John Henry Smith

John Henry Smith of Grail Securities specializes in the U.S. stock market and offers a unique and powerful advisory service to private investors, institutional investors, and SME asset managers, who are seeking to consistently beat the market. All our strengths are at your disposal to provide stock market research and recommendations with the only aim of growing wealth. To achieve this we develop with you a customized investment strategy in terms of your risk and return preferences.Full bio

[clear]

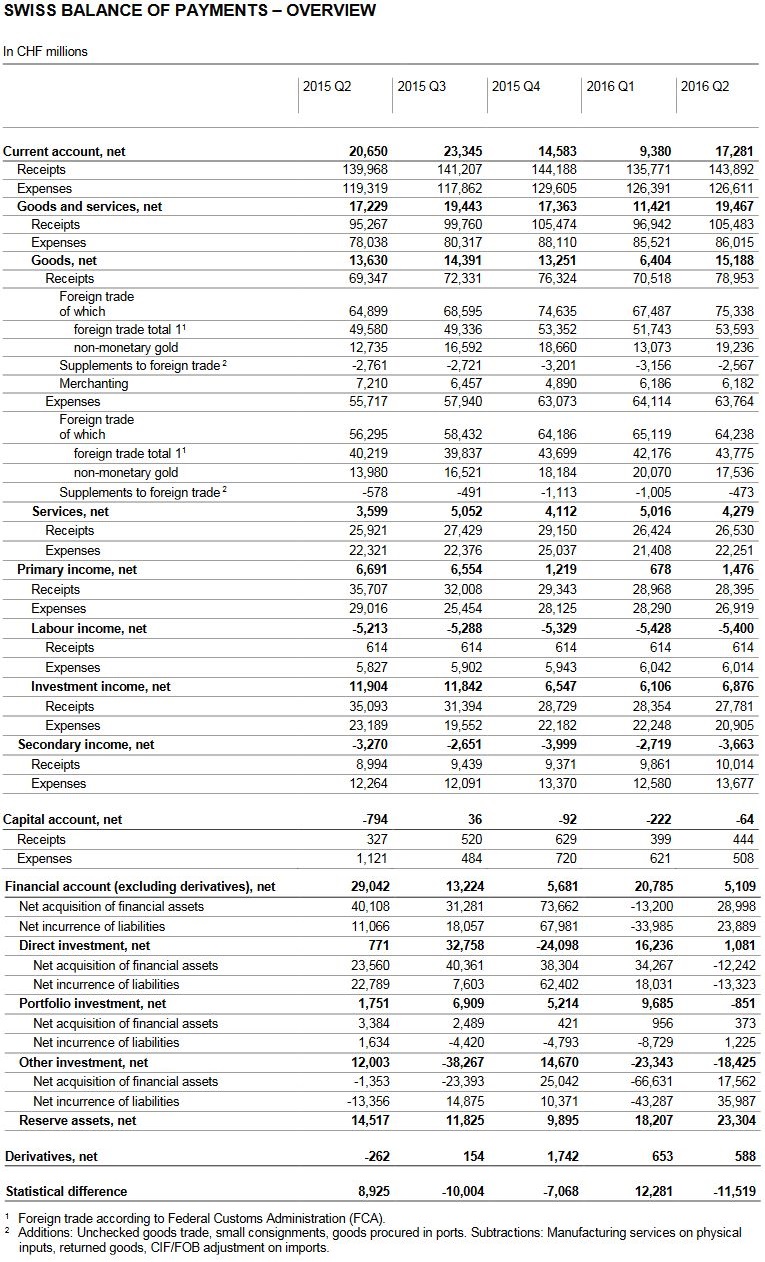

In the second quarter of 2016, the current account surplus amounted to CHF 17 billion. This was CHF 3 billion less than in the year-back quarter, mainly due to a decline in the receipts surplus in primary income (labour and investment income). The receipts surplus in primary income was CHF 1 billion, compared to CHF 7 billion in the year-back quarter. By contrast, the second-quarter surplus of receipts from trade in goods and services increased year-on -year by CHF 17 billion to almost CHF 20 billion.

