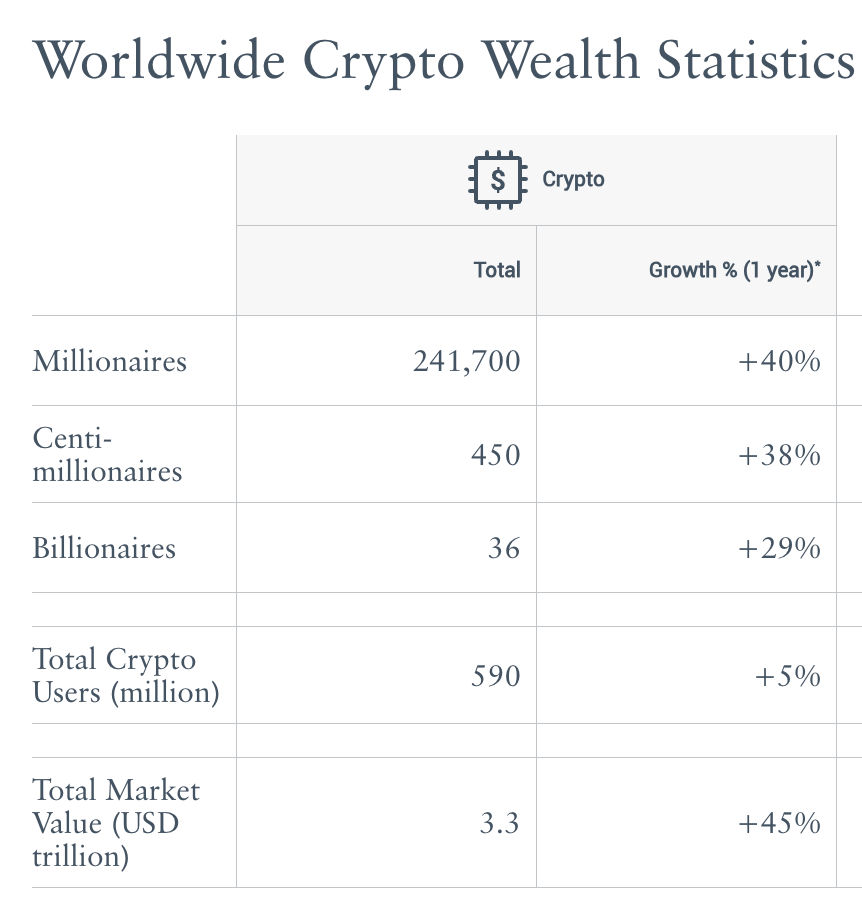

Soaring cryptocurrency prices over the past year have pushed the number of crypto millionaires to a record of 241,000 individuals worldwide as of July 2025, marking a remarkable 40% year-over-year (YoY) increase, according to a new report by British investment migration consultancy Henley & Partners.

The report, which is based on in-house wealth tier models and open-source information from CoinMarketCap, Binance, BscScan, and Etherscam, also found significant increases in the number of crypto centi-millionaires and crypto billionaires.

As of mid-2025, 450 individuals held US$100 million or more worth of crypto, up 38% YoY, while the number of individuals holding US$1 billion or more rose 29% YoY to 36.

This surge coincides with a broad rally in crypto markets. Over the past year, Bitcoin (BTC) nearly doubled in value, climbing from about US$63,000 to US$125,000, data from CoinGecko show. Similarly, Ether (ETH) gained 92% during the same period, soaring from about US$2,430 to US$4,690.

Overall, total crypto market capitalization reached a record of US$4.3 trillion in early October 2025, reflecting a 91% YoY increase.

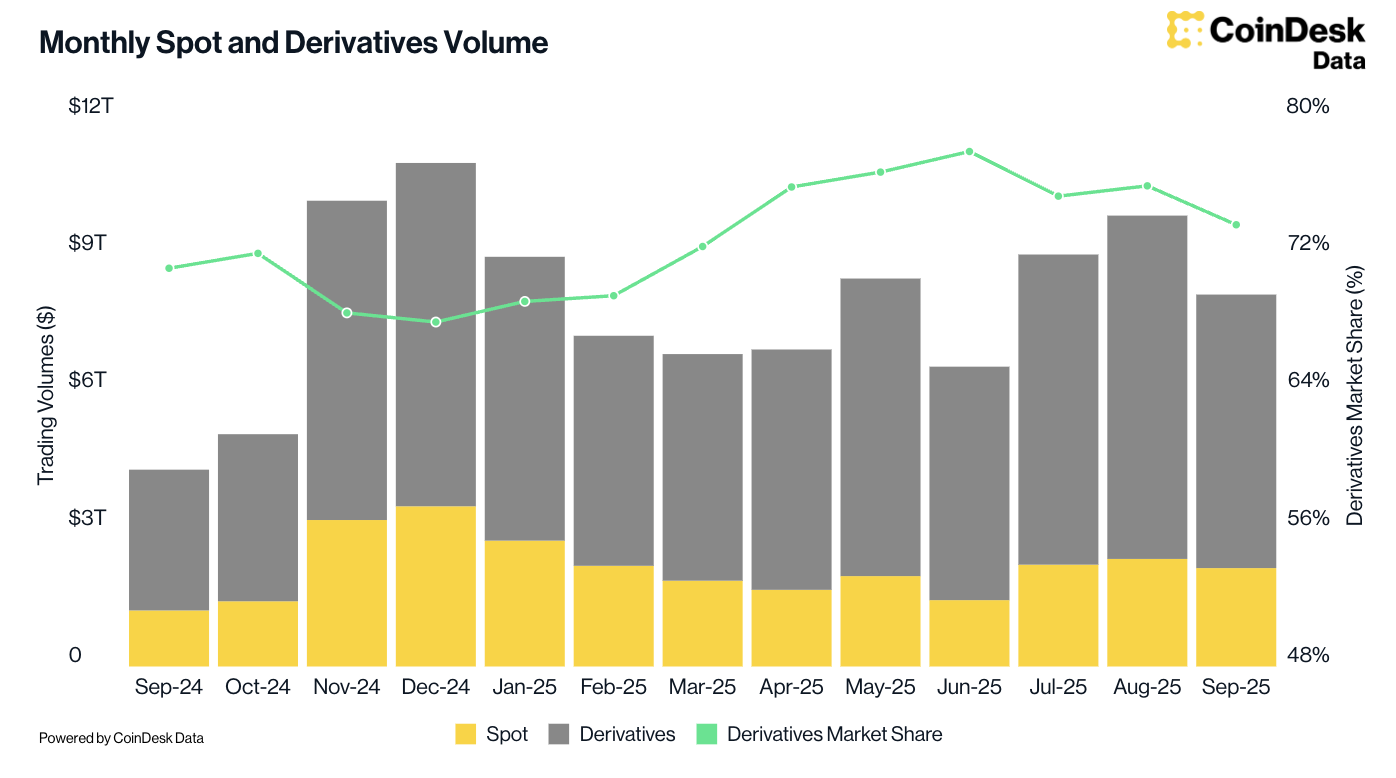

Crypto trading volumes also surged, with total activity across centralized exchanges hitting a yearly peak of US$9.72 trillion in August 2025, rising 7.58% month-over-month (MoM), according to CoinDesk Data’s August 2025 Exchange Review.

This growth was driven by derivatives trading, which jumped 7.92% to US$7.36 trillion and now accounts for 75.7% of all centralized exchange activity. Spot trading volumes also posted solid gains, climbing 6.55% to US$2.36 trillion in the market’s strongest showing since January.

Booming crypto adoption among retail and institutions

The boom in crypto prices parallels strong growth in crypto adoption across both retail and institutional markets.

According to Triple-A, a licensed crypto payment service provider from Singapore, the number of crypto owners grew at a compound annual growth rate (CAGR) of 99% between 2018 to 2023. Growth has expanded more moderately since but remains nevertheless robust, with crypto ownership rising by 34% between 2023 and 2024, increasing from 420 million to 562 million.

These growth rates far exceeds those of traditional payment methods, which expanded at an average of 8% annually between 2018 and 2023.

Between 2024 and 2025, crypto adoption was the strongest in Asia-Pacific (APAC), with India, Pakistan and Vietnam ranking among the world’s top five hubs for grassroots crypto activity, according to data from US-based blockchain analytics firm Chainalysis. During the 12 months ending June 2025, the region recorded the highest global growth rate, with the value received rising 69% from US$1.4 trillion to US$2.3 trillion.

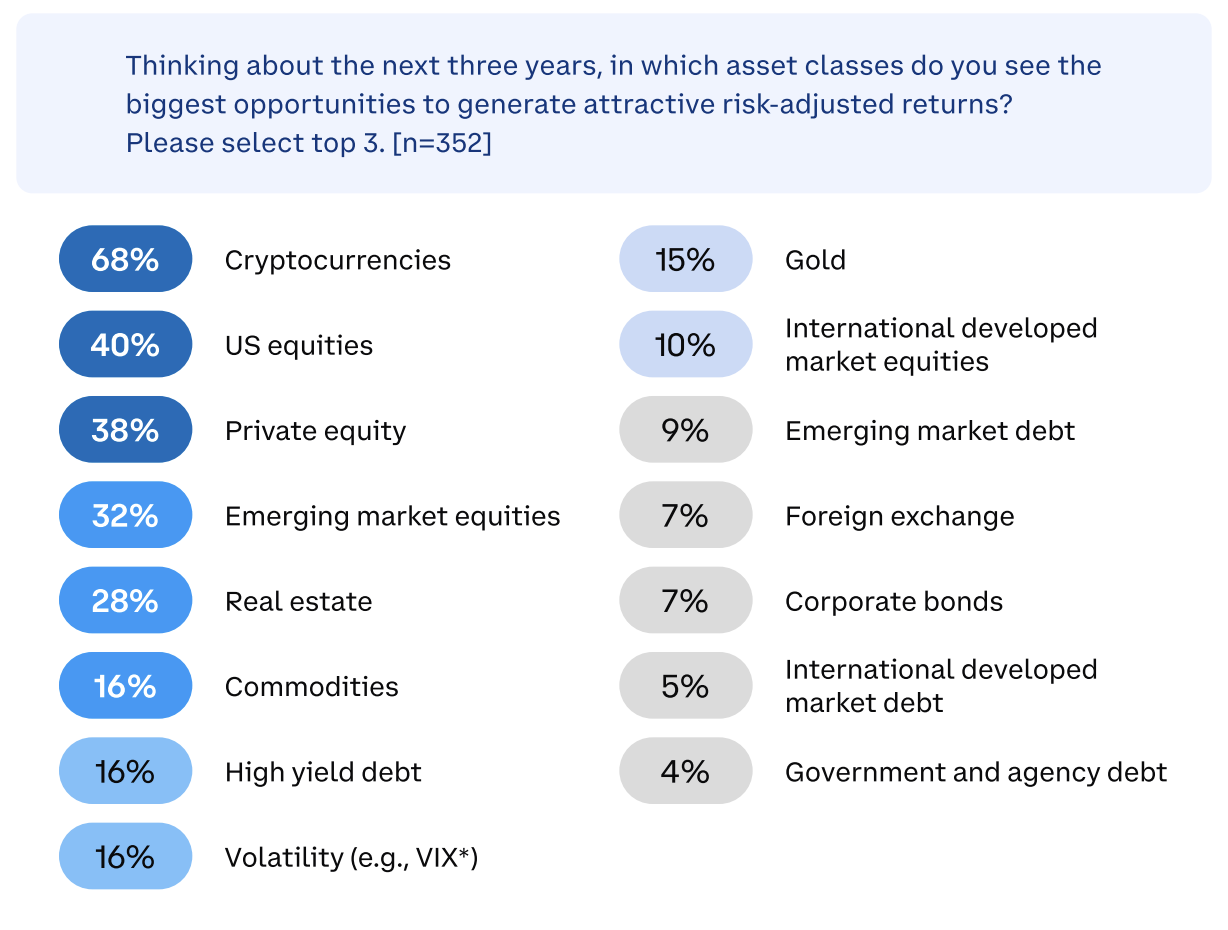

Institutional participation is also rising sharply. A survey of 352 institutional investors conducted by Coinbase, in collaboration with EY-Parthenon practice, found that 86% had exposure to digital assets in January 2025, or plan to make digital asset allocations during the year. Nearly 70% viewed cryptocurrencies as the biggest opportunity to generate attractive risk-adjusted returns.

