Category Archive: 4.) Marc to Market

Canada Renews Inflation Target, but Tweaks Core Measures

Canada maintains inflation target of the middle of a 1-3% band. Adopts a trimmed and median core measure like Australia. Market seems to be under-estimating the risk of a BoC rate cut next year.

Read More »

Read More »

FX Daily, October 28: Dollar Sidelined, Krona Stabilizes, Rates Firm

The main development here in the last full week of October is the sharp rise in bond yields. US 10-year yields rose nine bp this week coming into today's session, which features the first look at Q3 GDP. The two-year yield is up four bp. European 10-year benchmark yields mostly rose 11-17 bp. UK Gilts were are the upper end of that range. Two-year yields are 3-5 bp higher.

Read More »

Read More »

Yellen and Fischer Still Singing from the Same Song Book

Many see Yellen and Fischer at odds over benefits of high pressure economy. However, this fails to put the comments in the proper context--same message different styles. They are arguing against the doves who don't want to hike this year.

Read More »

Read More »

FX Daily, October 27: Rising Yields Continue to be the Main Driver

The euro remains pinned near the seven-month low it recorded two days ago near $1.0850. It approached $1.0950 yesterday and has been confined to about a 15-tick range on either side of $1.0905 today. Against the yen, the dollar remains near the three-month high (~JPY104.85) also seen two days ago. New dollar buying emerged yesterday near JPY104.

Read More »

Read More »

Great Graphic: CRB Index Revisited

Interest rates and 10-year break-evens are rising. Some think the CRB Index is tracing out a head and shoulders bottom. We look for inflation in non-tradable goods' prices (think services).

Read More »

Read More »

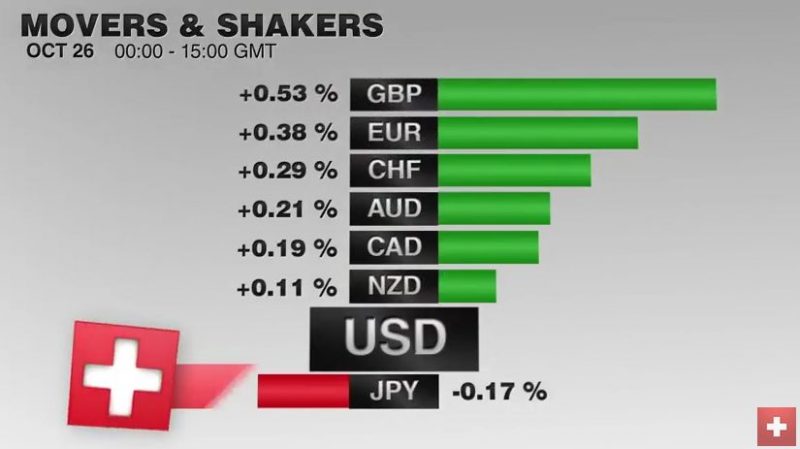

FX Daily, October 26: Euro and Yen Extend Recovery

After touching 1.08, which apparently the "new floor", the SNB moved the EUR/CHF upwards yesterday and Monday. Today's EUR recovery against USD, let also the EUR/CHF rise. The US dollar's upside momentum reversed in North America yesterday and has been sold in Asia and Europe. This seems like mostly position adjustments ahead of next week's FOMC, BOE and RBA meetings, in an otherwise subdued news period. The euro has at three-day highs. It has...

Read More »

Read More »

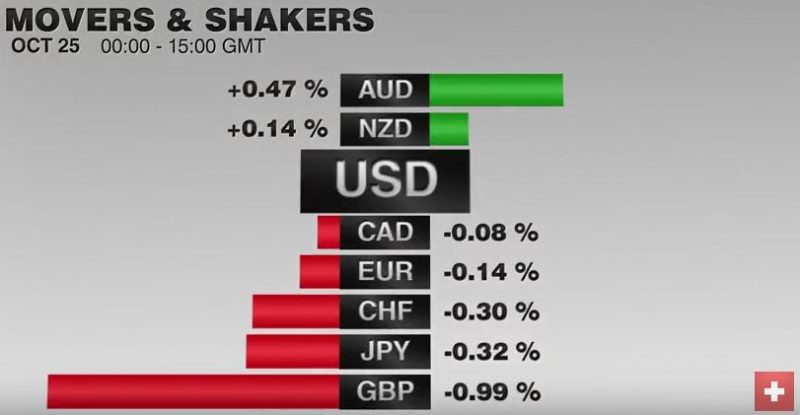

FX Daily, October 25: Germany IFO, Dollar Going Nowhere

The US dollar has been confined to extremely narrow ranges against the euro, yen, and sterling. To the extent that there is much action in the foreign exchange market, it is with the dollar-bloc and emerging market currencies.The Canadian dollar was whipsawed by comments from the Bank of Canada.

Read More »

Read More »

Seven Things I Learned while Looking for Other Things

Mainland demand for HK shares has dried up this month. EMU growth may accelerate in Q4, while the collective deficit continues to fall. German fertility rate increased last year.

Read More »

Read More »

Yuan Not

There were two dogs that did not bark this year. There are the Japanese yen, which despite negative interest rates and an unprecedented expansion of the central bank's balance sheet, the yen has strengthened 15% against the dollar. The yen has been the strongest major currency, and the third strongest currency in the world behind the high-yielding Brazilian real, recovering from last year's drop, and the Russian rouble, aided by a rebound in oil.

Read More »

Read More »

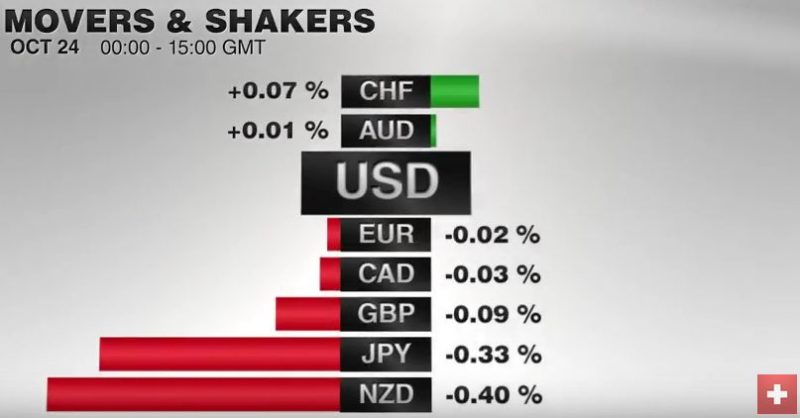

FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even further against the Swiss Franc than its current...

Read More »

Read More »

FX Weekly Preview: Forces of Movement in the Week Ahead

Fitch cut Italy's rating outlook to negative from stable, while DBRS left Portugal's rating and outlook unchanged. Europe and Canada's free trade negotiations broke down, but many seem to be making exaggerating the significance of the drama. Japan and Australia report inflation figures, and both are exceptions to the generalization that price pressures are rising in (most) high income countries.

Read More »

Read More »

Demographics and a New Old Paradigm

The hangover from the debt crisis and secular stagnation are the two main explanatory models for the low growth and low interest rates. Anew Fed paper brings the focus back to demographics. If true, warns of a protracted period of slow growth, low interest rates.

Read More »

Read More »

FX Daily, October 21: Greenback Ending Week on Firm Note

The US dollar is firm especially against the European complex and emerging market currencies. The yen continues to be resilient, and exporters are thought be capping the dollar above JPY104. The dollar is lower against the yen for the fourth consecutive session and set to snap a three-week advancing streak.

Read More »

Read More »

Great Graphic: Italian Banks and a German Bank

DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound.

Read More »

Read More »

Cool Video: Double Bloomberg Feature–ECB and US Baby Boomers

This afternoon I had the privilege of being on Bloomberg TV, with anchors Scarlet Fu and Matt Miller. I was joined by an old market friend Bob Sinche. We had a lively discussion (what did you expect?) on two issues. The first was on the ECB. At his press conference earlier today, Draghi indicated that the question of extending QE and tapering was not discussed.

Read More »

Read More »

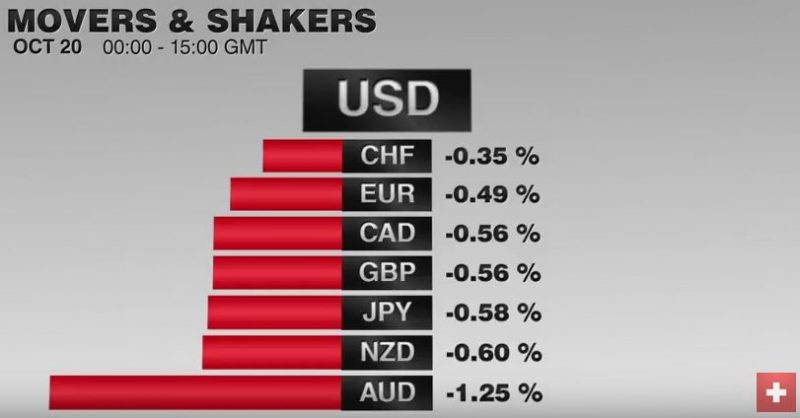

FX Daily, October 20: ECB Unlikely to Shake Dollar’s Slumber

GBP/CHF rates have fallen dramatically over the past month, as Sterling continues to find itself under pressure against the major currencies. However, despite these losses it is not all doom and gloom for those clients holding GBP, as Tuesday’s positive spike for the Pound proved. Currency does not move in a straight line and therefore we will see opportunities for those clients holding GBP to take advantage of, even if a sustainable Sterling...

Read More »

Read More »

Draghi Says Nothing to Undermine Expectations of New Action in December

Extending or tapering QE was not discussed, but means little in terms of what the ECB decides in Sept. Draghi said growth risks are on the downside and inflation has yet to enter a meaningful uptrend. Reiterates that abrupt end of purchases is unlikely.

Read More »

Read More »

FX Daily, October 19: FX After China GDP

The Swiss Franc has strengthened against the pound as global uncertainty persists in the form of the UK’s Brexit vote and the US Presidential Election. Looking ahead it seems the CHF may soften a little as we learn of the new President, I found it very interesting that yesterday Paddy Power paid out on any bets for Hilary Clinton to become President in the United States.

Read More »

Read More »

ECB: Dovish Hold

Draghi will like emphasis inflation is the key to policy and ECB is committed using allow for its technical tools to achieve its legal mandate. Key decisions will be made in December. The more the euro rises against sterling, the greater the pressure for the euro to fall against the dollar.

Read More »

Read More »

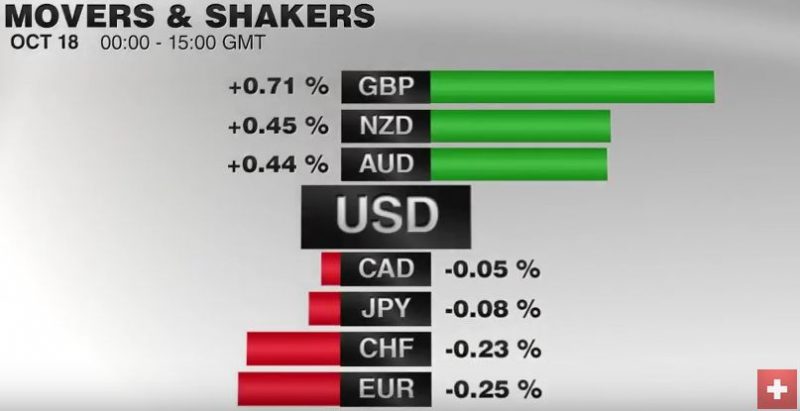

FX Daily, October 18: Dollar Slips Broadly but not Deeply

According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value.

Read More »

Read More »