Summary

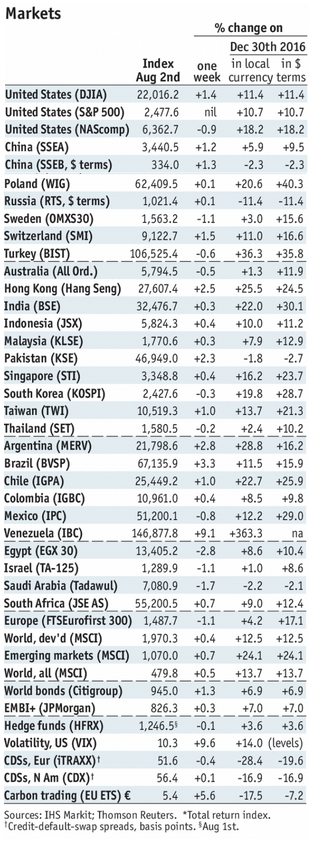

Stock MarketsIn the EM equity space as measured by MSCI, Hungary (+2.9%), Brazil (+2.4%), and Hong Kong (+2.0%) have outperformed this week, while Egypt (-2.2%), Philippines (-1.9%), and Qatar (-1.6%) have underperformed. To put this in better context, MSCI EM rose 0.4% this week while MSCI DM rose 0.3%.

In the EM local currency bond space, Brazil (10-year yield -18 bp), Russia (-10 bp), and Philippines (-6 bp) have outperformed this week, while Colombia (10-year yield +7 bp), China (+6 bp), and Czech Republic (+4 bp) have underperformed. To put this in better context, the 10-year UST yield fell 2 bp to 2.27%. In the EM FX space, COP (+1.3% vs. USD), ARS (+1.0% vs. USD), and INR (+0.9% vs. USD) have outperformed this week, while ZAR (-3.0% vs. USD), ILS (-2.0% vs. USD), and RUB (-1.0% vs. USD) have underperformed. |

Stock Markets Emerging Markets, August 2nd Source: economist.com - Click to enlarge |

IndiaThe Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. This reverses the 25 bp hike in the reverse repo rate back in April. Going forward, RBI policy will get harder to predict. After cutting rates, it kept a neutral stance and said inflation will rise in H2. We’ll have to take it meeting by meeting but we believe the RBI will err on the side of caution for the time being.

IndonesiaBank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Governor Martowardojo said “Bank Indonesia sees that inflation continues to be manageable, and provided conditions remain good with supporting data, we aren’t closed to the possibility of easing.” He added that “we will consider [a cut] as we head into the upcoming meeting of board of governors.” The next policy meeting is August 22, and the odds of a cut have risen.

Czech Republic

|

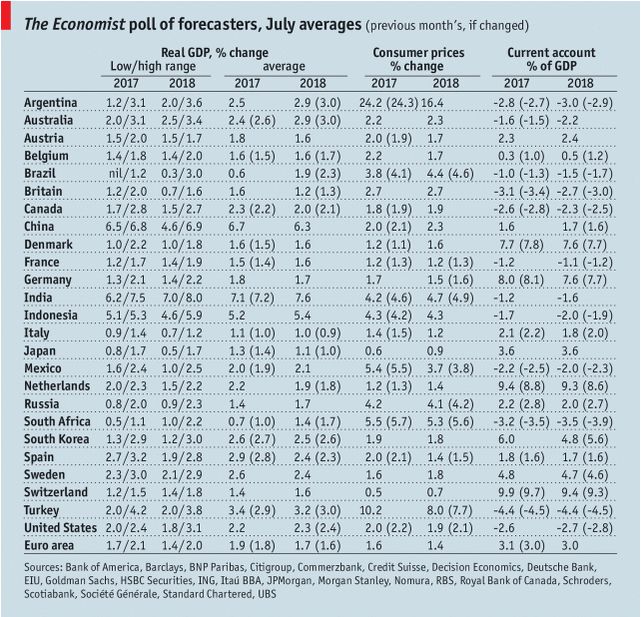

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent,win-thin