Category Archive: 6b) Austrian Economics

Per Bylund on Sweden

A major "Democratic Socialist" argument is to bring up Nordic countries. In this clip from Episode #69 Per Bylund explains the reality of Sweden and their economic system

Read More »

Read More »

Studium abgebrochen und finanziell frei – wie geht das? Transformations-Fallstudie

Wie 24-jähriger durch unsere Tipps 5-stellig verdient

Kostenloses Freiheitsgespräch: https://thorstenwittmann.com/telefontermin-formular-hpc/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

In der heutigen Video-Fallstudie „Finanzielle Freiheit mit Plan umsetzen“, stelle ich dir jemand aus unserer Community vor.

Dieser junge Mann ist ein Paradebeispiel für einen Machertyp. Er hat einfach stringent umgesetzt, was er von mir die...

Read More »

Read More »

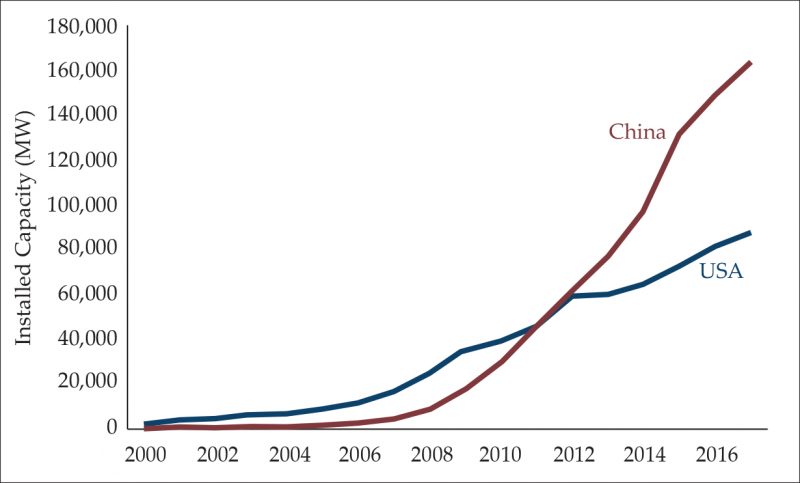

An Anatomy of Failure: China’s Wind Power Development

Abstract: China is currently the world’s largest installer of wind power. However, with twice the installed wind capacity compared to the United States in 2015, the Chinese produce less power. The question is: Why is this the case? This article shows that Chinese grid connectivity is low, Chinese firms have few international patents, and that export is low even though production capacity far exceeds domestic production needs.

Read More »

Read More »

Why the State Demands Control of Money

Imagine you are in command of the state, defined as an institution that possesses a territorial monopoly of ultimate decision making in every case of conflict, including conflicts involving the state and its agents itself, and, by implication, the right to tax, i.e., to unilaterally determine the price that your subjects must pay you to perform the task of ultimate decision making.

Read More »

Read More »

Menschen 2ter Klasse – Druck auf Ungeimpfte nimmt zu (Lockdown)

Die Ministerpräsidentenkonferenz war wieder einmal ein Schmierentheater. Fakten werden weiterhin ignoriert und die Spaltung der Gesellschaft weiter vorangetrieben. Die ausgeschlossene Impfpflicht ist jetzt defacto durch die Hintertüre da. Wer sich nicht impfen lässt wird diffamiert und das Leben erschwert.

Read More »

Read More »

Protect Yourself By Getting In A Lifeboat | Why Purchasing Power Matters To Jon

Purchasing Power Matters! Jon shares what and why it matters to him. Get in the lifeboat while you still can. Share your thoughts in the comment section below. Tell your story and let the world hear why Purchasing Power Matters to you.

Connect with Jon on Twitter here:

https://twitter.com/jonnylitecoin

Visit the PPM website for details on how to share your story and to read informative articles.

https://www.purchasingpowermatters.co

Follow the...

Read More »

Read More »

The Old Right on War and Peace

As the force of the New Deal reached its heights, both foreign and domestic, during World War II, a beleaguered and tiny libertarian opposition began to emerge and to formulate its total critique of prevailing trends in America.

Read More »

Read More »

Bitcoin $100.000 noch DIESES Jahr und Bullenmarkt ist NICHT vorbei! (PlanB/stocktoflow)

Viele haben es versucht und wir haben es geschafft: Plan B ist erstmalig auf einem deutschsprachigen Kanal exklusiv nur bei mir zu sehen beziehungsweise zu hören ;-)

Er sagt, dass der Bitcoin Bullenmarkt noch nicht vorbei ist, dass wir dieses Jahr 100.000 Dollar noch erreichen und in was er noch neben Bitcoin investiert.

