The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion.

The focus shifts elsewhere in the week ahead, for which the US sees a relatively light calendar of economic reports in a holiday-shortened week. Then again, the recent employment, trade, inflation, and retail sales data offer valuable insight. The course is set, and the Fed seems inclined to look beyond the near-term economic fluctuations, ensuring that the meeting at the end of the month is as close to a non-event as an FOMC meeting and a Powell press conference can be.

There are four central bank meetings to note, and none are likely to do anything, so the words are more important than the actions. The Bank of Japan begins with Governor Kuroda holding at the conclusion of the two -day meeting on January 21. Under the yield-curve control initiative, it puts the deposit minus 10 bp and targets the 10-year yield at zero =/+ 20 bp. Global tensions have eased, and the yen has weakened to the lower end of where it has been in the past six months. Prime Minister Abe’s fiscal support (~$122 bln) and preparation for the Olympics may also help the BOJ’s efforts to support the economy.

The BOJ will provide updated forecasts. In October, it anticipated growth of 0.7% in FY20 and 1.0% in FY21. Core inflation, which excludes the price of fresh food, was forecast to rise by 1.1% in FY20 and 1.5% in FY21. The forecast seems optimistic. The Bloomberg economists survey found median forecasts for 2020 growth at 0.5% and 0.7% in 2021. Japan has not reported core CPI above 1% since April 2015. The tax increase will the optics, but the BOJ and investors know better.

That said, deflation has been halted, and Japan, like many other countries, is experiencing low inflation. Core CPI has been above zero since the end of 2016. Policymakers and economists understood the tax increase would push economic activity in Q3 from Q4. The actions the government took were meant to ensure a quick rebound. Data from November suggests capex bounced back strongly and consumption slower. While the easing of US-China trade tensions helps lift uncertainty, quantitative targets may give American companies an edge, all else being equal.

The Bank of Canada’s decision is the next day, January 22. It is in a holding pattern. The real sector data has disappointed, even though employment in December recovered from the unexpected weakness in November. Firm inflation readings may be deterring the Bank of Canada from easing, and the government is promising fiscal support. The fact that the Federal Reserve is understood to be on hold also gives Bank of Canada officials some time, though last year’s three cuts by the US did not induce a move by Canada.

Shortly before the outcome of the meeting is announced, Canada will report December CPI figures. The month-over-month pace declined in three of the four months through November by a cumulative 0.3 percentage points. In the same period in 2018, the cumulative decline in the four months through November was twice as much. The base effect seems behind the year-over-year rise of all the Canadian measures above 2%.

Also, most economists expect the current run of soft data is not a prelude to a more severe slowdown. About three-quarters of the economists in a recent Reuters survey expect the Bank of Canada to remain on hold into 2021. However, officials are more optimistic than private-sector economists. The former see growth accelerating from about 1.7% to a little more than 2.0% in 2020. Private economists, according to the Bloomberg survey, see the growth slipping to 1.6%, which would be the slowest pace in four years.

It may be helpful to review the status of the three drivers of the Canadian dollar: First, commodities and oil have rallied into the end of last year but have eased at the start of 2020. The price of oil (WTI) is off about 3.3%, while the CRB Index fell by almost 2%. Second, the Canadian dollar typically appears to do better when there are strong risk appetites, for which the S&P 500 is a rough proxy. Investors are willing to take on risk with the S&P 500, and its equivalent in Europe (Dow Jones Stoxx 600) is also setting new record highs. The MSCI Emerging Markets Index has rallied for seven consecutive weeks, the longest positive run since late 2017 and early 2018.

United StatesThe third driver of the US-Canada exchange rate is the interest rate differential. Canada’s two-year yield moved above the US last October, but it dipped back below in the first part of November. It has consistently remained above the US since early December. The US offered almost 90 bp more than Canada on 10-year notes in late Q1 19. It offers about 25 bp now and has been consolidating for the last couple of months. Meanwhile, speculative positioning in the futures market is biased toward a stronger Canadian dollar. The net long non-commercial (speculative) position has seen a big jump since late last year and stood near 26.5k contracts in the most recent report that covered through January 7. The bulls have been driving it. They added about 20k contracts (notional value CAD100k per) over the past three reporting weeks to a gross long position of 68.8k contracts, the most since mid-November. The bears have barely changed their gross exposure of around 42.4k short contracts. |

