Category Archive: 6b.) Mises.org

Be on the Lookout for These Lies in Biden’s State of the Union Address

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Understanding the AI Revolution

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Separating Information from Disinformation: Threats from the AI Revolution

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

No, There Is Not a Perfect Open Border System between the States

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Economics of the AI Revolution

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Free Markets and the Antidiscrimination Principle

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Great Depression and Great Depression II: Similarities, Differences

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Folly of Rent Control in New York City (Again)

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

A Tale of Two Bureaucracies

Ludwig von Mises is known for his theory of the business cycle and his development of praxeology, but he is best known for discrediting socialism. This critique is found in Economic Calculation in the Socialist Commonwealth (Mises 1990) and Socialism: An Economic and Sociological Analysis (Mises 1951). In a similar vein is a work written near the end of the Second World War: Bureaucracy (Mises 1944). Mises observed shifts away from the market...

Read More »

Read More »

Bureaucracy and Grove City College: How One College Resisted the Bureaucratization of Higher Education

In the last section of his Bureaucracy, Ludwig von Mises laments the loss of the “critical sense” that protected people from authoritarianism (Mises 1944, 108). According to Mises, this was the fault of the bureaucratization of education, which taught students falsehoods, especially in economics (Mises 1944, 82). A prime example was the academic class in the German Empire, which formed an “intellectual bodyguard” (Mises 1944, 82) of the empire’s...

Read More »

Read More »

Haiti, Jimmy Barbeque, and Uncle Sam

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Milei’s First One Hundred Days: An Assessment

Javier Milei, presiding over Argentina, the first libertarian president in history – self-proclaimed anarcho-capitalist- has warranted worldwide attention and cast light over libertarianism around the globe. Libertarianism has become more widespread since he entered the political scene. This comes with a definitely positive side and a more dangerous one. The positive side is obviously that libertarianism is more popular than before.The dangerous...

Read More »

Read More »

CNN Is Wrong. Deflation Is a Good Thing

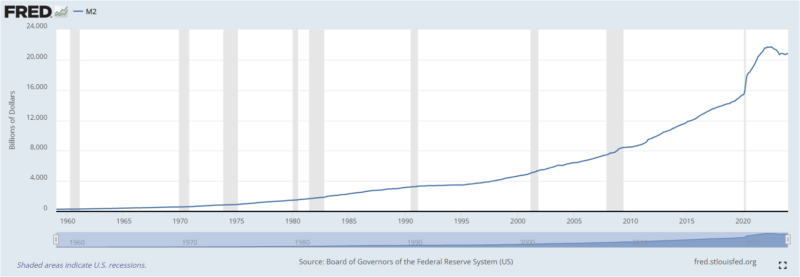

A recent video by CNN states that lower prices are bad for the United States economy and that consumers must get used to the newer, higher prices. The video goes so far as to say, “We’re never going to pay 2019 prices again.” The video claims that deflation is responsible for a long list of problems including layoffs, high unemployment, and falling incomes. Americans should simply get used to paying more and more each year and be happy about it....

Read More »

Read More »

How State Intervention Fueled Haiti’s Descent into Chaos

As the internationally recognized government in Haiti loses its grip on power, the small Caribbean country is descending into violence. The media reports about the situation are quick to, either implicitly or explicitly, place the overall blame for the violence on the absence of state institutions.Situations like this are often used to dismiss libertarians. Before Haiti, it was Somalia that experienced a so-called stateless period in the 1990s and...

Read More »

Read More »

Is the Violence in Haiti a Preview of a Libertarian Society?

As the internationally recognized government in Haiti loses its grip on power, the small Caribbean country is descending into violence. The media reports about the situation are quick to, either implicitly or explicitly, place the overall blame for the violence on the absence of state institutions.Situations like this are often used to dismiss libertarians. Before Haiti, it was Somalia that experienced a so-called stateless period in the 1990s and...

Read More »

Read More »

Tapping 401ks to Pay the Bills

For lower income folks the landing is already hard. Chief investment strategist at Charles Schwab Liz Ann Sonders posted on X (and reported by Almost Daily Grant’s) that the tally of domestic temporary help employees slipped to a three-plus-year low of 2.748 million down from 3.181 million as of March 2022. The 14% comes in 4th in the category’s downward drops percentage-wise since 1990; to the early 2000s, the 2008 financial crash and the Covid...

Read More »

Read More »

Abundance, Generosity, and the State: An Inquiry into Economic Principles

Human action is usually driven by the desire to obtain more for less, and, ideally somethingfor nothing. This has sometimes been called the economic principle. The wish to “get freestuff” pervades all times and places, all sectors of the economy, all ages, and all socialbackgrounds. The very selfishness for which the market economy is often chided is, atbottom, a universal quest to obtain goods for free. Jörg Guido Hülsmann sets out to explorethe...

Read More »

Read More »

The Mises Institute: How Capitalism Can Save America Again

Power & Market offers a contrarian take on world events. We favor individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Connect to Power & Market via Twitter and RSS.Power & Market is published CC4, unless denoted otherwise.

Read More »

Read More »

Reimagining Public Safety – The Case for Privatizing Security

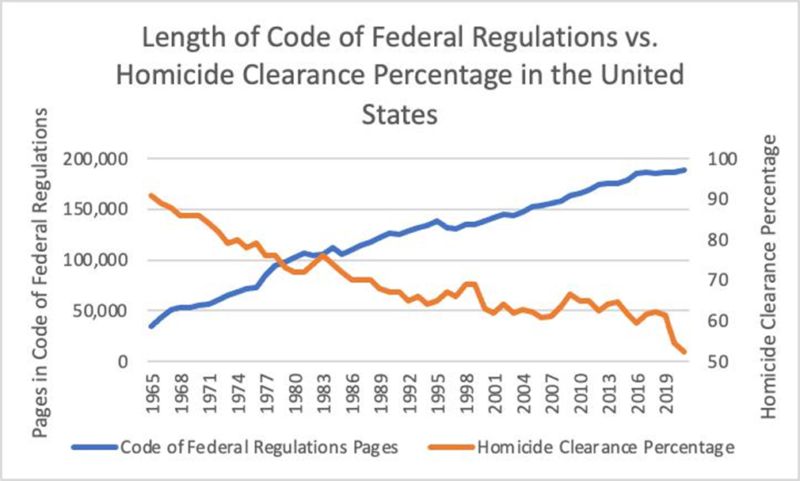

Since the conclusion of World War II, each biennial session of Congress has ushered in a staggering 4-6 million words of additional legislation. However, amidst this flood of legal text, the State's focus on expanding regulations and enforcing compliance has overshadowed its fundamental obligation: provision of security—the cornerstone of what progressives call the social contract.This neglect is starkly evident in the steady decline of the...

Read More »

Read More »

The Case for Secession: How Breaking Away Maximizes Liberty

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »