On Wednesday, the Securities and Exchange Commission announced changes to money market fund (MMF) regulation. According to the SEC Chairwoman, Mary Jo White, the new rules, “will reduce the risk of runs in money market funds…” Her worry about financial stability seems to contradict the views of the Federal Reserve and establishment economists.

Last week, Fed Chair Janet Yellen said, “The financial sector has continued to become more resilient…” Since February, “further important progress has been made in … strengthening the financial system.” Nobel laureate economist Paul Krugman actually mocks any concern as “the desperate desire to see a debt crisis.”

To understand Ms. White’s claim that the new rules, “will reduce the risk of runs in money market funds…” let’s look at the two new MMF rules. The first is simple enough (though blatant cronyism). During times of stress, MMFs can charge a fee to withdraw your money, or even delay paying.

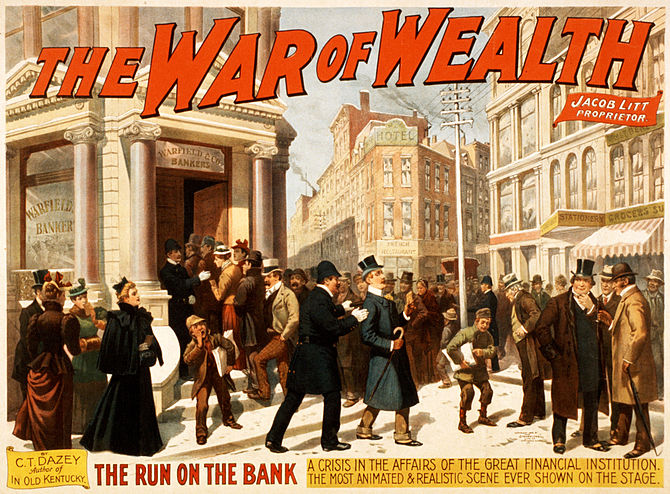

A poster for the 1896 Broadway melodrama The War of Wealth depicts a typical 19th-century bank run in the U.S. (Photo credit: Wikipedia)

MMFs are basically mutual funds, though with a share price fixed at $1. The second rule allows the share price to change with market conditions. In normal times, the MMF share price doesn’t need to change. MMFs invest only in short-term debt, which is not volatile. They respond to small price changes by adjusting their yields.

We aren’t in normal times. Let’s not forget that the Fed is still reacting to the last crisis with what they call unconventional policy response. MMFs now face liquidity risk, when investors don’t want to buy more because they need to sell, to raise cash.

This is a real problem for the borrower, typically a corporation selling short-term debt to finance itself. When each debt contract matures, the issuer must sell a new one. If the market seizes up, it can get into big trouble.

When I was a boy, I would sometimes roughhouse with other kids. My mom once told us, “It’s all fun and games until someone puts out an eye.” The credit market is just like this. It’s all fun and games until someone misses a payment. When they can’t roll their debts, many corporations may miss a payment.

It’s a serious threat to money market mutual funds, because they own this debt. It’s what they hold as assets. While the market value of the MMFs asset is falling, the share price of the MMF remains fixed at $1. Suppose the fund’s assets drop to 90 cents. That means the fund loses 10 percent with every redemption. If there are enough withdrawals, then remaining investors get stuck holding an empty bag (MMFs are not FDIC insured).

The SEC says it wants to fix this problem.

By allowing the share price to drop if necessary, it does remove the incentive for investors to rush for the exit. Sure, investors take losses and risk further losses, but the threat of total loss is eliminated. By allowing penalties, it discourages withdrawals, but investors who need their money badly enough will take it out anyway. By allowing MMFs to delay paying, it prevents runs that might occur even with a floating share price and withdrawal penalties.

The SEC is right to plan for another crisis. Insolvency caused the last one, and the Fed responded by buying bonds and cutting the interest rate. This masked the problem, while encouraging everyone to borrow more. The timing of the SEC’s new rules may be coincidence. If not, then the next crisis may erupt soon.

A floating share price creates the perception of risk that MMFs never had. The possibility of fees and delays adds a risk that’s hard to quantify. MMFs are now a less attractive place to park money than they used to be. Some investors may pull their money before the new rules go into effect in 60 days.

The SEC is trying to walk a tightrope. MMFs contributed to the last crisis but with its regulatory change, the SEC may precipitate the very run on the bank it is so desperately trying to prevent.

See more for