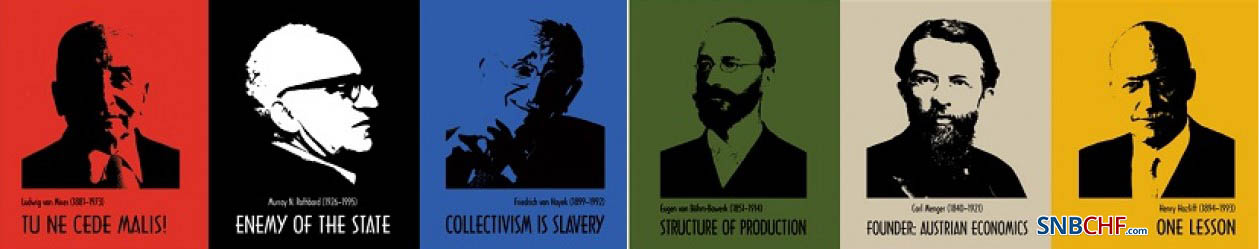

Category Archive: 6b) Austrian Economics

LIVE Salesian College Preparatory vs. Hercules [High School Volleyball]

Watch Here ⏩ https://www.youtube.com/redirect?event=video_description&q=http://4ty.me/rh5kxa

STREAMING! Today California High School Volleyball, Salesian College Preparatory and Hercules,

The Hercules (CA) varsity volleyball team has a home non-conference match vs. Salesian College Preparatory (Richmond, CA) on Monday, February 27 @ 7p.

Game Details: Var Only

Salesian College Preparatory High School Volleyball

Hercules High School...

Read More »

Read More »

LIVE Marysville vs. River Valley [High School Volleyball]

Watch Here ⏩ https://www.youtube.com/redirect?event=video_description&q=http://4ty.me/op65n0

STREAMING! Today California High School Volleyball, Marysville and River Valley,

The River Valley (Yuba City, CA) varsity volleyball team has a home non-conference match vs. Marysville (CA) on Monday, February 27 @ 7p.

Game Details: Foundation Game

Marysville High School Volleyball

River Valley High School Volleyball

Marysville vs River Valley...

Read More »

Read More »

LIVE Monroe Catholic vs. Ben Eielson [High School Girls Basketball]

Watch Here ⏩ https://www.youtube.com/redirect?event=video_description&q=http://4ty.me/ltfm5k

STREAMING! Today Alaska High School Girls Basketball, Monroe Catholic and Ben Eielson,

The Ben Eielson (Eielson AFB, AK) varsity basketball team has a home conference game vs. Monroe Catholic (Fairbanks, AK) on Monday, February 27 @ 6p.

Monroe Catholic High School Girls Basketball

Ben Eielson High School Girls Basketball

Monroe Catholic vs Ben...

Read More »

Read More »

LIVE Franklin vs. McClatchy [High School Volleyball]

Watch Here ⏩ https://www.youtube.com/redirect?event=video_description&q=http://4ty.me/jvul66

STREAMING! Today California High School Volleyball, Franklin and McClatchy,

The McClatchy (Sacramento, CA) varsity volleyball team has a home non-conference match vs. Franklin (Elk Grove, CA) on Monday, February 27 @ 7p.

Game Details: Foundation Game

Franklin High School Volleyball

McClatchy High School Volleyball

Franklin vs McClatchy

Franklin v...

Read More »

Read More »

LIVE Beckman vs. Tesoro [High School Volleyball]

Watch Here ⏩ https://www.youtube.com/redirect?event=video_description&q=http://4ty.me/eu6ot8

STREAMING! Today California High School Volleyball, Beckman and Tesoro,

The Tesoro (Rancho Santa Margarita, CA) varsity volleyball team has a home tournament match vs. Beckman (Irvine, CA) on Monday, February 27.

Game Details: NO BUS

Beckman High School Volleyball

Tesoro High School Volleyball

Beckman vs Tesoro

Beckman v Tesoro

Beckman - Tesoro...

Read More »

Read More »

LIVE San Dieguito Academy vs. Mater Dei Catholic [High School Softball]

Watch Here ⏩ https://www.youtube.com/redirect?event=video_description&q=http://4ty.me/d0r84h

STREAMING! Today California High School Softball, San Dieguito Academy and Mater Dei Catholic,

The Mater Dei Catholic (Chula Vista, CA) varsity softball team has a neutral tournament game vs. San Dieguito Academy (Encinitas, CA) on Monday, February 27 @ 7p.

Game Details: Cougar Tournament

San Dieguito Academy High School Softball

Mater Dei Catholic...

Read More »

Read More »

Capitalism Has Improved Life in India, but the Spirit of Collectivism Still Dominates

In 1991, India's political leaders moved away from socialism, embracing markets and improving the economy. But Indian elites continue to push socialism to the detriment of the people.

Original Article: "Capitalism Has Improved Life in India, but the Spirit of Collectivism Still Dominates"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Roald Dahl and James Bond Books Are Getting Woke Rewrites. Copyright Law Ensures You Can’t Stop Them.

The estate of Roald Dahl this month announced that it would be rewriting many of the long-dead author’s books to better suit a “modern” audience. Translation: The books will be rewritten so the text is more in line with the editors’ notions of politically correct language.

As a parent of four children, I’ve read my share of Roald Dahl books over the years, although I wouldn’t consider myself an especially big fan. Yet it’s hard to imagine what is...

Read More »

Read More »

Loss of Religious Belief Is a Greater Loss for a Civilized Society

There has been a noticeable decline in the percentage of Americans identifying as religious. Some perceive this seismic shift as evidence of a secularizing culture. In some quarters, the secularization of America is viewed favorably as an agent of modernization. But researchers are theorizing that the erosion of religious beliefs portends negative consequences for society because religion cultivates meaningful social relationships by nurturing a...

Read More »

Read More »

Covid-19: Will the Political and Health Scandals Erupt into the Public Light?

Three years after the covid virus hit the world, we are just starting to take a hard look at the damage caused by the covid restrictions. The "experts" not only were wrong; they were scandalously wrong.

Original Article: "Covid-19: Will the Political and Health Scandals Erupt into the Public Light?"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Is Democracy under Attack in Canada? No, but It Should Be

When the legacy media tells you that democracy is under attack in Canada, don’t believe it. Democracy is alive and well, working exactly as it was designed to work, which is to benefit the political class and their friends at the expense of average citizens who still believe that their vote actually means something. This is consistent with how democracy works in most democratic countries. Professors Martin Gilens and Benjamin Page tell us:

The...

Read More »

Read More »

CORONA aus dem Labor? (USA Ergebnis geändert!)

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Switzerland: Still a bright beacon of freedom

Switzerland’s long-standing and well-deserved reputation as one of the last bastions of individual and financial liberty has been recently vindicated and reaffirmed. It was a much-needed boost of confidence for Swiss citizens like myself who had come to worry over the last years whether the governmental trespasses of our neighboring nations and the way they rule their people might one day come to influence or even corrupt our own system of...

Read More »

Read More »

News: CORONA aus dem LABOR?

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Die schockierenden Enthüllungen der Twitter Files (Worüber nicht berichtet wurde)

? Schütze Dich vor digitaler Überwachung mit NordVPN (Rabattaktion)

http://nordvpn.com/marc

Und NordVPN Anitvirus ?️

https://go.nordvpn.net/aff_c?offer_id=725&aff_id=83144&url_id=22447

Die Twitter Files - hast Du davon schon mal gehört? In den Medien hört man dazu nur ein breites Schweigen, doch die Enthüllungen bringen brisante Informationen ans Licht, die vor allem eines ganz klar zeigen: Die Zensur auf Twitter hat seine Wurzeln tief...

Read More »

Read More »