Pure-play digital asset manager Bitwise has listed five of its flagship crypto ETPs on the SIX Swiss Exchange this week.

The listings provide investors with additional options to gain exposure to the cryptocurrency market, including staking and index ETPs.

Bitwise’s range of crypto ETPs consists of financial instruments designed to integrate with traditional portfolios, offering exposure to digital assets as an asset class.

In August 2025, Bitwise reported that client assets across its 40 investment products had surpassed US$15 billion, a 200% increase since October 2024.

Switzerland remains a key market for Bitwise in Europe, serving both retail and professional investors.

The country has historically been an early adopter of digital assets, both in terms of market development and regulation.

Across Europe, more jurisdictions are expanding access to exchange-traded crypto products.

In the UK, regulators are expected to relax retail access to crypto ETPs from October 8 2025, while French authorities are reviewing similar measures.

Ronald Richter, Regional Director of Investment Strategy at Bitwise Europe, said:

“The five flagship products we have listed in Switzerland will broaden options for investors looking to benefit from the full potential of crypto markets. Europe is rapidly opening up for digital assets, and Switzerland is a leading and crucial market at the heart of the continent. I’m extremely pleased that we’re developing our product suite on the widely respected SIX exchange, with new options such as staking and index products.”

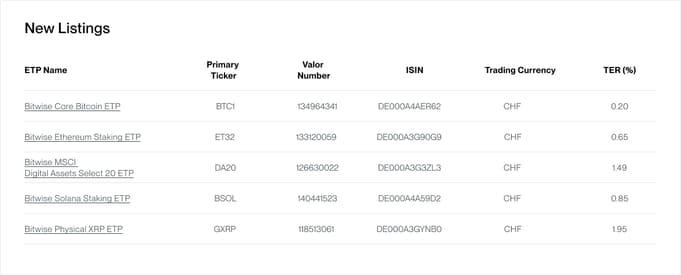

The newly listed ETPs on the SIX Swiss Exchange are:

Bitwise Core Bitcoin ETP (BTC1, ISIN: DE000A4AER62)

A cost-efficient Bitcoin ETP with a total expense ratio (TER) of 0.20% per annum, suitable for long-term investors. The NAV is calculated three times daily, using primary market liquidity from Hong Kong, the EU, and the United States, providing an extended liquidity window for institutional investors.

Bitwise Ethereum Staking ETP (ET32, ISIN: DE000A3G90G9)

An institutional-grade vehicle designed to leverage ETH staking. ET32 has experienced consistent net inflows this year while maintaining competitive bid-ask spreads, and targets a low total cost of ownership among ETH staking ETPs.

Bitwise Solana Staking ETP (BSOL, ISIN: DE000A4A59D2)

An institutional-grade, fully backed ETP providing exposure to staked Solana. BSOL is benchmarked against the Compass Solana Total Return Monthly Index, offering transparency in performance and valuation of SOL staking rewards.

Bitwise MSCI Digital Assets Select 20 ETP (DA20, ISIN: DE000A3G3ZL3)

DA20 seeks to track the performance of the MSCI Global Digital Assets Select Top 20 Capped Index, after fees and expenses. Managed by MSCI and rebalanced quarterly, the index covers the 20 leading investable cryptocurrencies, representing more than 90% of the total cryptocurrency market capitalisation.

Bitwise Physical XRP ETP (GXRP, ISIN: DE000A3GYNB0)

This ETP tracks XRP, the world’s fifth-largest crypto asset with a market capitalisation exceeding US$80 billion. Ripple, the network behind XRP, has seen growing adoption for applications such as cross-border remittances, institutional DeFi, and real-world tokenisation.

Bitwise ETPs allow investors to gain exposure to digital assets without the need for a cryptocurrency wallet.

They trade on regulated exchanges like traditional stocks or ETFs and can be incorporated into standard brokerage or ETF portfolios.

Each ETP is fully backed by the underlying digital asset, which is held in institutional-grade cold storage.

Similar to precious metal ETCs, Bitwise crypto ETPs feature a physical redemption mechanism.

Investor protection is further strengthened through the involvement of an independent trustee and administrator, ensuring that the assets are held off the issuer’s balance sheet and reducing issuer-default risk.

Featured image credit: SIX

The post Bitwise Lists 5 Crypto ETPs on SIX Swiss Exchange appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Featured,newsletter