Category Archive: 6b) Austrian Economics

Grundsteuerreform 2022: Alles was DU wissen musst! (Elster + Spartipp)

Die Grundsteuerreform ist da!

WICHTIG: Diese betrifft auch Mieter!

Schon jetzt sind Millionen von Immobilienbesitzern überfordert, gefrustet und verzweifelt. Heute erkläre ich euch das komplexe Thema verständlich und kompakt, wie ihr vorgehen müsst, welche Daten ihr benötigt, wo ihr diese findet sowie wie ihr bares Geld sparen könnt. Ich zeige euch auf, warum die Reform für die meisten teurer wird und wieso auch Mieter betroffen sind, wo Gefahren...

Read More »

Read More »

How British Efforts to Enforce Equality Have Led to a Woke Totalitarianism

From the Equal Pay Act 1970 to the Equality Act 2010, there has been a wave of legalization in Britain to turn the state into some omniscient being that can determine the intentions of an employer. While these pieces of legislation did not enforce direct quotas onto businesses, they have increased inefficiencies through the increase in human resources roles for companies and organizations to cover their own backs.

Read More »

Read More »

DIESE FRAU WILL DEIN VERMÖGEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

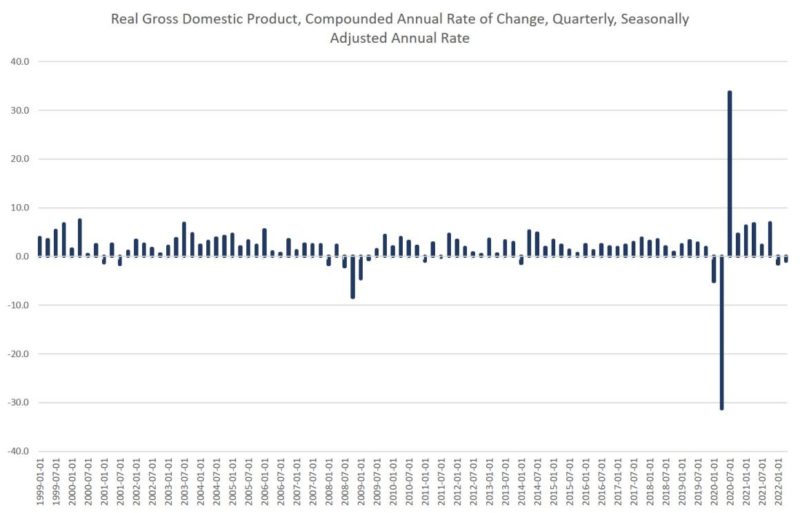

GDP Shrinks Again as Biden Quibbles over the Definition of “Recession”

The U.S. economy contracted for the second straight quarter during the second quarter this year, the Bureau of Economic Analysis reported Thursday. With that, economic growth has hit a widely accepted benchmark for defining an economy as being in recession: two consecutive quarters of negative economic growth.

Read More »

Read More »

BÄRBOCK DREHT DURCH!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

Emil Kauder as an Austrian Dehomogenizer

Rothbard's two-volume An Austrian Perspective on the History of Economic Thought contains a lengthy reference list, but a close look at the books reveals that Rothbard continually cited certain authors and borrowed his theses from them.

Read More »

Read More »

Dirk Müller: Hungeraufstände️in Schwellenländern zu erwarten!

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Tagesausblick220714

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Tagesausblick vom 14.07.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

ICH WÄRE SONST GESTORBEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

Regional Territories: A Decentralization Plan for the USA

There is more talk of secession and civil war in the United States today than at any time since the 1850s, and popular confidence in government appears to be at an all-time low. As a foreigner, I have no particular red or blue loyalties, but I have deployed with Americans on many occasions, and in some ways, their history is also mine.

Read More »

Read More »

Austrians vs. Neoclassicists on Monopolies

A monopoly is often seen as one of the gravest and most concerning manifestations of market failure. In the neoclassical tradition, the existence of a monopolist in a market is generally seen as sufficient justification for government intervention to put a halt to the monopolist's exploitative ways.

Read More »

Read More »

Investment Versus Speculation: Is There a Difference? | Finance Friday With Jim Brown

In today's episode of Finance Friday, Jim Brown will moderate a discussion between Seth Levine & Keith Weiner. The theme of the discussion will be a contrast between two great historical experts:

- Benjamin Graham, the father of value investing (and Warren Buffett's mentor), made a significant distinction between "speculation" and "investment."

- Ludwig Von Mises, the central figure of the Austrian School, said speculation...

Read More »

Read More »

The Unknown Future of Food Prices – Global Macro Update

Today I spoke with economist and agriculture expert Dan Basse of AgResource. The discussion was more than I expected—the US and the world are facing serious food security issues.

Read More »

Read More »

Cashkurs*Wunschanalysen: PayPal, Newmont Mining und SFC Energy unter der Chartlupe

Mario Steinrücken hat wieder die Aktienwünsche unserer Mitglieder unter die Chartlupe gelegt: Hier geht’s zum vollständigen Video mit weiteren spannenden Titeln wie Adobe, Nintendo und Vale: https://bit.ly/Wunschanalysen2907

Als Mitglied können Sie sich im Kommentarbereich auf https://www.cashkurs.com/ Ihren Favoriten für die nächste Runde wünschen - Unsere Experten nehmen jeden Freitag die Wunschaktien unter die Chartlupe!

***Bitte beachten Sie,...

Read More »

Read More »

Was ist Geld WIRKLICH? – Interview mit Gabriele Eckert

Was ist Geld WIRKLICH? Wie kommst du jeden Tag mehr in die Leichtigkeit?

Europakongress: https://europakongress.com/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Gabriele Eckert Homepage: https://www.cqm-hypervoyager.de/home

Verblüffendes Tippvideo: Was ist Geld wirklich?

Gold, Krypto, Auslandskonten … alles tolle und wichtige Themen.

Aber was ist denn Geld eigentlich wirklich?

Geldmünzen und Geldscheine? Nein, das...

Read More »

Read More »

Prof. Hans-Werner Sinn deckt Böses auf – Der große Knall steht kurz bevor! Pflichtvideo!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Prof. Hans-Werner Sinn, Dr. Markus Krall, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

Inflation Takings Require Just Compensation: Slash Governments!

“If you don't expect too much from meYou might not be let down.” — Gin Blossoms, “Hey Jealousy”

Inflation is a mechanism that government people use to fund wars, tyrannical governments, and favors to cronies. Inflation takes away significant fractions of the real value of savings.

Read More »

Read More »

The Government Runs the Ultimate Racket

"Seniors hurt in Ponzi scam" headlined the story of elderly Southern Californians bilked in a pyramid scheme. While sad, the story reminded me of Social Security, since it is also a Ponzi scheme involving those older, with high payoffs to early recipients coming from pockets of later participants. With Social Security, however, it benefits those older at others' expense.

Read More »

Read More »