Category Archive: 6b.) Debt and the Fallacies of Paper Money

Vive la Revolution! Brexit and a Dying Order

A Dying Order Last Thursday, the Brits said auf Wiedersehen and au revoir to the European Union. On Friday, the Dow sold off 611 points – a roughly 3.5% slump. What’s going on?

Read More »

Read More »

The Fed Doomsday Device

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply.

The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic.

Read More »

Read More »

Janet Yellen’s $200-Trillion Debt Problem

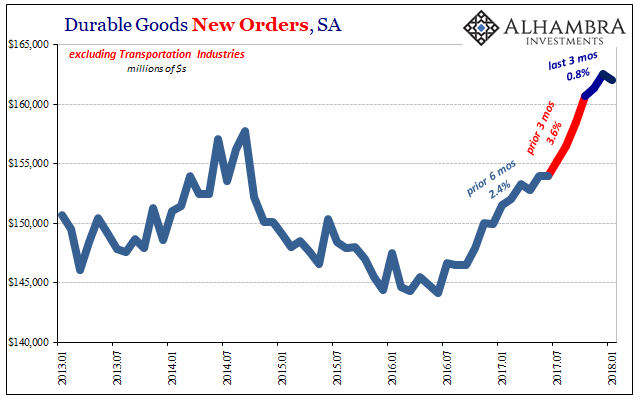

More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations.

And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it?

Read More »

Read More »

A Market Ready to Blow and the Flag of the Conquerors

The U.S. is too big, too varied, too much of everything. You can’t fix a single view of it, even in your mind.

But now our problems, challenges, and discontents are big. They are national and international. We cannot see them. We cannot understand them.

Instead, we draw their measure from the news media – based on a flag that flutters and sags, depending on which way the wind is blowing.

Read More »

Read More »

How the Welfare State Dies

People have become used to the idea that the State is their sugar daddy. Many apparently believe that it has some undisclosed, infinite stash of resources at its disposal which it can shower them with at will. The reality is unfortunately different.

Read More »

Read More »

Down Go the Hopes and Dreams of Three Generations

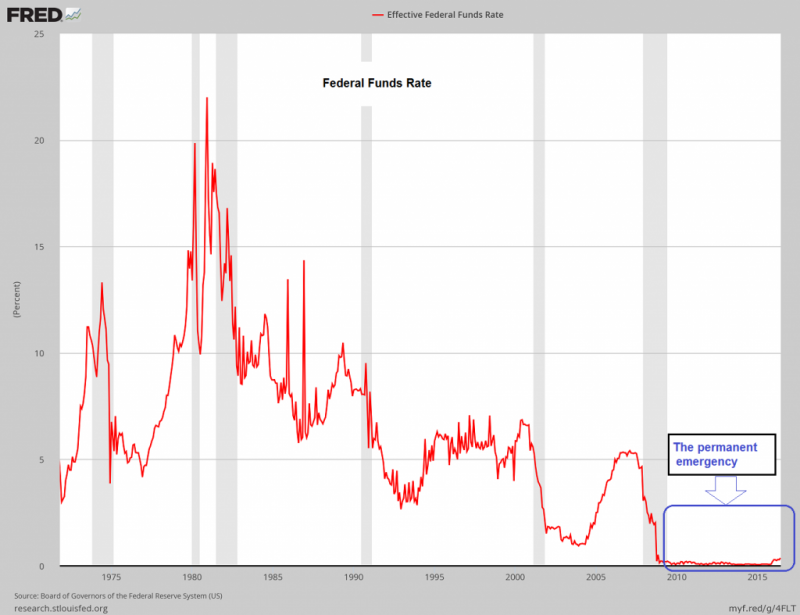

On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this?

If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three generations of retirees.

