Category Archive: 6b) Austrian Economics

Global Governance versus Freedom and Free Enterprise

When assailing global governance, pundits rarely comment on its impact on small countries. Yet the degree to which small countries are ignored by global institutions—like the G7, the International Monetary Fund, and the World Bank—helps to illustrate how institutions of global governance tend to primarily reflect the values of managerial elites from large and wealthy states.

Read More »

Read More »

Markus Dan: Wahre Geschichte des Geldes

Inflation, Hyperinflation, Markus Krall, Dirk Müller, Neustart, reset, der große reset, Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland, Geld Deutschland

Read More »

Read More »

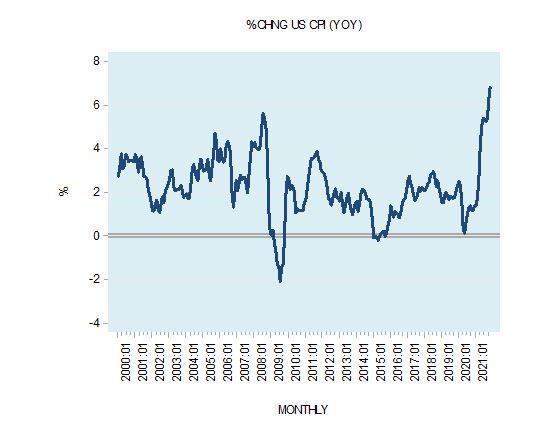

Stop Pretending Price Inflation Is a Result of “Too Much” Profit

Some commentators attribute the latest sharp increase in the Consumer Price Index to businesses pushing prices of goods higher in order to secure higher profits. (See the New York Times article “Democrats Blast Corporate Profits as Inflation Surges,” January 3, 2022). Note that the yearly growth rate of the Consumer Price Index jumped to 6.8 percent in November 2021 from 1.2 percent the year before.

Read More »

Read More »

RUNDUMSCHLAG – Bitcoin, Gold, Silber und Inflation mit Willem Middelkoop

Heute gibt es einen Rundumschlag! Wie ist Willem Middelkoops Ansicht zu Bitcoin, was sind seine Preisprognosen für Gold, Silber, aber auch andere vielleicht noch nicht so präsente Investments? Was sagt er zu der momentanen Inflation und wie lange sieht er den Euro noch am Leben? All dies und noch mehr heute in einer neuen Folge "Marc spricht mit..."

Willem Middelkoop Twitter:

https://twitter.com/wmiddelkoop

Willem Middelkoop Buch DE:...

Read More »

Read More »

What the Regime Will Do to Fight Private Digital Currencies

During a confirmation hearing with the US Senate this week, Fed chairman Jerome Powell was asked about whether or not a digital currency issued by a central bank could exist side by side with private cryptocurrencies. Powell responded that there is nothing that would prevent private cryptos from “coexisting” with a “digital dollar.”

Read More »

Read More »

DESASTRE. Disfrazar paro con empleo público, estrategia suicida.

Lectura adicional: https://www.dlacalle.com/diez-razones-que-muestran-por-que-los-datos-de-paro-de-diciembre-2021-son-malos/

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

ACHTUNG! STELLT ALLES IN DEN SCHATTEN! RAY DALIO PROGNOSE SCHOCKT! DAS WIRD ALLES BEHERRSCHEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren? Wie funktioniert die Wirtschaft? Kommt die Bankenkrise? Wie entwickeln sich Versicherungen, digitaler Euro & die Wirtschaft?

Read More »

Read More »

The New Deal and the Emergence of the Old Right

During the 1920s, the emerging individualists and libertarians — the Menckens, the Nocks, the Villards, and their followers — were generally considered Men of the Left; like the Left generally, they bitterly opposed the emergence of Big Government in twentieth-century America, a government allied with Big Business in a network of special privilege, a government dictating the personal drinking habits of the citizenry and repressing civil liberties,...

Read More »

Read More »

Cashkurs*Wunschanalysen: Disney, Salesforce & Domino’s Pizza unter der Chartlupe

Mario Steinrücken nimmt Ihre Aktienwünsche unter die Lupe: Hier geht’s zum vollständigen Video mit weiteren Titeln https://bit.ly/3quTp4h

Im Video bespricht unser Experte die von der Cashkurs*Community gewünschten Titel am Chart.

Heute: Disney, Salesforce & Domino’s Pizza und noch mehr spannende Aktien wie Alphabet, Aixtron und Accenture…

Welchen Titel soll Mario für Sie kurz & knackig unter die Chartlupe legen? Als Mitglied können Sie...

Read More »

Read More »

¿RECORD DE EMPLEO 2021? Desmontando el ataque de los TROLL

Todos los datos aquí:

https://www.dlacalle.com/diez-razones-que-muestran-por-que-los-datos-de-paro-de-diciembre-2021-son-malos/

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

Ist Bitcoin TOT? Ex-Währungsbanker packt aus!

Bitcoin tot oder lebendiger denn je? Bankeninsider im Interview

Das Neue Geld – Live: https://thorstenwittmann.com/ngo-2022

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Das Rätsel Bitcoin – was passiert im Hintergrund?

Mit dem Ex-Top-Investmentbanker Jürgen Wechsler spreche ich heute über Kryptowährungen und deren Zukunft.

Wie tot ist Bitcoin wirklich?

Wird es verboten?

Oder ist Krypto lebendiger als je zuvor?...

Read More »

Read More »

ERNST WOLFF: ICH MUSS DAS JETZT SAGEN! WIRTSCHAFT 2022 AM AUSSTERBEN?! KOMMT DIE FINANZKRISE 2022

Ernst Wolff und Markus Krall aktuell über Finanzeliten, Wirtschaftskrise und Great Reset im Wirtschaftsystem - Wann kommt wirtschaftlicher Zusammenbruch?

Read More »

Read More »

Healthcare Freedom

As the Omicron variation of COVID-19 continues to spread, the American people need to be asking themselves an important question: Do they want healthcare freedom or not?

Read More »

Read More »

The Divided States of America | A Conversation with Jeff Deist & Tom Woods

Mises Institute President, Jeff Deist, and Tom Woods, author and host of the Tom Woods podcast, join Judge Napolitano to go in-depth on the state of America today.

Read More »

Read More »

Tina Moran

Provided to YouTube by Viva Records Corporation

Tina Moran · Andrew E · Andrew E · Andrew E

Porno Daw

℗ 2002 Viva Records

Released on: 2002-01-28

Auto-generated by YouTube.

Read More »

Read More »

Inflation in Deutschland | Was wir 2022 erwarten können!

Ähnliche Meinungen teilen andere bekannte Experten, unter anderem: Mr. Dax, Dirk Müller, Dr. Markus Krall, Prof. Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Dr. Daniel Stelter, Prof. Max Otte, Prof. Clemens Fuest, Andreas Popp, Thorsten Polleit,

Read More »

Read More »

How Easy Money Inflated Corporate Profits

In the incessant media discussion about whether inflation is transitory there is a big elephant in the room about which all are silent. Perhaps strangely some do not see it. Others for whatever reason pretend it is not there. The elephant is the fantastic surge in US corporate profits that monetary inflation has fueled during the second year of the pandemic.

Read More »

Read More »

Hat CORONA die digitale Überwachung vorangetrieben? (Interview Norbert Häring)

Auch Norbert Häring sagt, unser Finanzsystem steht vor dem Ende. Wieso er es mit einem Schneeballsystem vergleicht, was genau dies für uns bedeutet und wie Corona die Digitalisierung und damit verbundene totale Überwachung fördert, erfahrt ihr heute in einer neuen Folge "Marc spricht mit..." Norbert Häring.

Norbert Häring sein neues Buch:

https://amzn.to/3BJVWdt

Norbert Häring Twitter:

https://twitter.com/norberthaering

Norbert Häring...

Read More »

Read More »

Die Ereignisse werden sich überschlagen! Das ist jetzt zu tun!

? JETZT AUCH BEI TELEGRAM ! Folgt uns um nichts mehr zu verpassen ? ? https://t.me/financeexperience ❤️ ____________________ ❌KRISENVORSORGE - EMPFEHLUNGEN❌ (*) Krisenvorsorge Ausrüstung: https://www.amazon.de/shop/financeexperience-geldfinanzenwirtschaft?listId=3VXBJI1FZWZPB&ref=cm_sw_em_r_inf_list_own_financeexperience-geldfinanzenwirtschaft_dp_1ZFs28sKehRzJ (*) Krisenvorsorge - Erste Hilfe und Hygiene:...

Read More »

Read More »