DJIA – the wrong way to value investment performance and an economy

For a start, the Dow Jones Industrial Average is an odd measure for a economy’s success. There are hundreds of publicly traded companies in the United States, but the DJIA only considers 30 of them. There is no clear reason why it includes those particular 30 and their performance is calculated using the Dow Divisor (which is currently 0.14602128057775).

Trump is celebrating something that has come about in the face of what he called ‘a false economy.’ An economy, that he inherited from Obama and continues to benefit from – the economy that has been pumped up by the Federal Reserve including a massive increase in public and national debt.

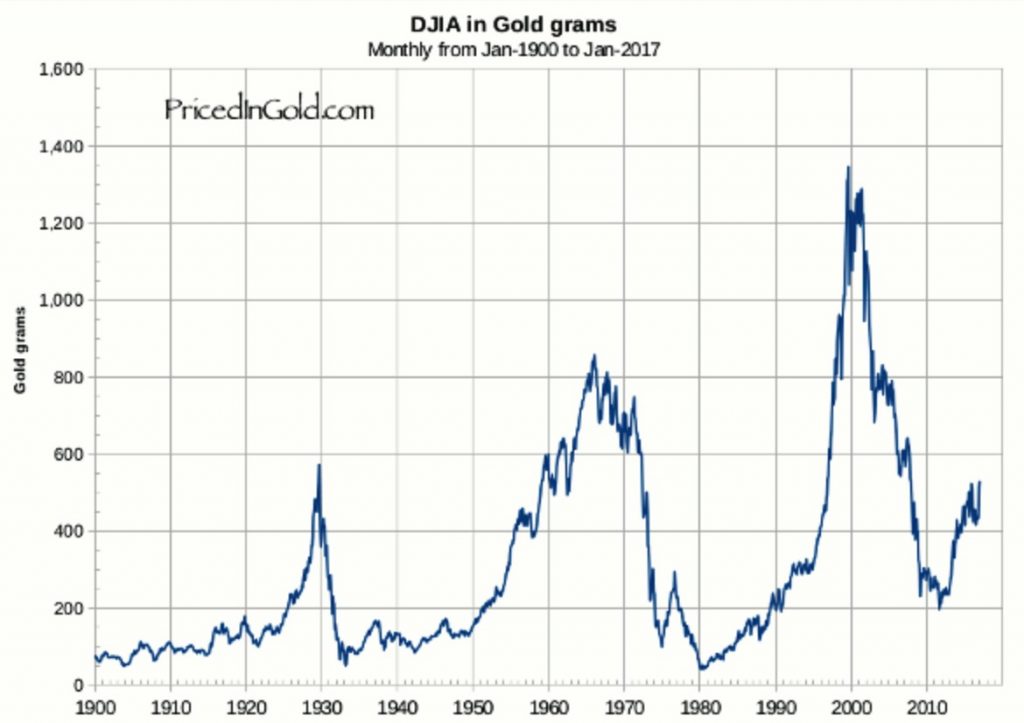

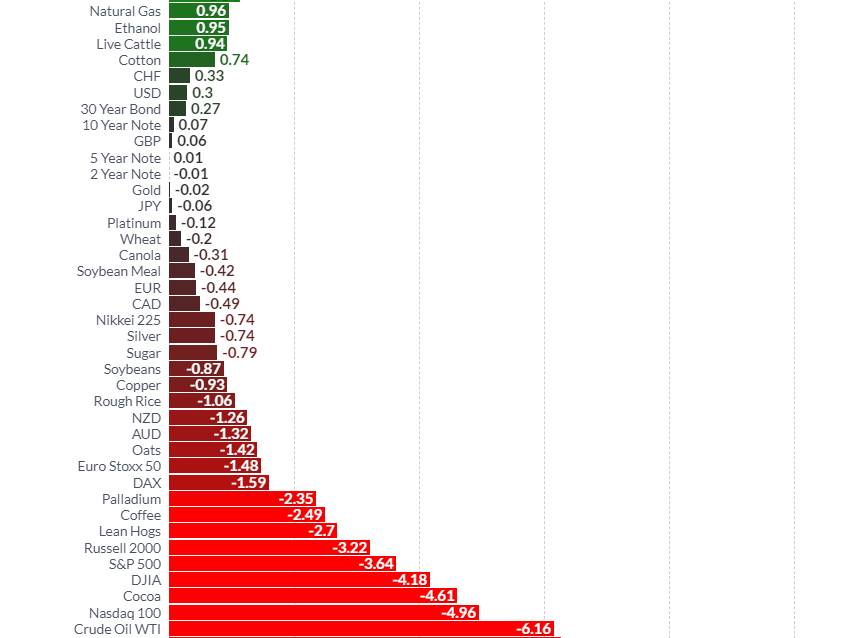

When you look at the DJIA against something that has held its value, as opposed to the debased dollar and the artificially stimulated US economy, then you will see a different story.