Read More »

Read More »

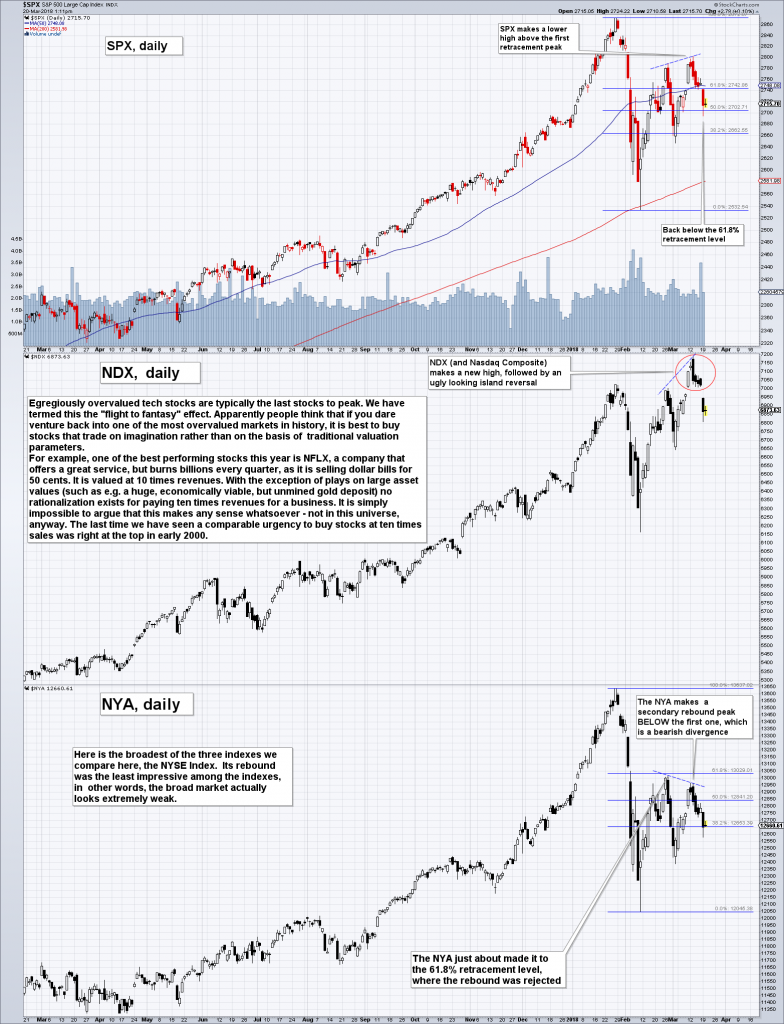

The VIX Breaks Out – Market Risk Continues to Surge

The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock...

Read More »

Read More »

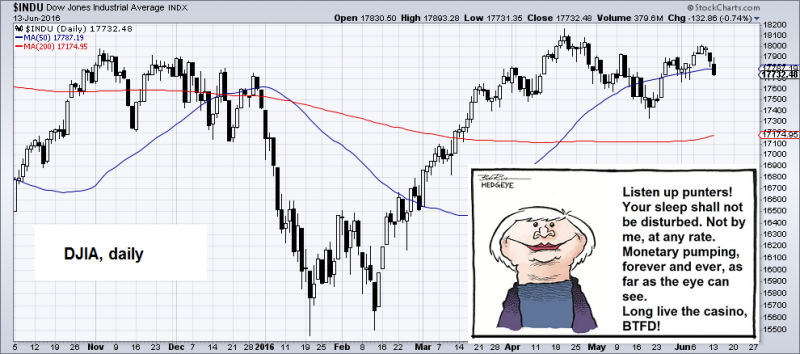

Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. Th...

Read More »

Read More »

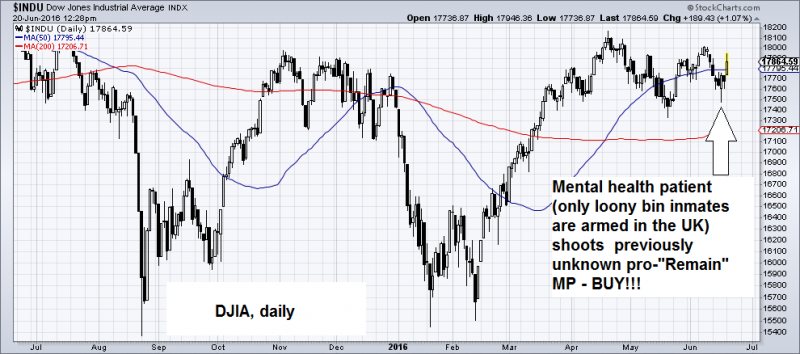

Brexit Paranoia Creeps Into the Markets

European Stocks Look Really Bad… Late last week stock markets around the world weakened and it seemed as though recent “Brexit” polls showing that the “leave” campaign has obtained a slight lead provided the trigger. The idea was supported by a not...

