Category Archive: 4.) Marc to Market

Great Graphic: Consumer Inflation: US, UK, EMU

Price pressures appear to have bottomed for the US, UK, and to a lesser extent, EMU. Rise in prices cannot be reduced solely to the increase of oil. Core prices are also rising.

Read More »

Read More »

Is Oil about to Rollover?

Oil has rallied 20% since mid-September. Market may be getting ahead of itself. US rig count has risen by more than 100 in less than 4-months and inventories, seasonally adjusted are at record highs.

Read More »

Read More »

FX Daily Rates, October 17: Dollar Starts Week Narrowly Mixed, while Bonds and Stocks Retreat

The US dollar is consolidating in relatively narrow trading ranges. Participants appear to be waiting for fresh incentives, while the recent rise yields continue and equities have begun the new week on a soft note. Yellen spoke before the weekend, and her explicit willingness to tolerate higher inflation pushed yields higher, while not deterring expectations for a hike in December.

Read More »

Read More »

A Few Thoughts on Canada

Bank of Canada meets Wed. Look for a dovish hold. Foreigners continue to buy Canadian bonds and stocks. The EU-Canadian free-trade deal is facing challenges, with the most pressing one coming from Belgium.

Read More »

Read More »

FX Weekly Preview: Four Key Events in the Week Ahead

Of the forces driving prices in the week ahead, events appear more important than economic reports.There are four such events that investors must navigate.The Bank of Canada and the European Central Bank meet. The UK High Court will deliver its ruling on the role of Parliament in Brexit.The rating agency DBRS updates its credit rating for Portugal.

Read More »

Read More »

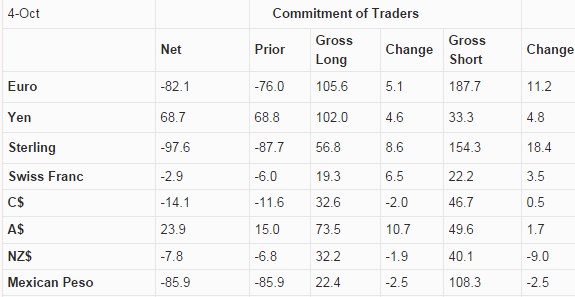

Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

Speculators turned more bearish the euro and Swiss Franc and less bullish the Japanese yen in the Commitment of Traders week ending October 11.

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

Great Graphic: China’s PPI and Commodities

China's PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China's PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside.

Read More »

Read More »

FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow.

Read More »

Read More »

IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

The increase in the yen's share of reserves was flattered by the yen's 9% appreciation. The dollar and euro's share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan's share of reserves.

Read More »

Read More »

High Court Hears UK Constitutional Challenge

Regardless of outcome early next week, the High Court's decision will likely be appealed. The issue is the role of parliament. The greater the role, the greater the risk of a delay, but also a better chance to minimize a hard Brexit.

Read More »

Read More »

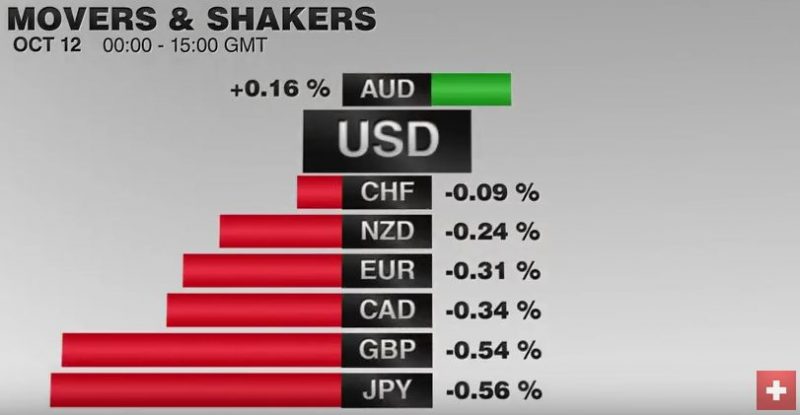

FX Daily, October 12: May Concedes to Parliament, Sterling Rises after Pounding

News that UK Prime Minister May has accepted that Parliament should vote on her plan for exiting the EU stopped sterling's headlong slide. Sterling had been pounded for roughly 8.5 cents since the start of the month including the last four sessions. The idea that parliament, where the Conservatives enjoy a slim majority, is less enthusiastic about Brexit may mean a less acrimonious divorce.

