Category Archive: 4.) Forex Live

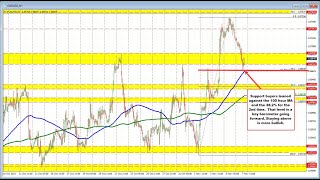

USDCHF breaks key resistance levels, maintains bullish bias

The USDCHF has climbed above its 200-hour moving average and broken the 38.2% retracement level, indicating a stronger upside bias. The price remains above the 100-hour and 200-day moving averages, further supporting the bullish sentiment. Traders await a sustained move above these levels to confirm the upward momentum.

Read More »

Read More »

Jerome Powell speech interrupted by climate protestors

Jerome Powell IMF speech interrupted by climate protestors. The video feed cuts away but the audio stays live as he tells them to "close the f**king door".

Read More »

Read More »

AUDUSD: Potential upside momentum as price threatens to snap 3-day decline

The AUDUSD has moved lower recently but is now showing potential for upside momentum as the price threatens to end its 3-day decline. Buyers have come in near support levels, and if they can hold above the rising 200-hour moving average, there is the possibility of a move towards the 100-hour moving average and a swing area. Stay updated on the AUDUSD's price action.

Read More »

Read More »

USDCAD struggles to maintain bullish technical momentum. A deep dive into the USDCAD pair.

The USDCAD faces resistance as buyers fail to push the price above key levels and falling oil prices weigh on the upside. With the price below the 200-hour moving average, sellers are gaining confidence for a potential downside move.

Read More »

Read More »

NZDUSD Holds Support, Buyers Attempt to Take Control Above Moving Averages

The NZDUSD has moved lower but found support near the swing area and is now attempting to stay above key moving averages. Buyers are showing willingness to keep control and push the price higher, but need to stay above specific levels to gain more control.

Read More »

Read More »

Kickstart your FX trading with a technical look at the EURUSD, USDJPY and GBPUSD.

Get the latest insights on the EURUSD and USDJPY currency pairs in today's Forex trading update. Discover swing levels for EURUSD and key support for USDJPY, and see how market traders are battling with their biases. Stay informed and make informed trading decisions.

Read More »

Read More »

S&P 500 Technical Analysis

Here's a quick technical analysis on the S&P 500 with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Quick thoughts: Real money is hitting the bond market

Adam Button from ForexLive talks about the backdrop in markets on Nov 8, 2023 and what it means going forward.

Three main topic:

1) Yields and what they're saying

2) The dollar rallying despite the strong risk trade

3) The drop in oil and whether it's sending mixed signals

Read More »

Read More »

USDCAD has been helped (to the upside), by lower oil prices. What about the technicals?

Oil moved below $76 today and the USDCAD moved above the 200 hour MA but can that momentum continued today?

Read More »

Read More »

Kickstart your FX trading for November 8 with technical look at EURUSD, USDJPY and GBPUSD

What is moving the markets from a technical perspective in the 3 major currency pairs on November 8, 2023.

Read More »

Read More »

What’s next for the S&P 500? A SPX technical analysis that matters.

? Is the S&P 500 About to Take a Bearish Turn? | Full Technical Analysis Breakdown?

? *Prepare for Jerome Powell's speech aftermath with our in-depth technical analysis!*

? Dive deep into the intricacies of the S&P 500 as we explore what the future holds post-Jerome Powell's crucial address. We're not just chart-watchers; we're chart-breakers. On today's episode, we meticulously dissect the 4-hour chart, equipped with the Williams %R...

Read More »

Read More »

USDJPY Technical Analysis

Here's a quick technical analysis on the USDJPY pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

USDCAD rebounds higher and retraces 50% of the move down from last week’s high. What next?

The 50% of the move down comes in at 1.37634. The 100 hour MA is close support now at 1.3740.

Read More »

Read More »

EURUSD bounces off the 38.2% retracement and 100 hour MA support for 2nd time today

The dip buyers against the 38.2% were joined by the 100-hour moving average near the 1.0664 level. Traders leaned against that level as risk can be defined and limited. That could be you too. Were you there?

Read More »

Read More »

Kickstart your FX trading for November 7 with technical look at EURUSD, USDJPY and GBPUSD

What is moving the markets from a technical perspective in the 3 major currency pairs on November 7, 2023.

Read More »

Read More »

EURUSD Technical Analysis

Here's a quick technical analysis on the EURUSD pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »