Bond vigilantes had been questioning Janet Yellen's debt management tactics in her role as Treasury Secretary. Specifically, they accused her of shifting debt issuance away from longer-term maturities and toward shorter ones. We think her strategy made sense. Yellen was issuing more debt where demand was the greatest and trying to limit the amount of debt where demand was weaker. Secondly, she was making a bet on lower interest rates. She issued more shorter-term debt in hopes that rates would come down. It could then be rolled over into longer-term debt at lower interest rates when it matures. The new Treasury Secretary, Scott Bessent, also seems to believe that interest rates for long-term debt will decline in the coming months and years.

Unlike Yellen, Scott Bessent is a "markets guy." Accordingly, as a former hedge fund manager, he has a better grasp of the Treasury market dynamics. While many of his views differ from Yellens, Bessent seems to agree with her strategy of issuing more short-term debt and limiting long-term debt. Per Bessent:

Based on current projected borrowing needs, Treasury anticipates maintaining nominal coupon and FRN auction sizes for at least the next several quarters

In addition to keeping the issuance strategy intact, Bessent is focused on reducing longer-term interest rates. Per Reuters:

Bessent said in an interview with Fox Business on Wednesday that while President Donald Trump wants lower interest rates, he will not ask the Federal Reserve to cut rates, and that he and the president were intently focused on the 10-year Treasury yield.

Scott Bessent's comments over the past few weeks, alongside Musks's deficit reduction actions, are resulting in lower yields. The term premium is fading as deficit and inflation fears ease.

What To Watch Today

Earnings

Economy

Market Trading Update

I could not produce our weekly Bull Bear Report this past weekend as I presented at Michael Campbell's Moneytalks Conference in Vancouver. However, I wanted to use today's technical update to review some of the statistical analysis we produce each week in that commentary. Such is mainly the case given last Monday's "tariff" shock and Friday's employment report. (Subscribe for free to the weekly Bull Bear Report.)

It was a second volatile week of trading, which was unsurprising given the news flow. However, despite the volatility, the market continues to hold support within the current bullish trend. The market is not overbought, and the money flow remains strongly positive.

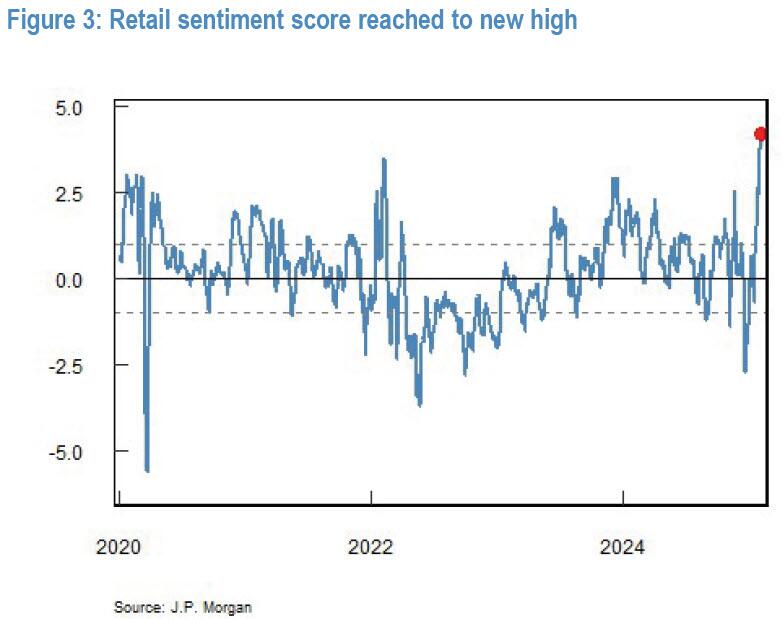

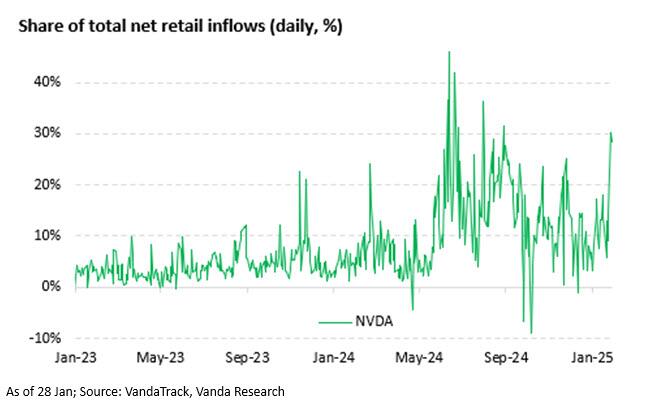

The market defies more negative news because retail investors continue to step in and "buy the dip." In our recent Bull Bear reports, we discussed the push by retail investors, but looking at retail sentiment is quite remarkable. Since the pandemic, retail investors have never been this bullish on the stock market. Such is amazing, given that their mailboxes are not being stuffed with government stimulus checks.

At the same time, their optimism about stock market returns is supported by putting their money where their mouth is.

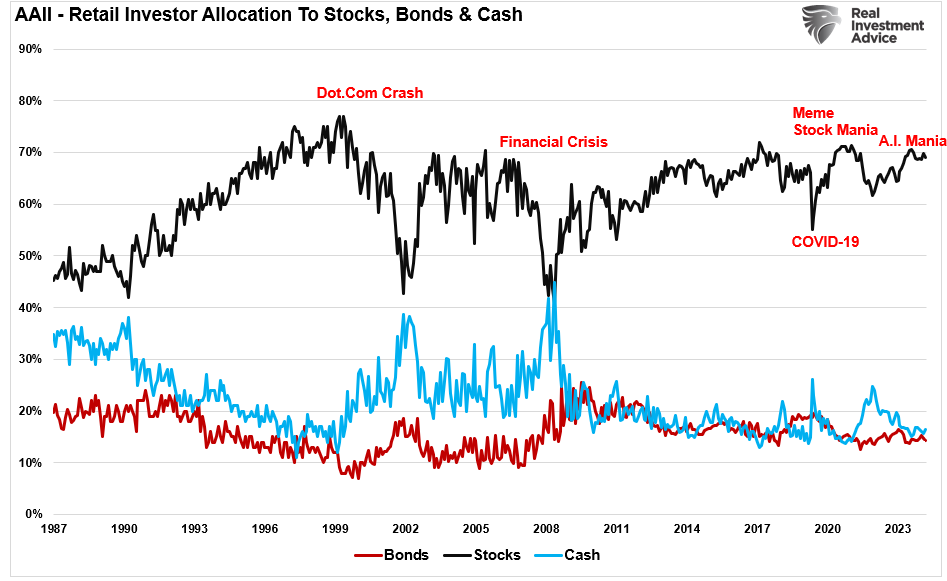

The most recent AAII allocation survey of retail investors shows the same allocation to equities. Currently, their allocations to equities are at levels seen at previous market peaks and only slightly lower than the peak during the "Dot.com" mania. At the same time, their allocations to cash and bonds are near lows. While such is not indicative of a near-term market reversal, it does suggest that much of the "market gains" are already priced in by investors.

As we have often discussed in the Bull Bear Report, investor optimism or pessimism, particularly at extremes, often tend to be strong contrarian indicators. While such a statement does not mean the market is about to crash, more often than not, a period of underperformance has not been unusual.

We will see how this week goes. I will expand more on this commentary in tomorrows Techncially Speaking blog post.

Employment & The Week Ahead

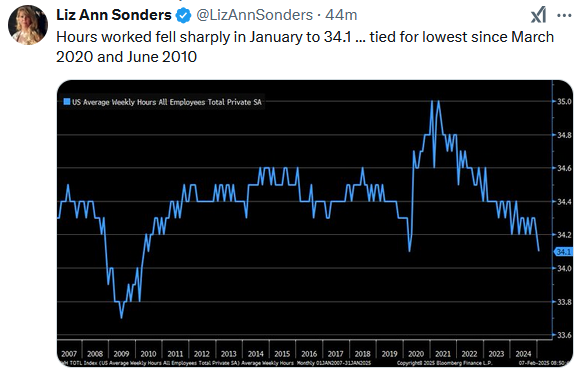

The BLS employment data on Friday was mixed. Total nonfarm payroll employment rose by 143,000 in January, and unemployment fell by 0.1% to 4.0%. Employment was about 50,000 below estimates, but revisions added a net 100,000 jobs in November and December. Also, the BLS revised the job gains lower between March 2023 and March 2024 by 554k. The graph below charts aggregate wages based on the number of people working, average hours worked, and hourly wages. As it shows, aggregate wages are still slightly above the pre-pandemic run rate but well within the norm from that period. Moreover, as we share in the Tweet of the Day, hours worked have been steadily declining and are down to the level at the trough of the pandemic. Prior to that one has to go back to 2010 to find a similar level.

With employment data behind us, inflation is now on the docket. CPI on Wednesday is expected to show a 0.2% increase and 2.9% year over year. PPI will follow on Thursday. Chairman Powell will testify to Congress on Wednesday. We suspect he will make some market-moving comments. Also, there will be a 10-year Treasury auction on Wednesday and a 30-year auction on Thursday. Retail sales will cap the week on Friday. The current estimate is a 0.3% increase, a tenth below last month's figure.

The corporate earnings calendar will slow considerably. Of note this week are McDonald's, Coke, Cisco, and Duke Energy. Stock buybacks will pick up as many companies are no longer in buyback blackout periods following earnings.

Forecasting Error Puts Fed On Wrong Side Again

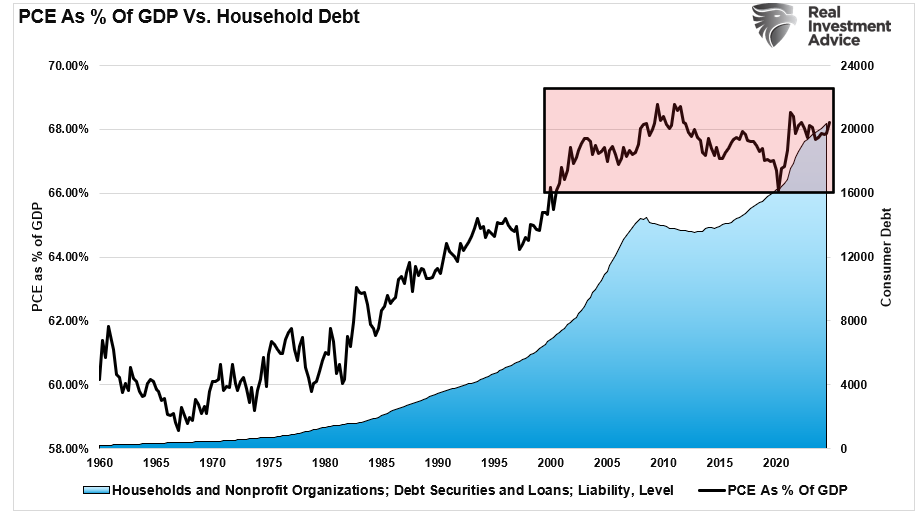

The obvious problem for the Federal Reserve is that forecasting is always problematic due to unexpected events that can disrupt consumer activity. This is particularly the case today, more than in the past, given that consumption is nearly 70% of the U.S. economy. However, it is notable that since 2000, while household debt continues to increase dramatically, it is no longer fueling increases in economic activity. In other words, households are consuming more debt to sustain their standard of living rather than increasing it, as seen from 1980 to 2000.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Bessent Follows Yellens Strategy appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter