Category Archive: 4.) Marc to Market

Podcast Discussing Dollar, Fed, BOJ on Futures Radio Show

I had the privilege of being interviewed by Anthony Crudele, who is trader at the CME, for the Futures Radio Show.

There was much to discuss. The FOMC met yesterday. The market, judging from the Fed funds futures see little chance of a Ju...

Read More »

Read More »

FX Daily April 28: What is the Next Shoe to Drop?

One can appreciate the frustration in Tokyo. The Bank of Japan surprised the world by adopting negative rates in January and the yen rallied. Today it disappointed many by not easing, and the yen rallied. The BOJ next meetings in mid-June and like this week, the outcome of its meeting will be announced the day … Continue reading »

Read More »

Read More »

Central Banks Roil Markets

The Bank of Japan defied expectations and its economic assessment to leave policy unchanged. The inaction spurred a 3% rally in the yen and an even larger slump in stocks. The financial sector took its the hardest and dropped almost 6%. The...

Read More »

Read More »

FOMC Statement Demonstrates Firm Grasp of the Obvious

The FOMC delivered a statement largely as expected. It upgraded its assessment of the global economy by dropping the reference to risks. It downgraded its assessment of the domestic economy by acknowledging that growth has slowed.

Otherwi...

Read More »

Read More »

What is the BOJ Going to Do?

Under Kuroda's leadership the BOJ has surprised the market a number of times, most recently with the move to negative rates at the end of January.

It is not that such a move, which has been tried by several European central banks, was without...

Read More »

Read More »

FX Daily April 27: Two Issues Loom Large Today: Soft Australia CPI and FOMC

The foreign exchange market is largely quiet as the market awaits fresh trading incentives and the FOMC statement later in the North American session. The main exception to the consolidative tone is the Australian dollar, which is posting its largest loss (~1.7%) in a couple of months. The short-term market was caught the wrong-footed when …

Read More »

Read More »

Great Graphic: Measuring Cost of Extend and Pretend

There is a debate. On one hand is Summers, who argues that modern economies have entered an era of secular stagnation. Full utilization of the factors of production and particularly capital and labor is not possible without stimulating aggregate demand in a way that facilitates bubbles. The broad strokes of the argument can be found …

Read More »

Read More »

Greenback Mostly Softer, Sterling Shines

The gains the US dollar registered in the second half are being pared, but it is sterling’s strength that stands out. It is difficult to attribute it to Obama’s push against Brexit, but there does appear to have been a change in sentiment. Sterling is the best-performing currency not only today but for the past …

Read More »

Read More »

FX Daily April 25: Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the … Continue reading...

Read More »

Read More »

FX Daily April 25: Dollar Pares Pre-Weekend Gains Against Euro and Yen

The US dollar starts what promises to be an eventful week giving back some the gains score in second half of last week against the euro and yen. Equity markets are extending their pre-weekend losses. Commodities are also trading with a heavier bias. Markets in Australia, New Zealand, and Italy are closed for national …

Read More »

Read More »

The Week Ahead: FOMC, BOJ and More

The last week of April is eventful. The Reserve Bank of New Zealand, the Federal Reserve and the Bank of Japan hold policy meetings. The UK, eurozone, and the US provide the first estimates of Q1 GDP. Japan, the eurozone, and Australia report consumer prices, while the US updates the Fed’s preferred (targeted) inflation measure, the …

Read More »

Read More »

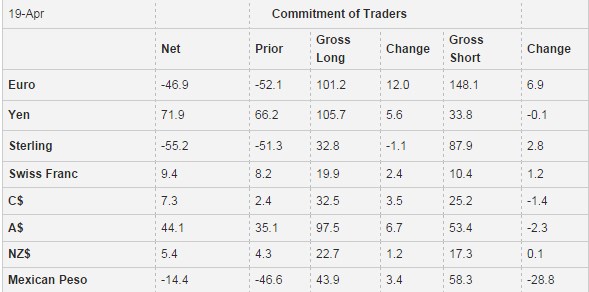

Weekly Speculative Positions: Reduction of US Dollar Exposure at What may be the Bottom

Speculators in the futures market continued to press a bearish view of the US dollar the CFTC reporting week ending April 19. For one and half month traders continue to increase their long CHF position against the dollar. It has risen to 7.3k contracts.

Read More »

Read More »

Dollar’s Technical Tone Improves

It is not that the US dollar had a particularly good week. It was mixed. The best performers were sterling and the Canadian dollar. The pound led with a 1.6% gain, followed closely by the Canadian dollar.

The latest polls suggest that tho...

Read More »

Read More »

The State of the Bull

(here is a draft of my monthly column for a Chinese paper)

The US dollar has had a rough few months. It has fallen against most major and emerging market currencies this year. A critical issue for global investors and policymakers is whether ...

Read More »

Read More »

Emerging Markets: What has Changed

(from my colleague Dr. Win Thin)China’s central bank may be leaning less dovish

Turkey has a new central bank governor

Argentina issued external debt for the first time since it defaulted 15 years ago

Brazil's lower house voted to impeach Preside...

Read More »

Read More »

FX Daily, April 22: Capital Markets Mostly Consolidate, Yen Drops

Equity markets are seeing this week's gains trimmed after the S&P 500 fell 0.5% yesterday, recording its biggest loss in two weeks. Disappointing earnings in some tech leaders spurred profit-taking, The US 10-year Treasuries are consolidati...

Read More »

Read More »

Japanese Capital Flows: Six Observations

The following observations are drawn from the weekly report of Japan’s Ministry of Finance unless noted otherwise. We use the weekly data instead of monthly to identify changes of trend earlier. We use simple convention of the week by the last rather than the first day. That means that the report for the week ending April …

Read More »

Read More »

FX Daily, April 21: ECB Takes Center Stage

The ECB meeting is the session's highlight. In recognition of the risk that ECB President Draghi expresses displeasure with the premature tightening of financial conditions through the exchange rate channel is encouraged a modest bout of euro s...

Read More »

Read More »

Status of 9/11 Bill and the Saudi Threat

There continues to be much discussion among investors of New York Times report last weekend in which a Saudi official threatened to sell $750 bln of US Treasuries and assets if a bill that would allow families of victims to sue the Saudi governm...

Read More »

Read More »