Category Archive: 6b.) Mises.org

To Fight Russia, Europe’s Regimes Risk Impoverishment and Recession for Europe

European politicians are eager to be seen as "doing something" to oppose the Russian regime following Moscow's invasion of Ukraine. Most European regimes have wisely concluded—Polish and Baltic recklessness notwithstanding—that provoking a military conflict with nuclear-armed Russia is not a good idea.

Read More »

Read More »

Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game

Money printing may bring rising wages, but it also brings rising prices for goods and services. And those increases are outpacing the wage increases.

Original Article: "Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Nationalities Question

[This article was published in in The Irrepressible Rothbard, available in the Mises Store.]

Upon the collapse of centralizing totalitarian Communism in Eastern Europe and even the Soviet Union, long suppressed ethnic and nationality questions and conflicts have come rapidly to the fore. The crack-up of central control has revealed the hidden but still vibrant "deep structures" of ethnicity and nationality.

To those of us who glory in...

Read More »

Read More »

Jon Stewart Asks Great Questions of Federal Reserve Chief

In a recent episode of “The Problem With Jon Stewart,” the former Daily Show host asks former president of the Kansas City Fed Thomas Hoenig why the Fed couldn’t have bailed out homeowners, or just “quantitative ease” away the Treasury’s debt. Hoenig gives muddy answers, so Bob tries to clarify.

Read More »

Read More »

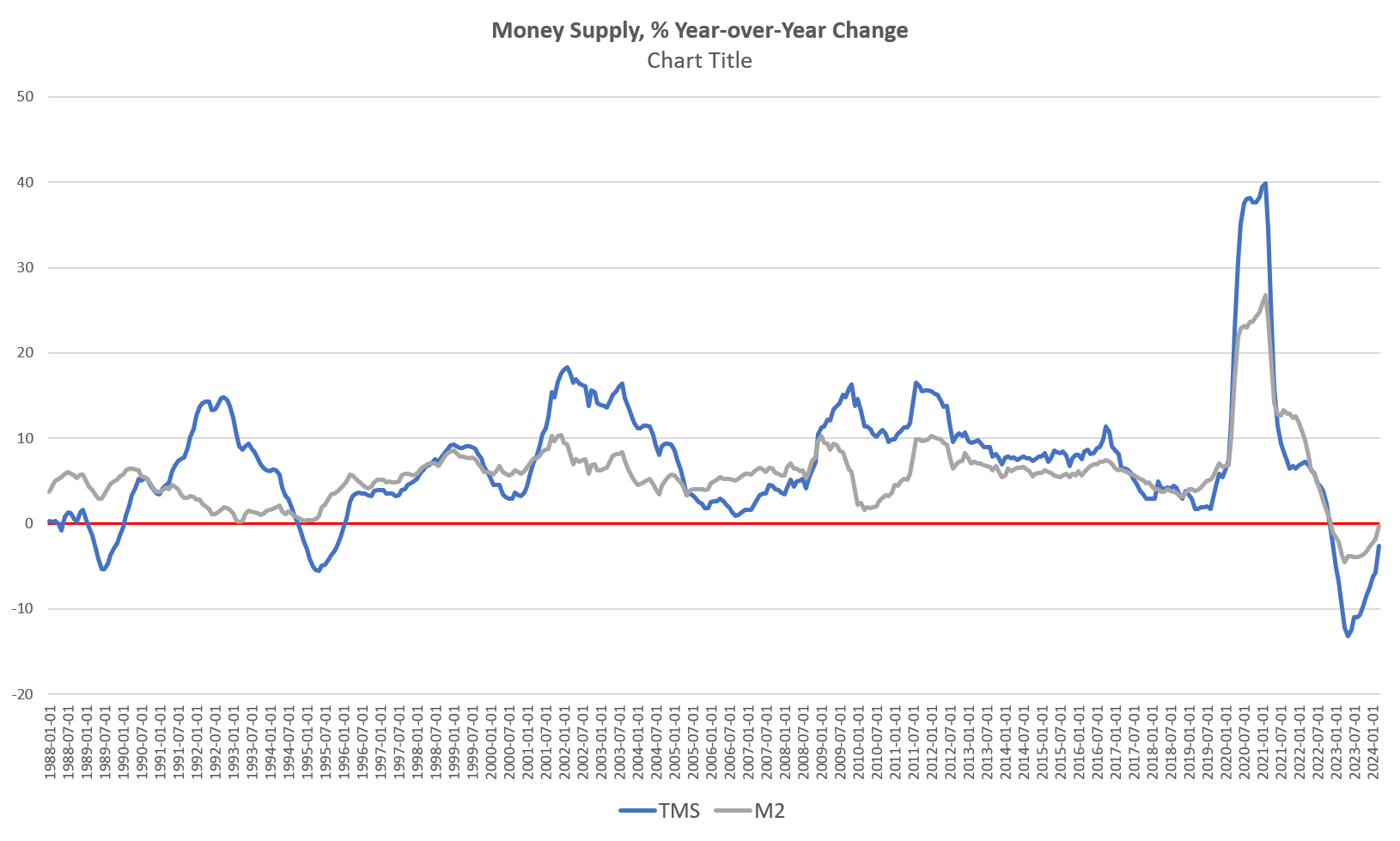

Keynesians and Market Monetarists Didn’t See Inflation Coming

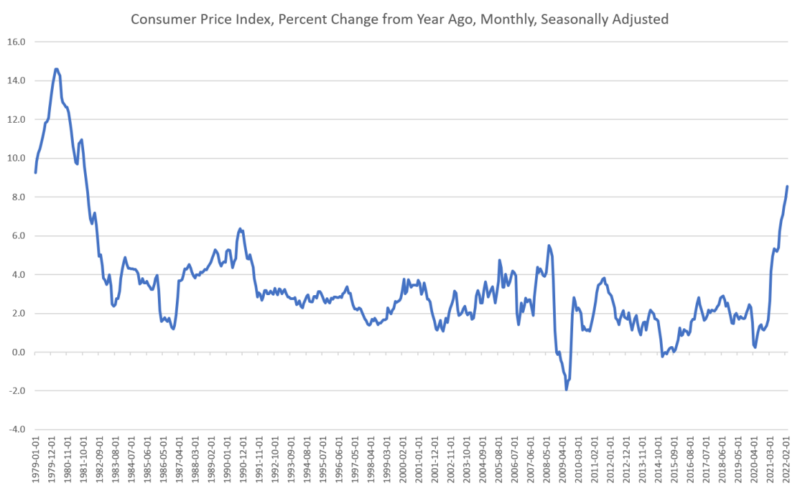

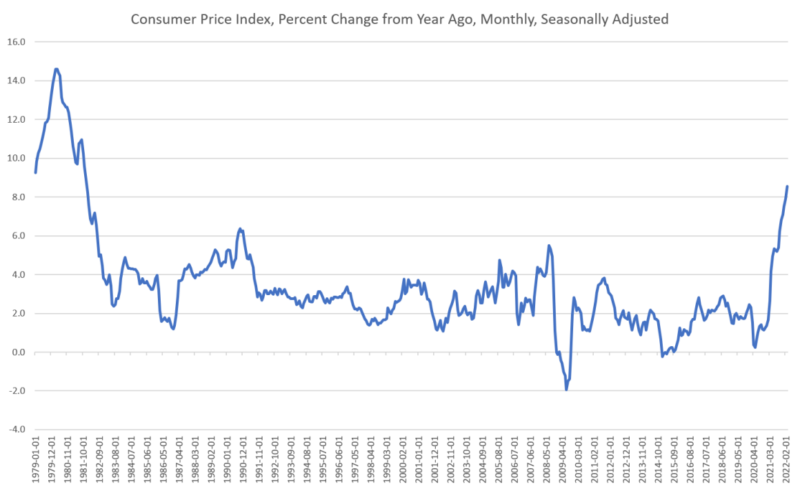

The government’s latest report puts the twelve-month official consumer price inflation rate at 8.5 percent, the highest since December 1981:

As economists debate the causes of, and cure for, this price inflation, it’s worth recounting which schools of thought saw it coming. Although individuals can be nuanced, generally speaking the Austrians have been warning that the Fed’s reckless policies threaten the dollar. In contrast, as I will document...

