Category Archive: 6b) Austrian Economics

Más PRIVILEGIOS para CATALUÑA

Sánchez insiste en que va a haber financiación singular para Cataluña y plan de regeneración democrática. Es decir, más privilegios.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon -...

Read More »

Read More »

The UK Blood Scandal Exposes British Elites

The United Kingdom’s political landscape has been rocked once again by yet another scandal. This scandal relates to tainted blood that was given to unsuspecting patients leaving them permanently horribly ill. This scandal is different from other more recent scandals; it has been known for decades that this has been happening, yet nothing has been done by successive governments on all sides of the political spectrum. As libertarians, we know why...

Read More »

Read More »

Welfare Policies have Great Consequences

In discussions of politics, it is common to see politicians praised for policies and programs that expand the welfare state. Politicians who sign off or approve spending at a greater magnitude than other politicians are often seen as more generous.

Read More »

Read More »

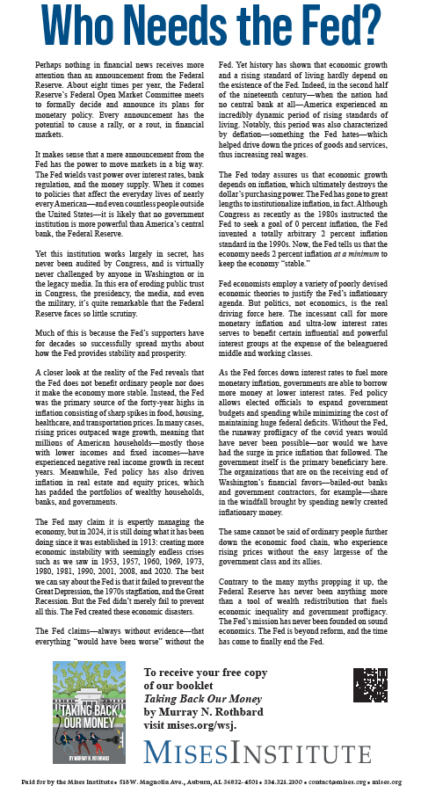

Taking Back Our Money

ForewordWe do not need a technocratic elite to manage the supply of money. In these three short articles, Murray N. Rothbard removes the Federal Reserve’s veil of scientific mystique to reveal a wholly unnecessary and malignant system. Rothbard contrasts the instability and unjust redistribution inherent in our current central banking system with the integrity of sound money and honest banking practices.Since the articles were published in 1995,...

Read More »

Read More »

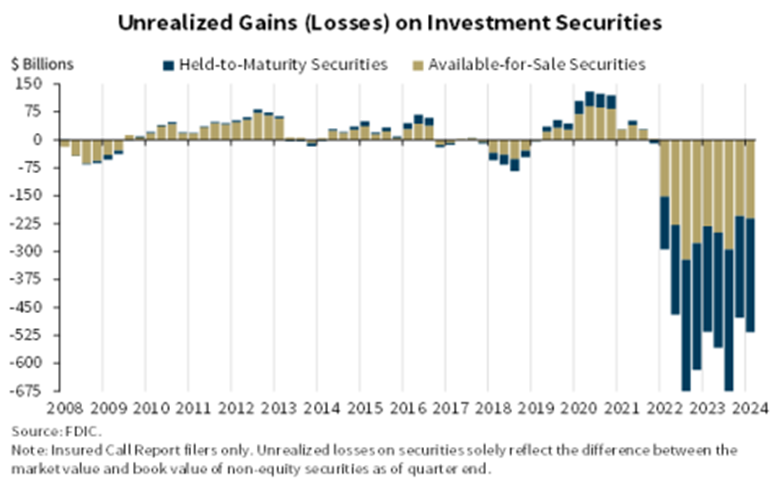

Commercial Bank Chickens Come Home to Roost

The FDIC added 11 new banks to its Problem List in the first quarter of 2024, bringing the total to 63. The specific banks on this are kept confidential, but the endemic, underlying issues in the commercial banking sector are increasingly obvious.Interest Rate Risk and LiquidityThe FIDC reported that “Unrealized losses on securities totaled $516.5 billion in the first quarter, an increase of $38.9 billion (8.2 percent) from fourth quarter 2023.

