EUR/CHF mildly falls on Friday as markets digest Eurozone HICP inflation data for November.

The Euro weakens as it does little to change the outlook for interest rates , a key driver of FX valuations.

CHF gains marginally on stronger GDP growth data but hamstrung by comments for the SNB’s President Schlegel.

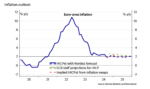

EUR/CHF edges lower to trade on the 0.9300 handle on Friday after the release of Eurozone inflation data continues to suggest European Central Bank (ECB) members will cut interest rates at their December meeting despite the figures meeting economists’ expectations. Lower interest rates are negative for the Euro (EUR) since they decrease net capital inflows, and this puts pressure on the pair.

The Swiss Franc (CHF) meanwhile, gains a mild tailwind after the

Read More »

-638453232816314704-150x57.png)