Dow Jones Versus Gold

‘Sir Charles’ over at pricedingold.com, draws our attention to the fact that the Dow priced in gold is nowhere near its high of 1110 grams of gold (49 oz) seen in 1999 when the DJIA rose to a record of 11,700 and gold was at a record low of $240 per ounce (see chart). Last Friday, when Trump was inaugurated the Dow was at 530g (18.1 oz).

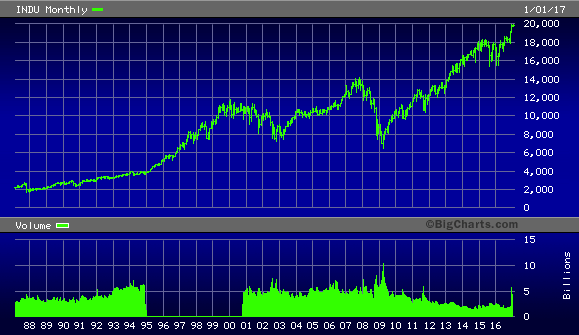

Breaking through 20,000 is clearly an important psychological level for traders and markets, as it was in 1972 when it reached 1,000, then 5,000 in 1995 and 10,000 in 1999 and 15,000 in 2013. The difference though from the first big milestone in 1972 and today is that much of that was driven by a real economy, real company profits and real economic growth.

Sir Charles explains:

“Breaking the 1,000 barrier in November of 1972 was an emotional moment for traders on the floor and investors around the world. It seemed to mark a new era of prosperity, even as, behind the scenes, inflation and recession were preparing to set in. At that time, Dow 1,000 USD meant Dow 482 grams of gold, and through the rest of 1972, the Dow traded between 480 and 500 grams.’

It wasn’t until 1973 that the strings began to unravel and both the dollar and stock market began to fall, the Dow reached its all time low of 37g (1.3oz) in 1980. Were that to happen today with the DJIA at 20,000, we would need to see gold prices surge to $15,384 per ounce.

As you can see from the important chart above, the largest bull-market in the Dow Jones began in 1980, Sir Charles states that we need to ask if we are

“now following the trajectory of the early 1980s (on our way to the moon again) or if we are instead channeling the spirit of 1974 to 1977 (a major bear market rally, on our way to a retest of all-time lows).”

Trump, the Fed and gold

The answer to this question lies with Donald Trump. As we have explained already, whilst the recent highs in the DJIA might not mean much in real-terms, it is an important indicator of the high expectations traders have for Trump and his radical policies – at least in the short term anyway.

This is a President who has won an election on promises to grow a real economy and to bring it back to its former glory days, this surely means a currency that is worth something.

For all of Trump’s comments on the Fed during the election campaign and complaints about the strong dollar in the run-up to the inauguration, he actually hasn’t done much to reassure us that he is aware of how to fix the financial system. Instead, he talks about the strong dollar in relation to its exchange rate with another currency, not in terms of its real value.

For Trump the solution appears to lie in protectionism, which just seems to be a way of papering over very odgy vulnerable and cracked foundations. Economics and the Triffin Dilemma tells us that Trump can’t have his cake and eat it – there is an incompatibility between the domestic policy of a country (which operates a global reserve currency) and the international monetary order.

Instead, the solution may lie in real monetary reform. Something his recent pronouncements and cabinet appointees strongly suggest will not take place.

During the Republican nomination rounds, there was plenty of talk about the value of the dollar and how it could be reformed to some of its past glory through the gold-standard. Since Trump’s nomination, this has not been mentioned again.

From a Libertarian perspective, he is proving himself very disappointing indeed. Both in terms of economic and monetary policies and indeed in terms of his expansionist, some would say quasi-imperialist foreign policies.

If Trump really wants a reason to fist pump on social media, and show that he is bringing real value to the US economy, he would have to begin to focus on honest money and basing his monetary policies on something of real value – gold. So far there is little sign of this – quite the opposite as his fiscal policies are wildly expansionary and this needs to be paid for by the already massively indebted U.S. sovereign.

The New York Sun editorial summed it up well this week:

“This is a moment to press the importance of true monetary reform — a point that was marked on the Journal op-ed page January 24 in a piece by John Mueller. He argues precisely that Mr. Trump’s trade real trade problem is not a lack of protectionism but a lack of the right monetary system. “When America had a gold or silver standard, the federal budget ran an annual surplus averaging 0.4% of gross domestic product,” he writes. “When it hasn’t, the average deficit has been 2.7%.”

Who is going to carry this reform for Mr. Trump? He has an early chance to nominate two governors of the Federal Reserve and, before long, to replace the chairman and vice chairman. These choices will be important. Mr. Trump’s nominee as Treasury Secretary, Steve Mnuchin, seems lukewarm or even indifferent to the cause of honest money. Vice President Pence, however, gets it down to the ground. We’ve already suggested Senator Cruz as the next Fed chairman.

A long-shot, no doubt, though the senator of Texas was the first candidate to thrust monetary policy to the center of the campaign. This week, the editor of the Interest Rate Observer, James Grant, asks a craftier suggestion: “Is it so farfetched,” he quips, “to imagine Stephen Bannon as chairman of a Trumpian Federal Reserve?” We’ve met Mr. Bannon only glancingly, but he strikes us as having the kind of crust that will be needed if Mr. Trump is to get a monetary reform to undergird his radical presidency.”

A return to the gold standard may seem a way off, but if Trump’s presidency continues to be as radical as it initially appears it is not impossible to imagine monetary reform happening.

However, it may be that necessity rather than prudence forces the President’s hand. Given the scale of U.S. debt, a dollar crisis seems increasingly likely. The new President may then be forced to look to gold as a way to restore confidence in a battered greenback.

Conclusion – Dollar ‘great’ or dollar crisis?

To conclude, ‘Sir Charles’ sums it up nicely. He writes that gold is not perfect, but that

“it has stood the test of time, both as cash money and as a measure of value, for thousands of years – while hundreds of other currency systems have come and gone.”

Trump so far appears to be exacerbating and accelerating financial, monetary and geo-political trends that were already taking place. What was happening slowly and almost imperceptibly under Bush II and Obama is now becoming more apparent and intensifying under Trump. Wars are very expensive things to wage and have to be financed. Today they are being financed by stealth currency devaluation.

Will Trump accelerate the decline and devaluation of the US dollar during his Presidency? Or will he make the dollar “great again” and restore the greenback to its former glory?

The signs in the first few days of his Presidency are not good, underlining once again the importance of owning physical gold to protect against geo-political risks, stock and bond market bubbles and the continuing devaluation of all fiat currencies.

Gold and Silver Bullion – News and Commentary

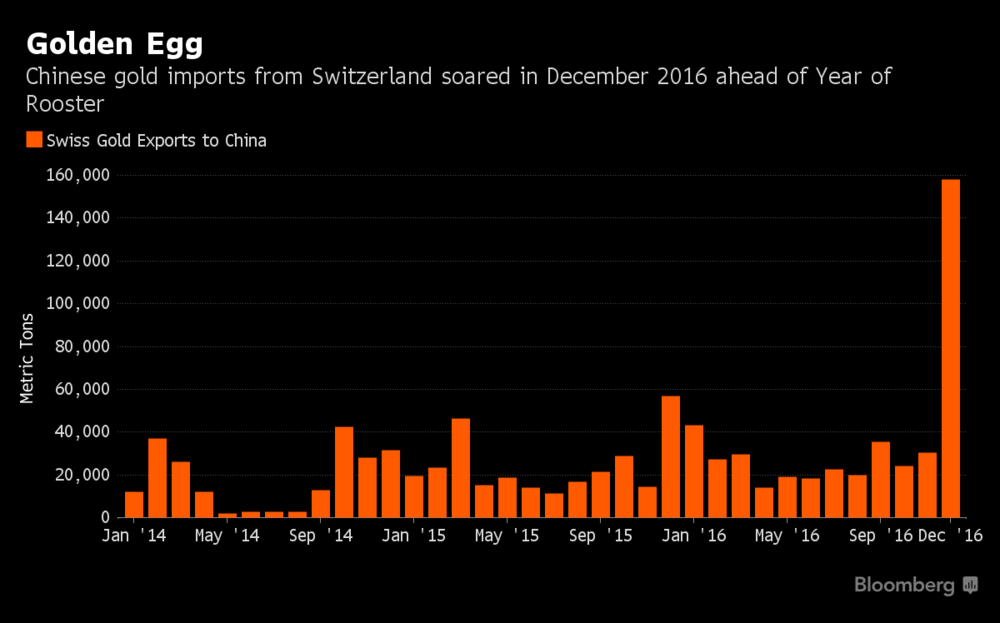

Gold Exports to China Soar in Run-Up to Year of the Rooster (Bloomberg.com)

Gold prices consolidate after yesterday’s weakness (BullionDesk.com)

GFMS say physical gold demand slides to 7-year low in 2016 (Reuters.com)

Gold down on firm dollar; heads for 1st weekly drop in 5 (Reuters.com)

U.S. new home sales fall; weekly jobless claims rise (Reuters.com)

Recent Market Updates

– Switzerland’s Gold Exports To China Surge To 158 Tons In December

– Blockchain – Central Banks Banking On It

– Sharia Standard May See Gold Surge

– Gold Price To 2 Month High As Fiery Trump Declares New American Order

– Gold’s Gains 15% In Inauguration Years Since 1974

– Turkey, ‘Axis of Gold’ and the End of US Dollar Hegemony

– Gold Up 5.5% YTD – Hard Brexit Cometh and Weaker Dollar Under Trump

– Bitcoin and Gold – Outlook and Safe Haven?

– Physical Gold Will ‘Trump’ Paper Gold

– Gold Lower Before Trump Presidency – Strong Gains Akin To After Obama Inauguration

– Gold Rallies To $1,207 After Trump Press Conference Shambles

– Prince Owned Land and Gold Bars Worth $800,000

– Gold Price In GBP Up 4% On Brexit and UK Risks

Tags: newslettersent,Weekly Market Update