Category Archive: 6b) Austrian Economics

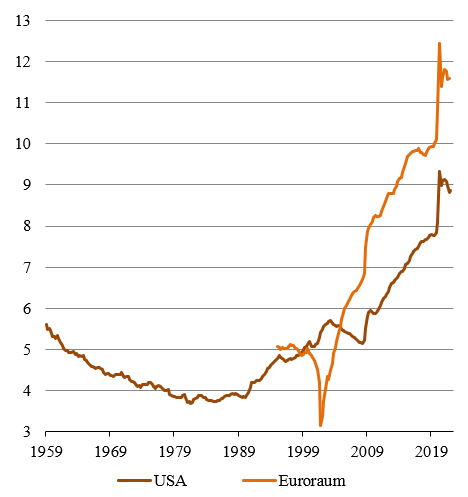

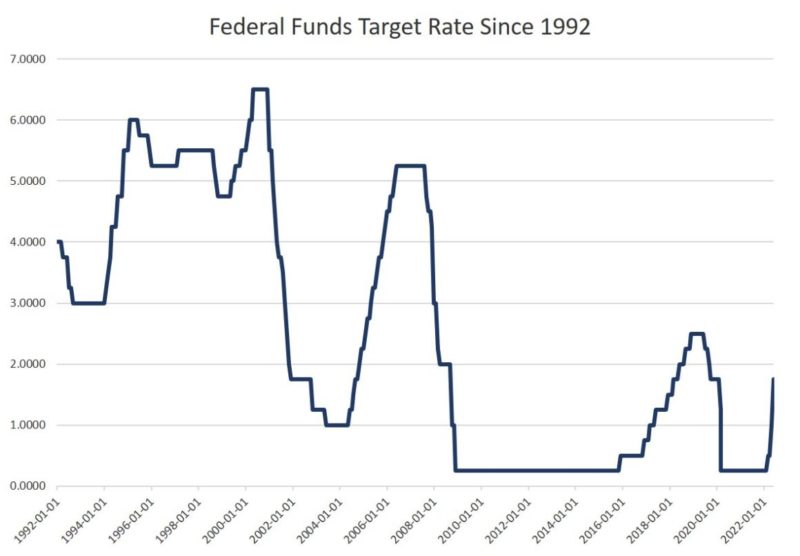

Krugman Is Wrong (Again): Artificially Low Interest Rates Created Bubbles

In his June 21 New York Times article “Is the Era of Cheap Money Over?,” Paul Krugman argues against the view that the Fed has kept interest rates artificially low for the past ten to twenty years.

Read More »

Read More »

Über das Bestreben, Bargeld abzuschaffen und digitales Zentralbankgeld einzuführen

Gleich zu Beginn möchte ich Ihnen die Schlussfolgerungen meiner Überlegungen mitteilen: Das Bargeld zurückzudrängen oder aus dem Verkehr zu ziehen und digitales Zentralbankgeld auszugeben, sind äußerst problematisch, weil.

Read More »

Read More »

UKRAINE ENTEIGNET EIGENE BÜRGER!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren? Wie funktioniert die Wirtschaft? Kommt die Bankenkrise?

Read More »

Read More »

filmmaker & director talks about real-life lessons “Escuelita” (part one)

In this first segment filmmaker & director Guillermo Alfonso (Soflaa) talks about his best learning experiences and those were his teaching moments that prepared him for his independent projects.

FIYE show instagram: https://www.instagram.com/fiye.show/

Guillermo Alfonso instagram: https://www.instagram.com/soflaaa/

Read More »

Read More »

Dirk Müller: Gas- und Stromkrise – Komplett selbstgemacht!

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate220704

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 04.07.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

NOTSTAND IN ITALIEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

Nupur Sharma Issue & The Irrationality Of Indians | The Labyrinth #68

Jayant Bhandari is an investor and entrepreneur. He is a contributing editor for the Liberty Magazine and he has written on political, economic and cultural issues for numerous publications.

Read More »

Read More »

Private property rights under siege – Part I

Part I of II, by Claudio Grass, Hünenberg, Switzerland. It wouldn’t be an exaggeration to argue that private property rights, as understood by classic liberal thinkers, by those who embrace Austrian economic theory and by all member of an enlightened society, are not only the cornerstone, but also the last defense of human civilization and the Western way of life in particular.

Read More »

Read More »

To Avoid Civil War, Learn to Tolerate Different Laws in Different States

Most commentary on the Supreme Court's decision in Dobbs v. Jackson Women's Health Organization—which overturns Roe v. Wade—has focused on the decision's effect on the legality of abortion in various states. That's an important issue. It may be, however, that the Dobbs decision's effect on political decentralization in the United States is a far bigger deal.

Read More »

Read More »

Steuern werden weiter steigen! (Mehrwertsteuer, Bitcoin, Immobilien)

Kommt eine Immobilienabgabe? Welche Steuern steigen noch und werden eingeführt? Ist das Auswandern in steuerfreundliche Länder wie zum Beispiel Dubai immer noch sinnvoll und welche Haken könnte es dabei geben?

