Category Archive: 6b.) Bawerk

Understanding Your Banking Direct Debit Card: A Comprehensive Guide

In today's fast-paced world, convenience and efficiency are paramount, especially when it comes to managing our finances. Gone are the days of carrying wads of cash or meticulously writing checks for every purchase.

Read More »

Read More »

Assessing the Hawkish Stance in Modern Monetary Policy: Implications and Outcomes

In the intricate world of economic management, the term "monetary policy" often surfaces in discussions among policymakers, economists, and financial analysts. As central banks navigate the delicate balance between fostering economic growth and curbing inflation, their stance on monetary policy becomes a focal point of analysis and debate.

Read More »

Read More »

Breaking Down the Salary Structure for Investment Banking Analysts at Raymond James

Investment banking is a high-stakes, fast-paced field that attracts some of the brightest minds in finance. Among the many firms that dominate this industry, Raymond James stands out for its robust client relationships, comprehensive services, and a reputation for fostering talent.

Read More »

Read More »

Unveiling Hidden Hazards: Common Commodities Containing Radioactive Materials

In our daily lives, we often overlook the presence of materials that emit radiation, associating radioactivity primarily with nuclear power plants or medical imaging technology. However, radioactive materials can be found in a surprising array of common commodities, spanning various industries and applications.

Read More »

Read More »

Navigating Banking Law: Insights from Attorney Johanna Shallenberger

Navigating the intricate landscape of banking law requires a blend of acute legal acumen, steadfast dedication, and the ability to foresee the evolving regulatory environment. Johanna Shallenberger, a distinguished attorney specializing in banking law, exemplifies these qualities with her extensive expertise and unwavering commitment to her clients.

Read More »

Read More »

Top Commodities to Invest in for 2024: Maximizing Returns in a Volatile Market

**Navigating the Commodities Landscape: Top Investment Picks for 2024**As the global economy continues to evolve in the face of technological advancements, shifting geopolitical landscapes, and environmental challenges, investors are seeking new avenues to diversify and strengthen their portfolios.

Read More »

Read More »

Revolutionizing Finance: The Rise of JN Live Online Banking

In the rapidly evolving landscape of financial technology, the term "live online banking" is becoming increasingly prevalent. As consumers demand more convenience and instant access to their financial information, banks and financial institutions are stepping up to offer real-time banking solutions.

Read More »

Read More »

Decoding the ‘Big Name in Banking’ Crossword Clue: Key Players and Tips for Solving

In the world of crossword puzzles, where cryptic hints and clever wordplay reign supreme, few things bring as much satisfaction as filling in that elusive final square. One common challenge that has stumped both novice and seasoned solvers alike is the clue "big name in banking."

Read More »

Read More »

Cracking the Code: Inside the Operations of the Dutch Banking Giant

In the intricate world of finance, where the ebb and flow of capital mirrors the complexity of a grand puzzle, certain institutions stand out as giants shaping the economic landscape. Among these towering entities, Dutch banks hold a significant place, not just within Europe but on the global stage.

Read More »

Read More »

Navigating Economic Waters: The Role and Impact of Monetary Policy

**The Role and Impact of Monetary Policy in Modern Economies**In the intricate web of modern economies, few instruments wield as much influence as monetary policy. At its core, monetary policy encompasses the actions undertaken by a nation's central bank to manage the money supply, interest rates, and inflation, with the overarching goal of fostering economic stability and growth.

Read More »

Read More »

Decoding Monetary Policy: How Central Banks Steer the Economy

Monetary policy stands as a cornerstone of modern economic management, wielded by central banks worldwide to influence the economic landscape. This dynamic toolset plays a pivotal role in steering economies through the ebbs and flows of growth, inflation, and employment.

Read More »

Read More »

Exploring the Impact of Monetary Policy on Aggregate Supply: A Comprehensive Analysis

In the intricate dance of economics, the relationship between monetary policy and aggregate supply often remains a nuanced and complex topic. While much attention is typically given to the immediate impacts of monetary policy on aggregate demand—such as changes in interest rates and their effect on consumer spending and investment—the potential repercussions on aggregate supply are equally significant, albeit less straightforward.

