Category Archive: 6b) Austrian Economics

The Origins of the Federal Reserve

Where did this thing called the Fed come from? Murray Rothbard has the answer here — in phenomenal detail that will make your head spin. In one extended essay, one that reads like a detective story, he has put together the most comprehensive and fascinating account based on a century's accumulation of scholarship.

The conclusion is that the Fed did not originate as a policy response to national need. It wasn't erected for any of its stated...

Read More »

Read More »

Unserem System fehlt die Menschlichkeit! (Paradigmenwechsel & Spiritualität)

Fröhliche Feiertage wünsche ich euch und um diese so richtig zu feiern, gibt es eine Runde harmonievolles, philosophisches und spirituelles Interview aus der Reihe "Nachgefragt" von Fairtalk. Es geht um die Sinnfrage und den schnöden Mammon. Aber auch, warum Krisen essenziell sind und uns stärker machen. Wieso lehne ich mich nicht einfach zurück, sondern möchte immer weiter aufklären und mache mich damit ohne Not angreifbar. Was hat das...

Read More »

Read More »

Reclaiming the Anti-State Roots of Christmas

While Christians the world over look to the celebration as a way to remember the incarnation of Christ, some dismiss it as a Christianized version of the ancient Rome’s Saturnalia. Whatever one’s view happens to be, I humbly suggest that it ought to be used by Christians and non-Christians alike as a reflection upon a collision of two kingdoms and two forms of rule. One that makes the way for life, and the other for misery, suffering, and death.

If...

Read More »

Read More »

How Christmas Became a Holiday for Children

During the 1980s, millions of American children pored over the Toys 'R' Us catalog, daydreaming about what toys we hoped to receive in a few weeks on Christmas morning. After all, by the mid twentieth century, Christmas—for countless middle-class households with children— had become more or less synonymous with an enormous number of gifts for children in the form of toys and games. Barbie playsets and a myriad of action figures were routinely...

Read More »

Read More »

La tercera gran recesión del Siglo XXI ¿LLEGA UNA RECESIÓN MUNDIAL?

#crisis #economia #inversiones #macroeconomía #americalatina #economix #mercados

Programa completo aquí:

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG...

Read More »

Read More »

How Marxism Abuses Ethics and Science to Deceive Its Followers

In his 1922 book on socialism, Die Gemeinwirtschaft, Ludwig von Mises attributes socialism’s attractiveness to the claim that Marx’s doctrine would be both ethical and scientific. In truth, however, Marxism represents a metaphysical dogma that promises an earthly paradise yet threatens civilization itself.

Thesis of the Inevitability of Socialism

Marxism explains that immoral capitalist economies will necessarily be replaced by socialist systems...

Read More »

Read More »

Budget Deficit Hits Monthly Record Due to Biden’s Policies

America’s “monthly federal deficit hit a record $249 billion in November—$57 billion more than the same month last year—with federal spending also hitting new heights in consecutive months, while tax revenues dropped,” reports the London Daily Mail.

The deficit is $57billion higher than it was in November of 2021—which is a record-breaking year-on-year change. Federal spending is up $28billion from last year to $501billion in November 2022,...

Read More »

Read More »

Money Laundering: Another Noncrime Pursued by Criminal Authorities

Money laundering is illegal in the USA, but like so many other federal crimes, it is difficult to identify and define. That is the perfect recipe for government abuse of innocent people.

Original Article: "Money Laundering: Another Noncrime Pursued by Criminal Authorities"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

NOS VENDEN EL ESTANCAMIENTO ECONÓMICO COMO UN ÉXITO

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

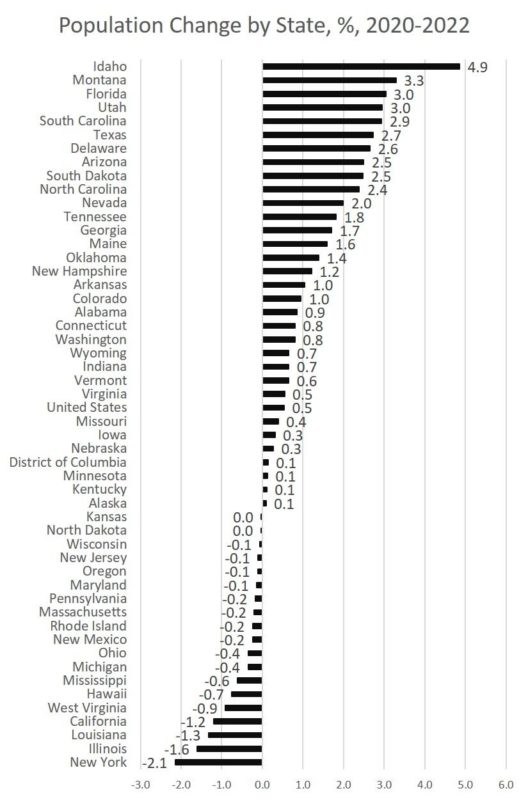

Since Covid Lockdowns, New York Lost More of Its Population than Any Other State

Florida Governor Ron DeSantis has frequently bragged that Florida is in high demand among people looking to relocate. In a new report released this week from the Census Bureau, it seems that he's been correct. According to the Bureau's report:

