Category Archive: 6c) Crypto Currencies English

Boerse Stuttgart Group Launches Pan-European Blockchain Settlement Platform

Boerse Stuttgart Group is developing the infrastructure for the future of the digital capital market with Seturion, a pan-European, blockchain-based platform designed to enable faster and more cost-efficient settlement of tokenised assets across national borders.

Seturion is accessible to all market participants in Europe, including banks, brokers, trading venues, both traditional and digital, and tokenisation platforms.

Its open architecture and...

Read More »

Read More »

Amina Bank Expands Circle Partnership and Launches Stablecoin Rewards

Switzerland-based Amina Bank announced on X on August 29 that it had expanded its partnership with Circle through the Circle Alliance Programme, reinforcing its position in the stablecoin market.

Regulated by the Swiss Financial Market Supervisory Authority (FINMA), the bank highlighted the scale of its involvement, stating:

“Over the years, Amina has transacted billions in USDC and EURC through our FINMA-regulated banking system.”

As reported by...

Read More »

Read More »

Gemini Opens ETH and SOL Staking to UK Users

Gemini, the global digital asset platform, has made staking for Ethereum (ETH) and Solana (SOL) available to users in the UK.

This development allows UK users to participate in the crypto ecosystem and earn passive income through the Gemini platform, reinforcing the company’s commitment to expanding its presence in the region following the opening of its first permanent UK office in London.

Staking is an integral component of the Proof-of-Stake...

Read More »

Read More »

Bitpanda Launches in the UK with Access to 600+ Digital Assets

Bitpanda has officially launched in the UK, offering British investors access to more than 600 digital assets, the most comprehensive selection on the UK market.

Bitpanda has over 7 million users across Europe and holds multiple regulatory licenses outside the UK.

Its offering includes a wide range of digital assets, from well-known cryptocurrencies such as Bitcoin and Ethereum to emerging tokens and stablecoins.

Users also have access to selected...

Read More »

Read More »

SPAR Switzerland Launches Crypto Payments with Binance Pay and DFX.swiss

Swiss shoppers can now pay for groceries using stablecoins and other cryptocurrencies following a partnership between SPAR, Binance Pay, and Swiss fintech firm DFX.swiss.

Through the collaboration with Binance Pay, a crypto payment service from Binance, and DFX.swiss, customers are able to make payments with cryptocurrency at more than 100 SPAR stores across Switzerland.

The rollout marks the first nationwide introduction of a crypto payment system...

Read More »

Read More »

Crypto Crime Surges in 2025, Set to Break Records

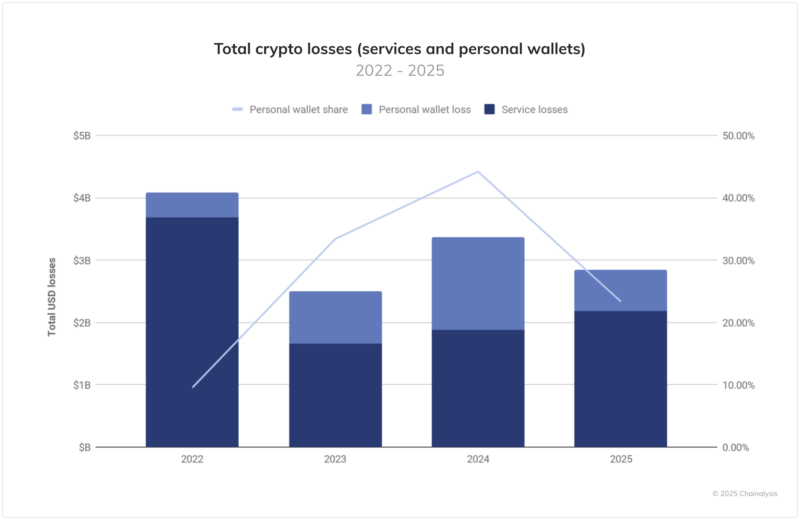

Cryptocurrency crime is surging in 2025, with total crypto losses for the first half of the year already exceeding the 2023 total and on track to set a new record, according to a new report by American blockchain analysis firm Chainalysis.

This surge is being driven by thefts from cryptocurrency services, and personal wallet compromises.

Total crypto losses reached approximately US$2.8 billion in H1 2025, 12% higher than the 2023 total of about...

Read More »

Read More »

Blockstream Acquires Elysium Lab, Launches European HQ in Switzerland

Blockstream, a Canadian global provider of Bitcoin-based financial infrastructure, has announced its acquisition of Swiss digital asset company Elysium Lab.

The deal will also mark the launch of Blockstream CH SAGL, the company’s new European headquarters and incubator entity, based in Lugano.

The move reflects Blockstream’s continued engagement with Switzerland’s fintech sector and its broader expansion efforts across Europe.

The new entity will...

Read More »

Read More »

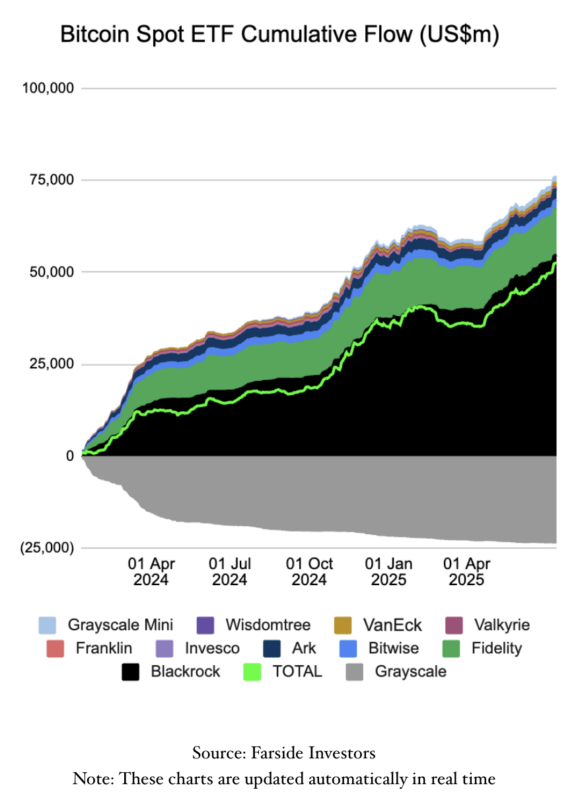

BlackRock’s Bitcoin ETF Becomes Top Revenue Driver, Surpasses S&P 500 Fund

BlackRock’s bitcoin exchange-traded fund (ETF) is becoming a major revenue generator for the asset manager.

According to Bloomberg, the roughly US$75 billion iShares Bitcoin Trust ETF (IBIT) earns an estimated US$187.2 million in annual fees at a 0.25% expense ratio, surpassing the US$187.1 million from the firm’s core iShares S&P 500 ETF (IVV). IBIT is now the third highest revenue-generating ETF for BlackRock across nearly 1,200 funds, says...

Read More »

Read More »

SNB Extends Project Helvetia and Broadens Tokenised Asset Settlement Trials

As part of its ongoing exploration into the settlement of tokenised assets using central bank money, the Swiss National Bank (SNB) has announced the extension and expansion of Project Helvetia.

Since late 2023, the SNB has been piloting the provision of wholesale central bank digital currency (CBDC) for financial institutions on the SIX Digital Exchange trading and settlement platform.

Following an internal evaluation, the SNB has decided to...

Read More »

Read More »

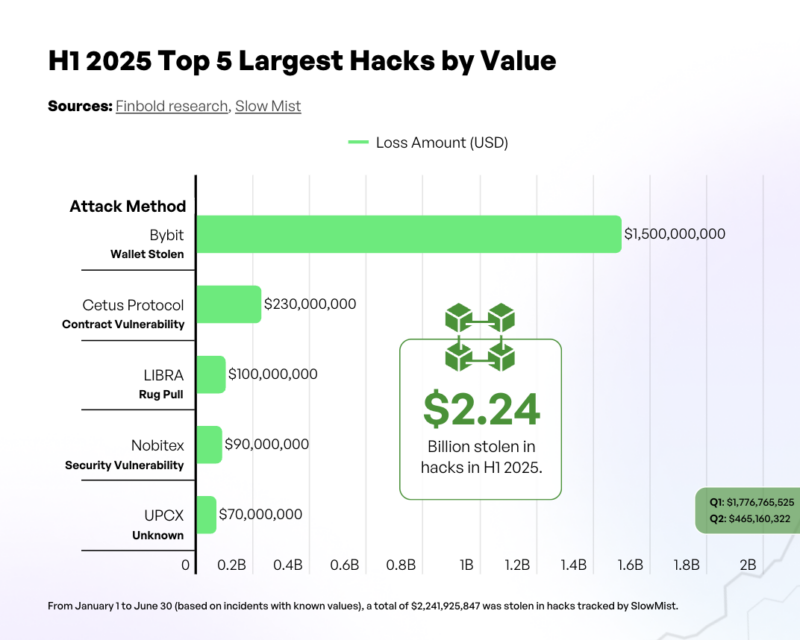

Despite Major Thefts, Crypto Adoption and Wealth Hit New Highs

The global cryptocurrency market saw some volatility in the first half of 2025, marked by major hacks but also an increase in bitcoin millionaires and wider adoption of bitcoin ATMs, according to a new report by Finbold, a finance and crypto news and data platform.