[br]

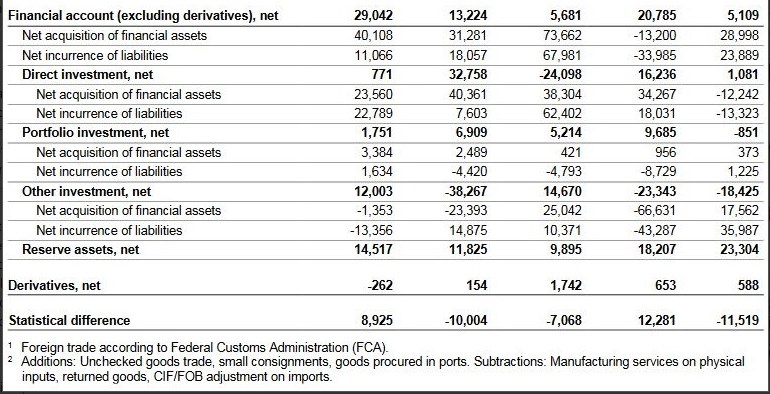

In the quarter under review, the financial account recorded a net acquisition on both the assets and liabilities sides. On the assets side, the net acquisition amounted to CHF 29 billion (Q2 2015: CHF 40 billion), which was primarily made up of reserve assets and other investment. On the liabilities side, the net acquisition totalled CHF 24 billion (Q2 2015: CHF 11 billion), due mainly to other investment. In total, the financial account showed a balance of CHF 5 billion, or CHF 6 billion with the inclusion of derivatives.

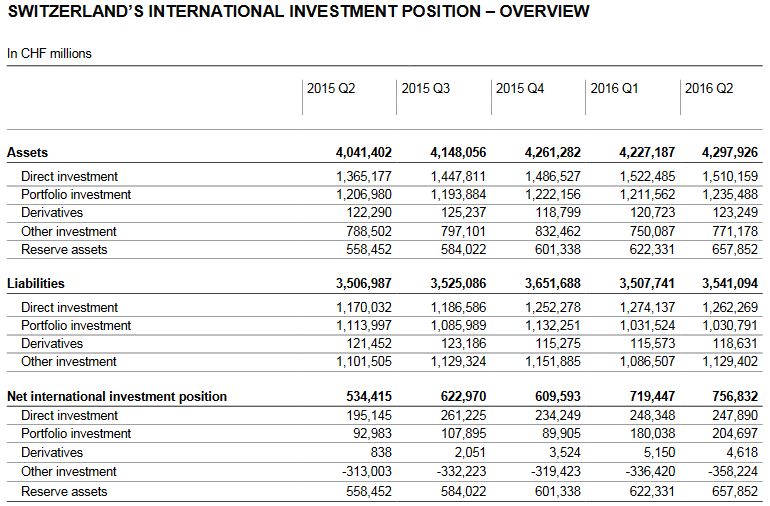

In the international investment position, stocks of foreign assets increased by CHF 71 billion to CHF 4,298 billion in the second quarter of 2016. The increase was attributable both to transactions reported in the financial account and to capital gains resulting from stock exchange and exchange rate movements. Stocks of foreign liabilities also rose, by CHF 33 billion to CHF 3,541 billion, mainly due to transactions reported in the financial account. The net international investment position advanced by CHF 37 billion to CHF 757 billion.

The balance of payments (current account and financial account) covers Switzerland’s cross-border transactions with other countries over a given period. The international investment position indicates the stocks of Switzerland’s foreign financial assets (claims) and liabilities abroad at the end of this period. Transactions recorded in the financial account are the first factor which leads to changes in assets and liabilities in the international investment position. The second factor which has an impact on capital stocks is capital gains and losses resulting from stock market and exchange rate movements, as well as other changes in stocks.

