Category Archive: 6b.) Mises.org

Will AI Steal Our Jobs (or End Us)?

Professor Per Bylund joins Bob to debunk the worries over AI and to question whether the latest version of chatbots should even be called "intelligent."

Per on Robots Taking your Jobs: Mises.org/HAP392a

[embedded content]

Read More »

Read More »

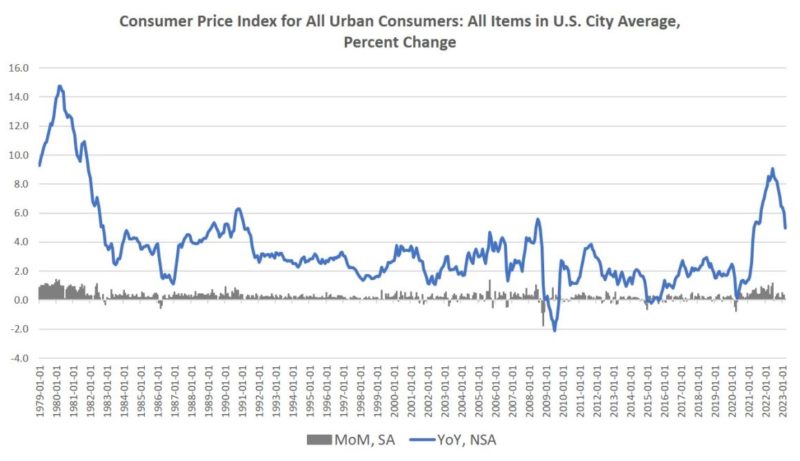

Real Wages Fall for Two Years Straight as “Transitory” Inflation Turns Stubborn

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data last week, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in twenty-three months. According to the BLS, Consumer Price Index (CPI) inflation rose 5.0 percent year over year in March before seasonal adjustment. That’s down from February’s year-over-year increase of 6.0...

Read More »

Read More »

Biden’s Wealth Tax Is a Trojan Horse Requiring Multiple Manipulations

President Biden pushes a wealth tax as a measure of "fairness." Not only is it unconstitutional, but it's also bad for the economy.

Original Article: "Biden's Wealth Tax Is a Trojan Horse Requiring Multiple Manipulations"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Prevent Future Losses Like East Palestine by Reducing Regulation and Empowering Torts

On February 3, 2023, on Norfolk Southern Railway’s general merchandise freight train 32N, a suspect bearing on the twenty-third car measured at 38°F above ambient, then 103°F above ambient, then 253°F above ambient. In East Palestine, Ohio, eleven tank cars derailed and hazardous materials ignited.

First responders mitigated the fire, but afterward the temperature was still rising in one tank car that carried vinyl chloride liquid. Responders...

Read More »

Read More »

Lincoln’s Main Target Was “Anarchy” and Secession, Not Slavery

In a recent column, I discussed an argument about secession made by Abraham Lincoln and sympathetically expounded by Michael P. Zuckert in his important book A Nation So Conceived. Lincoln maintained that a nation once formed could not allow secession because doing so would open it to unlimited fissiparous tendencies, culminating in anarchy. This argument did not address the problem of slavery, surely relevant to the concrete circumstances of the...

Read More »

Read More »

If at First You Don’t Secede . . .

David Gordon explores how Abraham Lincoln's stated view on secession was fundamentally Hobbesian, cynical, and violent.

Original Article: "If at First You Don't Secede . . ."

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Disinformation and the State: The Aptly Named RESTRICT Act

The RESTRICT Act (Restricting the Emergence of Security Threats that Risk Information and Communications Technology Act) has recently been making the rounds in the media, and rightfully so. The act is truly terrifying, but more than the open tyranny that it would further, the act illustrates a very clear problem from the perspective of the state.

In previous eras, either formally or informally, the state exercised a great deal of control over the...

Read More »

Read More »

How Government Schools Use Bad History to Promote the State

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop look at common American history myths baked into government school curriculums. While Republican governors have begun to prioritize removing "critical race theory" and other forms of modern "leftwing indoctrination" from textbooks, there are a number of historical episodes left unchallenged that all lead to a deification of state power and a celebration of...

Read More »

Read More »

