Category Archive: 6b) Austrian Economics

Dirk Müller: Alles hängt an der Inflation

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Inflation_11Mai

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 11.05.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

DannyDSBG:WNBA skills trainer beginning journey,DSBG brand,training pro athletes Erica Wheeler

In the full podcast release WNBA skills trainer Danny talks about his Journey in the skills training business, changing the culture in girls basketball in South Florida, his DSBG sports wear brand, and training pro athletes such as Erica Wheeler, Betnijah Laney.

fiye show instagram: https://www.instagram.com/fiye.show/

DSBG instagram: https://www.instagram.com/dsbg_workouts/

DSBG website: https://dontsettlebegreat.com/

Read More »

Read More »

Haz crecer tu dinero – Charlando con Daniel Lacalle & Los Locos de Wall Street

Me han entrevistado desde el canal de Los Locos de Wall Street. ¡Espero que te guste! - https://www.youtube.com/c/LoslocosdeWallStreet

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

Student Loans and Government Subsidies: Another Government “Benefit” Creates Financial Chaos

The origins of the federal student loan program are well documented and follow a similar trajectory to most government subsidy programs in American history.

Read More »

Read More »

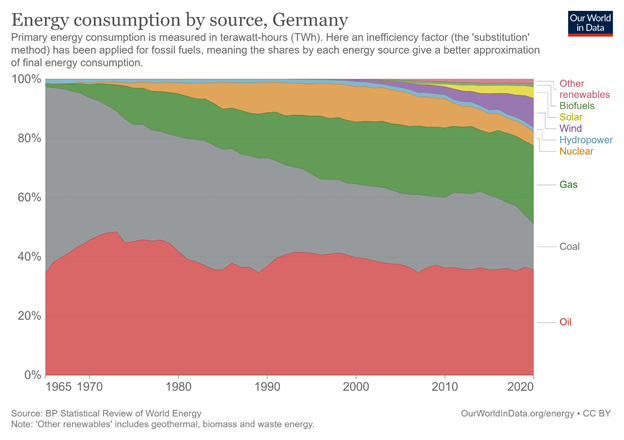

Lighting the Gas under European Feet: How Politicians and Journalists Get Energy So Wrong

“We live in a time where few understand how things get made. It is fine to not know where stuff comes from, but it isn’t fine to not know where stuff comes from while dictating to the rest of us how the economy should be run." —Doomberg

Read More »

Read More »

Lastenausgleich und Vermögensregister – werden wir alle enteignet?

Droht eine Zwangssteuer in Form eines Lastenausgleichs? Wie war das in der Vergangenheit? Wer ist vor allem betroffen? Wie kann man sich schützen? Was plant die Regierung und was hat es mit dem Vermögensregister der EU auf sich?

Mein Blog:

https://www.friedrich-partner.de/blog/neueste-blog-posts

Antrag der Linken - zentrales Immobilienregister:

https://dserver.bundestag.de/btd/20/015/2001513.pdf

► Mein neues Buch

Du möchtest das...

Read More »

Read More »

DannyDSBG:WNBA skills trainer working with Erica Wheeler,Betnijah Laney his love for the womens game

In segment 3 of this podcast WNBA skills trainer Danny talks about working with Erica Wheeler, Betnijah Laney and many more players. How the female pro athletes appreciate what he is doing for the game due to a lack of exposure.

fiye show instagram: https://www.instagram.com/fiye.show/

DSBG instagram: https://www.instagram.com/dsbg_workouts/

DSBG website: https://dontsettlebegreat.com/

Read More »

Read More »

Rothbard Explains The Failure of the “New Economics”

For most people, economics has ever been the "dismal science," to be passed over quickly for more amusing sport. And yet, a glance at the world today will show that we pass over economics at our peril.

Read More »

Read More »

WILLKOMMEN IM BÄRENMARKT! JETZT FÄLLT ALLES! AKTIEN, GOLD, BITCOIN IN KORREKTUR! ZINSEN STEIGEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst!