Read More »

Read More »

Thomas DiLorenzo Discusses Federal Reserve, Inflation, and Austrian Economics

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Caitlin Clark, Bullying and the Business of Basketball

Why do people watch sports? My mother believes it’s because “people want to be uplifted.” This may explain why many are upset about how basketball phenom Caitlin Clark, who broke the National Collegiate Athletic Association (NCAA) women’s and men’s scoring records, is being treated—or mistreated—in the Women’s National Basketball Association (WNBA).

Read More »

Read More »

Decoding Monetary Policy: How Central Banks Steer the Economy

Monetary policy stands as a cornerstone of modern economic management, wielded by central banks worldwide to influence the economic landscape. This dynamic toolset plays a pivotal role in steering economies through the ebbs and flows of growth, inflation, and employment.

Read More »

Read More »

Los empresarios son el PROGRESO

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Who Needs the Fed?

This article appears as a full-page ad in the Wall Street Journal today, June 24, 2024, and was made possible by one of our generous donors:Perhaps nothing in financial news receives more attention than an announcement from the Federal Reserve. About eight times per year, the Federal Reserve’s Federal Open Market Committee meets to formally decide and announce its plans for monetary policy. Every announcement has the potential to cause a rally, or...

Read More »

Read More »

The American Empire

[The following is a condensation of Garet Garrett’s pamphlet The Rise of Empire, published in 1952, and included in his collection The People’s Pottage (Caldwell, ID: Caxton Printers, 1953).]We have crossed the boundary that lies between Republic and Empire. If you ask when, the answer is that you cannot make a single stroke between day and night; the precise moment does not matter. There was no painted sign to say: “You now are entering Imperium.”...

Read More »

Read More »

BRUTAL DISCURSO DE MILEI EN MADRID

Brutal discurso de Milei en Madrid, diciendo verdades como puños y generando la ira de la ultraizquierda.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un...

Read More »

Read More »

El diálogo ANTIsocial

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Why Consumer Sentiment Fell To A Seven-Month Low

The University of Michigan Consumer Sentiment Survey plummeted to its lowest level in seven months. The index reading for June came in at 65.6, down from 69.1 in May and under the consensus expectation of 72. In the current conditions and expectations categories, the survey fell below economists’ expectations.Year-ahead inflation expectations were unchanged this month at 3.3%, but above the 2.3–3.0% range seen in the two years prior to the...

Read More »

Read More »

LOS BULOS ECONÓMICOS de Sánchez – Entrevista a José María Rotellar

Link al programa completo - &list=PL-j1qqL5tzpdd2AmBWsg04qNC1PMLEGl2&index=3

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!...

Read More »

Read More »

Harry Frankfurt, Humbug, and the Battle against Wokery

Although Harry Frankfurt was not a libertarian, his critique of egalitarianism reflects the principles of liberty. Frankfurt argued that “economic equality is not, as such, of particular moral importance” and that “if everyone had enough, it would be of no moral consequence whether some had more than others.” This has been described by David Gordon asan argument that most people who read Mises Institute articles will know already. In brief, the...

Read More »

Read More »

Democracy Is Not the Same Thing as Freedom

In our modern world, most states are democracies or at least call themselves “democratic.” The adoption of democracy is hailed as one of humanity’s greatest achievements. Once upon a time, humanity broke out of the shackles of monarchies and has never looked back since. Nowadays, all citizens in democratic countries are free and safe from despots. Except, that is far from the truth.Democratic systems have been around for a long time. Ancient Greece...

Read More »

Read More »

The Oklahoma City Curse, Skyscraper Edition

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

El INTERVENCIONISMO ESTATAL descontrolado

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Private Property Comes from Scarcity, Not Law

Property is a key economic principle for markets to operate and their participants to live in harmony with one another. But as with so many things in the modern age, the scene (and accompanying meme) from the 1987 movie The Princess Bride applies: “You keep using that word; I do not think it means what you think it means.”To the Marxian, property means unjust hoarding of resources. Most Americans think of their houses. To Murray Rothbard and many...

Read More »

Read More »