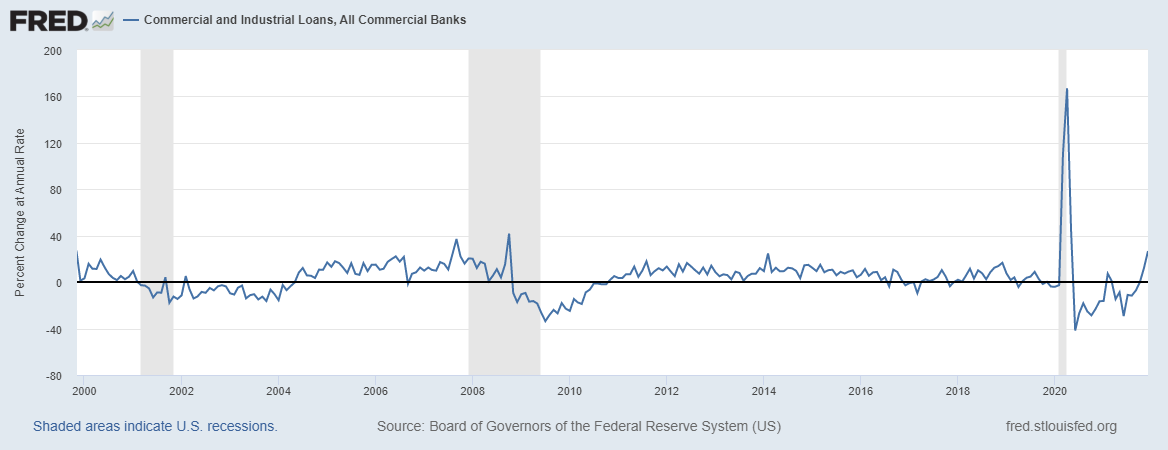

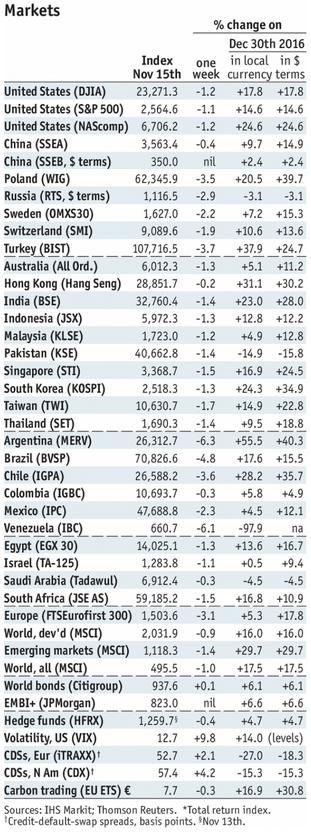

Stock MarketsEM FX ended the week firm, and capped off a good week overall. Best performers last week for ZAR and KRW, while the worst were TRY and IDR. Until we get higher US rates, the dollar may remain under modest pressure. This would help EM maintain some traction, though we remain cautious. |

Stock Markets Emerging Markets, November 15 Source: econnomist.com - Click to enlarge |

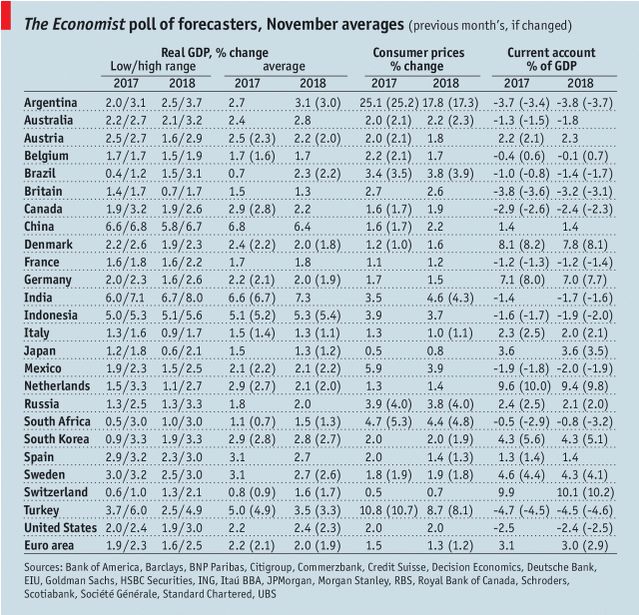

ChileChile will hold elections Sunday. Former President Pinera is widely expected to win. If so, we expect policies that may be more business-friendly than outgoing President Bachelet enacted in her second term. Chile reports Q3 GDP and current account data Monday. GDP is expected to grow 2.2% y/y vs. 0.9% in Q2. ThailandThailand reports Q3 GDP Monday, which is expected to grow 3.9% y/y vs. 3.7% in Q2. Bank of Thailand is on hold for now, and the lack of price pressures should allow steady rates well into 2018. Next policy meeting is December 20, no change expected then. TaiwanTaiwan reports October export orders and Q3 current account data Monday. Export orders are expected to rise 8% y/y vs. 6.9% in September. Orders have been slowing in recent months, suggesting a softer export outlook in 2018. October IP will be reported Thursday, which is expected to rise 4.2% y/y vs. 5.2% in September. PolandPoland reports October construction and industrial output, retail sales, and PPI Monday. The data are expected to show continued robustness in the economy. Central bank minutes will be released Thursday. The MPC remains split but the doves have the upper hand for now. KoreaKorea reports trade data for the first 20 days of November Tuesday. Signs of slowing growth in the mainland China economy do not bode well for the regional economies. Furthermore, won strength has pushed the key JPY/KRW cross down to 9.71, its lowest level since December 2015. Korean exporters like this cross to be above 10 for the sake of competitiveness. HungaryHungary central bank meets Tuesday and is expected to keep policy steady. The bank just eased at its September meeting and continues to send a dovish message. If the bank were to ease again, it would most likely be at the December 19 meeting. MalaysiaMalaysia reports October CPI Wednesday, which is expected to rise 4.0% y/y vs. 4.3% in September. The central bank does not have an explicit inflation target. However, the robust economy has led the bank to start talking about adjusting policy but stressing that it would be a “normalization.” South AfricaSouth Africa reports October CPI Wednesday, which is expected to rise 4.8% y/y vs. 5.1% in September. SARB meets Thursday and is expected to keep rates steady. While a firm rand might tempt it to cut rates, we think it’s unlikely ahead of both S&P and Moody’s planned ratings statements Friday. SingaporeSingapore reports October CPI Thursday, which is expected to remain steady at 0.4% y/y. October IP will be reported Friday, which is expected to rise 16% y/y vs. 14.6% in September. The economic data is coming in more robust in recent months. While we do not expect the MAS to tighten at its next meeting in April, it may take a more hawkish stance. BrazilBrazil reports mid-November IPCA inflation and October current account data Thursday. Price pressures are picking up, which supports the notion of a 50 bp cut to 7% December 6 and then no more easing. MexicoMexico reports mid-November CPI Thursday. Headline inflation is expected at 6.42% y/y vs. 6.3% in mid-October. Banxico also releases minutes Thursday. Inflation is ticking higher, but we do not think the central bank wants to hike again. Next policy meeting is December 14, and no change is likely. However, a hawkish surprise is possible if peso weakness accelerates. ColombiaColombia central bank meets Friday and is expected to keep rates steady at 5.0%. The bank just surprised the markets with a 25 bp cut last month, and another one this month seems to soon. Still, inflation is falling again even as the economy remains weak and so we see continued easing in 2018. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, November 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent,win-thin