Category Archive: 6b) Austrian Economics

4 Szenarien für dein Geld in 2022 – Dr. Nouriel Roubinis Prognosen

Was passiert 2022 mit deinem Geld? 4 Szenarien von Star-Ökonom Dr. Nouriel Roubini

Geldsicherheit LIVE: https://thorstenwittmann.com/geldsicherheit-garantiert/

Neue Tippvideos: https://thorstenwittmann.com/klartext/

Nouriel Roubini – was jetzt tun mit deinem Geld?

Nouriel Roubini ist einer der renommiertesten Ökonomen der Welt. ER unterscheidet sich von vielen anderen dadurch, dass er auch unangenehme Dinge anspricht, die von den meisten...

Read More »

Read More »

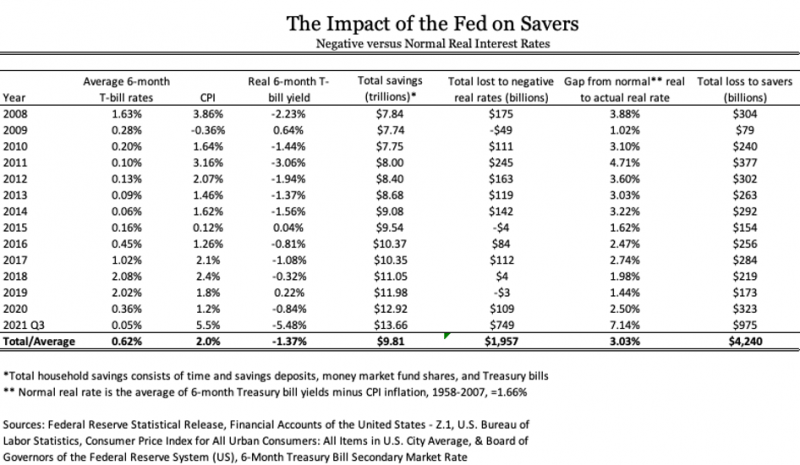

Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion

With inflation running at over 6 percent and interest rates on savings near zero, the Federal Reserve is delivering a negative 6 percent real (inflation-adjusted) return on trillions of dollars in savings. This is effectively expropriating American savers’ nest eggs at the rate of 6 percent a year. It is not only a problem in 2021, however, but an ongoing monetary policy problem of long standing.

Read More »

Read More »

Dr Markus Krall warnt eindringlich so schlecht stehts um unsere BANKEN

Einige tolle Finanzexperten: Markus Krall, Andreas Popp, Dirk Müller, Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Daniel Stelter, Max Otte, Clemens Fuest, Florian Homm

Read More »

Read More »

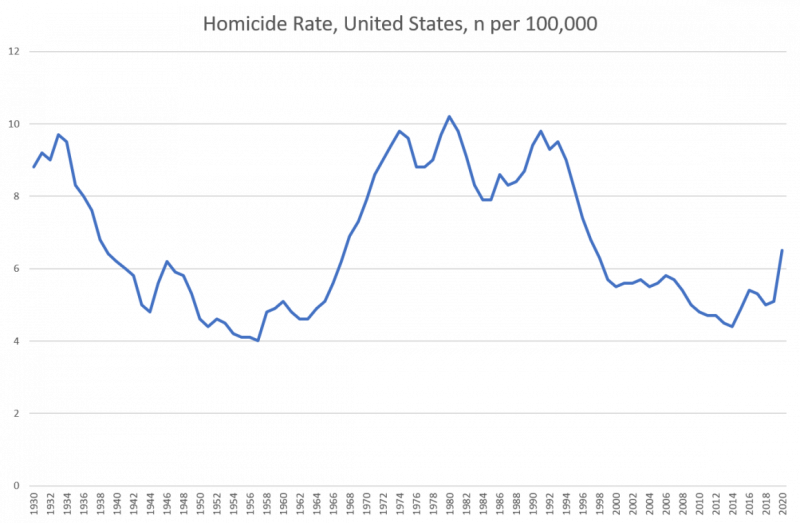

Homicide Rates in 2020 Rose to a 24-Year High. Is This a Crisis of State Legitimacy?

By mid 2020, it was already becoming clear that the United States was experiencing a spike in crime. Indeed, by midyear, numerous media outlets were already reporting remarkably large increases in homicide in a number of cities. It was clear that if then-current trends continued, homicide rates in the United States would reach levels not seen in over a decade.

Read More »

Read More »

Thorsten Polleit – Ein Referat über die Inflation

In diesem Beitrag, berichtet Thorsten Polleit über die verheerenden Folgen von Inflation auf das Marktgeschehen.

Read More »

Read More »

What the United States Can Learn from the European City-States

Over the past year and a half, we have seen some of the largest divides in US state policy in recent history. Certain states such as California have implemented heavy lockdowns, mask mandates, curfews, and other restrictions for months on end, whereas states such as South Dakota never had an official lockdown to begin with.

Read More »

Read More »

Dirk Müller: Die Musk-Brüder – Heilige oder doch nur Kapitalisten? Hintergründe zur Twitter-Umfrage

Sehen Sie das vollständige Video mit weiteren spannenden Infos auf Cashkurs.com!

Hier geht’s zur Anmeldung: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 12.11.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher

Cashkurs*Trends - Heute schon wissen was...

Read More »

Read More »

Prof Thorsten Polleit alarmiert – Der Euro ABSTURZ läuft!!!

THORSTEN POLLEIT: ALSO DIE ENTSTEHUNG DES GELDES LÄSST SICH ERKLÄREN ÜBER DIE SPONTAN KRÄFTE DES MARKTES MENSCHEN FINDEN SICH ZUSAMMEN IN EINER ARBEITSTEILUNG UND FRÜHER ODER SPÄTER ERKENNT MAN DASS DAS VERWENDEN VON EINEM INDIREKTEN TAUSCHMITTEL FÜR ALLE BETEILIGTEN

Read More »

Read More »

Biden’s Infrastructure Plan Points to Even More Price Inflation

What is the worst thing a government can do when there is high inflation and supply shortages? Multiply spending on energy and material-intensive areas. This is exactly what the US infrastructure plan is doing and—even worse—what other developed nations have decided to copy.

Read More »

Read More »

#RestartVienna at an unforgettable 10th Austrian Economics Conference – 1st Day

On November 4-5, the 10th Austrian Economics Conference took place at the Austrian Central Bank (Österreichische Nationalbank). The event was organized in collaboration with the Fundación Bases and the Hayek Institut and received more than 150 academics, researchers, think-tankers, entrepreneurs, and student advocates of the ideas of freedom from all over the world.

Read More »

Read More »

Will the Next “Skyscraper Curse” Be Found in the Digital World?

The vast majority of Mises Wire readers are already familiar with the Austrian business cycle theory. For those who are not, it is an Austrian perspective on what causes the sudden general cluster of business errors that results in a boom-bust cycle, with the busts being the recessions or depressions that we as a society so dread.

Read More »

Read More »

VUELVE LA ENERGÍA NUCLEAR. Fuerte Apuesta Mundial

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Employer Vaccine Mandates: When the Feds Pay the Piper, They Call the Tune

Vaccine mandates are much easier to enforce thanks to the spread of government spending, government contracting, and monopolized government services.

Read More »

Read More »

Dr. Markus Krall im Interview äußerst besorgt – Das ist das Ende der Meinungsfreiheit Mega Lockdown

dirk müller

markus krall

andreas popp

hans werner sinn

krall markus

marc friedrich

wirtschaftskrise 2021

dirk müller 2021

ernst wolff

max otte

mr dax

inflation 2021

silber

dr markus krall

florian homm

werner sinn

finanzkrise 2021

finanzcrash 2021

daniel stelter

popp andreas

dr. markus krall

krall

hans werner sinn 2021

wirtschaftskrise 2022

wirtschaftskrise

goldpreis

dr krall

michael mross

sinn hans werner

mark friedrich...

Read More »

Read More »

SANCHEZ ACUERDA UN HACHAZO A TU PENSIÓN Y ESTANCA LA ECONOMÍA

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Was ICH fordere – Politik, Geldsystem und Gesellschaft (Bitcoin, KI und Blockchain)

Heute mein Vortrag für das liberale Institut in Zürich.

Wie können wir die Technologie der Zukunft von Bitcoin und Blockchain für uns und für eine bessere Zukunft einsetzen? Wie muss die Politik der Zukunft aussehen? Was sehe ich für ein neues System und was sind meine Lösungsvorschläge?

#Bitcoin #Politik #Finanzen

► Mein neues Buch

Du möchtest "Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit...

Read More »

Read More »

How Asset Price Inflation Is Different from Goods Price Inflation

There has been no constant concept of asset price inflation through the modern age of fiat money even amongst those who recognize the condition. The term has become most popular in the present period of inflation targeting coupled with the use of radical monetary tools.

Read More »

Read More »

Thanks to Bailouts, Wall Street Banks Are More Fragile than Ever

The financial covid crash of 2020 came and went in a month as the US government threw every monetary and fiscal trick it had at the government-imposed flash panic. We’ll never know which malivestments would have been cleansed. We live on with goods and labor shortages and with higher prices we’re assured by experts are transient.

Read More »

Read More »

Dirk Müller – Jahresendrally oder Jahresendcrash – es bleibt spannend!

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 12.11.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher von Dirk Müller: http://bit.ly/DirkMuellerBuecher...

Read More »

Read More »