The study also revealed expanding participation in crypto markets, including decentralized finance (DeFi) use cases such as staking, lending, and derivatives. While only 24% of institutional investors engaged in DeFi in early 2025, this figure is set to triple to 74% in two years, according to survey respondents.

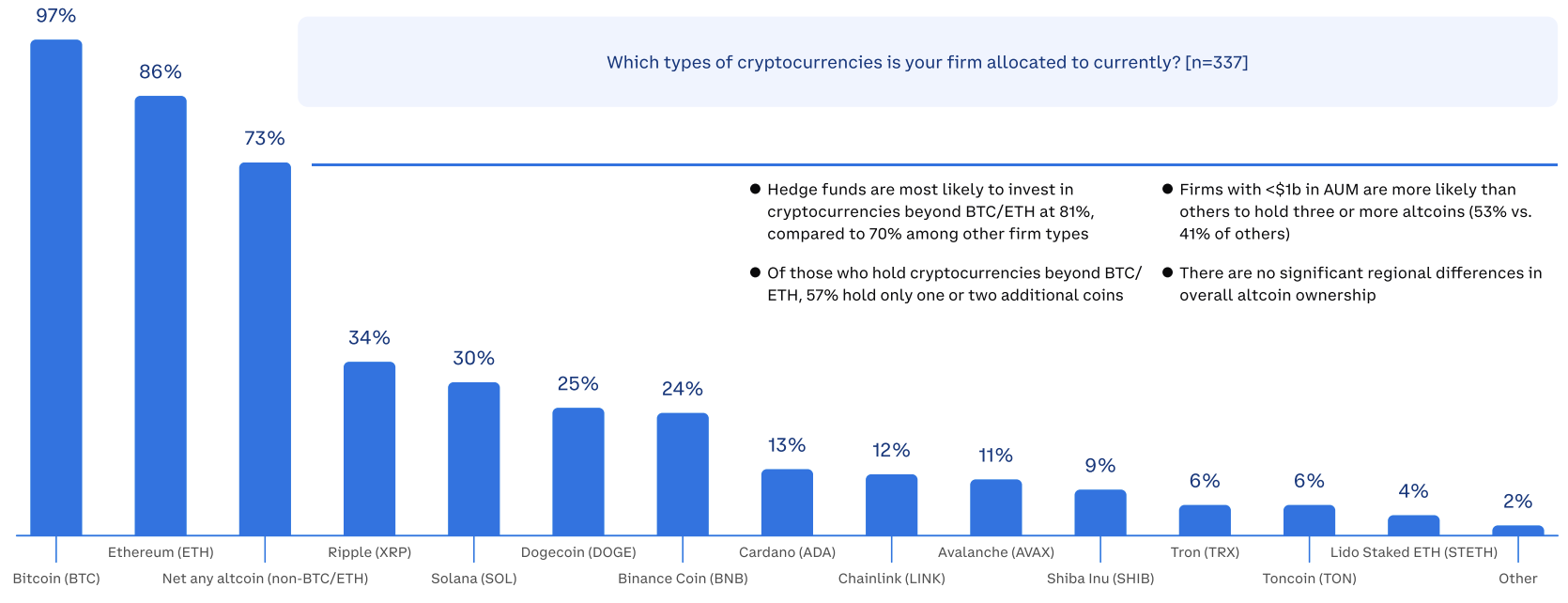

The survey also found a growing appetite to invest in a broader set of assets beyond BTC and ETH, with an increase in interest in other assets including Ripple (XPR) and Solana (SOL). Though BTC (97%) and ETH (86%) remained the dominant holdings among institutional investors, 73% of the surveyed investors owned cryptocurrencies beyond these two assets.

These developments are fueling corporate enthusiasm. Companies like Walmart, and Expedia are exploring launching their own stablecoins to streamline global payments, reduce processing fees, and lessen reliance on traditional financial infrastructure, the Wall Street Journal reports. Meanwhile, affiliates of banking giants such as JP Morgan Chase, Bank of America, Citigroup, and Wells Fargo are considering launching a joint stablecoin.

Featured image: Edited by Fintech News Switzerland, based on image by thanyakij-12 via Freepik

The post Global Crypto Wealth Surges, Driving 40% Increase in Millionaire Count appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Featured,newsletter