Category Archive: 6b) Austrian Economics

Danny DSBG:How he started DSBG, hopes to inspire people through his brand, pro athletes wearing dsbg

In segment 2 of this podcast Danny talks about how he started DSBG, how he hopes to inspire people through his brand message, and the appreciation of pro athletes such as Victor Oladipo, Erica Wheeler, John Wall, Carlos Boozer etc wearing DSBG and supporting the brand.

fiye show instagram: https://www.instagram.com/fiye.show/

Danny DSBG instagram: https://www.instagram.com/dsbg_workouts/

DSBG website: https://dontsettlebegreat.com/

Read More »

Read More »

KEINEN SCHRITT WEITER! MARKUS KRALL WARNT VOR ESKALATION DER KRISE! | WIRTSCHAFT AKTUELL

Markus Krall ist CEO von Goldhandel Degussa und Ökonom: Kommt jetzt die Inflation, Rezession und Stagflation? Wie entwickelt sich Deutschland und die deutsche Wirtschaft?

Read More »

Read More »

Will the Pentagon Induce Russia to Use Tactical Nukes in Ukraine?

For the past 25 years, the Pentagon has moved inexorably toward admitting Ukraine into NATO, which would then permit the Pentagon to install its nuclear missiles in Ukraine — that is, on Russia’s border.

Read More »

Read More »

Contrary to What Some Economists Claim, the Fed Can’t Give the Economy a “Neutral” Rate of Interest

On April 19, 2022, at the Economic Club in New York, the Chicago Federal Reserve Bank president Charles Evans said the Fed is likely to lift by year end its federal funds rate target range close to the neutral range of between 2.25 to 2.50 percent. Furthermore, on April 21, 2022, Fed chairman Jerome Powell corroborated this by stating that the Fed wants to raise its benchmark rate to the neutral level.

Read More »

Read More »

Danny DSBG:WNBA skills trainer on his journey becoming a trainer,how coaching helped mold him part 1

In segment one of this podcast WNBA skills trainer Danny talks to us about how his journey began and what led him to become a skills trainer. how coaching helped him become a better trainer.

fiye show instagram: https://www.instagram.com/fiye.show/

Danny DSBG instagram: https://www.instagram.com/dsbg_workouts/

DSBG WEBSITE:https://dontsettlebegreat.com/

Read More »

Read More »

Forget What the “Experts” Claim about Deflation: It Strengthens the Economy

For most experts, deflation is bad news since it generates expectations for a continued decline in prices, leading consumers to postpone the purchases of present goods, since they expect to purchase them at lower prices in the future. Consequently, this weakens the overall flow of current spending and this, in turn, weakens the economy.

Read More »

Read More »

War in Ukraine – Week 10

This is Liza. She is 15 years old. After her town got shelled and two people got injured she volunteered to drive them to get some medical help, because no one else would. First she got through mines on the road, then Russian soldiers shot at the car, injuring both of her legs. But she kept driving until the car stopped. Fortunately, they got picked up by our guys, and this brave little girl and her passengers are recovering right now.

Read More »

Read More »

Prognose von Markus Krall !!! Große Warnung !!! ILLUSION der EZB !!! Mega Inflation 2022 !!!

Ähnliche Meinungen teilen andere bekannte Experten, unter anderem: Mr. Dax, Dirk Müller, Dr. Markus Krall, Prof. Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Dr. Daniel Stelter, Prof. Max Otte,

Read More »

Read More »

CONVERSACIONES DEUSTO Daniel Lacalle

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

US-Experte: Russland ist nicht so schwach, wie dargestellt! (Biden krank?)

Der USA Experte und Insider Dr. Josef Braml sieht die NATO und die USA als Illusion und unverlässlichen Partner. Europa müsse sich emanzipieren und der Euro muss Weltwährung werden. Das sehe ich natürlich ganz anders. Spannend sind seine Insiderquellen in den USA: Diese sehen Russland nicht so schwach wie oftmals dargestellt und attestieren der Ukraine schlechte Karten. Außerdem erzählt er aus dem Nähkästchen den wahren Gesundheitszustand von...

Read More »

Read More »

Is It “Disloyal” to “Side with Russia”?

Last week, I received an email from a conservative-oriented libertarian who suggested to me that it is disloyal to “side with Russia” because Ukraine was “just sitting there” when it was invaded by Russia.

Read More »

Read More »

GENAU DAVOR HABEN WIR GEWARNT!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

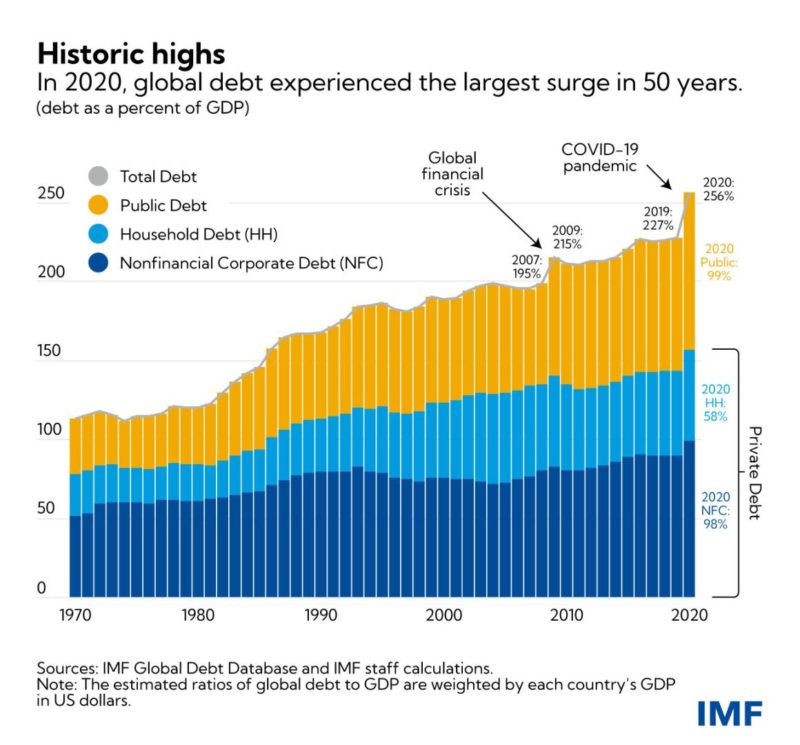

Roots of Our Current Inflation: A Deeply Flawed Monetary System

A monetary system that allows the creation of money out of thin air is vulnerable to the fits of credit expansion and credit contraction. Periods of credit expansion typically occur over many years and even decades while the phases of credit contraction happen like sudden implosions. The monetary policy makers tend to promote the prolongation of credit expansion because they fear deflation.

Read More »

Read More »

DESPLOME DEL EURO. MALA NOTICIA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

NEUER PLAN DER FINANZELITE!

Wirtschaft aktuell: Was passiert jetzt? Geld investieren, aber richtig - Gold kaufen? Immobilien kaufen? Sparen oder Investieren?

Read More »

Read More »

Expect Washington to Throw a Fit over China’s New Deal with the Solomon Islands

Washington regards the entire world as its "sphere of influence." But now Beijing is looking to follow the US playbook on hegemony and expand Beijing's network of military bases abroad.

Read More »

Read More »

Cashkurs*Wunschanalysen: Meta, AMD und ProSiebenSat.1 unter der Chartlupe

Mario Steinrücken hat wieder die Aktienwünsche unserer Mitglieder unter die Chartlupe gelegt: Hier geht’s zum vollständigen Video mit weiteren spannenden Titeln wie PayPal und Omnicell - https://bit.ly/Wunschanalysen_06Mai

Im Videoausschnitt hier bespricht unser geschätzter Charttechnik-Experte heute knackig und kurz die Charts von Meta Platforms, AMD und ProSiebenSat.1.

***Bitte beachten Sie, dass es sich hierbei nicht um eine Anlageberatung...

Read More »

Read More »

Euro-Crash durch Krieg mit Russland? Wie sicher ist dein Geld? Interview Jürgen Wechsler

Der Geldkrieg tobt! Es BRODELT beim Euro, Dollar und Rubel.

Geldtraining mit Jürgen Wechsler: https://thorstenwittmann.com/ngo-2022

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Es brodelt (!) an den Währungsmärkten – Russland bald pleite?

Was passiert im Hintergrund des aktuellen Finanzkriegs mit Russland?

Warum ist die Swiftausgrenzung Russlands möglicherweise ein großes Eigentor der USA?

Wie wahrscheinlich ist ein...

Read More »

Read More »