

Monday and Beyond

Monday Ranges: Euro: $1.0802-$1.0874JPY/$: JPY127.23-JPY128.87GBP: $1.2172-$1.2289CAD/$: CAD1.3353-CAD1.3418AUD: $0.6941-$0.7019MXN/$: MXN18.7313-MXN18.8566Rumors of an emergency BOJ meeting sent the dollar to its lows in Tokyo, slightly below the pre-weekend low (~JPY127.46). The on-the-run (most current) 10-year yield settled above the 0.50% cap and the generic 10-year bond has not traded below the 0.50% level since January 5. The market...

Read More »

Read More »

On Our Radar Screen for the Week Ahead

The week ahead is chock full of data, including Japan, the UK, and Australia's CPI. The UK and Australia report on the labor market. The US, UK, and Canada also report retail sales. The early Fed surveys from New York and Philadelphia for January will be released.

Read More »

Read More »

Dollar Index Gives Back Half of 21-Month Gains in 3 1/2 Months

Overview: The continued easing of US price pressures

has strengthened the market's conviction that the Federal Reserve will further

slow the pace of rate hikes and that the terminal rate will be near 5.0%. The

decline in US rates has removed a key support for the US dollar, which has

fallen against all the G10 currencies this week. The Dollar Index has now retraced half of what it gained since bottoming on January 6, 2021. Meanwhile, there are...

Read More »

Read More »

Is it Too Easy to Think the Market Repeats its Reaction to a Soft US CPI?

The market expects a soft US CPI print today, which has recently been associated with risk-on moves. The US 10-year yield is holding slightly above 3.50%, the lowest end of the range since the middle of last month. The two-year yield is a little above 4.20%, also the lower end of its recent range. Most observers see the Federal Reserve slowing the pace of its hikes to a quarter point on February 1.

Read More »

Read More »

Greenback Consolidates Near Recent Lows Ahead of Tomorrow’s US CPI

Overview: Fed Chair Powell did not push against the easing of US financial conditions when he ostensibly had an opportunity yesterday. This coupled with expectations of another decline in the US CPI, which will be reported tomorrow, has kept the greenback mostly consolidating the losses seen last Friday and Monday.

Read More »

Read More »