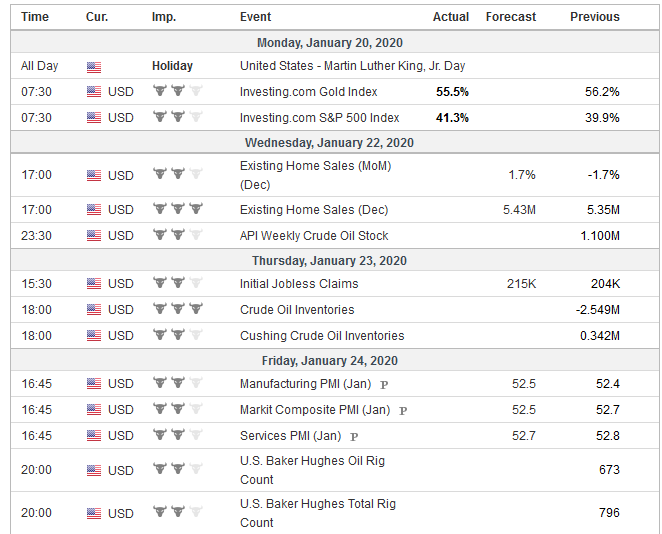

Economic Events: United States, Week January 20 |

Norway’s Norges Bank and the European Central Bank meet on January 23. Norway is not in a hurry to do anything. Its deposit rate bottomed at 50 bp in 2016 and remained there until late 2018 when it began a series of four hikes through last September. Officials seem comfortable with the 1.5% deposit rate, which is just above the December headline CPI print of 1.4%. The underlying rate (which excludes energy and adjusts for taxes) stands at 1.8%, the lowest since October 2018. The mainland economy grew by about 2.5% last year and is expected to slip below 2% according to the median forecast in the Bloomberg survey, but the government is projecting steady activity.

Norway’s central bank insulates the economy from the impact of the countries oil sales by funding its sovereign wealth fund. This month it is selling an average of NOK500 mln a day. Last year it averaged almost NOK600 mln a month, and in 2018 the monthly average was NOK645 mln down from the 2017 average of NOK845 mln a month.

The ECB meeting is not so much about policy as that seems set for the coming months. Instead, the focus is on the strategic review that is being launched. Most discussions are on how the price stability objective can be clarified. Currently, the target is expressed as “close to but below 2%.” Surveys suggest there is a high expectation for a symmetrical inflation target, where equal weight would be given to too high as well as too low inflation, and more importantly, a period of undershooting could lead to greater willingness to accept an overshoot.

The ECB risks putting the cart before the horse. In candid moments officials acknowledge that they do not fully understand why inflation is so low and so many different countries. One must squint ones’ eyes and tilt the screen just so to see the relationship between labor market conditions and general price pressures. It is not completely clear why negative interest rates have not spurred much of an increase in the general price level.

How can a strategic review be conducted without a great understanding of different macro relationships? It is like the St. Louis Fed President Bullard argued several years ago. Under a certain paradigm, the relationships are understood, but the paradigm has shifted, and new relationships have emerged. There is a sense that things are not working optimally now and the central banks (the Fed too is conducting a strategic review), without understanding why, will seek to remedy the situation. It reminds one of the story about the experiment where food is randomly put on the right side or the left side, and after a bit, the mouse stops going to one side at all and takes a 50% failure rate. A person faced with the same challenge tries to outguess the random movement and ends up doing worse than the mouse.

It also begs the question: does it matter? Imagine that at the conclusion of the strategic review, the ECB announces that going forward, it will target an average rate of inflation of two percent or that its inflation target is symmetrical? Will this make it more or less likely that the central bank will achieve its target? Maybe neither. It is unlikely to disrupt markets, i.e., change the market’s course, as it contains very little operational information.

While possible, it seems unlikely that the ECB would give up seeking price stability directly through inflation-targeting and shift to a nominal GDP target or unemployment. This is to say that the strategic view is unlikely to produce a paradigmatic shift. In fairness, observers may be too focused on the inflation target.

ECB President Lagarde will likely sketch out the broad parameters of the review. It is bound to include a review of tools as well as communication. Decisions here may have far-reaching implications. While many press accounts make it seem as if negative interest rates have fallen out of a favor, for example, but Lagarde provided a spirited defense at her first ECB meeting, and or course the SNB and BOJ defend it. The central bank’s balance sheet (Eurosystem) is within its mandate as are the targeted long-term refinancing operations (loans), but some evaluation of the relative merits is worth considering.

A review of the communications can also produce some important changes. Unlike other central banks, the ECB’s meeting record does not give room or recognize dissents. Too often, it seems the losers of an issue have little place within the official communications to make their opinion known and take their case to the press. At first, decisions were made unanimously, but as the institution grew and issues being more complex, voting was introduced but rarely used, according to reports. A more formal process and one that makes room for and respects dissents seem a reasonable expectation.

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Canada,Bank of Japan,ECB,newsletter,Norges Bank