Category Archive: 6b) Austrian Economics

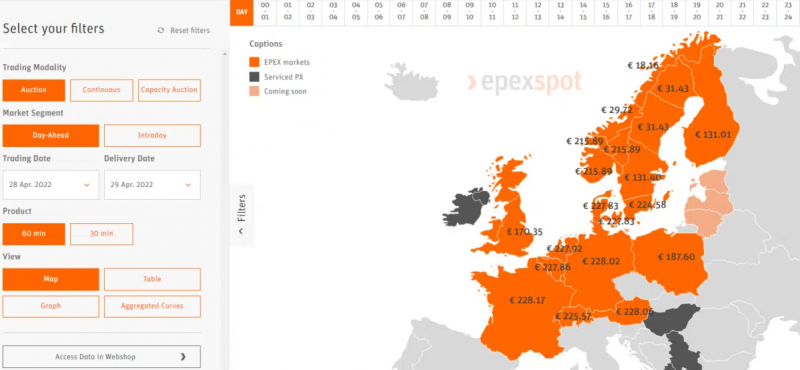

The EU energy price crisis – is the market design to blame?

The electricity prices reflect the supply and demand conditions in Europe and interfering with the price formation mechanism would have dangerous consequences.

Read More »

Read More »

ANONYM GOLD KAUFEN WIRD VERBOTEN!

Anonym Gold kaufen? Bald Vergangenheit? Vermögensregister und Blockchain Technologie lassen grüßen! Wirtschaft aktuell: Was passiert jetzt? Geld investieren, aber richtig - Gold kaufen?

Read More »

Read More »

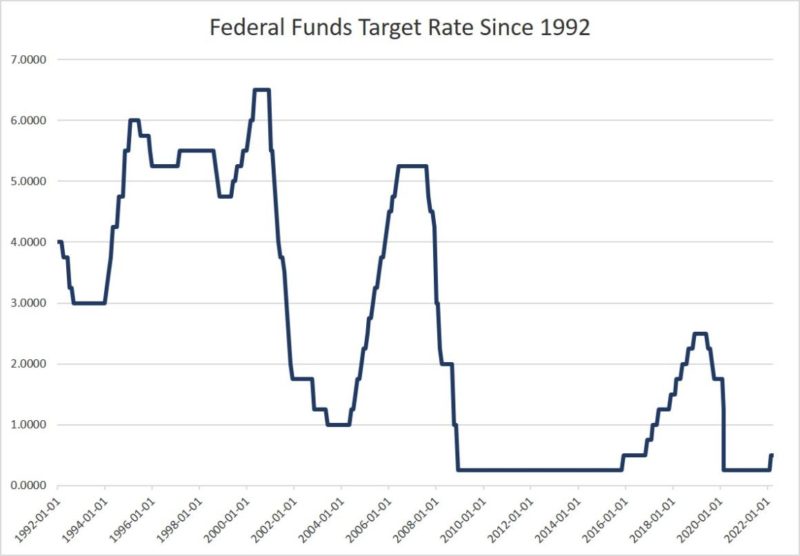

What Determines Interest Rates? Comparing Mainstream Economics to the Austrian School

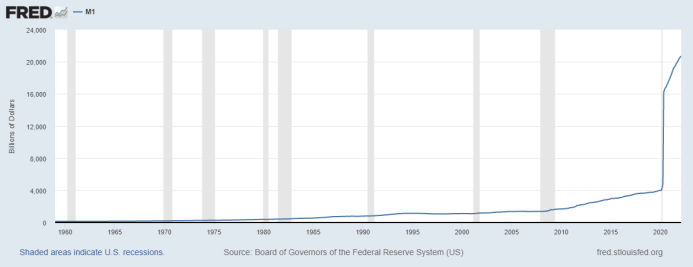

The conventional view among mainstream economists, as presented by Milton Friedman, is that three factors determine market interest rates: liquidity, economic activity, and inflationary expectations. In this viewpoint, whenever the central bank raises the growth rate in the money supply by buying financial assets such as Treasurys, this pushes the prices of Treasurys higher and their yields lower.

Read More »

Read More »

The Fed’s New “Tightening” Plan Is Too Little, Too Late

Since 2008, a key component of Fed policy has been to buy up mortgage-based securities and government debt so as to both prop up asset prices and increase the money supply. Over this time, the Fed has bought nearly $9 trillion in assets, thus augmenting demand and increasing prices for both government bonds and housing assets.

Read More »

Read More »

EL FALSO RECORD DE “EMPLEO FIJO” DE ABRIL

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Dirk Müller: US-Heimatschutzbehörde gründet Wahrheitsministerium!

Das ganze Video vom 03. Mai zum Tag der Internationalen Pressefreiheit finden Sie auf https://bit.ly/Pressefreiheit_0305

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige Finanzinformationsplattform zu den Themen Börse, Wirtschaft, Finanzmarkt von und mit Dirk...

Read More »

Read More »

Keith Weiner: Pound Measure Weight Of Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3rYob5F

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Keep your financial education strong with our CompactClub ▶︎ http://bit.ly/CompactClub

Keith Weiner is the founder and CEO of Monetary Metals, an investment firm that is unlocking the productivity of gold. Keith also serves as founder and President of the Gold Standard Institute USA. His work was instrumental...

Read More »

Read More »

WÄHRUNG GEHT BACH RUNTER! GEWOLLT!

Wirtschaft aktuell: Was passiert jetzt? Geld investieren, aber richtig - Gold kaufen? Immobilien kaufen? Sparen oder Investieren? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst!

Read More »

Read More »

No, It’s Not the Putin Price Hike, No Matter What Joe Biden Claims

Politicians love their buzzwords and talking points, and the Joe Biden White House and the Democratic Party use them as much or more than when Donald Trump and the Republicans ran Washington’s freak show. Last year, the mantra from the Biden administration was that inflation was “transitory,” meaning that the inflation would not last long.

Read More »

Read More »

Erst Inflation, dann Rezession? (Interview Andreas Beck)

Noch nie hat man Andreas Beck besorgter gesehen. Sieht er das Ende des Dollars? Wie steht es um die Weltwirtschaft und drohen sogar soziale Unruhen? Er empfiehlt, dass Länder aus der EU austreten und sieht die Gefahr, dass nach der Inflation eine Rezession droht. All dies und noch mehr in einer heutigen Folge “Marc spricht mit...” Andreas Beck.

Andreas Beck Twitter:

https://twitter.com/drandreasbeck

Hier gibt es das kostenlose E-Book von Andreas...

Read More »

Read More »

It’s Mid-2022 and the Fed Has Still Done Nothing to Fight Inflation

It was last August when Jerome Powell began to admit that inflation just might be a problem. But even then, he was only willing to say that inflation would likely be “moderately” above the arbitrary 2 percent inflation standard. Back in August, low inflation—not high inflation—was still perceived to be the “problem."

Read More »

Read More »

Gold: A use case for the modern era

Part II of II

The big picture here is clear and it is essential to understand that it represents a very significant paradigm shift. Whether it is online or offline, whether it is through a mobile app, an exchange or even through physical contracts, ownership titles to gold holdings keep changing hands. And thus, no matter the vehicle that is used to facilitate these transactions, the fact of the matter is that it acts as a gold-backed...

Read More »

Read More »

The Economic Sanctions against Russia Are Destructive and Counterproductive: We Must Oppose Them

Imposing economic sanctions upon Russia is tantamount to throwing gasoline on a raging fire. The sanctions will not end the Russian invasion of Ukraine and only will make things worse.

Original Article: "The Economic Sanctions against Russia Are Destructive and Counterproductive: We Must Oppose Them"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

To Fight Russia, Europe’s Regimes Risk Impoverishment and Recession for Europe

Politicians have become accustomed to conjuring whatever they want through the “miracle” of printing money. But in the real world, it’s still necessary to produce oil and gas through actual physical production.

Original Article: "To Fight Russia, Europe's Regimes Risk Impoverishment and Recession for Europe"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Gold: A use case for the modern era

Part I of II

For decades, physical gold investors have had to contend with superficial, naive and wholly ahistorical “arguments” from the mainstream financial press, from economists and experts of all stripes, claiming that gold is nothing but a barbarous relic. To them, the yellow metal is akin to investment superstition. It has no yield, it serves no practical purpose and the only attraction they could conceive of is merely symbolic, or...

Read More »

Read More »

Wie das unsolide Finanzsystem extreme Kreditzyklen auslöst, die zum Kollaps führen

Ein staatliches Fiat-Währungssystem mit einer nur teilweisen Deckung des Geldumlaufs durch die Bankreserven macht es möglich, dass die Geschäftsbanken mehr Geld als in Umlauf bringen als sie an Bargeld halten. Das sogenannte Giralgeld wird als Bankeinlagen gleichsam aus dem Nichts geschaffen.

Read More »

Read More »

DJ Genesis: Mastering his craft, touring with Kelly Rowland, BET awards, and The Miami Pro League

This is the full podcast release where DJ Genesis talks about his passion for DJ and mastering his craft, going on an international tour with Kelly Rowland, doing the pre-show at the BET awards networking at the after-parties, and the Miami pro-League, and how it's building its own reputation around the country!

Read More »

Read More »

Will die EU Bitcoin zerstören? Der Kampf gegen Bitcoin (MiCA)

Viele Fragen erreichten mich die letzten Wochen, ob der Besitz von Bitcoin mit den kommenden Regulierungen in Gefahr ist. Daher gebe ich euch heute im großen Rundum-Video ein Update, wie es um derzeitige Regulierungen und Bitcoin steht. Plant die EU ein Verbot von privaten Bitcoin-Wallets? Was hat es mit dem bestehenden "Kryptowertetransferverordnung" Gesetz auf sich und worauf sollte man beim derzeitigen Bitcoin-Kurs achten und wann...

Read More »

Read More »

1991: When America Tried to Keep Ukraine in the USSR

The US government today likes to pretend that it is the perennial champion of political independence for countries that were once behind the Iron Curtain. What is often forgotten, however, is that in the days following the fall of the Berlin Wall, Washington opposed independence for Soviet republics like Ukraine and the Baltic states.

Read More »

Read More »

Dirk Müller: … und den Yen in einer heiklen Abwärtsspirale gefangen hält (Teil 2/2)

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate_25April

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 25.04.2022 auf Cashkurs.com.)

In diesem Video:

Japan ist massiv verschuldet, der Yen fällt rapide gen Süden - Carry-Trades verschärfen das Problem. Dirk Müller erklärt in diesem Video, was hier passiert und wie gefährdet die Weltwirtschaft durch dieses Phänomen ist.

???????...

Read More »

Read More »