In the comments on the balance of payments, period-by-period comparisons of transactions refer to the year-back quarter, since certain positions are influenced by seasonal factors (e.g. tourism), especially in the current account. Seasonally adjusted data are not available. By contrast, the period-by-period comparisons in the international investment position refer to stocks at the end of the previous quarter. The focus in this case is on changes in stocks over the course of the period under review.

For comprehensive tables covering the balance of payments and the international investment position, cf. the SNB’s data portal, data.snb.ch, Table selection, International economic affairs.

Overview

In the second quarter of 2016, the current account surplus amounted to CHF 17 billion. This was CHF 3 billion less than in the year-back quarter, mainly due to a decline in the receipts surplus in primary income (labour and investment income). The receipts surplus in primary income was CHF 1 billion, compared to CHF 7 billion in the year-back quarter. By contrast, the second-quarter surplus of receipts from trade in goods and services increased year-on -year by CHF 17 billion to almost CHF 20 billion.

[br]

In the quarter under review, the financial account recorded a net acquisition on both the assets and liabilities sides. On the assets side, the net acquisition amounted to CHF 29 billion (Q2 2015: CHF 40 billion), which was primarily made up of reserve assets and other investment. On the liabilities side, the net acquisition totalled CHF 24 billion (Q2 2015: CHF 11 billion), due mainly to other investment. In total, the financial account showed a balance of CHF 5 billion, or CHF 6 billion with the inclusion of derivatives.

In the international investment position, stocks of foreign assets increased by CHF 71 billion to CHF 4,298 billion in the second quarter of 2016. The increase was attributable both to transactions reported in the financial account and to capital gains resulting from stock exchange and exchange rate movements. Stocks of foreign liabilities also rose, by CHF 33 billion to CHF 3,541 billion, mainly due to transactions reported in the financial account. The net international investment position advanced by CHF 37 billion to CHF 757 billion.

Remarks

The balance of payments (current account and financial account) covers Switzerland’s cross-border transactions with other countries over a given period. The international investment position indicates the stocks of Switzerland’s foreign financial assets (claims) and liabilities abroad at the end of this period. Transactions recorded in the financial account are the first factor which leads to changes in assets and liabilities in the international investment position. The second factor which has an impact on capital stocks is capital gains and losses resulting from stock market and exchange rate movements, as well as other changes in stocks.

In the comments on the balance of payments, period-by-period comparisons of transactions refer to the year-back quarter, since certain positions are influenced by seasonal factors (e.g. tourism), especially in the current account. Seasonally adjusted data are not available. By contrast, the period-by-period comparisons in the international investment position refer to stocks at the end of the previous quarter. The focus in this case is on changes in stocks over the course of the period under review.

For comprehensive tables covering the balance of payments and the international investment position, cf. the SNB’s data portal, data.snb.ch, Table selection, International economic affairs.

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

14 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Ruhestand ist dein Ende

Ruhestand ist dein Ende -

Kilo Koala Silver Coin: Unbelievable Size (Watch This Coin!)

Kilo Koala Silver Coin: Unbelievable Size (Watch This Coin!) -

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa -

Warum Lebensverlängerung nicht das eigentliche Problem löst.

Warum Lebensverlängerung nicht das eigentliche Problem löst. -

Strategie-Fehler korrigieren: So überlebt dein Portfolio jede Krise

Strategie-Fehler korrigieren: So überlebt dein Portfolio jede Krise -

Silber & Gold: Kommen jetzt neue Rekorde?

Silber & Gold: Kommen jetzt neue Rekorde? -

Private Credit Funds Falling Out Of Favor

Private Credit Funds Falling Out Of Favor -

Wichtige Morning News mit Oliver Klemm #537

Wichtige Morning News mit Oliver Klemm #537 -

Quartalszahlen Crash – United Health Aktie 22% im Minus!

Quartalszahlen Crash – United Health Aktie 22% im Minus! -

Covid ist nicht vorbei – die Folgen bleiben

Covid ist nicht vorbei – die Folgen bleiben