PlanB Twitter: https://twitter.com/100trillionUSD

PlanB Website: www.planbtc.com

Bitcoin Standard auf Deutsch:...

Read More »

Read More »

Savings Are the Foundation of Economic Growth

Most commentators’ regard savings as harmful to economic growth on the ground that savings are associated with fewer outlays. These commentators portray economic activity as a circular flow of money. Spending by one individual becomes part of the earnings of another individual, and spending by another individual becomes part of the first individual’s earnings.

Read More »

Read More »

Dirk Müller: Machtkampf in China & Auswirkungen auf westliche Tech-Konzerne

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 30.07.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »

EZB und CBDC als Alptraum der Freiheit – aber die Rebellen schlagen zurück! (Brisantes Interview)

Das NEUE Geld !!! Wirst du Gewinner oder Verlierer?

10% Rabatt-Aktion bis Sonntag 08.08.2021, Code: klartext

Krypto-Einsteiger-Kurs: https://thorstenwittmann.com/krypto-kurs

Krypto-Jahres-Abo: https://thorstenwittmann.com/krypto-serenity

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Die Finanzrevolution ist bereits mitten im Gange!

Es erinnert mich etwas an „Krieg der Sterne“, denn der polare Kampf um das neue Geld ist...

Read More »

Read More »

“They Said What?!” John Lennon edition

Bob unveils a new recurring series, in which he gives the context of infamous quotations. In this episode, he covers two allegedly shocking quotes from John Lennon, John Maynard Keynes' "in the long run we're all dead," Trump on Nazis being very fine people, Dan Quayle misspelling potato, Obama's "you didn't build that," and Bohm-Bawerk on Karl Marx.

Read More »

Read More »

What Made Rothbard Great

If you don’t mind, I am going to do what men of my age do from time to time, and that is tell you war stories—usually insufferably boring for younger people, but occasionally enlightening if you find that perhaps you are going through a similar trial. I want to talk about my own situation in 1961, ’62, ’63, when I was an undergraduate.

Read More »

Read More »

What Can Your Dollar Do For You? | Why Purchasing Power Matters To Patrick

Purchasing Power Matters! Patrick shares what and why it matters to him. Share your thoughts in the comment section below. Tell your story and let the world hear why Purchasing Power Matters to you.

Connect with Patrick on Twitter here:

https://twitter.com/TPS0011

Visit the PPM website for details on how to share your story and to read informative articles.

https://www.purchasingpowermatters.co

Follow the Purchasing Power Matters social media...

Read More »

Read More »

End the Shutdown, Again

Sixteen months ago, in March 2020, we argued for an end to government-imposed shutdowns of businesses, schools, churches, restaurants, and events due to the covid virus: The shutdown of the American economy by government decree should end. The lasting and far-reaching harms caused by this authoritarian precedent far outweigh those caused by the COVID-19 virus.

Read More »

Read More »

China ZERSTÖRT seinen Aktienmarkt – jetzt einsteigen?

Die chinesische Regierung geht rigoros gegen den Techsektor vor und sorgt für den stärksten Börsencrash seit 2008. Was sind die wahren Hintergründe, ist das Kursmassaker vorbei und sollte man jetzt einsteigen? All das heute im Video!

► Mein neues Buch

Du möchtest "Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung...

Read More »

Read More »

Dirk Müller: Löschung und Sperrung – Facebook-AGBs sind unwirksam!

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 30.07.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »

How the Federalists Bullied Rhode Island into Joining the United States

Doughty, courageous little Rhode Island was the last state left. It is generally assumed that—even by the most staunchly Antifederalist historians—Rhode Island could not conceivably have gone it alone as a separate nation.

Read More »

Read More »

Eine „gute“ Inflation gibt es nicht, aber es gibt „gute“ Preissteigerungen

Eine „gute“ Inflation gibt es nicht, aber es gibt „gute“ Preissteigerungen 19.07.2021 – Tot ist die Inflation nie, allenfalls nur scheintot – Wann Preissteigerungen Inflation sind – Inflation durch übermäßiges Ausweiten der Geldmenge – Nicht alle Preisanstiege sind Inflation – Alle Preise vermitteln Informationen, zumal wenn sie steigen – Eine „gute“ Inflation gibt es nicht, aber es gibt „gute“ Preissteigerungen – Die gute Inflation ist Humbug

von...

Read More »

Read More »