Category Archive: 6b.) Mises.org

From the Invisible Hand to the Invisible Sleight-of-Hand

Why are we using state money instead of market money? Put another way, why can’t we select the money we want to use? Cryptocurrencies are a market alternative, but they haven’t put state money out of business yet. If they ever threaten to do so, the state can prohibit them.

Market money is sound because of two essential features. First, it represents the market’s choice of a universally accepted medium of exchange, and second, it shackles...

Read More »

Read More »

Reason versus Emotion in Economics: A Praxeological Response

The field of behavior economics downplays the role of purposeful praxeology in economics. Austrian economics does not make that error.

Original Article: Reason versus Emotion in Economics: A Praxeological Response

Read More »

Read More »

No Monetary or Political Bailouts for Belt-and-Road Initiative Debtors

The countries have changed, but the story remains the same. Wealthier countries try to “invest” by lending money to African regimes, where the money disappears. This time, China is the big lender.

Original Article: No Monetary or Political Bailouts for Belt-and-Road Initiative Debtors

Read More »

Read More »

Cut through the Media Noise, and Remember the Economic Priorities

Modern prosperity is astonishing, but it can quickly disappear if our monetary unit fails. We need to keep up the fight for sound money.

Original Article: Cut through the Media Noise, and Remember the Economic Priorities

Read More »

Read More »

Seed Corn and Dry Powder

On this week's episode, Mark looks at the financial condition of the government and of American citizens on the cusp of the next recession. The financial condition of the United States Treasury, the Federal Reserve, and the American citizenry is weak; debt is high and rising, and this is very worrisome in an economic environment of rising interest rates and a weakening global economy. Please share this episode with a curmudgeon.

The U.S. Debt...

Read More »

Read More »

Bad, Worse, Worst: The Misguided Perfectionism of Gavin Newsom

My grandfather used to sing to me, “Good, better, best / never let them rest / till the good is better / and the better is best.” I appreciated that lesson and have been applying it to try to make sense of a recent bill signed by California governor Gavin Newsom. While the bill may be the result of Newsom’s grandfather singing to him about “bad, worse, and worst,” I have determined it is more likely a case of bad/worse/worst economic thinking. It...

Read More »

Read More »

Sovereign Debt is Eating the World

Sovereign debt is eating the world. Lining up a financial crash that could make 2008 look like a picnic.

How did we get here?

In short, governments and central banks deluded themselves into thinking that unlimited deficit spending financed by unlimited money printing won't do what they've done for literally millennia -- plunge the economy into stagflation.

They are, of course, wrong. And we're seeing the catastrophe unfold before our eyes.

From...

Read More »

Read More »

The Eurozone Disaster: Between Stagnation and Stagflation

The eurozone economy is more than weak. It is in deep contraction, and the data is staggering.

The eurozone manufacturing purchasing managers’ index (PMI), compiled by S&P Global, fell to a three-month low of 43.1 in October, the sixteenth consecutive month of contraction. However, European analysts tend to ignore the manufacturing decline using the excuse that the services sector is larger and stronger than expected, but it is not. The...

Read More »

Read More »

How Statism Leads to War

Mises' work explains how laissez-faire economies have incentives to be peaceful with each other, and how, inversely, tariffs and protectionism create isolation, instability, and war. His words are especially prescient today as conflicts rage and tensions between superpowers continue to rise—mirroring the rise in state power across the globe.

Dr. Jonathan Newman joins Bob to break down the history of warfare, how states fund war, and why war is more...

Read More »

Read More »

The Dollar See-Saws between Two Views on Fiscal Explosion

As the Biden administration ramps up new government spending—and budget deficits—to unheard-of peacetime levels, reality sets in. No economy and no currency can withstand this explosive assault for very long.

Original Article: The Dollar See-Saws between Two Views on Fiscal Explosion

Read More »

Read More »

What the Technocrats Call “Economic Stability” Is Really Just Inflation

There’s a growing palpable sense of optimism among many economists and journalists that the United States economy is heading toward a growth phase while avoiding recession. They are in turn lauding the Federal Reserve for its strategic handling of inflation—with economic growth and low unemployment rates—as well as praising the efficacy of the Biden administration in reining in prices through social pressure on profit-making and through increases...

