Quite often, investors describe economic forecasts as a hard landing (recession), a soft landing (weak growth but no recession), or no landing (moderate to strong economic growth). As evidenced by the massive rotation toward economically sensitive sectors like industrials and materials and the significant underperformance of interest-rate-sensitive growth stocks, the no landing, or as it's called today, the economic reflation narrative is preferred. While the reflation narrative neatly explains the recent market rotations, we still must question whether a no landing economic scenario is likely. Obviously, there is no answer, as no one knows what the future holds. That said, the current market sentiment reminds us of rule number nine from Bob Farrell’s ten famous trading rules:

When all the experts and forecasts agree, something else is going to happen.

Bob's rule holds that we should be concerned when the public and professional analysts are largely in agreement about the economic outlook. He argues the opposite is more likely. Taking Bob’s stance is certainly contrarian. Such a contrarian investment strategy usually rewards investors who appreciate the day's narrative but also recognize that it may not be the likely path. To this end, we share the graphic below courtesy of BofA. Among the global professional investment managers they surveyed, only 6% expect an economic hard landing, i.e., a recession. The majority now expect a “no landing” or continued strong economic growth. Moreover, the number of no landing votes has risen significantly from near zero nine months ago. Bear in mind, 50% of those surveyed last April thought the economy would experience a hard landing within a year.

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, I updated the sector-by-sector review from Monday for the missed energy sector. Before the opening bell this morning, we will get Walmart's latest earnings results. The expectations are currently for revenue to grow to $190 billion with earnings estimates at $0.73/share. As shown, such would equate to a modest growth in both revenue and earnings for the quarter.

The problem is that the growth rates of earnings and revenue make it difficult to justify current valuations of 42x forward P/E and a PEG ratio of 4.35. Yet, investors have been piling into the stock as of late, as the "value" trade gained momentum. However, based on forward earnings expectations, Walmart is currently more overvalued than at any time in the past, putting the stock at risk of near-term disappointment.

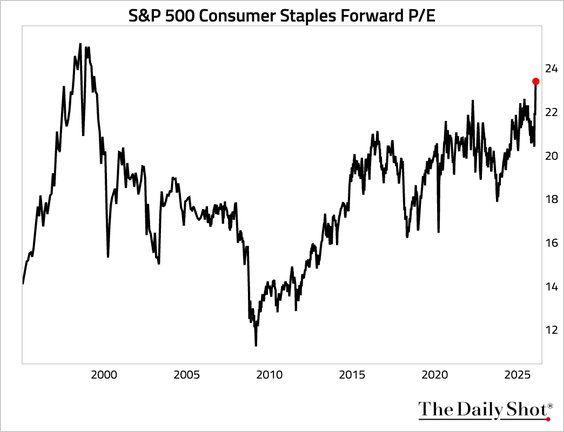

The reason I bring this up is that when Technology stocks sport high valuations, the "doom and gloom" crowd is quick to make comparisons to the "Dot.com" era. However, there is a vast difference between today and 2000, as earnings support the valuations in technology stocks today.

However, in the Staples sector (i.e., WMT), earnings growth is much more stable, making it hard to justify current levels of overvaluation.

Yet, I have not seen any analogs comparing Staples today to the Dot-com bust of 2000, which saw a sharp mean reversion in Staples' valuations. The point here is two-fold:

- Worry less about narratives and rationalizations and focus more on fundamentals.

- Focus more on risk management and less on chasing returns.

By doing those two things, you will survive the long game of the market and its eventual cycles.

WMT will likely set the tone for Staples today by having a strong report. Let's see how the market responds.

(Disclosure: We are long WMT in our core portfolios.)

Ray Dalio Hype Versus His Thoughts

Ray Dalio just spoke to the World Economic Forum, and the majority of his reviewers spout doom and gloom, as we share in the screenshot below. While his long-term outlook is concerning, the hype and fear being spread by the social and mainstream media is over the top. To wit:

What viral posts often add or exaggerate about Dalio's outlook:

- “Hyperinflation is coming fast.”

- “America is going broke right now.”

- “Dollar collapse is imminent.”

What Dalio has said:

- The U.S. faces a serious debt supply-demand problem.

- The deficit likely needs to shrink toward ~3% of GDP to stabilize things.

- If policymakers do nothing, markets could eventually force painful adjustments.

To summarize his views, Dalio stresses that the pace of debt issuance can not grow faster than our ability to pay for it forever. In time, he thinks the bond markets will push back and demand higher yields. At that time, policymakers must choose among austerity, artificially low interest rates, inflation, and or currency weakening. Importantly, however, the warning is not of a collapse in the coming weeks, but instead, the system becomes harder to manage over time as the debt grows.

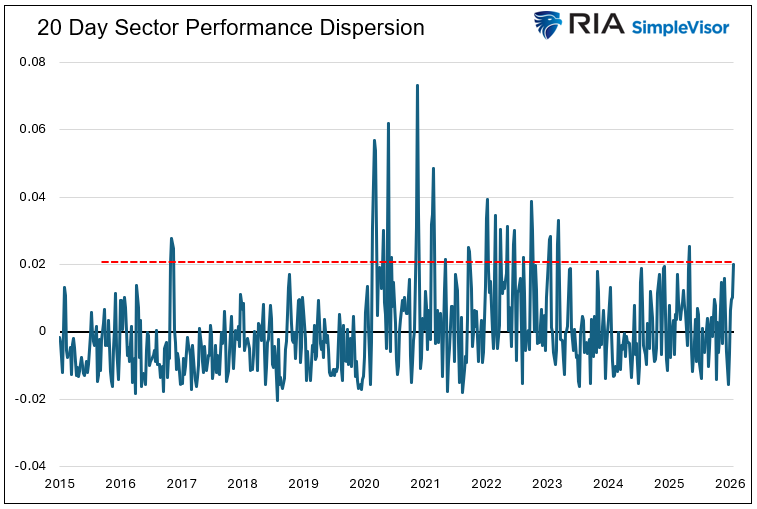

Calm Market Waters Hide Fierce Undercurrents

The price movement in the broad S&P 500 index is relatively calm. Yet the market’s undercurrent, as measured by sharply diverging returns across stock sectors and factors, is anything but calm. The current market picture we paint is well embodied by a quote from Jules Verne in 20,000 Leagues Under the Sea.

“The sea was perfectly calm; scarcely a ripple disturbed its surface. But beneath this tranquil exterior, powerful currents were flowing with irresistible force.”

Given this divergence between the calm market surface and the volatility of its underlying stocks’ returns, let’s get a better grip on the market’s undercurrent and decipher what it may be trying to tell us.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post A No Landing Outcome Is Assumed: Should It Be? appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter