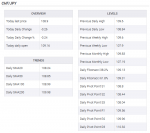

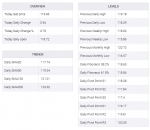

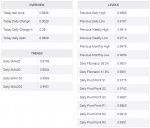

USD/CHF has met a confluence of support as the US Dollar extends higher. Latest positioning data shows that CHF net shorts had been climbing for a third week. FOMC minutes at the top of the hour is next major risk. USD/CHF has met a confluence of support as the US Dollar extends higher on Wednesday ahead of the Federal Open Market Committee’s Minutes today and US consumer Price Index tomorrow.

Read More »2019-10-11