After decades of rapid population increase, Florida now is the nation’s fastest-growing state for the first time since 1957, according to the U.S. Census Bureau’s Vintage 2022 population estimates released...

Read More »

Read More »

R.G. Collingwood on the Collapse of Civilization

R.G. Collingwood, a philosopher, historian, and archaeologist who taught at Oxford in the first half of the twentieth century, was much esteemed by Ludwig von Mises, especially for his essay “Economics as a Philosophical Science” and, more generally, for his work in the philosophy of history. In this week’s column, I’d like to consider a point that Collingwood makes in his “Fascism and Nazism,” published in Philosophy in 1940, that helps us answer...

Read More »

Read More »

Jeff Deist on What 2023 Portends

This week's show features a bare-knuckle discussion between Jeff and José Niño of "El Niño Speaks" on the biggest political, economic, and cultural events of 2022—and what they portend for 2023.

You don't want to miss Jeff's unvarnished thoughts on the Left, the Right, the economy, and what is sure to be a turbulent New Year.

Read José's Substack: josbcf.substack.com

[embedded content]

Read More »

Read More »

Steht der große Umbruch bevor? (Finanzen, Politik)

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3EC3fqA oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram: https://www.instagram.com/marcfriedrich7/

TikTok:...

Read More »

Read More »

The Reichsbank: Germany’s Central Bank Lays Foundation of Monetary Disaster

Long before there was the infamous German inflation of 1923, the Reichsbank created the scenario of monetary debasement.

Original Article: "The Reichsbank: Germany's Central Bank Lays Foundation of Monetary Disaster"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Notes from the Digital Gulag

As the author of Google Archipelago: The Digital Gulag and the Simulation of Freedom, I guess I should not be surprised to find myself squarely in the digital gulag—banished, perhaps permanently, from Twitter and Facebook. Twitter permanently suspended my account several weeks ago, mere days before Elon Musk took over the helm. Although I cannot be sure, I may have been banned because I suggested that the transgender movement is part of a...

Read More »

Read More »

Wie kann ich ein Investment beurteilen? 5-Punkte-Checkliste

Diese 5 simplen Punkte sparen dir viel Lehrgeld bei Investments

Link zum 32-Punkte-Video: https://www.thorstenwittmann.de/yt-32-punkte-checkliste

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Diese 5 Checklistenpunkte kommen dich teuer – aber nur, wenn du sie nicht kennst!

Geldanlage ist kein einfacher Spielplatz. Wenn du nicht weißt, was du tust, verlierst du schnell viel Geld.

Dafür haben wir die „32-Punkte-Checkliste...

Read More »

Read More »

Grover Cleveland Presented the Best Example of a True Liberal Populist

Six years after the election of Donald Trump, the Republican Party is still adrift. On the one hand, the GOP has embraced an antiestablishment and populist message. On the other hand, Republicans have not quite figured out how to balance populism with classically liberal values like constitutionalism and free markets. Indeed, populism and classical liberalism seem to be in direct conflict.

Read More »

Read More »

LA CRISIS ENERGÉTICA EUROPEA PERSISTE

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Ukraine’s War with Russia Has Nothing to Do With Freedom

Yesterday, Ukrainian President Volodymyr Zelensky appeared before a joint session of Congress to plead for more billions of dollars of U.S. taxpayer money to help Ukraine in its war with Russia.

One particular sentence in Zelensky’s address caught my attention: “We Ukrainians will also go through our war of independence and freedom with dignity and success.”

Read More »

Read More »

Felix Zulauf: “Wir sind im Endspiel unseres Systems” (Rezession/Woke-Demokratie)

Drei Jahre lang habe ich versucht, die Investorenlegende Felix Zulauf vor die Kamera zu bekommen und nun erstmalig im deutschen Raum spricht er offen und ehrlich über seine Gedanken zu 2023, dem Sterben von Währungen, Inflation, Politik, Woke-Demokratie, Klimareligion, Meinungsfreiheit und noch vielen weiteren spannenden Themen. Felix Zulauf ist Gründer und Inhaber der Zulauf Consulting und Makro-Experte.

Felix Zulauf Website:...

Read More »

Read More »