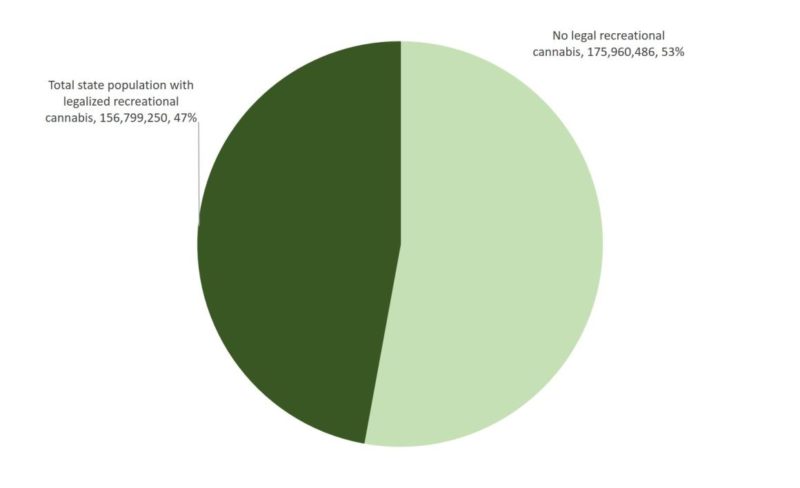

156 Million Americans Now Live in States with Legal Recreational Marijuana

Over the past year, three US states have enacted new legislation legalizing recreational marijuana within their borders. In May 2022, recreational cannabis became legal in Rhode Island, and the same occurred in Missouri in December of last year. In the wake of the 2022 election, in which Maryland voters approved Maryland Question 4, recreational use became legal in that state as well. With the addition of Rhode Island, New Hampshire—where cannabis...

Read More »

Read More »

A Pyrrhic End to 130 Years of Vicious Bad Money and Banking Crises

The original vicious circle starts with inflationary interventions in an up-to-then well-anchored monetary regime. Consequent asset inflation spawns a banking crisis. That leads to the installation of anticrisis safety structures (one illustration is a novel or enhanced lender of last resort). Alongside a possible monetary regime shift, these damage the money’s anchoring system. A great asset inflation emerges and leads on to an eruption of another...

Read More »

Read More »

Why the Regime Needs the Dollar to Be the Global Reserve Currency

Even a partial weakening of the dollar's global demand will limit the US regime's ability to throw its weight around internationally. Yet Washington is unwilling to do what's necessary to prevent it.

Original Article: "Why the Regime Needs the Dollar to Be the Global Reserve Currency"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Austrian Economists and Empiricism

Since its emergence in 1871, the Austrian school of economics has provided systematic opposition to empiricism in the development of economics. The Methodenstreit persists, even with different players. Several papers and publications have criticized the concept of economics based on empirical evidence. Positivism, and its different currents of thought, are consistently criticized by Austrian economists.

But the roots of attempts to make research...

Read More »

Read More »

What Will Our Energy Future Be? A Few Ideas

With the government foolishly handicapping the oil and gas industries and pushing other alternatives, the future is not very bright..

Original Article: "What Will Our Energy Future Be? A Few Ideas"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Failure of the Federal Reserve: The Covid Boom and Unnecessary Intervention

The Federal Reserve’s failure to meet its own policy goals of price stability and growth has become increasingly evident in the current economic situation in the United States. The country is now facing recessionary fears after experiencing historic inflation due to the misinterpretation of the causes of the Great Depression. The perverse effects of expansionary monetary policies also reflect the failure of the institutional economic position which...

Read More »

Read More »

Phil Simon on Tectonic Changes in the Workplace

Austrian economics recognizes change as a constant and provides guidance for adapting to it and managing it. Change is changing for business — it’s faster and more fundamental in the digital age. Austrian economics can help even more as a result of its practical and realist approach to adaptation and continuous adjustment.

Knowledge Capsule

Change is changing.

Change is a constant. You can think of the market in constant flux, as Mises...

Read More »

Read More »

Wars Cost More Than You Think

Ryan and Zachary talk about how wars are not nearly as cheap or economically harmless as many Americans seem to think. Rather, taxpayers must give up enormous amounts of resources to fund wars halfway across the globe that have little to do with actual defense. Americans are still paying interest on the trillions spent on Washington's many lost wars of recent decades.

Additional Resources

"On Paying for the Costs of War and War...

Read More »

Read More »

Cancel Culture: The Digital Panopticon

Like Bentham's panopticon, modern cancel culture is built upon fear and online bullying, making people police their own thoughts.

Original Article: "Cancel Culture: The Digital Panopticon"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Economics of Arts and Culture

To describe anything in human life without the context of economics is to erase the reasoning behind why it even exists. Why do we need reasons for items and concepts to exist? Because it is helpful for every human to think critically about what is truly valuable in society and to give that human the best possible information to best serve the public.

The arts are a fantastic aspect of our culture that display the talents of individuals for...

Read More »

Read More »

Waco 30 Years Later: It Is Not an Atrocity if the Feds Do It

Thirty years ago, FBI tanks smashed into the ramshackle home of the Branch Davidians outside Waco, Texas. After the FBI collapsed much of the building atop the residents, a fire erupted and 76 corpses were dug out of the rubble. Unfortunately, the American political system and media have never honestly portrayed the federal abuses and political deceit that led to that carnage.

What lessons can today’s Americans draw from the FBI showdown on the...

Read More »

Read More »

Canada’s Impotent Justice System Is the Product of Dysfunctional Canadian Democracy

Violent crime is on the rise in Canada, and its progressive democracy is helpless to stop it. Further empowerment of the state makes things worse.

Original Article: "Canada's Impotent Justice System Is the Product of Dysfunctional Canadian Democracy"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »