Category Archive: 6b.) Mises.org

The FBI and CIA Are Enemies of the American People

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Conservatives Are Wrong on Economics. Here’s How to Fix the Problem.

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Javier Milei vs. the Status Quo

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Homo Economicus Myth

Among the larger albatrosses burdening the economics profession is the idea of Homo economicus. To this day, most economics undergraduates hear about it in the context of neoclassical economics. Homo economicus, we are told, is the ideal economic man who always seeks to maximize profits and minimize costs. He only acts “rationally,” and rationalism is defined as, well, always seeking to maximize profits and minimize costs. Even worse, “profit” is...

Read More »

Read More »

How State-Sponsored Universities Distort Campus Activism

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

State Coercion and the Injustice of Apartheid

Many libertarians hold the view that state coercion is wrong, regardless of the ends to which that coercion is deployed. It is wrong for the state to force people apart in an apartheid system, and it is also wrong for the state to force people to engage in “inclusivity” under systems of equity and diversity which force people into contractual relations against their will for example in the context of employment or housing. This is what Lew Rockwell...

Read More »

Read More »

Public Schools and the State’s Omnipotent Bayonet

From everything I read you would think we were incapable of solving social problems.In truth, we find matters only getting worse because the proposed solutions almost always involve the culprit—the state—taking more control over our lives.The state is a box we desperately need to think outside of if we’re ever going to establish civil relations among people. We would do well to remember that the state is absolutely not in the business of making our...

Read More »

Read More »

Consumer Confidence

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

How Does the Federal Reserve Fit into Our Constitutional Order?

This article is adapted from a lecture delivered to the Federalist Society: The Federal Reserve is a fundamental problem for the Constitutional order of the American Republic. How can it be that it considered itself able to unilaterally impose permanent inflation on the country, without legislative debate or approval?The shifting theories believed by central banks are among the most important of macro-economic factors. For example, William...

Read More »

Read More »

The TikTok Ban Is the Next Patriot Act

HR 7521, called the Protecting Americans from Foreign Adversary Controlled Applications Act, is a recent development in American politics. TikTok has been in the news for the past few years, after the public became aware of its connections to China. The popular social media mobile app is currently owned by ByteDance Ltd, a Chinese company. China and the United States currently have a rocky relationship, leading to fears that the Chinese government...

Read More »

Read More »

A “New” Book of Essays by William Graham Sumner

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Robert Kagan Goes on a Tear

Rebellion: How Antiliberalism Is Tearing America Apart—Againby Robert KaganAlfred A. Knopf, 2024; 243 pp.Robert Kagan, a senior fellow of the Brookings Institution, has acquired over several decades a well-deserved reputation as a defender of war. Like Woodrow Wilson, he believes the world must be made safe for democracy. He strongly supported George W. Bush’s war against Iraq, and though the war is widely regarded as a failure, Kagan disagrees....

Read More »

Read More »

MMT and Boiling Frogs

“Why do we borrow our own currency in the first place?”Stephanie Kelton posed this question in her new documentary, Finding the Money, and a clip of Jared Berstein’s fumbled response to the question has gone viral on social media. Bernstein is the Chair of the Council of Economic Advisers to Biden, and so we would expect that he would have an articulate answer to Kelton’s question, but he did not.Instead of trying to parse his response or explain...

Read More »

Read More »

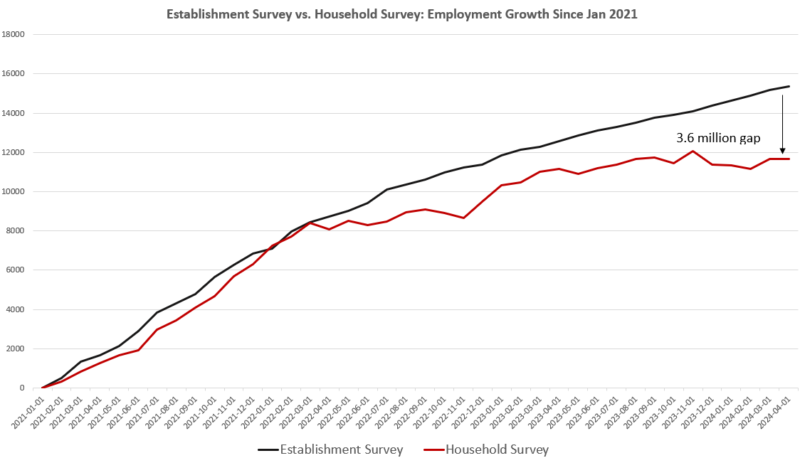

Full-Time Jobs Fall Again as Total Employment Flatlines in April

According to a new report from the federal government’s Bureau of Labor Statistics this week, the US economy added 175,000 jobs for the month of April while the unemployment rate rose slightly to 3.9%. The new reported job growth was considered a “miss” in that it came in below expectations, and for the first time in months, the media did not declare the jobs report to be “a blowout” or “strong.” Instead, the official narrative seemed to be that...

Read More »

Read More »

Texas Governor Abbott Doesn’t Understand the First Amendment

On the 27th of March, Texas Governor Greg Abbott signed an executive order which had the purpose of curbing speech deemed as “anti-semitic” on all state-run universities. Unfortunately, speech protection on public universities has been shaky in the past with universities attempting to restrict speech many times with varying levels of success. Supreme Court decision Healey v James 1972 states that “Among the rights protected by the First Amendment...

Read More »

Read More »

What Can Carl Menger Teach Us about Falafel Sandwiches?

Earlier this year, I gave a short course on Carl Menger’s Principles of Economics for scientists and engineers at my institute. The course was brief, and I focused only on ideas that were relevant for researchers in engineering and the natural sciences. One of the ideas we talked about was supply and demand, in order to link it to the supply and demand of research-related things: the labor of researchers, research articles on specific topics, and...

Read More »

Read More »

Biden Perpetuates Washington’s Idiotic Steel Trade Policies

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Federal Reserve’s Capital Has Now Plummeted to Negative $121 Billion

Hold up your hand if you think that the aggregate losses of an organization are an asset of that organization. No hands at all? Absolutely right. Losses are not an asset. That’s accounting 101. Yet the greatest central bank in the world, the Federal Reserve, insists on claiming that its continuing losses, which have accumulated to the staggering sum of $164 billion, are an accounting asset.The Fed seeks to palm off this accounting entry as a...

Read More »

Read More »

Free-Market Profit Comes From Voluntary Exchange, not Exploitation

In our modern political culture, many people claim that profits are the outcome of some individuals exploiting other individuals. Hence, anyone who is seen trying to make profits is regarded as an enemy of society and must be stopped before inflicting damage. According to Henry Hazlitt, “The indignation shown by many people today at the mention of the very word profits indicates how little understanding there is of the vital function that profits...

Read More »

Read More »

Hyperinflation and the Destruction of Human Personality

The Link between Economic Calculation and Human PersonalityEconomists and historians have clearly shown that the destruction of the value and function of money by hyperinflation makes economic calculation impossible and leads to economic and social disintegration and widespread poverty. What is not so clearly understood, even by many economists, is that during periods of rapid inflation, the inability to economically calculate undermines the very...

Read More »

Read More »