Read More »

Read More »

How the Fed’s Tampering with the Policy Rate Affects the Yield Curve

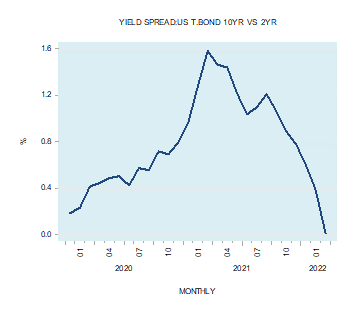

At the end of March this year the difference between the yield on the ten-year Treasury bond and the yield on the two-year Treasury bond fell to 0.010 percent from 1.582 percent at the end of March 2021.

Read More »

Read More »

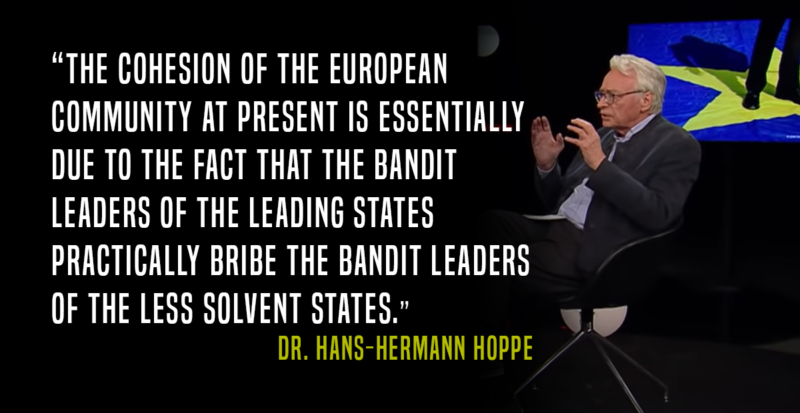

Hoppe: “My Dream Is of a Europe Which Consists of 1,000 Liechtensteins.”

Interviewer: I would like to welcome our second guest in the studio. It is the philosopher and economist with an international range Hans-Hermann Hoppe. Nice to meet you, Mr. Hoppe.

The dream of a united Europe, the eternal longing of the empire. Do you also dream this dream?

Read More »

Read More »

Dollar Dominanz am Ende – Wohlstand in Gefahr

Videoinhalte:Thorsten Polleit, Dirk Müller, Neustart, reset, der große reset, Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland, Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland, I

Read More »

Read More »

Darshan Mehta: Insights Are Game Changers For Business

What drives customer behavior and customer choices? It’s the existential question for business; you’ve got to know the answer. But it’s a mystery, hard to unlock. The solution to this answer lies in what market researchers call insights, based on the Austrian deductive method that we summarized in episode #164 with Per Bylund (Mises.org/E4B_164).

Read More »

Read More »

PL2 Highlights: Albion 1 Leeds 0

Andrew Moran's first-half strike was enough to separate the two teams at the American Express Elite Football Performance Centre.

Read More »

Read More »

Achtung Inflation: Wohlstand in Gefahr! (JF-TV Interview mit Thorsten Polleit)

Seit 2021 steigt die Inflationsrate kontinuierlich an, lag im März dieses Jahres bei besorgniserregenden 7,3 Prozent. In Medien und Politik wird diese Entwicklung oft mit dem Krieg in der Ukraine assoziiert, in Wahrheit liegen die Gründe jedoch viel tiefer, wie der Chefökonom der Degussa Goldhandel, Thorsten Polleit, im JF-TV Interview erklärt. Und Polleit fürchtet: "Diese Inflation ist gekommen um zu bleiben", selbst eine vorrübergehend...

Read More »

Read More »

Achtung Inflation: Wohlstand in Gefahr!

“So act that your principle of action might safely be made a law for the whole world.”

| Immanuel Kant (1724–1804)

Read More »

Read More »

Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game

According to a new report released Wednesday by the US Bureau of Labor Statistics, the Consumer Price Index increased in March by 8.6 percent, measured year over year (YOY). This is the largest increase in more than forty years. To find a higher rate of CPI inflation, we have to go back to December 1981, when the year-over-year increase was 9.6 percent.

Read More »

Read More »

We Still Haven’t Reached the Inflation Finale

Inflations have an inbuilt mechanism which works to burn them out. Government (including the central bank) can thwart the mechanism if they resort to further monetary injections of sufficient power. Hence inflations can run for a long time and in virulent form. This occurs where the money issuers see net benefit from making new monetary injections even though likely to be less than for the initial one which took so many people by surprise.

Read More »

Read More »

The Future of Gold and Money (Jeff Deist, James Dale Davidson, Keith Weiner, David Gornoski)

Classic roundtable from September, 2020.

In this roundtable discussion, David Gornoski is joined by Mises Institute’s Jeff Deist, Keith Weiner of Monetary Metals, and James Dale Davidson, author of the Sovereign Individual. Together, they discuss the history and future of gold as an investment asset for the average Joe, general misconceptions of investing in gold, the Fiat money system, the economic effects of foreign policy, and more.

Read More »

Read More »

The Ukraine War Shows Nukes Mean Safety from US-Led Regime Change

Some journalists like Steve Portnoy of CBS seem unable to grasp that escalations that might lead to nuclear war are a bad thing. The journalist seemed incredulous last week when asking White House spokeswoman Jen Psaki why the United States has not started a full-on war with Moscow. Psaki’s position—with which any reasonable person could agree—was that it is not in the interest of Americans “to be in a war with Russia.”

Read More »

Read More »

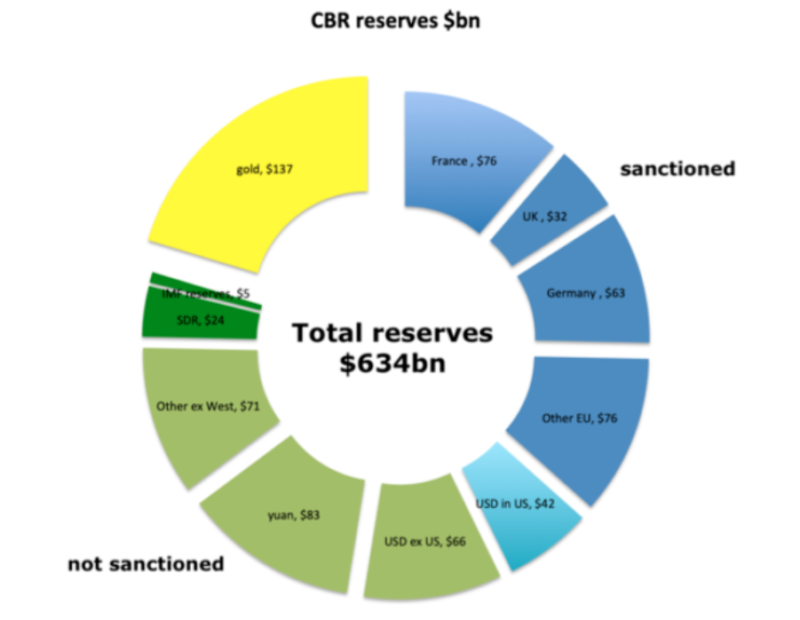

Heavy Sanctions against Russia Could Usher in a Wider Economic War

Vladimir Putin’s invasion of Ukraine was met with unprecedented economic sanctions by the United States and its allies in order to cripple Russia’s capacity to wage war. Never before in post–World War II history has an economy of Russia’s size been reprimanded with such force. Moreover, the sanctions could remain in place after the war ends and reach other major economies too, in particular China. In this case, current sanctions could be the...

Read More »

Read More »