Read More »

Read More »

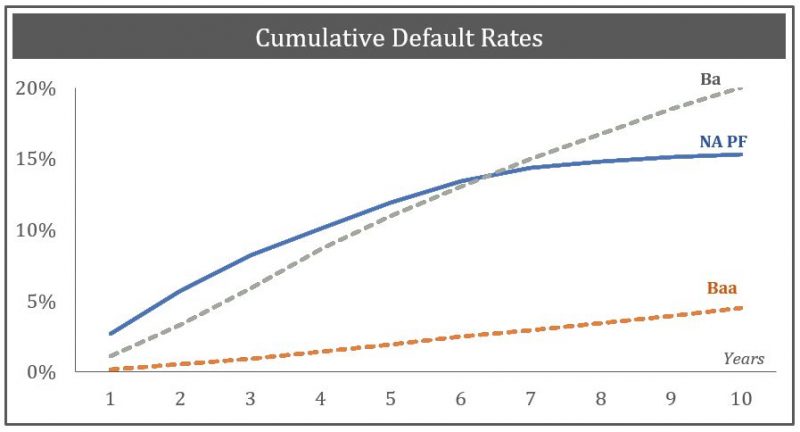

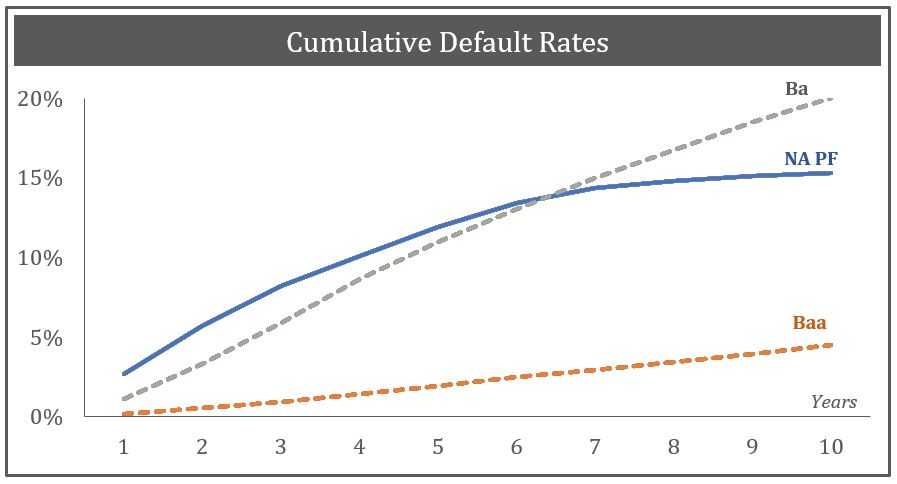

Necessity is the Mother of Invention – Retirees Desperate Reach for Yield

Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden years of millions of retirees...

Read More »

Read More »

