Category Archive: 6b) Austrian Economics

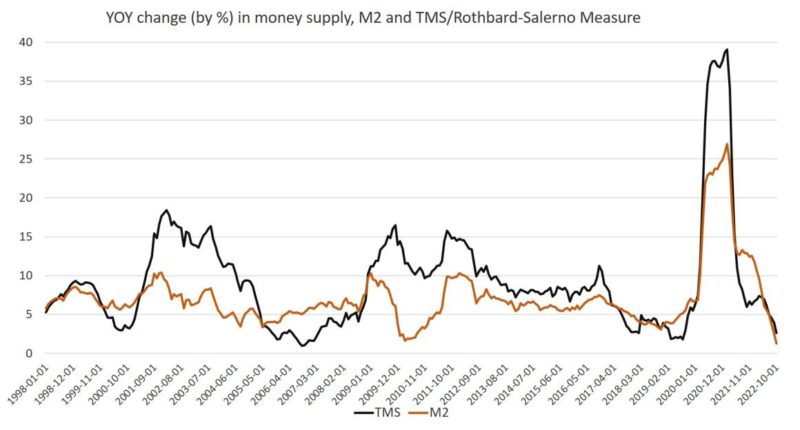

Money-Supply Growth in October Fell to a 39-Month Low. A Recession Is Now Almost Guaranteed.

Money supply growth fell again in October, dropping to a 39-month low. October's drop continues a steep downward trend from the unprecedented highs experienced during the thirteen months between April 2020 and April 2021. During that period, money supply growth in the United States often climbed above 35 percent year over year, well above even the "high" levels experienced from 2009 to 2013.

Read More »

Read More »

Vortrag in Regen am 17.12.2022

Https://www.regentreff.de/vortrag-dezember-2022/

Vortrag von Claudio Grass am Samstag, 17. Dezember 2022 in Regen

Der «Great Reset»

und was es wirklich bedeutet

Claudio Grass stellt die «geistigen Täter» der heutigen Gesellschafts- und Systemkrise vor und erklärt, was hinter dem Schlachtruf «der lange Marsch durch die Institutionen» steckt. Er beleuchtet die Geschichte des Geldes und des heutigen Bankensystems. Was bedeutet Inflation...

Read More »

Read More »

Digital Dollar: Beginning Of A New Dark Age? | Keith Weiner

The Federal Reserve is rolling out a test of the Digital Dollar. This represents an increase in control of the monetary system. Keith Weiner, CEO of Monetary Metals joins us to discuss the potential for loss of liberty resulting from the Digital Dollar. The fight for liberty is not one that needs to be fought by going to the streets, but is an intellectual battle, he says. The American people continue to accept further restrictions on their liberty...

Read More »

Read More »

College Loans and Hazlitt’s Lesson: Ignoring the Larger Picture

As of 2022 the national student debt reached $1.6 trillion with the average student loan debt at about $28,000. Many former college students are discovering it is difficult to pay back such a large amount of debt. This is especially true of students that graduate with fruitless degrees like sociology, for example.

Read More »

Read More »

Experte: Wir haben das instabilste Stromnetz aller Zeiten!

Die Blackout-Gefahr wird immer größer! So meint YouTuber und Experte für Krisenversorgung, Stefan Spiegelsberger: "Wir haben offiziell das instabilste Stromnetz aller Zeiten!". Was seiner Meinung nach ein Rat an die Politik wäre, um einen Blackout zu vermeiden, ob wir uns in Deutschland mit grüner Ideologie selber zerstören (Deindustrialisierung, Gas- und Stromkrise) und welchen Rat er meinen Zuschauern für die perfekte Vorsorge geben...

Read More »

Read More »

Latinoamérica. Inflación y pobreza “Imprimiendo dinero para el pueblo”

#shorts

#argentina

#venezuela

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

The Great Gold Robbery of 1933

[Originally published August 13, 2008]

It's been 75 years since the federal government, on the spurious grounds of fighting the Great Depression, ordered the confiscation of all monetary gold from Americans, permitting trivial amounts for ornamental or industrial use.

Read More »

Read More »

Cashkurs*Wunschanalysen: Fresnillo, Microsoft und Hapag-Lloyd unter der Chartlupe

Cashkurs*Academy: Schnuppern Sie kostenlos in den Kurs Charttechnik rein – Jetzt den Code „Wunschanalysen“ einlösen und das erste Modul gratis belegen: https://bit.ly/CKA_charttechnik

In diesem Video bespricht unser Experte Mario Steinrücken die von der Cashkurs*Community gewünschten Titel am Chart: Heute sehen Sie hier die kurz, knackigen Analysen von Fresnillo, Microsoft und Hapag-Lloyd. Hier geht’s zum vollständigen Video mit weiteren...