A total of US$2.24 billion was stolen in crypto hacks in H1 2025, driven by major incidents at Bybit, Cetus Protocol, and Libra:

Crypto exchange Bybit lost US$1.5 billion to North...

Read More »

Read More »

BX Digital Participates in Swiss National Bank’s Project Helvetia

BX Digital, a Zurich-based firm, is participating in Project Helvetia, a Swiss National Bank (SNB) initiative focused on the settlement of tokenised assets using real-time gross settlement (RTGS) infrastructure.

The project is designed to support knowledge exchange and practical learning through the use of the Swiss Interbank Clearing System (SIC-System) for payment processing.

Through its involvement, BX Digital contributes its technical expertise...

Read More »

Read More »

Paxos Launches USDG Stablecoin in the EU Under MiCA Compliance

Paxos has launched its stablecoin, Global Dollar (USDG), in the European Union, with the rollout beginning on 1 July.

Regulated under the EU’s Markets in Crypto-Assets (MiCA) framework and overseen by both the Finnish Financial Supervisory Authority (FIN-FSA) and the Monetary Authority of Singapore (MAS), USDG is now accessible to over 450 million consumers across 30 countries.

The stablecoin is available through platforms including Kraken, Gate,...

Read More »

Read More »

Five Arrested in Spain Over $542M Crypto Investment Scam

The European Union Agency for Law Enforcement Cooperation, or Europol, has reported the arrest of five individuals linked to a “criminal network engaged in cryptocurrency investment fraud”.

According to Cointelegraph, the Spanish Guardia Civil, with support from Europol and law enforcement agencies in the US, France and Estonia, detained five suspects allegedly involved in defrauding more than 5,000 investors, including 100 from Switzerland, out of...

Read More »

Read More »

Turkish Bank Garanti BBVA Kripto Partners with Wyden to Enhance Digital Asset Trading

Wyden, a Zurich-based provider of institutional digital asset trading infrastructure for regulated institutions, has formed a strategic partnership with Garanti BBVA Kripto, a subsidiary of Garanti BBVA, one of Turkey’s largest banks.

The collaboration aims to enhance Garanti BBVA Kripto’s digital asset trading services for both retail and corporate clients.

Through the partnership, Garanti BBVA Kripto will offer trading pairs in Turkish Lira and...

Read More »

Read More »

Crypto Giants to Gain EU Access as Regulator Tensions Rise

Two of the world’s largest cryptocurrency firms are on the verge of securing licenses to operate across the European Union, as tensions rise among regulators over the pace and stringency of certain countries’ approval processes, according to sources familiar with the matter.

Under the EU’s new Markets in Crypto-Assets (MiCA) regulation, which came into effect earlier this year, member states are authorised to issue licenses that permit crypto firms...

Read More »

Read More »

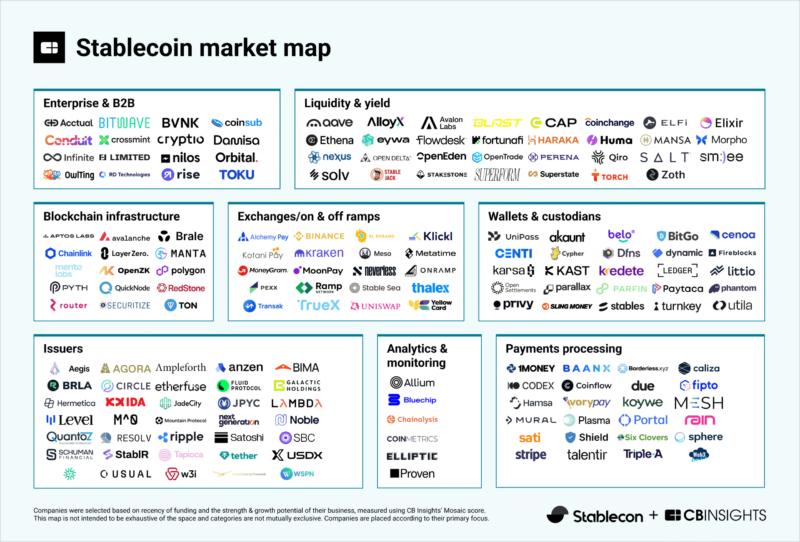

Stablecoins Gain Ground in Finance, Key Trends Include Yield Products, Cross-Border Payments

Stablecoins are rapidly evolving from a niche vertical in the cryptocurrency ecosystem into a foundational element of the global financial system.