Read More »

Read More »

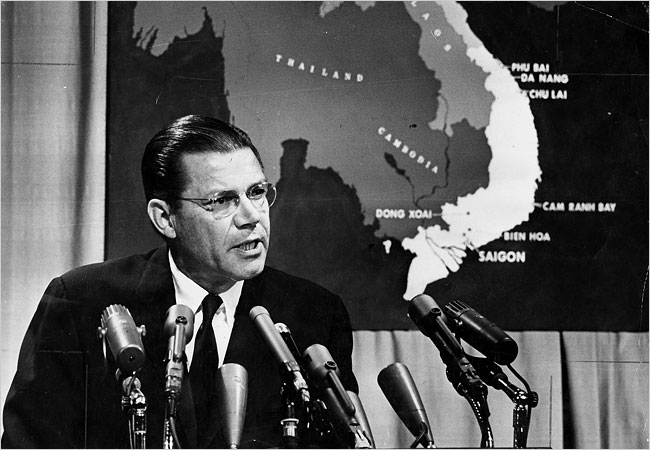

Is It Our Duty to Fight When the Deep State Asks?

Hero or Traitor? And it’s one, two, three, What are we fighting for? Don’t ask me, I don’t give a damn, Next stop is Vietnam; And it’s five, six, seven, Open up the pearly gates, Well there ain’t no time to wonder why, Whoopee! We’re all gonna di...

Read More »

Read More »

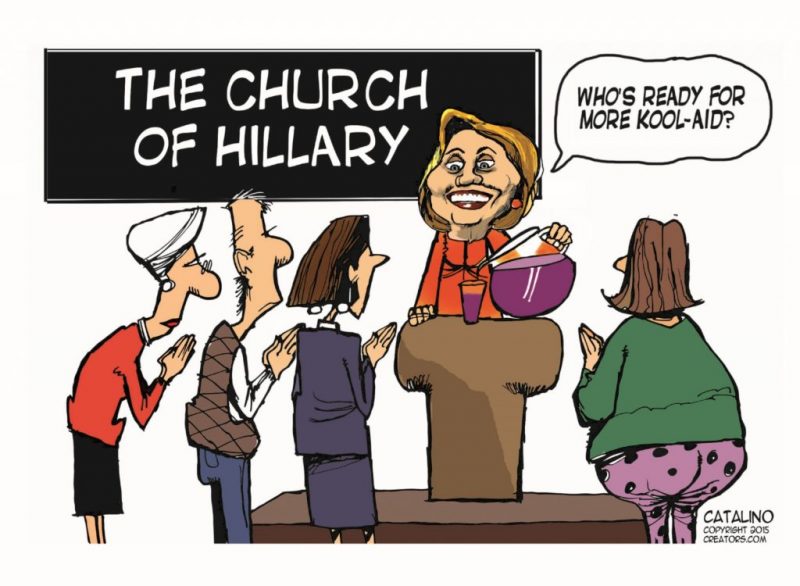

What Congress Really Thinks of Voters

Battle of Wits BALTIMORE – On Wednesday, the Dow rose over 18,000, for the first time since April. Hillary is riding high, too. She is a pro. She has the entire Deep State behind her – including almost every crony and zombie in the country – and a...

Read More »

Read More »

A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. The economy – comple...

Read More »

Read More »

Wealth Management Products: What Could Possibly Go Wrong?

Wealh Management Products issuance equaled $1.1 trillion in 2015, a nearly 75% jump on the prior year and equaling 40% of the total growth in credit. Almost one-third of the WMP were bought by credit institutions for inclusion in other WMP – WMP Squared!

Read More »

Read More »

The Trump Risk: Will President Trump Trigger a Recession?

“The economic consequences of a Trump win would be severe,” claims Mr. Summers in the headline. But he has no way of knowing what the consequences would be, let alone if they would be severe. Would they be worse than if Ms. Clinton were elected? No one knows.

Read More »

Read More »

Free Speech Under Attack

Offending People Left and Right Bill Bonner, whose Diaries we republish here, is well-known for being an equal opportunity offender – meaning that political affiliation, gender, age, or any other defining characteristics won’t save worthy targets ...

Read More »

Read More »

Janet Yellen – Backtracking Again

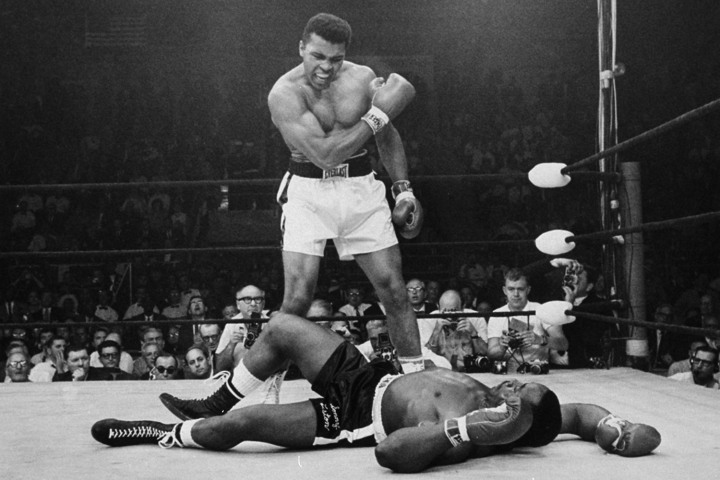

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather ...

Read More »

Read More »

The Real Reason We Have a Welfare State

From Subject to Citizen BALTIMORE – June 5th, the Swiss cast their votes and registered their opinions: “No,” they said. We left off yesterday wondering why something for nothing never works. Not as monetary policy. Not as welfare or foreign aid. N...

Read More »

Read More »

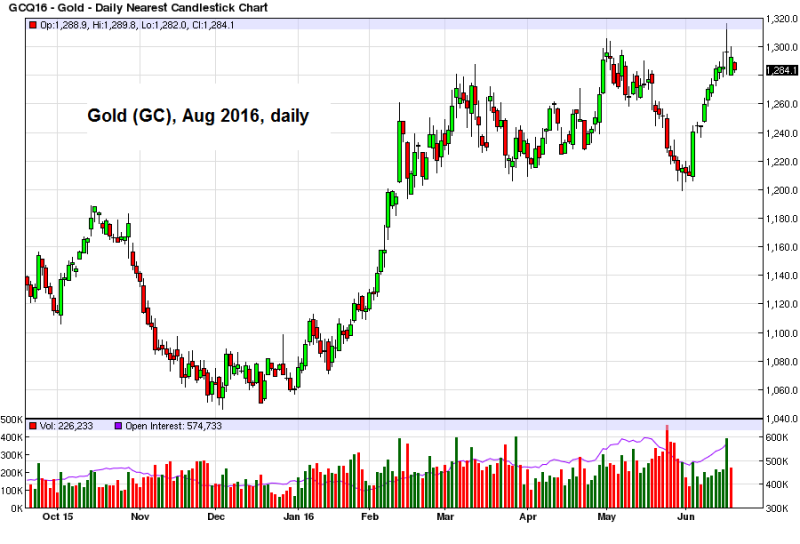

Moving Closer to BREXIT

Polls Show Growing Support for a Break with the EU In the UK as elsewhere, the political elites may have underestimated the strength of the trend change in social mood across Europe. The most recent “You-Gov” and ICM pools show a widening lead in f...

Read More »

Read More »

Free Money Leaves Everyone Poorer

Destroying Lives BALTIMORE – A dear reader reminded us of the comment, supposedly made by Groucho Marx: “A free lunch? You can’t afford a free lunch.” Groucho dispensing valuable advice Photo via imdb.com He was responding to last week’s Diary ...

Read More »

Read More »