Read More »

Read More »

LA OCDE DESTRUYE LOS PRESUPUESTOS, UK, LATAM E INVERSIÓN. ECONOMIX II

Hablamos de las nuevas previsiones de la OCDE que hunden las estimaciones de los presupuestos, del riesgo de recesión en Europa, de Latinoamérica, inflación y estancamiento y de oportunidades de inversión.

Programa 2 de Economix.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook -...

Read More »

Read More »

Dirk Müller: Adobe Aktie – Sensationell, aber…

?????-????-?????? ??? ??.??. +++ ? ?????? ????????*?????? ?ü? €?? ????? €??? +++ ????????????e: ?????? ?????? ????ö???: https://bit.ly/Black22CKT

Bei diesem Video handelt es sich um einen Ausschnitt aus dem CASHKURS*TRENDS-Webinar vom 23.11.2022.

Das Webinar steht allen Mitglieder von CASHKURS*TRENDS bereits vollständig zum Abruf zur Verfügung steht. ?????? ???????? ??????: https://bit.ly/CKTMitglied

Den vollständigen Ausschnitt zur Analyse der...

Read More »

Read More »

19% Übersterblichkeit – woran liegt es? #shorts

Short zum Video "Übersterblichkeit steigt massiv an - was ist der Grund?"

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Billionaire David Rubenstein REVEALS Key Insights from Top Investors

Want a transcript? Sign up for our free weekly e-letter, and you’ll get a transcript every week, plus a summary and link to the video: https://www.mauldineconomics.com/go/JM499G/MEC

Imagine bringing together the greatest investors of our age—people like Stan Druckenmiller, Ray Dalio of Bridgewater, Larry Fink of BlackRock, real estate investor Sam Zell, and Seth Klarman of Baupost—and ask them just one question: how to invest.

That’s exactly...

Read More »

Read More »

Das digitale Geld – eine JAHRTAUSENDREVOLUTION und Hölle für dein Geld, wenn du nicht handelst …

Hölle für dein Geld, wenn du nicht vorbereitet bist!

Jahrtausend-Chance-Telefonat: https://www.kryptopowerhouse.com/zum-jahrtausendtelefonat/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Die Geld-Jahrtausendrevolution ist mitten im Gange und kaum einer kriegt es mit!

Nun, wir leben in einer turbulent-faszinierenden Zeit, die in die Geschichtsbücher besonders eingehen wird. Auch gerade in Bezug auf das Geldsystem.

Ist dir...

Read More »

Read More »

The Near Collapse of the UK Pension Sector Exposes Failures by Financial Regulators

In an earlier article, I explained that the collapse in the long-dated UK government bond (or gilts) market on September 28 that followed the ill-fated Kwarteng “mini budget” of a few days earlier had exposed a hitherto underappreciated problem: UK pension schemes were massively exposed to changes in long-dated gilts rates.

Read More »

Read More »

INVERSIÓN INMOBILIARIA Y EL FIN DEL DINERO GRATIS

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Insiderinfos: So kommst du noch GÜNSTIG an Silber! (Differenzbesteuerung)

ACHTUNG Insiderinfos: Die letzte Chance günstig Silber physisch mit vergünstigtem Steuersatz von nur 7,6% anstatt 19% zu erwerben ist da. Warum und wie seht ihr im Video. Auch wie man in Zukunft sogar für 0% MwSt. Silber kaufen kann, verrate ich euch. Viel Spaß!

*GoldSilberShop Wertelager:

https://www.goldsilbershop.de/wertelager-mf.html

Wertelager Infobroschüre:...

Read More »

Read More »

The REAL Solution to the Coming Economic Crisis

My previous article demonstrated how the free market solves a boom-bust crisis and is the only solution, its effectiveness depending upon the magnitude of the crisis and, more importantly, how much the government intervenes in response. The bigger the problem created by the Fed, the greater the crisis and the more government intervenes, and the slower the economy recovers.

Read More »

Read More »

CEO Keith Weiner interviewed on Ticker News

CEO of Monetary Metals Keith Weiner joins Ticker News Insight to talk about the emerging success of Monetary Metals' gold bonds, failing fiat currencies, and what investors should expect from gold. Ticker News Insights focuses on the best of businesses minds from all around the world.

Interest on Your Gold and Silver with Monetary Metals

? Gold Fixed Income https://buff.ly/3nWdLBw

? The New Way to Hold Gold https://buff.ly/3xoCgNm

? The Case...

Read More »

Read More »

Futures Edge Ep 34 : Why Gold is better than Bitcoin with Keith Weiner

** BuyMeACoffee- https://www.buymeacoffee.com/pathtrading

** Patreon - https://www.patreon.com/pathtradingpartners

** TradingView - https://www.tradingview.com/gopro/?share_your_love=spekul8r

** Twitter - http://www.twitter.com/Path_Trading

-+-+-+-+

Get caught up on our free YouTube ‘trading training’ videos

How I set up my Charts

--

EMA - 'Exponential Moving Average' : Crypto Technical Analysis

SMA - 'Simple Moving Average' Crypto...

Read More »

Read More »