For years, European banks were leery of passing on the ECB's negative -0.40% deposit rate to their clients for fears of deposit flight and other unintended consequences, in the process being forced to "eat" the difference and impacting their interest income.

Read More »

Category Archive: 6b.) Zerohedge on Negative Rates

Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos' elites discussed why the world needs to "get rid of currency," the European Commission has introduced a proposal enforcing "restrictions on payments in cash.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

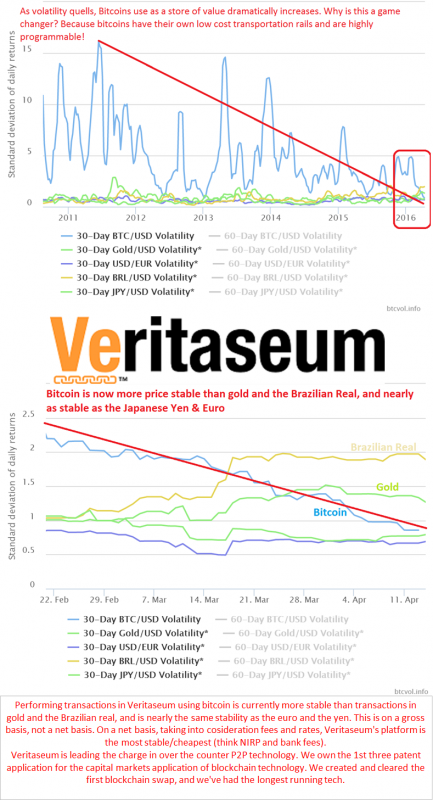

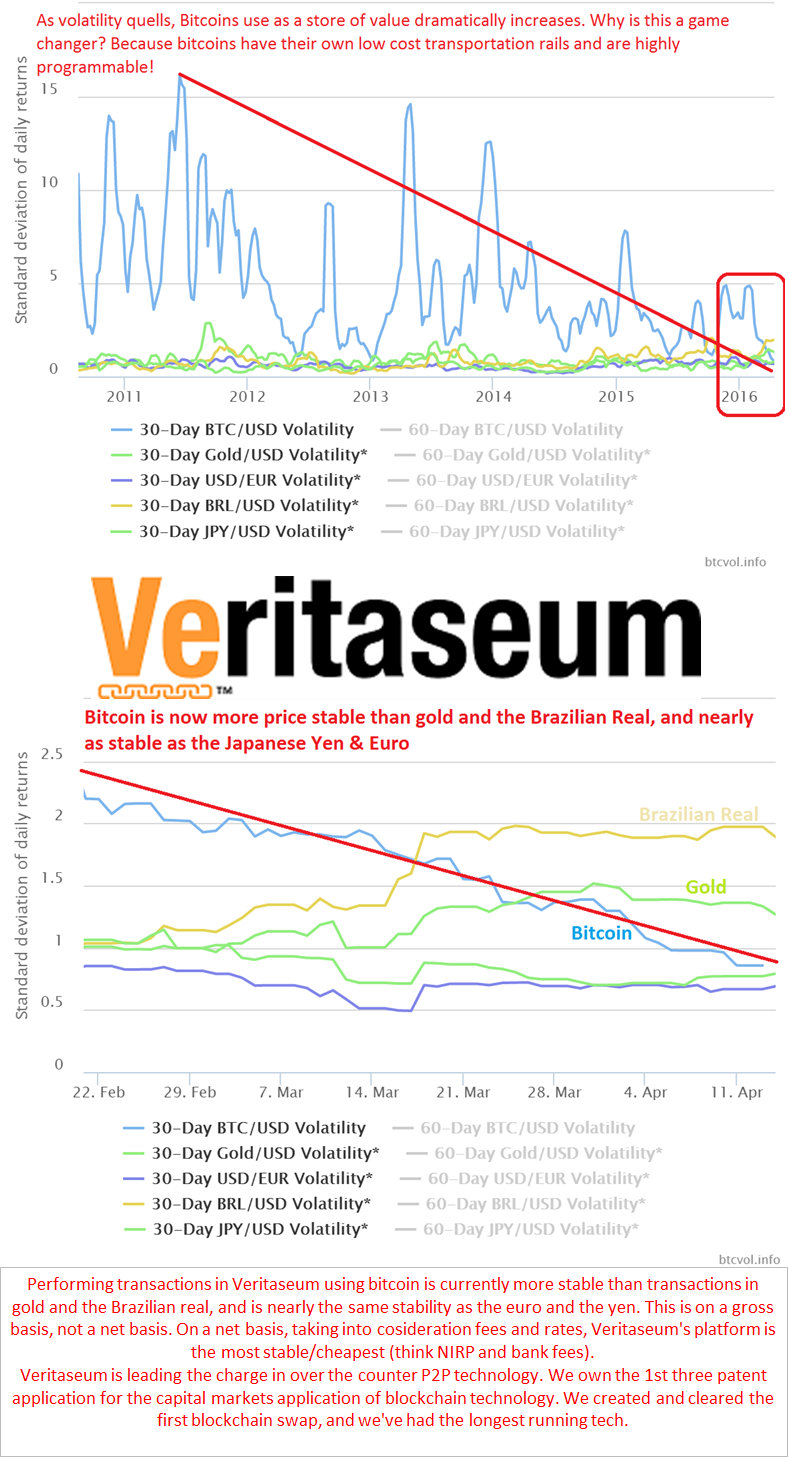

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »

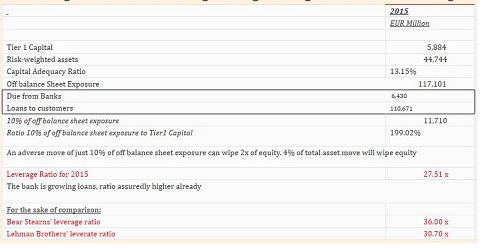

ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks...

Read More »

Read More »