Category Archive: 6b.) Mises.org

Milei’s Political Caste

All government agencies intervene in people’s lives and liberty. The entire government bureaucracy exists precisely to do that. These agencies have an impact on social life and facilitate government spending. Whoever holds these positions, with matching differences in power and relevance levels, will serve at least a minimally statist agenda. In consequence, unless an agency and everything to do with its inner workings is completely abolished, the...

Read More »

Read More »

The Menace of the State

The election is upon us. We wonder whether we have to have war, tariffs, and deficit spending, regardless of whom we support. What are we to do? Faced with the intractable problems of misgovernment, we need to look deeper. Following the great Murray Rothbard, we should ask, do we need a State at all? Rothbard’s answer was a clear “No.” And not only do we not need a State; the State is a menace.Following Franz Oppenheimer and Albert Jay Nock,...

Read More »

Read More »

Sound Money Movement Chalks Up Seven State Legislative Victories in 2024

This year is shaping up to be one of the most legislatively successful in US sound money history. Money Metals Exchange was instrumental in achieving six new sound money victories, as well as one key defensive win. The upshot is that sound money legislation, carefully crafted and propelled by grassroots enthusiasm, is proving to be both practical and achievable.The seven legislative successes, coming on the heels of five in 2023, range from new...

Read More »

Read More »

With JD Vance and Elon Musk, Suddenly Ideas Are Back in this Campaign

This presidential campaign season may be one of those turning points in history for reasons good and bad. Anyone watching the one debate between the Republican and Democratic Party candidates would not have come away with the view that this was a great battle of competing principles and visions for the future. It was a campaign of name-calling and bullets, where one candidate avoided discussing ideas at all costs – and even avoided the media at all...

Read More »

Read More »

The American Empire

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

No Matter Who Wins, Half the Country Won’t Believe in the Election

Today, in theory, will conclude the 2024 presidential election, one of the most bizarre in American political history. From inner-party coups to assassination attempts, Kamala’s Brat summer social media trend to Trump’s courting of comedian podcasts, the campaign cycle has been saturated with the unconventional. It has, of course, also seen its expected share of shallow, political, rhetorical rhetoric and general economic illiteracy, which are the...

Read More »

Read More »

No Matter How You Vote, Politicians Don’t Represent You

One of the most foundational assumptions behind modern democracy is that the elected officials somehow represent the interests of those who elected them.Advocates for the political status quo flog this position repeatedly, claiming that taxation and the regulatory state are all morally legitimate because the voters are “represented.” Even conservatives, who often claim to be for “small government” often oppose radicalism of any kind — such as...

Read More »

Read More »

No Mises Bust at the University of Vienna

This past summer I joined my son in Vienna. He was there on a fellowship from his senior year at Carleton College to study architecture, in particular the work of Otto Wagner, the Secession movement, and so on. I had only been there once before, when backpacking during law school. I accompanied him on his explorations and we feasted on Viennese cuisine at places recommended by local friends. I suggested that we take time to visit the University of...

Read More »

Read More »

A Brief History of Tariffs and Stock Market Crises

The most important and globally misunderstood aspect of tariffs is their impact on the stock market. History has demonstrated that tariffs can cause immediate market corrections and destroy investor capital. They also backfire on American manufacturers and consumers.Tariffs may be aimed at foreign companies and governments, but their domestic consequences are often far greater. Advocates for protectionist measures on steel, lumber, electric...

Read More »

Read More »

Mises on Predicting Election Outcomes

As of this morning, ABC’s Project FiveThirtyEight says that Donald Trump wins 53 times out of 100 and Kamala Harris wins 47 times out of 100. How can we make sense of this statement?To do so, we have to understand the difference between case probability and class probability.Presidential elections are unique events that are determined by the actions of humans, and so belong to the case probability category. The nature of such events is that...

Read More »

Read More »

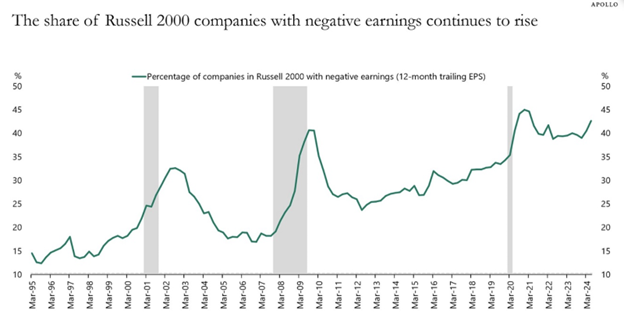

Markets Made of Glass—How the Fed Destroyed Economic Resilience

Central to any good investor’s decision-making process is determining the degree to which the target of investment is “robust to the downside.” Can the investment maintain its value—or even continue to provide sufficient return on capital—in the event of a pullback in the broader economy or a specific sector?Warren Buffett has aptly referred to this feature as “margin of safety.” While critical to rational decision-makers, margin of safety seems...

Read More »

Read More »

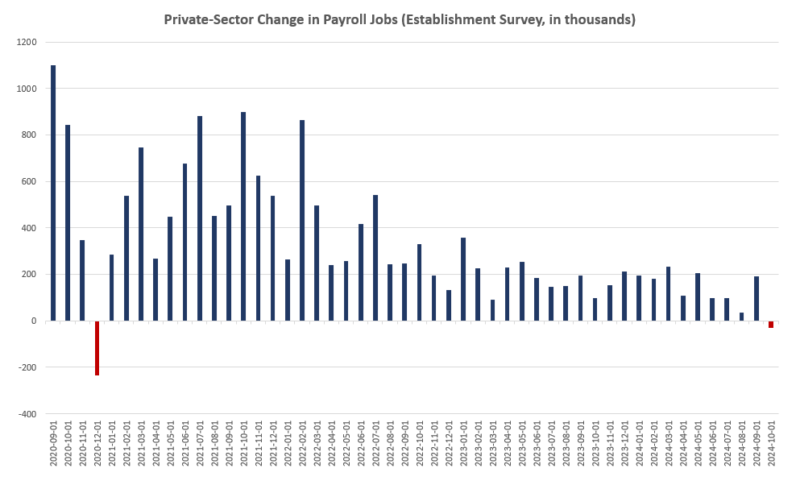

The Private-Sector Job Market Is Shrinking

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Does the Fed’s Lowering the Interest Rates Strengthen Economic Growth?

On September 18, 2024 the Federal Reserve (“Fed”) lowered its policy interest rate target by 0.5 percent to 5 percent. Most commentators, including the Fed chairman Jerome Powell, hold that the lowering of the policy rate is going to strengthen the economy. This way of thinking is based on the view that the lowering of interest rates is going to strengthen the demand for goods and services. As a result, this would strengthen the production of goods...

Read More »

Read More »

The Systematic Bankrupting of America

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Arbitrary Laws Have “Saved” New Yorkers From “Peanut” the Squirrel

The internet has blown up in rage at the recent capture and euthanization of a famous TikTok/Instagram Squirrel named “Peanut.” Peanut was rescued over 7 years ago by his owner Mark Longo. Since then, Peanut has become a hit on TikTok and Instagram where he garnered millions of views and support. But the State of New York has declared war on this little critter, as well as his companion, “Fred” the raccoon. Mark Longo described in a TMZ...

Read More »

Read More »

To “Save Democracy,” Facebook Bans “Dictator”

Facebook notified me on Sunday morning that eight years ago, I posted a link to my Washington Times article warning of Dictatorial Democracy regardless of whether Hillary Clinton or Donald Trump won the 2016 election. The opening sentence set the tone: “The 2016 election campaign is mortifying millions of Americans in part because the presidency has become far more dangerous in recent times.” Facebook always gives users the option to “Share a...

Read More »

Read More »

Consumers Upbeat, Bankruptcies and Foreclosures Increase

Normal folks rejoiced when the Federal Reserve lowered the only interest rate it controls, Fed Funds, by a surprise 50 basis points. However, since then, the rate on 10-year bonds has increased 70 basis points. Focusing on the positive, Almost Daily Grant’s (ADG) reports “An outbreak of optimism has taken hold across the land, as the Conference Board’s monthly gauge of consumer sentiment painted a pretty picture for the economy and asset prices...

Read More »

Read More »

There’s No Market Process Independent of Competition

Many misconceptions about the nature of the free market system stem from an ignorance of who ultimately benefits from the market process. That the significant number of those who would benefit the most from the operations of the market—consumers—tend to also harbor much of the antagonisms against logically necessary features of the market highlights the unfortunate reality that the majority of people have yet to rightly understand how their best...

Read More »

Read More »

Government Coverups and Censorship Are the Problem

“What makes it possible for a totalitarian or any other dictatorship to rule is that people are not informed; how can you have an opinion if you are not informed? If everybody always lies to you, the consequence is not that you believe the lies, but rather that nobody believes anything any longer… And a people that no longer can believe anything cannot make up its mind. It is deprived not only of its capacity to act but also of its capacity to...

Read More »

Read More »

Private-Sector Jobs Went Negative in October. Will the Fed Panic Again?

According to the most recent report from the federal government’s Bureau of Labor Statistics, the US economy added only 12,000 payroll jobs during October. This was the smallest month-to-month employment gain in nearly four years. Moreover, total private jobs fell in October by 28,000.This is the worst employment report since 2020, and it reflects an overall downward trend in employment growth since 2022. In addition to the drop in private...

Read More »

Read More »