Category Archive: 6b.) Bawerk

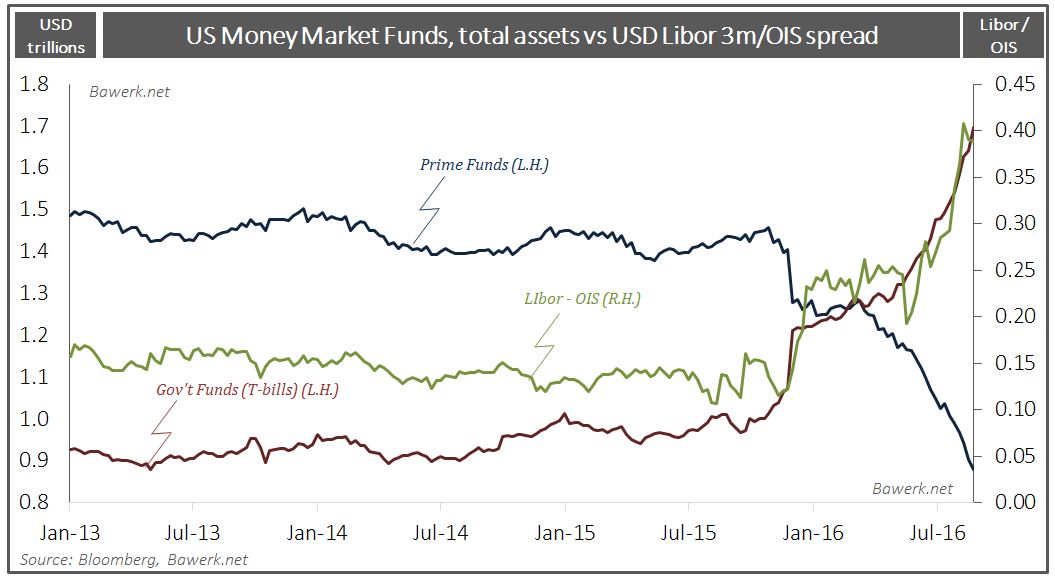

The FOMC Butterfly that Will Ruin the World

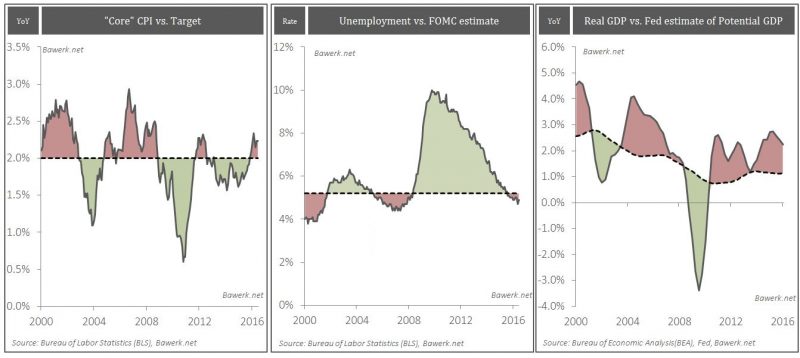

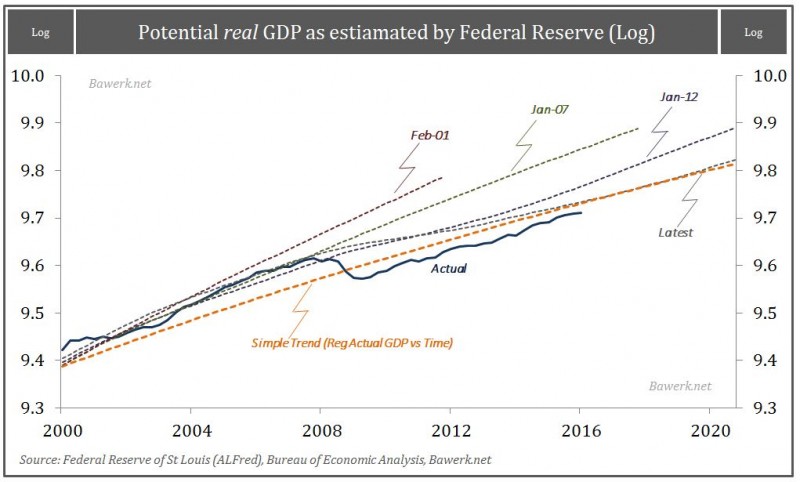

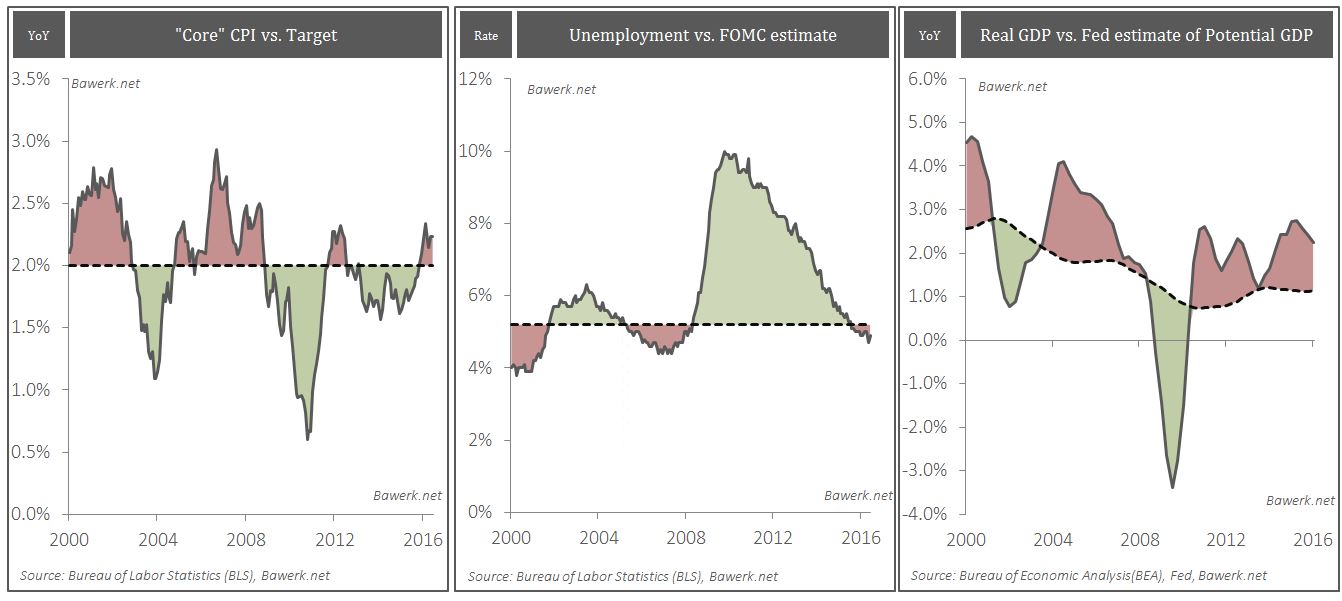

Given the fact that the core CPI is currently over the arbitrarily set 2 per cent target unemployment below what the FOMC regards as full employment and GDP running at a rate far above the Federal Reserve’s own estimates of so-called potential; you would say the Federal Funds rate would be in the vicinity of five per cent.

Read More »

Read More »

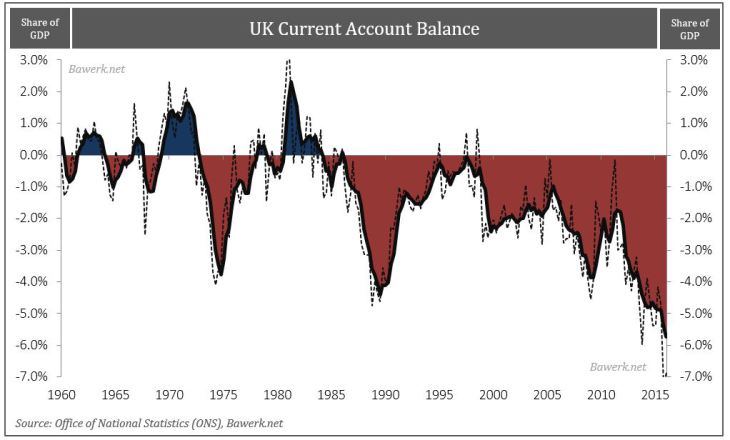

Brexit or not, the pound will crash

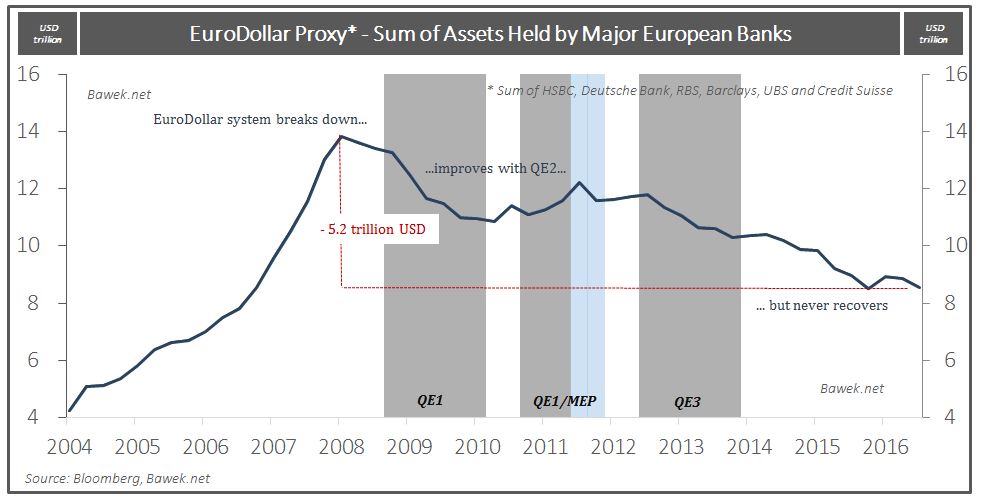

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

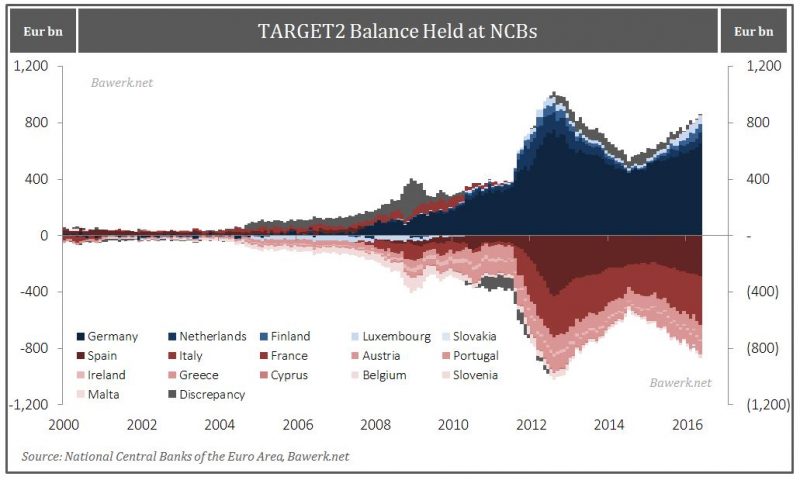

Money confuses and blurs economic relations

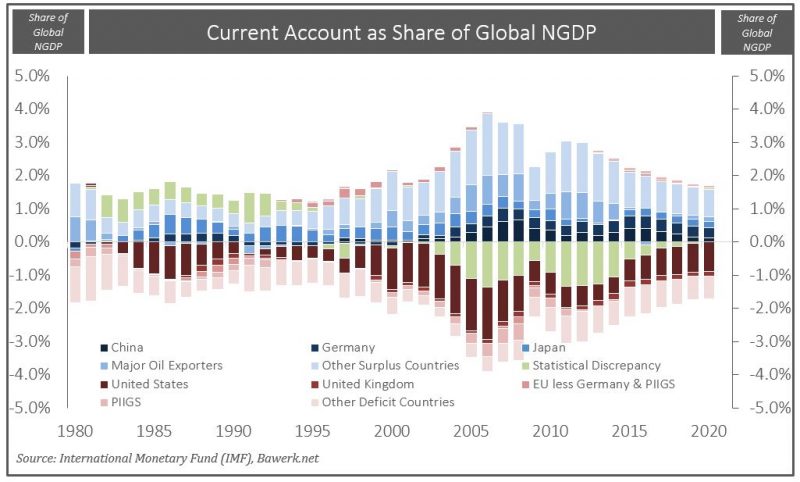

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »

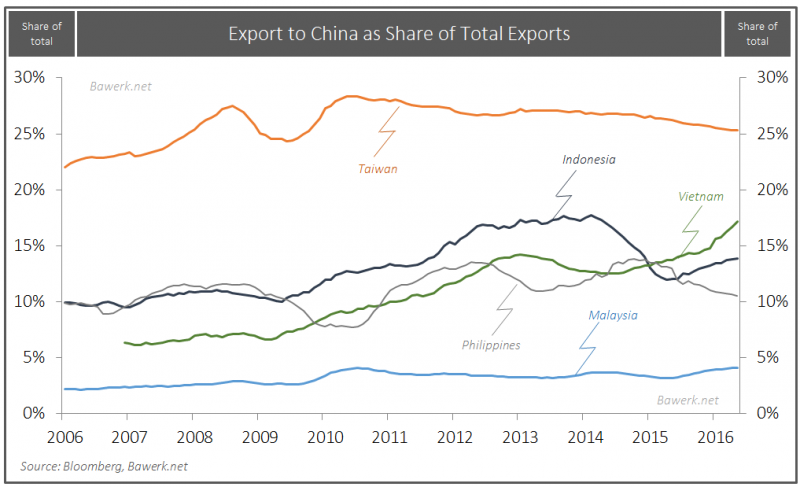

South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters.

Read More »

Read More »

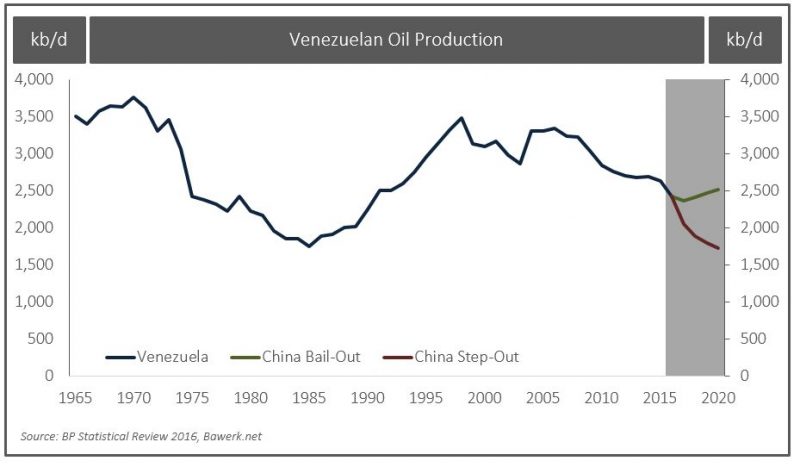

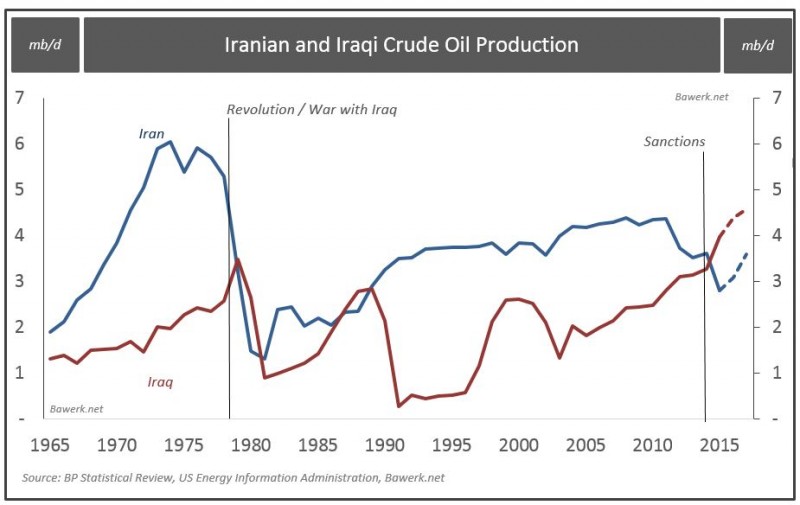

China the lender of last resort for many oil producers

Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs.

Read More »

Read More »

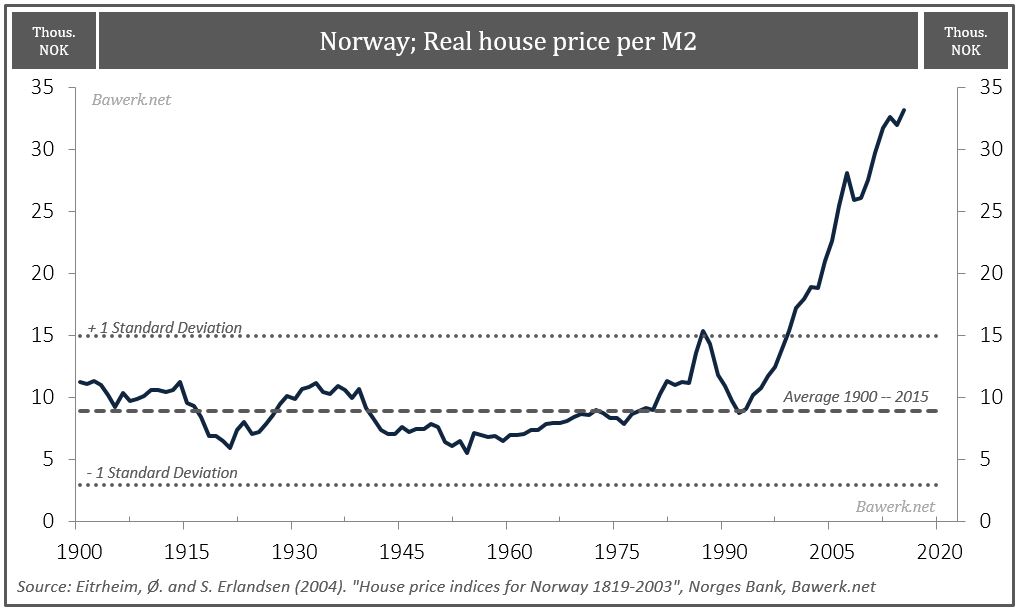

Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

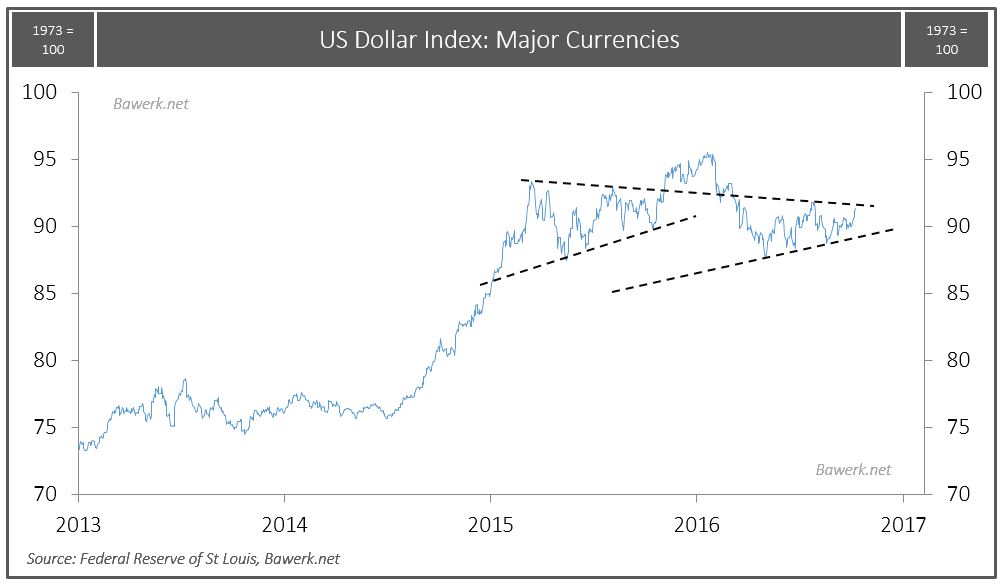

The Greatest Keynesian monetary experiment is not sustainable. It will not continue ad infinitum. Our money masters are just postponing the inevitable bust that will eventually correct these imbalances through worldwide capital re-allocation. Bawerk shows 3 graphs how investment growth gets slower and slower since the End of Bretton, how debt is increasing and how cheap dollar fuel debt-driven growth.

Read More »

Read More »

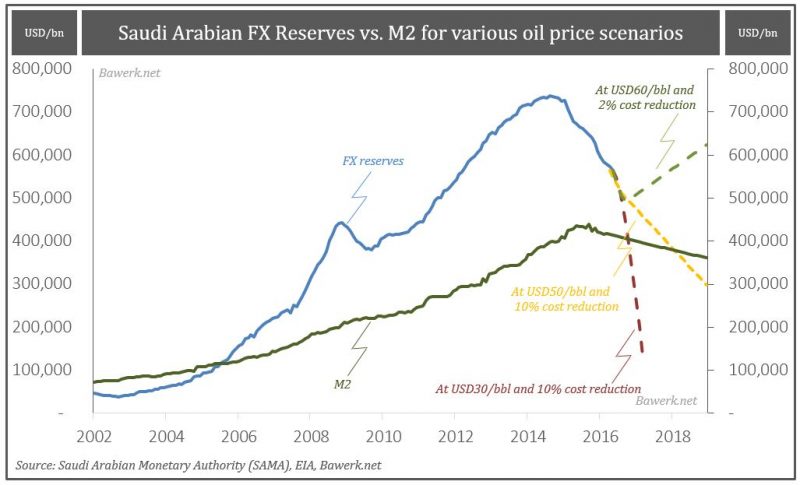

Saudi-Arabia: Peg or Banking Crisis?

During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the...

Read More »

Read More »

OPEC’s Game within a Game

The fact OPEC just agreed to agree on nothing in Vienna. What next? Lots of noise about collective output vs. country allocations.

Read More »

Read More »

Notes from ECB Press Conference

ECB press conference June 2 2016 Q; Risk to inflation balanced? April meeting, no conclusive evidence of second round effects, are they now? A; Additional stimulus beyond CSPP and TLTRO2 not necessary as we expect higher inflation. We do not see evid...

Read More »

Read More »

Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has...

Read More »

Read More »

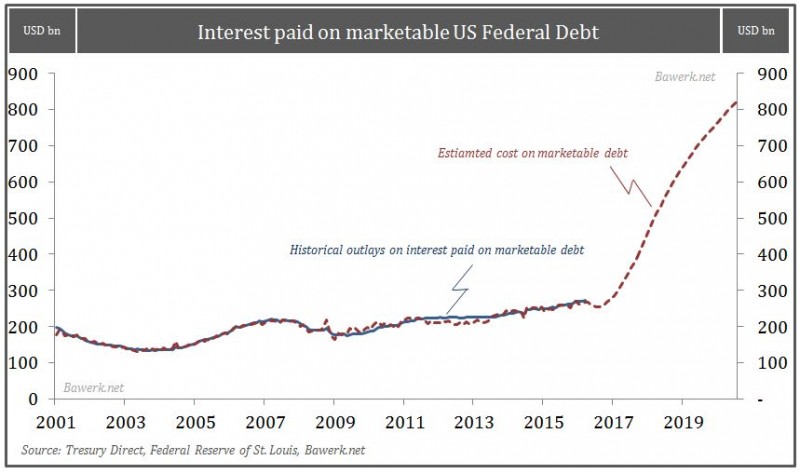

Fed Suppression, Long Term Economic Repression

The Federal Reserve really wants to raise rates, but they do not dare as the consequence of interrupting an unprecedented level of capital misallocation is too grave to face head on. So our money masters continue their low interest rate policy; pulli...

Read More »

Read More »

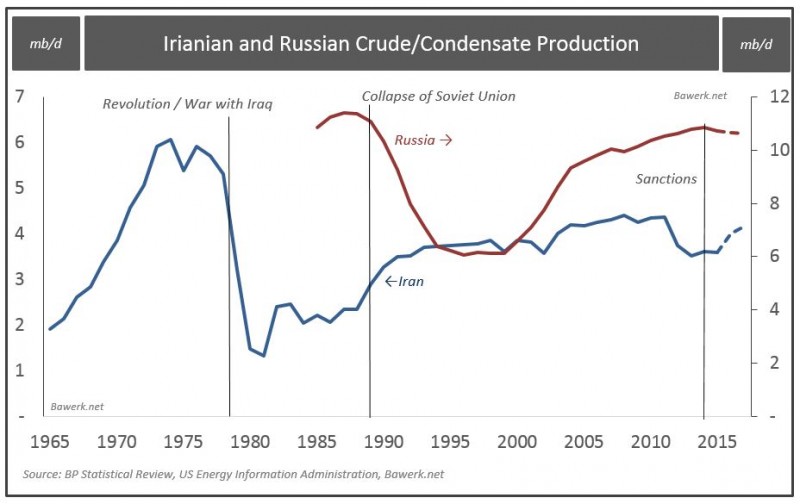

OPEC Politics: Russian King, Iranian Crown Prince?

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town.

Read More »

Read More »

The ‘Strange’ Death of Mr. Abadi

As expected, PM Abadi was always going to come off worse in his last ditch attempt to try and regain some kind of political initiative by appointing a new look ‘technocratic’ government in Baghdad. But the ailing Prime Minister has managed to back hi...

Read More »

Read More »

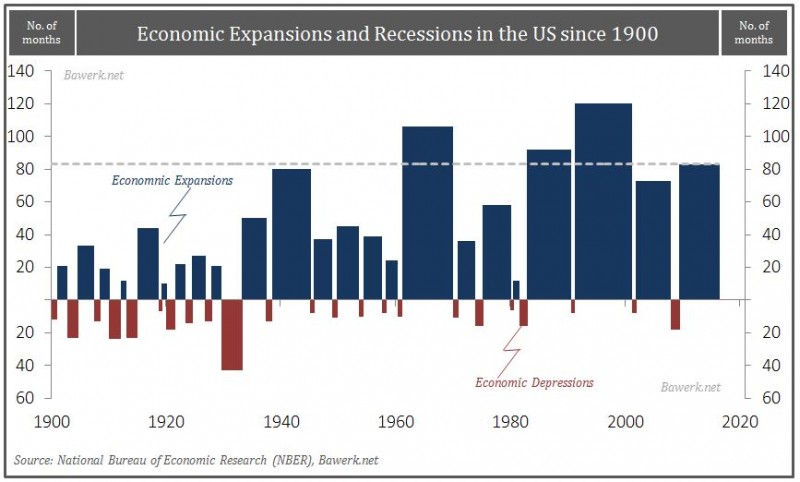

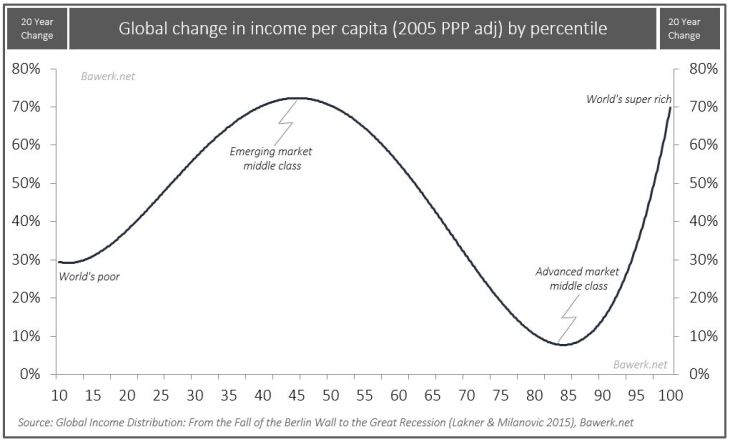

Hillary Will be the Least of Your Worries – America has Economic Diarrhea

According to the National Bureau of Economic Research (NBER), the official recession arbiter, the US economy is currently at its fourth longest expansion in history. By the sheer nature of a capitalistic society with its inherent cyclicality it is a ...

Read More »

Read More »

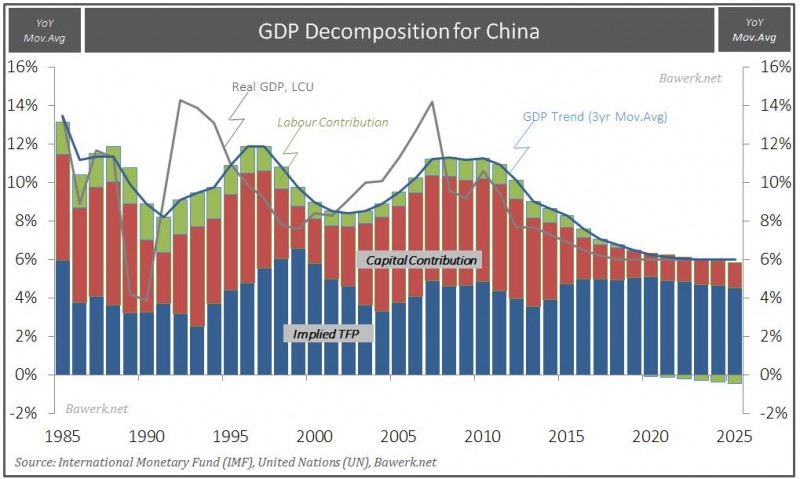

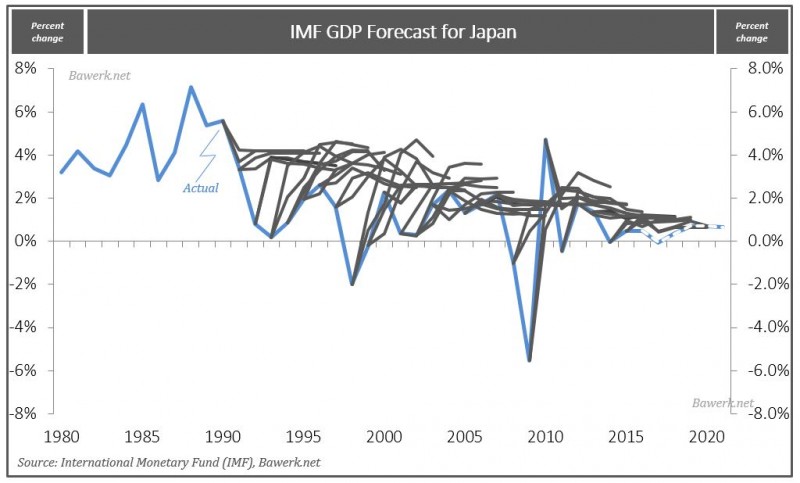

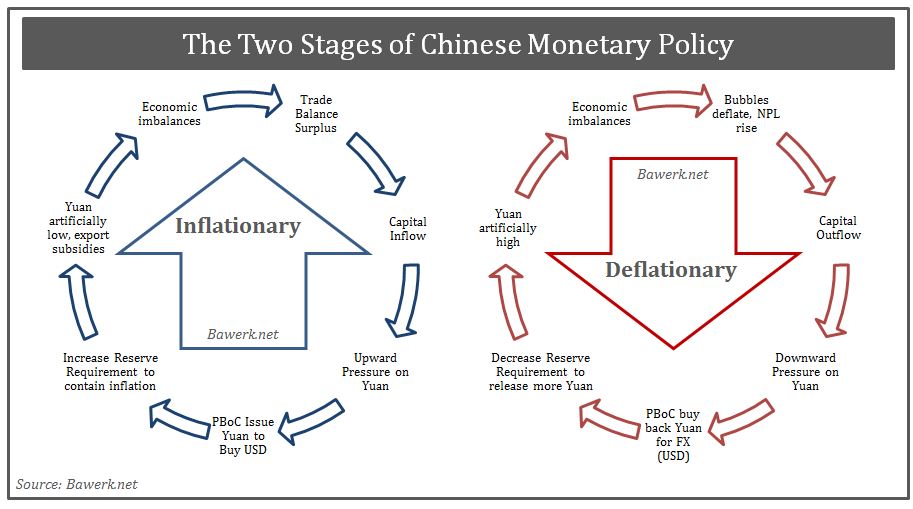

Chinese Dragon: Breathing Credit Fumes

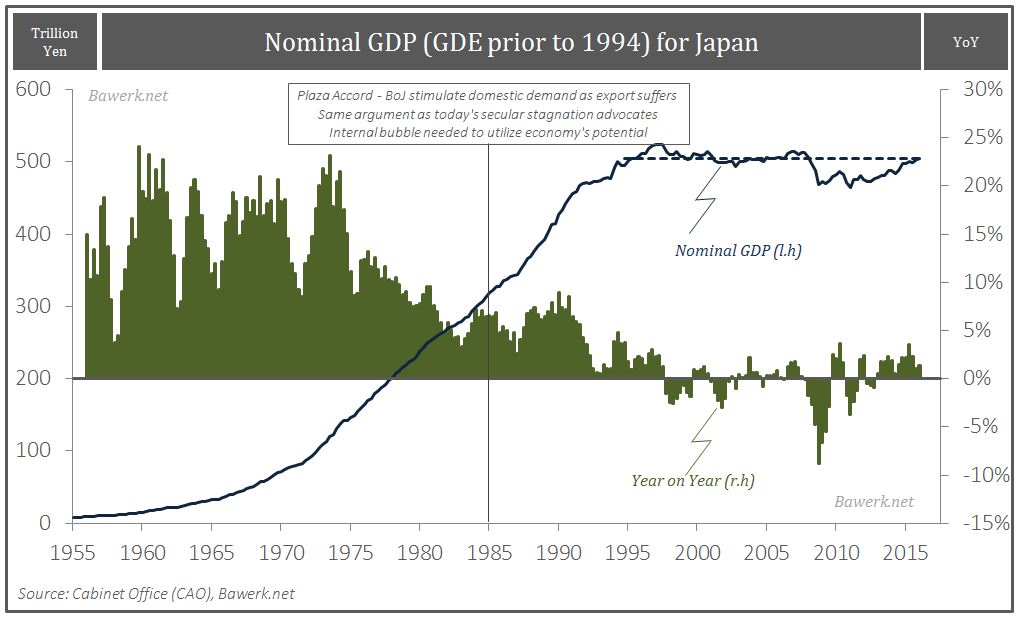

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate.

Read More »

Read More »

Circulus in probando

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because ...

Read More »

Read More »

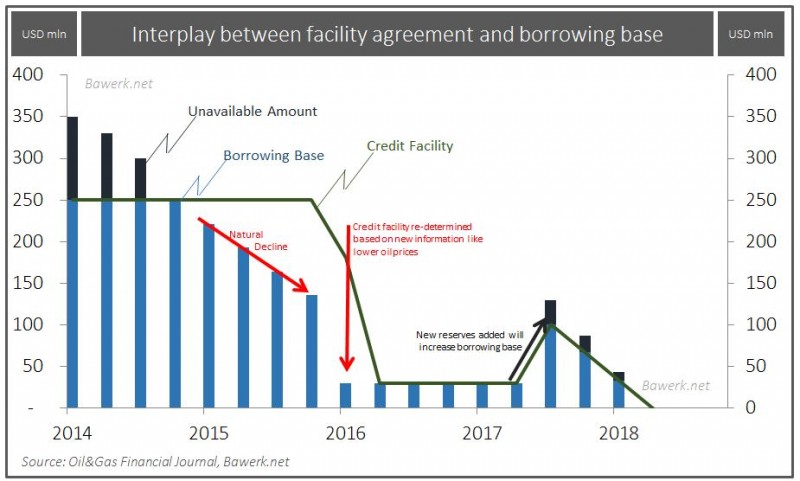

OPEC’s Doha Dilemma: 3mb/d US lock in?

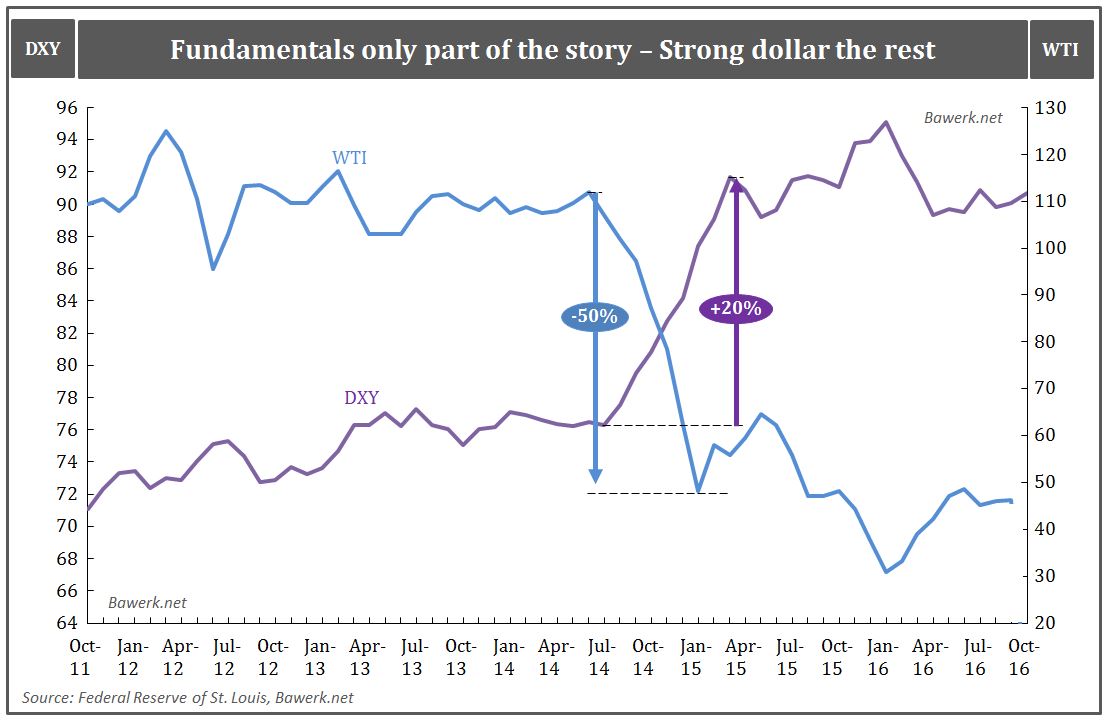

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs.

Read More »

Read More »

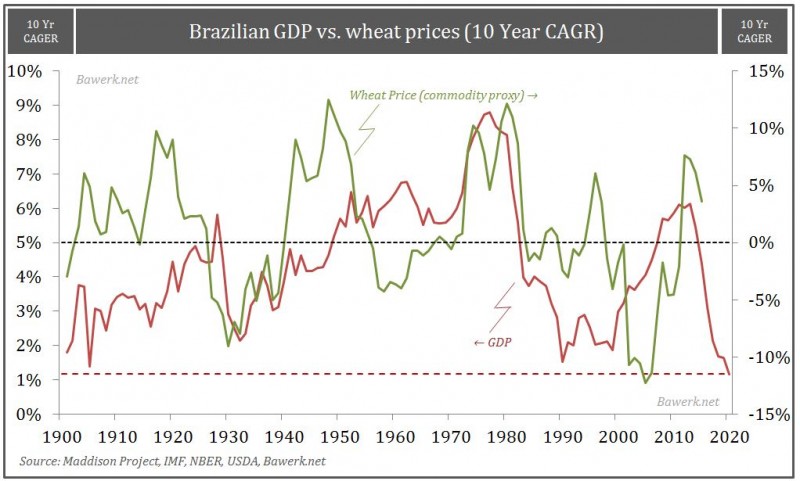

Latin America – Seven Ugly Sisters in Deep Political Trouble

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices.

Read More »

Read More »

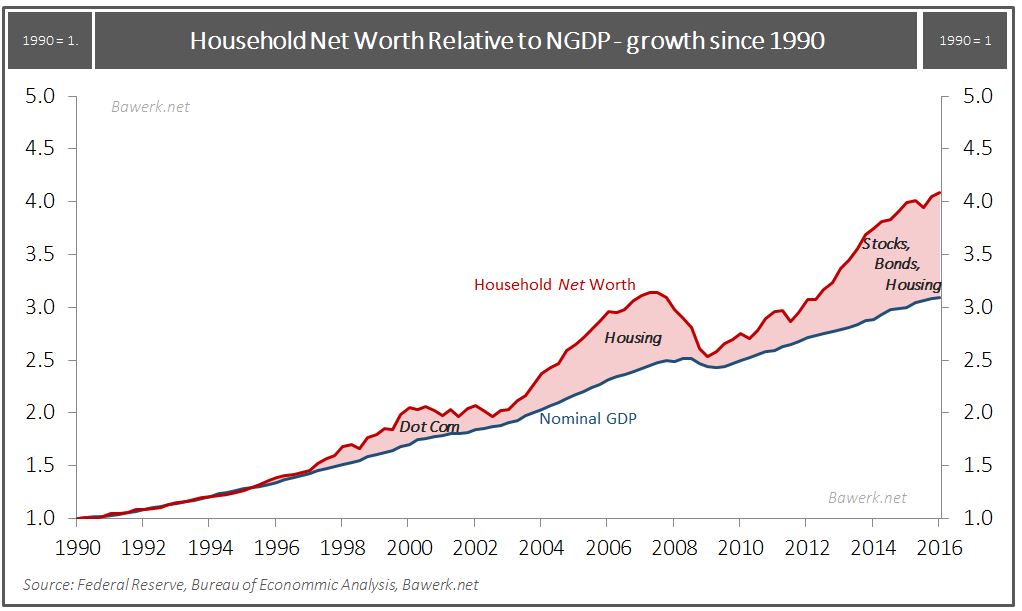

Greenspan, the Sheepherder

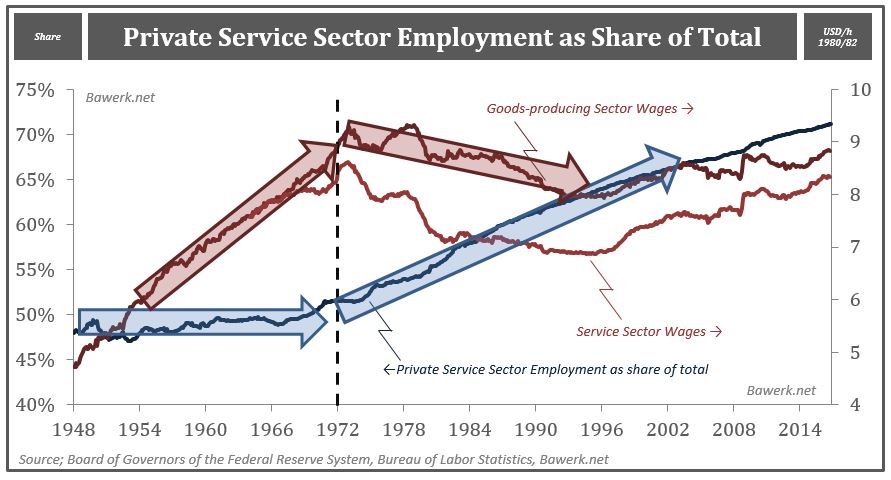

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated,...

Read More »

Read More »

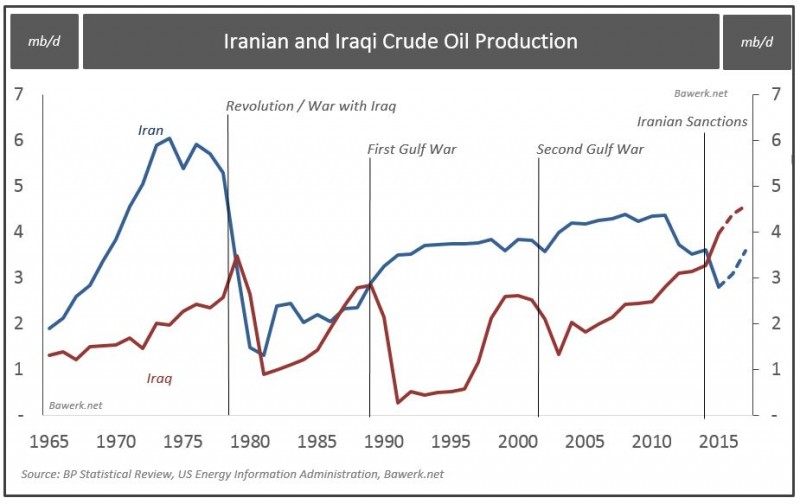

Revolutionary Guards: The Way of the Iranian Future

Iranian elections have supposedly put a very nice ‘moderate’ spin on Iranian politics in parliamentary ranks, and more importantly, Assembly of Experts composition. While it would be churlish to deny, it represents a significant step forward for Pres...

Read More »

Read More »