A new analysis by CB Insights, in partnership with industry player Stablecon, looks at this burgeoning ecosystem, highlighting key trends emerging in this industry, and mapping the sector’s top players.

One of the main trends outlined in the report is the increased participation of traditional financial...

Read More »

Read More »

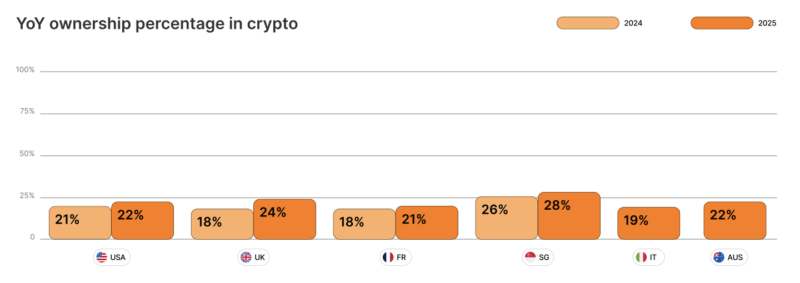

Crypto Adoption on the Rise, Driven by Europe, Younger Demographics

Cryptocurrency adoption has increased remarkably over the past year, driven by European customers, and younger generations. according to a new survey commissioned by Gemini. Positive developments, including the launch of US cryptocurrency exchange-traded funds (ETFs) and pro-crypto policies from the Trump administration, have also contributed to rising confidence and interest in digital assets, the study found.

Conducted in H1 2025, the research...

Read More »

Read More »

Bybit Secures MiCAR License, Establishes European HQ in Vienna

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has been granted a Markets in Crypto-Assets Regulation (MiCAR) license by the Austrian Financial Market Authority (FMA).

The license allows Bybit to operate as a regulated crypto-asset services provider and to offer its crypto products and services across 29 European Economic Area (EEA) member states.

Its EEA hub, located in Austria, enables the firm to passport its...

Read More »

Read More »

Bitcoin causes 98 million tonnes of CO2 per year

The Bitcoin network currently has a carbon footprint more than twice as large as that of Switzerland. This is shown by figures from the crypto portal Digiconomist. +Get the most important news from Switzerland in your inbox Calculated on an annual basis, the network of the popular cryptocurrency currently generates 98 million tonnes of CO2. …

Read More »

Read More »

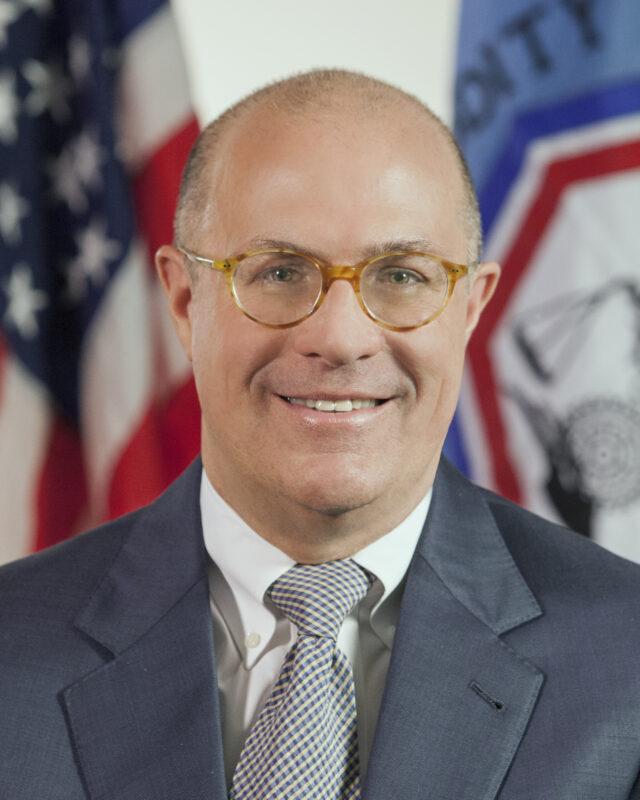

Former US CFTC Chair Chris Giancarlo Joins Sygnum as Senior Policy Adviser

Sygnum, a digital asset banking group, has announced the appointment of J. Christopher Giancarlo, former Chairman of the United States Commodity Futures Trading Commission (CFTC), as its Senior Policy Adviser.

During his time at the CFTC, Giancarlo was known for his support of open markets, innovation, and balanced regulatory approaches.

His advocacy for cryptocurrency before the US Congress earned him the informal title of “crypto dad.”

He remains...

Read More »

Read More »