Read More »

Read More »

Sterling: Has the Breaking Point been Reached?

Sterling's decline is not longer coinciding with lower rates. Sterling's decline is boosting inflation expectations. If the inflation expectations are realized (Sept CPI next week), it will quickly erode what ever competitive gains there may have been.

Read More »

Read More »

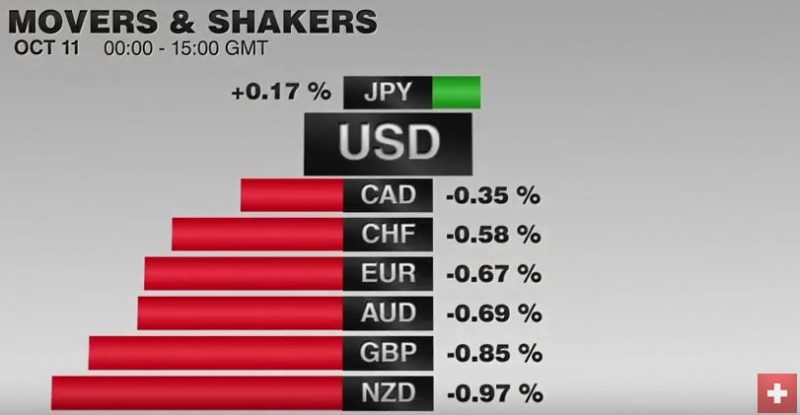

FX Daily, October 11: The Dollar Remains Bid

The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger today at 1.77%, which is the highest in four months.

Read More »

Read More »

Great Graphic: Euro is Approaching Year-Long Uptrend

The year-long euro uptrend comes in near $1.1035, just below the August lows. The technical are fragile, but the euro is below its lower Bollinger Band. The fundamental driver seems to be the backing up of US rates, and widening premium over Germany.

Read More »

Read More »

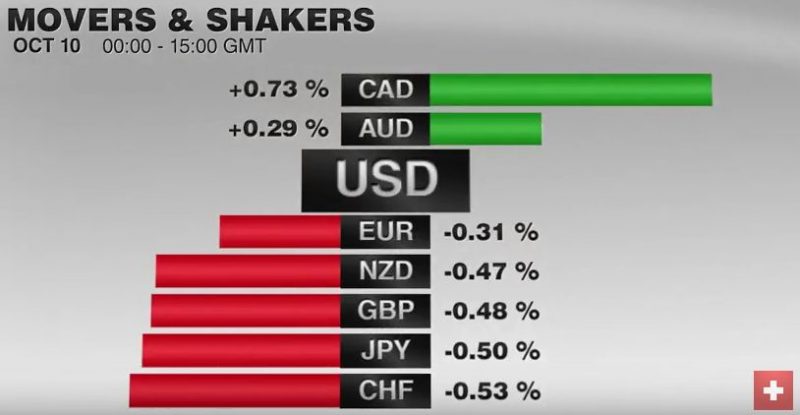

FX Daily, October 10: Dollar after the Second Debate

The US dollar has started the new week on a firm note. The light news stream and holidays in Japan, Canada and the United States make for a subdued session. Notable exceptions to the dollar's gains are the Canadian dollar and Mexican peso. Both currencies appear to have been. underpinned by US political developments, the main feature of which is the implosion of the Trump campaign.

Read More »

Read More »

FX Weekly Preview: The Week Ahead: It’s Not about the Data

High frequency economic reports will be not be among the key drivers of the capital markets in the week ahead.The light schedule, consisting mostly of industrial production in Europe, inflation for Scandinavia, and US retail sales, will have minimal impact on rate expectations.

Read More »

Read More »

Great Graphic: US-German 2-Yr Differential and the Euro

The US premium over Germany is at its widest since 2006. This is despite a small reduction in odds of a hike in December. There are many forces are work, but over time, the widening differential will likely give the dollar better traction.

Read More »

Read More »

Swiss Franc Net Shorts Getting Reduced

Last week SNB Q3 window cleaning that led to a big CHF net short position. This week this changed again. Both longs and shorts on CHF increased, but the net short position fell.

Read More »

Read More »

FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480.

Read More »

Read More »