Category Archive: 6b) Austrian Economics

Keith Weiner: Gold 1, Bitcoin 0

Tom welcomes back Keith Weiner, to the show. Keith is the President & Founder of Gold Standard Institute USA and CEO of Monetary Metals.

Read More »

Read More »

50 years since the closure of the “gold window”

President Nixon’s unilateral decision to sever the last link between the dollar and gold had wide ranging and long lasting consequences for the global economy and for the entire monetary system. The end of sound money facilitated and accelerated the concentration of power at the top and the ability to manipulate the currency allowed politicians and central planners to further expand the state’s reach and push ahead with populist, reckless and...

Read More »

Read More »

Dirk Müller: Wunderwirksame Bundestagswahl – Wer würfelt eigentlich die Zahlen?

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 08.10.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »

Warum gibt es NEGATIVE Schlagzeilen über Krypto? Soll ich noch Bitcoin kaufen? Jürgen Wechsler

KRYPTOREVOLUTION und BITCOIN-COUP

J. Wechsler NGO-LIVE: https://thorstenwittmann.com/ngo-2021

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Homepage Thorsten Wittmann: https://thorstenwittmann.com/

Die Kryptorevolution und wie Kleinanleger ausgeschlossen werden (außer du verstehst das Spiel)!

Manche Dinge sind nicht so, wie sie zu sein scheinen.

Im heutigen Tippvideo von „Faszination Freiheit“ werfen wir einen Blick...

Read More »

Read More »

“Shortages” Aren’t Causing Inflation. Money Creation Is.

For central bankers and mainstream analysts the recent inflation outburst is only a transitory phenomenon which has nothing or very little to do with the massive monetary and fiscal stimuli unleashed during the pandemic. Although the Fed has recently conceded that price pressures are persisting longer than expected, the surge of inflation is allegedly due to supply bottlenecks caused by the pandemic.

Read More »

Read More »

Dr. Markus Krall nennt ZEITRAUM wann der CRASH KOMMT! Es ist unausweichlich!

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin,

Read More »

Read More »

Why Does Money Have Value? Not Because the Government Says It Does.

Why does the dollar bill in our pockets have value? According to some commentators, money has value because the government in power says so. For other commentators the value of money is on account of social convention. What this implies is that money has value because it is accepted, and why is it accepted?

Read More »

Read More »

Ampel Regierung: Sozialismus, Steuern und Enteignung (Kanzler Olaf Scholz)

Nachlese zur Wahl: Was bedeutet ein Kanzler Scholz für unseren Wohlstand, Dein Geld und die Zukunft? Wird jetzt alles besser? Oder noch schlimmer? Muss man jetzt gar auswandern? Wie konnte Scholz die Wahl gewinnen, obwohl er etliche Skandale an der Backe hat? Wie konnte es soweit überhaupt kommen?

► Mein neues Buch

Du möchtest "Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit Signatur:...

Read More »

Read More »

The Economic Foundations of Freedom

Animals are driven by instinctive urges. They yield to the impulse that prevails at the moment and peremptorily asks for satisfaction. They are the puppets of their appetites. Man's eminence is to be seen in the fact that he chooses between alternatives. He regulates his behavior deliberatively.

Read More »

Read More »

ATENCIÓN: Inflación Verde Y Crisis Energética

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Time, Income & Savings | Why Purchasing Power Matters to Iustin

Purchasing Power Matters! Iustin shares what and why it matters to him. Your time spent earning income increases, while your ability to save and purchase goods decreases.

Share your thoughts in the comment section below. Tell your story and let the world hear why Purchasing Power Matters to you.

Find out more about Iustin here:

https://www.masteringthehumanexperience.com/

Visit the PPM website for details on how to share your story and to read...

Read More »

Read More »

Dirk Müller: Wie naiv sind wir eigentlich!?

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 05.10.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »

Ex-CIA Berater PACKT aus und lässt BOMBE platzen! Die STIMMUNG KOCHT!

Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland

Read More »

Read More »

Berliners in 2021 Want to Expropriate Private Housing

On September 6, 2021, the city-state of Berlin, Germany’s capital, held a referendum: voters in Berlin had to decide whether thousands of housing units owned by “large real estate firms” should be nationalized. 56.4 percent voted yes, 39 percent no.

Read More »

Read More »

CORONA – die Wahrheit kommt ans Licht (Interview Dr. Roland Wiesendanger)

Corona ist immer noch präsent wie eh und je, doch sind die wichtigsten Fragen weiterhin ungeklärt. Wo kam das Virus her und wie sehen die Konsequenzen aus, wenn es tatsächlich aus Menschenhand erschaffen wurde? Was muss passieren damit die Beweiskraft anerkannt wird? Dies und noch mehr zur Labortheorie besprechen wir heute im zweiten Part "Marc spricht mit..." Dr. Roland Wiesendanger.

► Interview Dr. Roland Wiesendanger Teil 1:

►...

Read More »

Read More »

Dirk Müller: Monopolistische Strukturen feuergefährlich – Freie Marktwirtschaft adé

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 05.10.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »

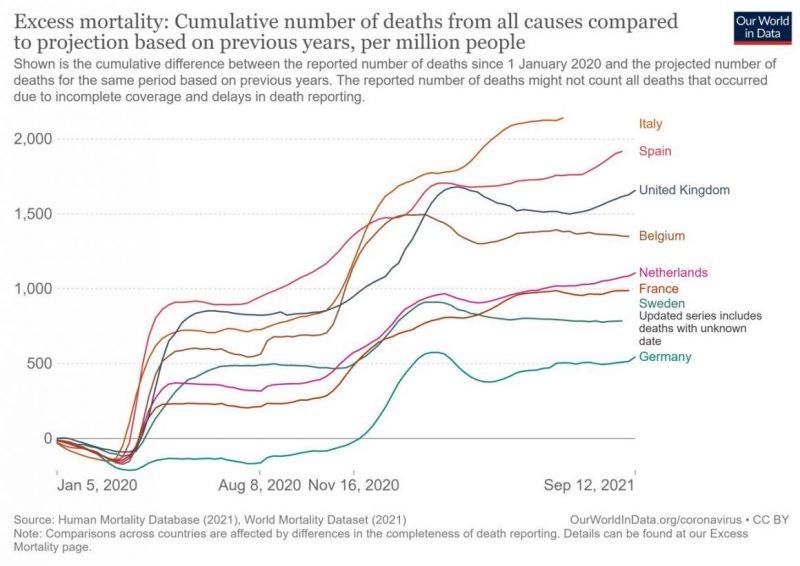

Without Lockdowns, Sweden Had Fewer Excess Deaths Than Most of Europe

It’s now been more than eighteen months since governments began the new social experiment now known as “lockdowns.” Prior to 2020, forced “social distancing” was generally considered to be too costly in societal terms to justify such a risky experiment.

Read More »

Read More »