Read More »

Read More »

Exposing Our Fed-Driven Bubble Economy

The Great Money Bubble: Protect Yourself from the Coming Inflation Stormby David A. StockmanHumanix Books, 2022; 229 pp.

David Stockman served for a short while as budget director during Ronald Reagan’s first term as president, but he soon resigned owing to Reagan’s refusal to cut government spending. He has since that time worked as a private investment adviser, at which difficult profession he has been highly successful, and he has written a...

Read More »

Read More »

The Fed and the Fate of the Dollar

Recorded at the Mises Circle in Fort Myers, Florida, 4 November 2023.

Special thanks to Murray and Florence M. Sabrin for making this event possible.

Read Bob's book Understanding Money Mechanics: Mises.org/Mechanics

The Fed and the Fate of the Dollar | Bob Murphy

Video of The Fed and the Fate of the Dollar | Bob Murphy

Read More »

Read More »

Are We Headed for a Recession in 2024?

Recorded at the Mises Circle in Fort Myers, Florida, 4 November 2023.

Special thanks to Murray and Florence M. Sabrin for making this event possible.

Are We Headed for a Recession in 2024? | Patrick Newman

Video of Are We Headed for a Recession in 2024? | Patrick Newman

Read More »

Read More »

The Dangers of a “Cashless” Economy

While the ruling elites and the Federal Reserve try to sell digital money as “modern” and “convenient,” it poses threats to financial privacy and civil liberties.

Original Article: "The Dangers of a ""Cashless"" Economy

Read More »

Read More »

Four Economic Activities and the Wealth of Nations

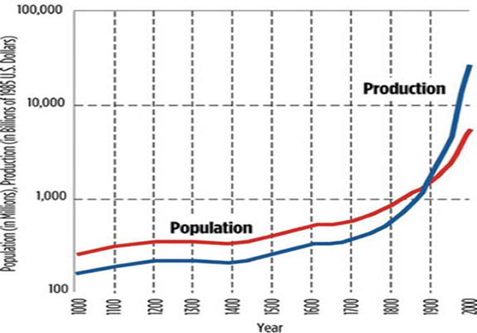

Trading, forecasting, aggregating, and innovating—referred to from here on out as the Four—are activities that people have engaged in since the beginning of humanity. They are part of the human fabric because they stem from mankind’s peculiarities—heterogeneity, inclination to forecast, sociality, and inventiveness. The Four are key social interactions in human life at both the individual and aggregate levels.

In 2022, the value of worldwide global...

Read More »

Read More »

The Fed Has No Plan, and Is Just Hoping for the Best

The Federal Reserve’s Federal Open Market Committee (FOMC) last week left the target policy interest rate (the federal funds rate) unchanged at 5.5 percent. This "pause" in the target rate suggests the FOMC believes it has raised the target rate high enough to rein in price inflation which has run well above the Fed's arbitrary two-percent inflation target since mid-2021. I say "believe," but perhaps the more appropriate word...

Read More »

Read More »

If the Fed Goes, The State Will Soon Follow

The leviathan US state would not be possible without the Fed underwriting its growth. But the Fed is not all-powerful, nor can it continue to exist by only creating chaos.

Original Article: If the Fed Goes, The State Will Soon Follow

Read More »

Read More »

False Virtue: The Life and Death of “American Exceptionalism”

The impending decline of the dollar is apparently imposing a real Halloween scare on the American foreign policy establishment. An August 22, 2023, article on the Council on Foreign Relations website entitled “The Future of Dollar Hegemony” explained that

the dollar’s global hegemony gives the U.S. government power to impose crippling sanctions and wage other forms of financial welfare against adversaries. . . . In 2022, more than twelve thousand...

Read More »

Read More »

Dollar Hegemony Fuels America’s Foreign Crusades

Mises Institute president Thomas DiLorenzo joins Ryan and Tho to discuss the moralistic claims behind American foreign policy. These claims intensified with the American Civil War and became a creed of American nationalists by the twentieth century. With the rise of the global dollar and dollar hegemony, America's foreign crusades became ever larger and more frequent.

"False Virtue: The Life and Death of 'American...

Read More »

Read More »