Read More »

Read More »

Powell Is the New Arthur Burns, Not the New Paul Volcker

Last year, just as it was becoming increasingly clear that price inflation was mounting, Jerome Powell repeatedly denied there was any reason for concern. He called inflation "transitory." A few months later, he admitted it was not transitory, but denied it was "entrenched." Then, by late 2021, he admitted price inflation was getting out of control but still took no action of any consequence.

Read More »

Read More »

How Money Printing Destroyed Argentina and Can Destroy Others

Inflation in Argentina is far worse than neighboring countries. It has only one cause: an extractive and confiscatory monetary policy—printing pesos without control and without demand.

Read More »

Read More »

Peter Lewin and Steven Phelan: How Do Entrepreneurs Calculate Economic Value Added? Subjectively.

At the core of the entrepreneurial orientation that is the engine of vibrant, growing, value-creating, customer-first businesses, we find the principles of subjectivism and subjective value. Subjective value embraces not only the value the customer seeks, but also the value that entrepreneurs establish in their companies: capital value.

Read More »

Read More »

Stagflation 2.0 Is Here To Stay | Ronald Stöferle and Mark Valek

Ronald Stöferle and Mark Valek of Incrementum AG are pioneers in the world of hard assets, stern devotees of gold and Bitcoin, and deep skeptics about the sustainability of debt-based monetary systems.

Read More »

Read More »

Who Really Makes US Foreign Policy? Who Benefits and Who Loses?

In a piece of news that shocked the mainstream media, but which shocked no one familiar with the academic industry writ large, retired US Army general John Allen was forced to resign as president of the Brookings Institution after it was revealed the FBI was investigating him for lobbying on behalf of the Qatari monarchy.

Read More »

Read More »

Cashkurs*Wunschanalysen: Standard Lithium, Siemens und BYD unter der Chartlupe

Mario Steinrücken hat wieder die Aktienwünsche unserer Mitglieder unter die Chartlupe gelegt: Hier geht’s zum vollständigen Video mit weiteren spannenden Titeln wie Disney, Linde oder Volkswagen: https://bit.ly/Wunschanalysen01Juli

Als Mitglied können Sie sich im Kommentarbereich auf https://www.cashkurs.com/ Ihren Favoriten für die nächste Runde wünschen - Unsere Experten nehmen jeden Freitag die Wunschaktien unter die Chartlupe!

***Bitte...

Read More »

Read More »

How Bad Were Recessions before the Fed? Not as Bad as They Are Now

With a recession looming over the average American, the group to blame is pretty obvious, this group being the central bankers at the Federal Reserve, who inflate the supply of currency in the system, that currency being the dollar. This is what inflation is, the expansion of the money supply either through the printing press or adding zeros to a computer screen.

Read More »

Read More »

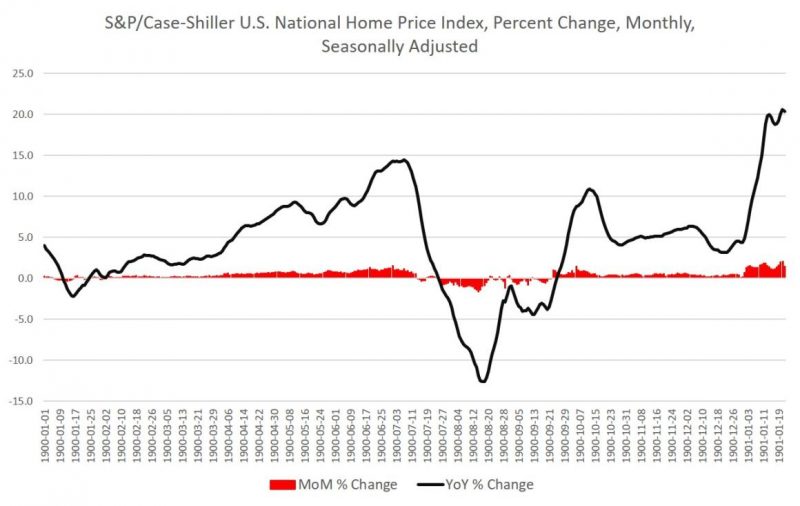

What Will It Take to End Rampant Home-Price Inflation?

Real wages are falling, inflation is at a 40-year high, and the Atlanta Fed predicts we'll find GDP growth at zero for the second quarter. Meanwhile, both the yield curve and money-supply growth point to recession. But when it comes to the latest data on home prices, there's still no sign of any deflation or even moderation.

Read More »

Read More »

Economic Winter Has Arrived

The average card-carrying Austrian would say that the Federal Reserve is creating money by the bale, with evidence being Consumer Price Index prints of 8.6 percent per the Bureau of Labor Statistics or over 15 percent per John Williams’s shadowstats.com computation based on the way the government calculated CPI back in 1980.

Read More »

Read More »