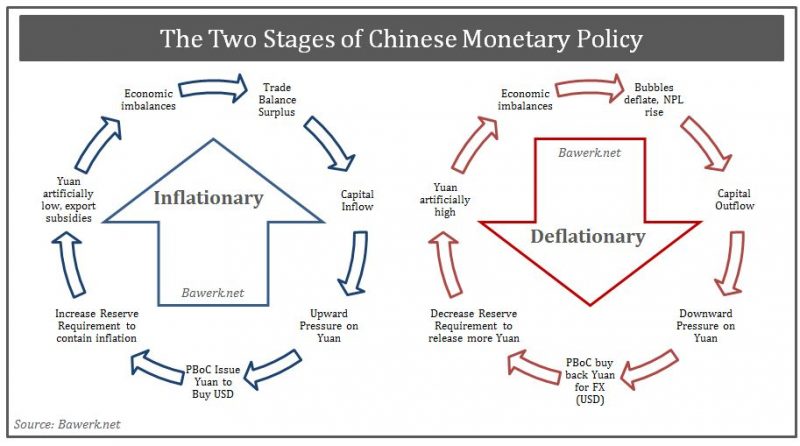

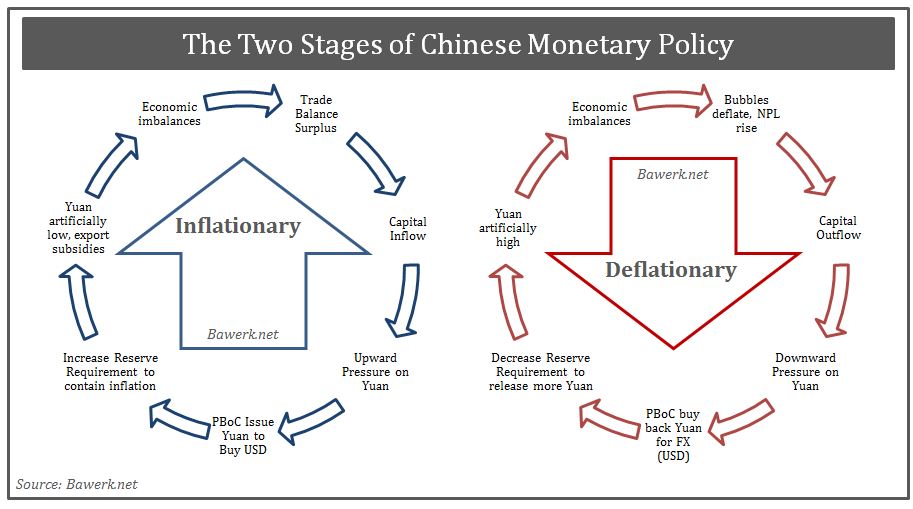

Chinese Philosopher Kings, Losing their Yuan FX Religion?

It took a while, but the world are slowly coming to grips with the simple fact that the red-suzerains in Beijing are not the infallible leaders en route to a new superior economic model as they thought they were. All the craze that emanated from the spurious work of Joshua Cooper Ramo, which eventually led to works like “How China’s Authoritarian Model Will Dominate the Twenty-First Century,” are slowly catching up to reality.

Read More »

Read More »

How to Invest in the New World Order

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar.

Read More »

Read More »

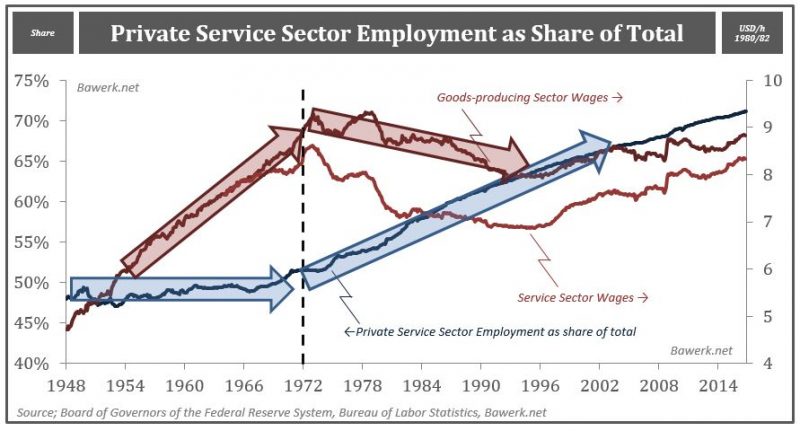

Toward A New World Order, part III

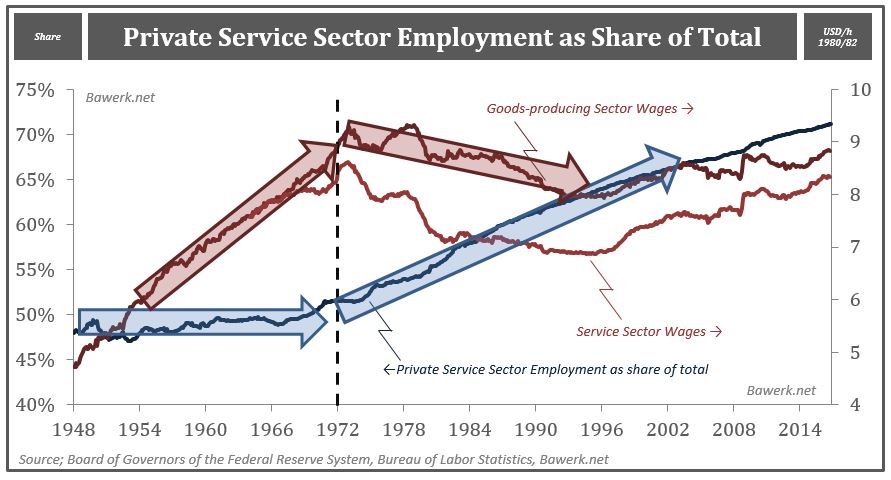

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

Toward a New World Order, Part II

One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil.

Read More »

Read More »

Toward a New World Order?

A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future.

Read More »

Read More »

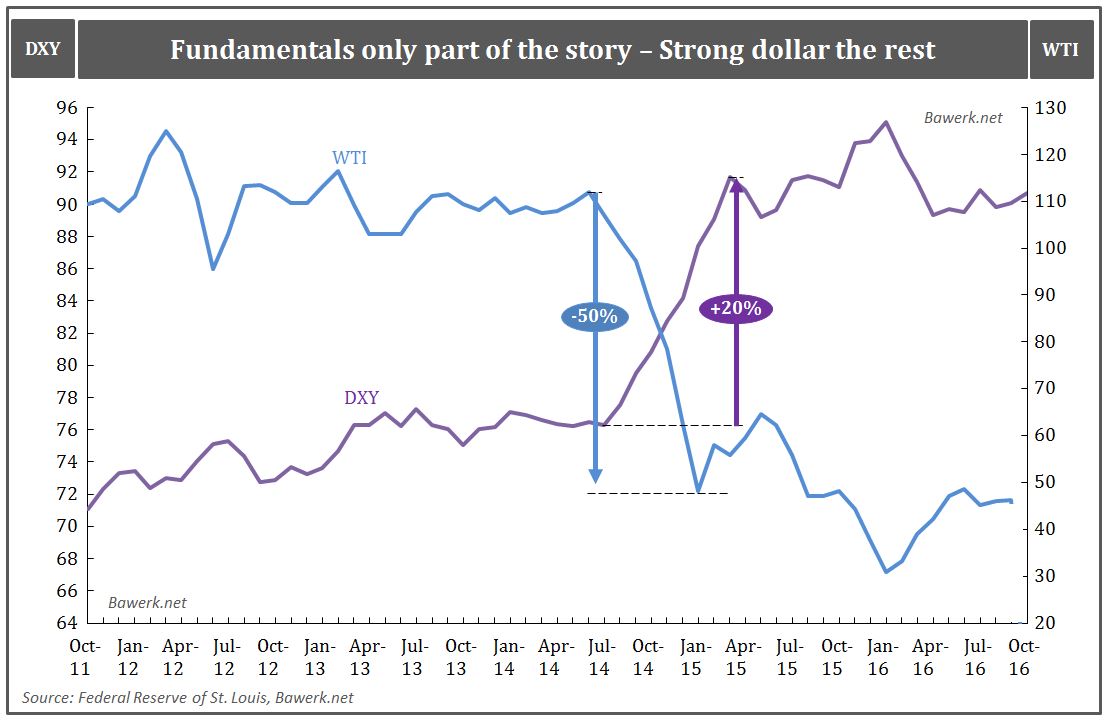

“Subtle forward guidance”: The marriage between best practice central banking and commodity markets

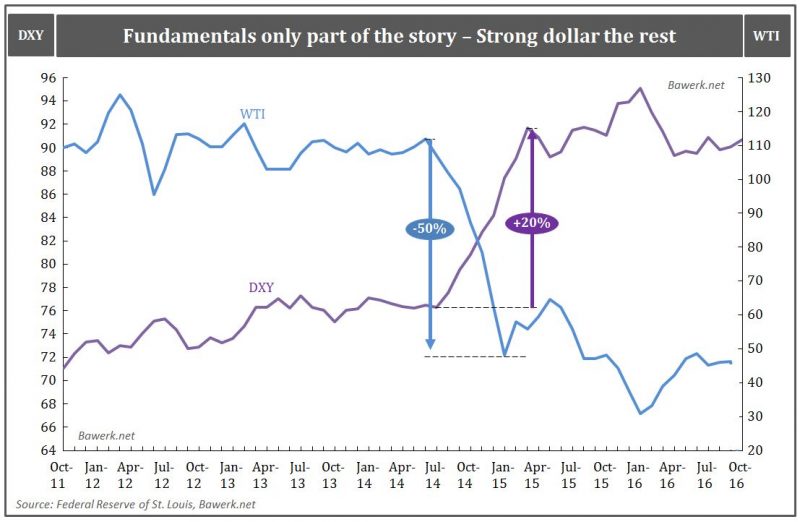

In the years following the 2008 crash and today, the use of forward guidance from central banking policy makers has become increasingly important. What this nonsense ultimately has translated into is a ridiculous track record in posting upbeat assessments on the economic environment, aimed at trying to fool the marginal investor into believing “there are no need for worry, central bankers have everything under control”.

Read More »

Read More »

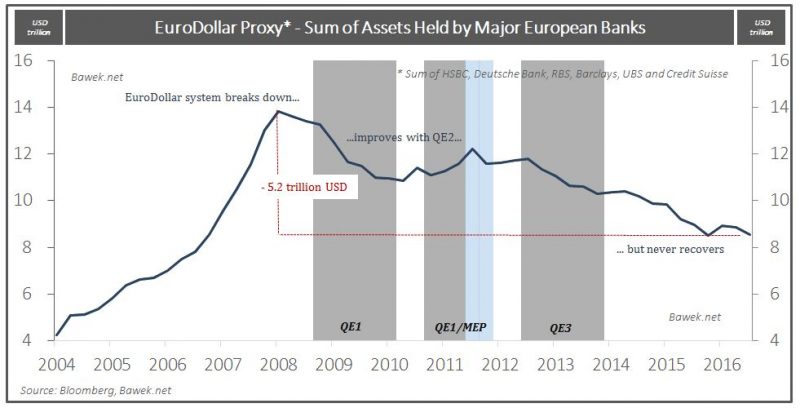

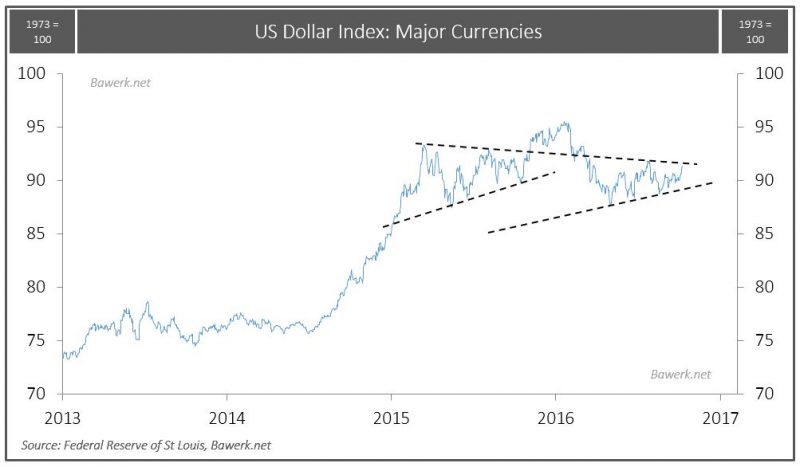

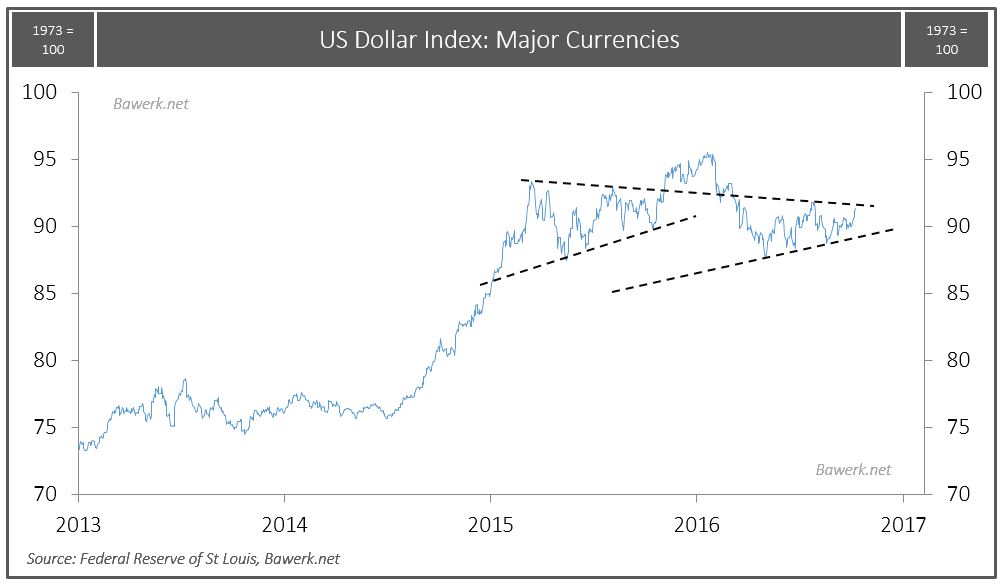

USD ready for a second leg higher – then what?

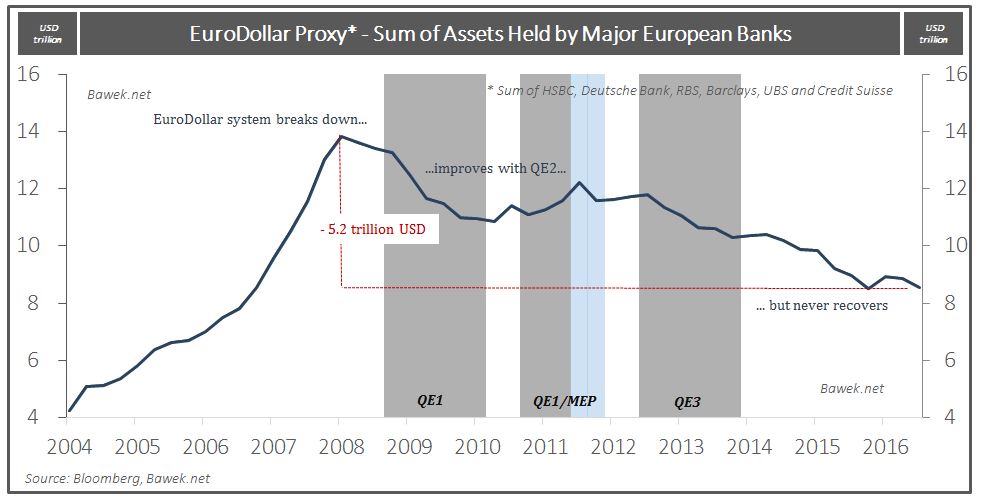

One year ago we showed the following chart to explain the relative strong dollar that was on everyone’s mind at the time. With a second leg higher in the US dollar imminent, this particular chart will be more important than ever. Claims to dollars, such as demand and time deposits, or even more opaque money-like products created by the shadow banking system is just that, a claim or derivative on the final mean of payment, namely base money.

Read More »

Read More »