Category Archive: 6b.) Mises.org

Banning Fossil Fuels Will Make Heat Waves More Dangerous, Not Less

On Sunday, activists from the environmentalist organization Extinction Rebellion stormed the green in the final, pivotal moments of the Travelers Championship, a professional golf tournament. The protesters tossed red and white chalk and smoke bombs before being tackled to the ground by police. The stunt came days after two protesters with the group Just Stop Oil, a youth-led offshoot of Extinction Rebellion, sprayed orange paint on Stonehenge.The...

Read More »

Read More »

The Draft: Slavery Re-Imposed

Last week, a most disturbing development took place that should concern all those who value liberty. The House of Representatives passed the National Defense Authorization Act and included in it a provision requiring the automatic enrollment of men from 18 to 26 years old for the draft. Before that, men were required to register for the draft when they turned eighteen, but whether to do that was up to them. Many of them didn’t, even though failing...

Read More »

Read More »

Stop Taxing Tips

Donald Trump recently promised that, if he wins the November election, he will support eliminating taxes on tips as part of his proposal to renew and expand the 2017 tax cuts. This tax law change would be a long overdue boost for millions of Americans.Tips often comprise a substantial portion of the earnings of waiters and waitresses, as well as of other service-sector employees. However, unlike regular wages, a service-sector employee usually has...

Read More »

Read More »

The 45-Year-Old Cold War with Iran Is a Failure. It’s Time for a New Approach

Since its establishment in 1979, the Islamic Republic of Iran has become the third-largest threat to United States national security. It may therefore seem like the ideal strategy to combat this threat would be one that is confrontational and aggressive. However, this approach has proven largely ineffective. The truth is that hawkish policies stressing interventionism only escalates tensions with adversarial foreign powers. Moreover, such actions...

Read More »

Read More »

How Bad Economic Policies Drive Out Good Entrepreneurs

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Governments Hate Privacy Software

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Quest for Lebensraum

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

There Are Only Downsides to Prolonging the War in Ukraine

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Decolonizers’ Assault on Science

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Best Thing Governments Can Do for Business Is Get Out of the Way

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Has Interventionism Jeopardized America’s Future?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Trump’s Faulty Tariff Scheme

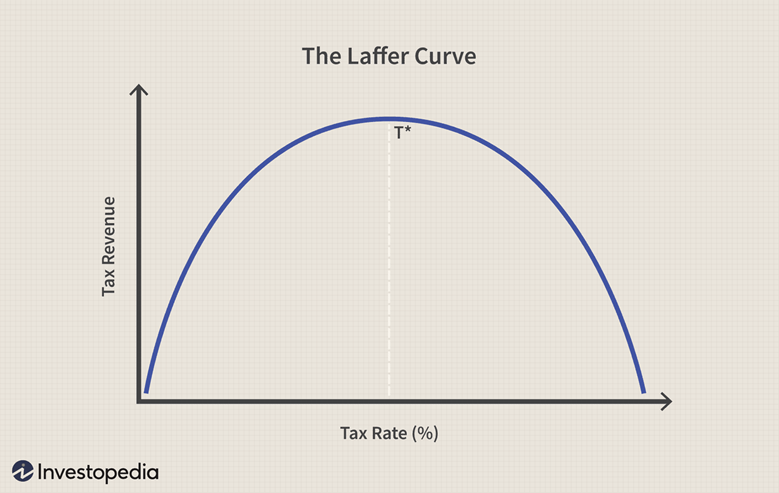

Donald Trump recently addressed top CEOs with a proposal that he sells as helping to reduce income taxes. Trump came out in favor of possibly abolishing income taxation and replacing it with tariffs to finance the federal government. It is likely that the trade-off is simply rhetoric to sell everyone on his protectionist policy, but it is still worth picking apart a critical flaw in the idea regardless.Let’s assume there will be no cuts to...

Read More »

Read More »

AI: “Existential Crisis” or Excuse for Cronyism?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Phony Civil Rights

Natural-rights libertarians reject egalitarianism, regarding it as a revolt against nature. On that premise, the only valid rights are those that give effect to self-ownership and private property. All rights created to give effect to egalitarian values are phony rights, and as Lew Rockwell has explained, “phony civil rights put your life in danger.”Murray Rothbard was against all phony rights, “all ‘rights’ for special groups,” with no exceptions....

Read More »

Read More »

Lysander Spooner’s Flawed War on Poverty

One of the most legendary figures in the history of the liberty movement was Lysander Spooner (1808–87), a Massachusetts-based lawyer, writer, and political theorist. He is particularly well known for his abolitionism, rejection of social contract theory, and belief in natural law. Unfortunately neglected, however, are his economic writings, including among them Poverty: Its Illegal Causes and Legal Cure and Universal Wealth Shown to Be Easily...

Read More »

Read More »

The UK Blood Scandal Exposes British Elites

The United Kingdom’s political landscape has been rocked once again by yet another scandal. This scandal relates to tainted blood that was given to unsuspecting patients leaving them permanently horribly ill. This scandal is different from other more recent scandals; it has been known for decades that this has been happening, yet nothing has been done by successive governments on all sides of the political spectrum. As libertarians, we know why...

Read More »

Read More »

Welfare Policies have Great Consequences

In discussions of politics, it is common to see politicians praised for policies and programs that expand the welfare state. Politicians who sign off or approve spending at a greater magnitude than other politicians are often seen as more generous.

Read More »

Read More »

Taking Back Our Money

ForewordWe do not need a technocratic elite to manage the supply of money. In these three short articles, Murray N. Rothbard removes the Federal Reserve’s veil of scientific mystique to reveal a wholly unnecessary and malignant system. Rothbard contrasts the instability and unjust redistribution inherent in our current central banking system with the integrity of sound money and honest banking practices.Since the articles were published in 1995,...

Read More »

Read More »

Commercial Bank Chickens Come Home to Roost

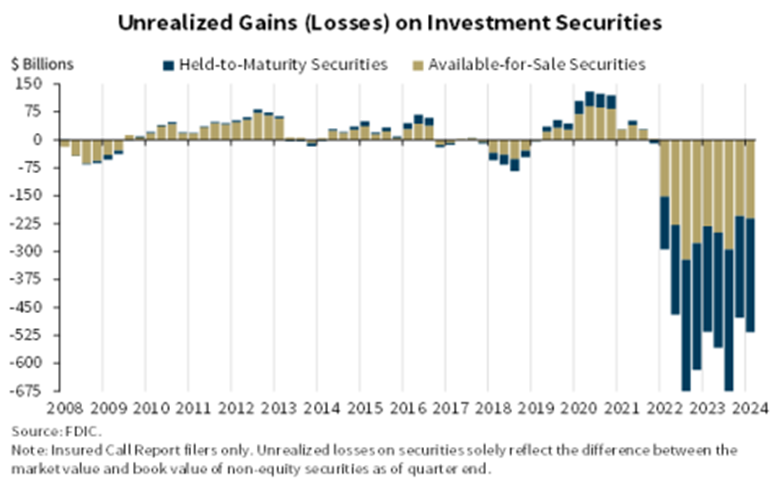

The FDIC added 11 new banks to its Problem List in the first quarter of 2024, bringing the total to 63. The specific banks on this are kept confidential, but the endemic, underlying issues in the commercial banking sector are increasingly obvious.Interest Rate Risk and LiquidityThe FIDC reported that “Unrealized losses on securities totaled $516.5 billion in the first quarter, an increase of $38.9 billion (8.2 percent) from fourth quarter 2023.

Read More »

Read More »

Thomas DiLorenzo Discusses Federal Reserve, Inflation, and Austrian Economics

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »