| Buyers know there will always be a greater fool willing to pay more for an over-valued asset because the Fed has promised us it will always be the greater fool.I realize nobody wants to hear that most of their “wealth” is nothing more than wispy Cloud Castles in the Sky that will dissipate in the faintest zephyr, but there it is: that which was conjured out of thin air will return to thin air. | |

| I’ve assembled a few charts that reflect the illusion of financial wealth that has a death grip on the public psyche. Something for nothing is a powerful attractor, but it doesn’t offer a narrative that the delusionally self-important demand: I earned this by working hard and being smart. Oh, right, yeah, sure. It had nothing to do with currency being created out of thin air and made available to insiders, financiers, banks, etc., or being able to leverage this new money into ever-larger bets, all guaranteed to be winning trades by the Federal Reserve. Nope, you’re all stone-cold geniuses. | |

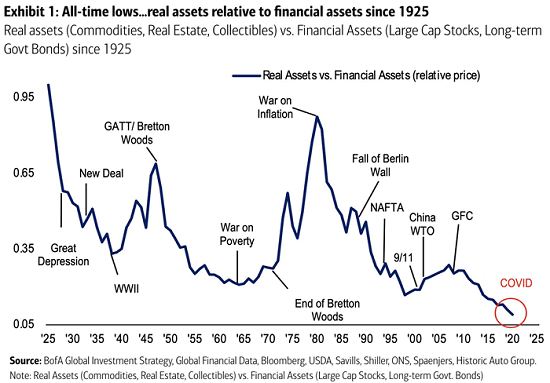

| Back in reality, note that tangible assets–real as opposed to financial conjuring–are at historic lows relative to financial-bubble assets: tangible assets represent such a meager proportion of total assets that we might assume they could slip to zero without affecting our “wealth” much at all.

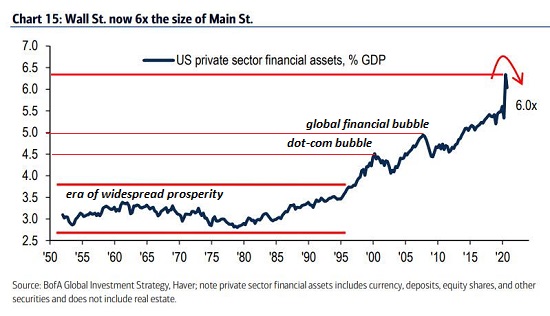

If we compare financial-bubble assets to the nation’s Gross Domestic Product (GDP), a (flawed) measure of real-world activity, we find Cloud Castles in the Sky are worth over six times the nation’s real-world economy. This reflects what happens to the valuations of Cloud Castles in the Sky when “money” is created out of thin air and then leveraged into fantastic, monstrous illusions of “wealth.” |

|

| The next two charts illustrates the sole dynamic driving assets higher: the Fed is the greater fool. Assets are chasing their own tails higher, completely disconnected from the real world, a reality visible in the chart of IWM, the small-cap index. Examine the recent rocket launch higher and explain why this is completely disconnected from previous decades’ valuations.

The answer is the Fed is the greater fool: since everyone knows the Fed will always save the day should valuations falter, buyers know there will always be a greater fool willing to pay more for an over-valued asset because the Fed has promised us it will always be the greater fool. |

|

| Take a look at the chart of M2 money stock, and please explain how this is just plain old normal healthy “capitalism” at work. After you’ve explained chasing your own tail, then explain who’s getting all the Fed’s free money for financiers. It isn’t those working for a living, as evidenced by the chart of money velocity, which has plummeted into the Dead Money black hole from which there is no escape.

So by all means, lavish yourself with praise for constructing a Cloud Castle in the Sky of “wealth” with your hard work and genius, and keep chasing your own tail because the Fed has promised us it will always be the greater fool. What a pretty cloud, what a pretty fantasy. Look on my works, ye Mighty, and despair!” Nothing beside remains. Round the decay Of that colossal wreck, boundless and bare. |

Tags: Featured,newsletter