Read More »

Read More »

The Chinese Slowdown: Much More Than Covid

The most recent macroeconomic figures show that the Chinese slowdown is much more severe than expected and not only attributable to the covid-19 lockdowns. The lockdowns have an enormous impact. Twenty-six of 31 China mainland provinces have rising covid cases and the fear of a Shanghai-style lockdown is enormous.

Read More »

Read More »

Danny DSBG:How he started DSBG, hopes to inspire people through his brand, pro athletes wearing dsbg

In segment 2 of this podcast Danny talks about how he started DSBG, how he hopes to inspire people through his brand message, and the appreciation of pro athletes such as Victor Oladipo, Erica Wheeler, John Wall, Carlos Boozer etc wearing DSBG and supporting the brand.

fiye show instagram: https://www.instagram.com/fiye.show/

Danny DSBG instagram: https://www.instagram.com/dsbg_workouts/

DSBG website: https://dontsettlebegreat.com/

Read More »

Read More »

KEINEN SCHRITT WEITER! MARKUS KRALL WARNT VOR ESKALATION DER KRISE! | WIRTSCHAFT AKTUELL

Markus Krall ist CEO von Goldhandel Degussa und Ökonom: Kommt jetzt die Inflation, Rezession und Stagflation? Wie entwickelt sich Deutschland und die deutsche Wirtschaft?

Read More »

Read More »

Will the Pentagon Induce Russia to Use Tactical Nukes in Ukraine?

For the past 25 years, the Pentagon has moved inexorably toward admitting Ukraine into NATO, which would then permit the Pentagon to install its nuclear missiles in Ukraine — that is, on Russia’s border.

Read More »

Read More »

Contrary to What Some Economists Claim, the Fed Can’t Give the Economy a “Neutral” Rate of Interest

On April 19, 2022, at the Economic Club in New York, the Chicago Federal Reserve Bank president Charles Evans said the Fed is likely to lift by year end its federal funds rate target range close to the neutral range of between 2.25 to 2.50 percent. Furthermore, on April 21, 2022, Fed chairman Jerome Powell corroborated this by stating that the Fed wants to raise its benchmark rate to the neutral level.

Read More »

Read More »

Danny DSBG:WNBA skills trainer on his journey becoming a trainer,how coaching helped mold him part 1

In segment one of this podcast WNBA skills trainer Danny talks to us about how his journey began and what led him to become a skills trainer. how coaching helped him become a better trainer.

fiye show instagram: https://www.instagram.com/fiye.show/

Danny DSBG instagram: https://www.instagram.com/dsbg_workouts/

DSBG WEBSITE:https://dontsettlebegreat.com/

Read More »

Read More »

Forget What the “Experts” Claim about Deflation: It Strengthens the Economy

For most experts, deflation is bad news since it generates expectations for a continued decline in prices, leading consumers to postpone the purchases of present goods, since they expect to purchase them at lower prices in the future. Consequently, this weakens the overall flow of current spending and this, in turn, weakens the economy.

Read More »

Read More »

War in Ukraine – Week 10

This is Liza. She is 15 years old. After her town got shelled and two people got injured she volunteered to drive them to get some medical help, because no one else would. First she got through mines on the road, then Russian soldiers shot at the car, injuring both of her legs. But she kept driving until the car stopped. Fortunately, they got picked up by our guys, and this brave little girl and her passengers are recovering right now.

Read More »

Read More »

Prognose von Markus Krall !!! Große Warnung !!! ILLUSION der EZB !!! Mega Inflation 2022 !!!

Ähnliche Meinungen teilen andere bekannte Experten, unter anderem: Mr. Dax, Dirk Müller, Dr. Markus Krall, Prof. Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Dr. Daniel Stelter, Prof. Max Otte,

Read More »

Read More »

CONVERSACIONES DEUSTO Daniel Lacalle

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »