In Switzerland, financial institutions are increasingly recognizing the long-term potential of blockchain and integrating the technology into their growth strategies.

According to a new study by the University of St. Gallen, in collaboration with vision& and mintminds, more than 80% of Swiss banks are either planning to develop and actively expanding their blockchain offerings, with a particular focus on cryptocurrencies.

Conducted between April to June 2024, the study polled 19 banks in Switzerland, including retail (47%), private banks (37%), universal (11%) and investment banks (5%) to understand the blockchain strategies, priorities, and challenges these institutions face as they integrate blockchain technology, cryptocurrencies and tokenized assets.

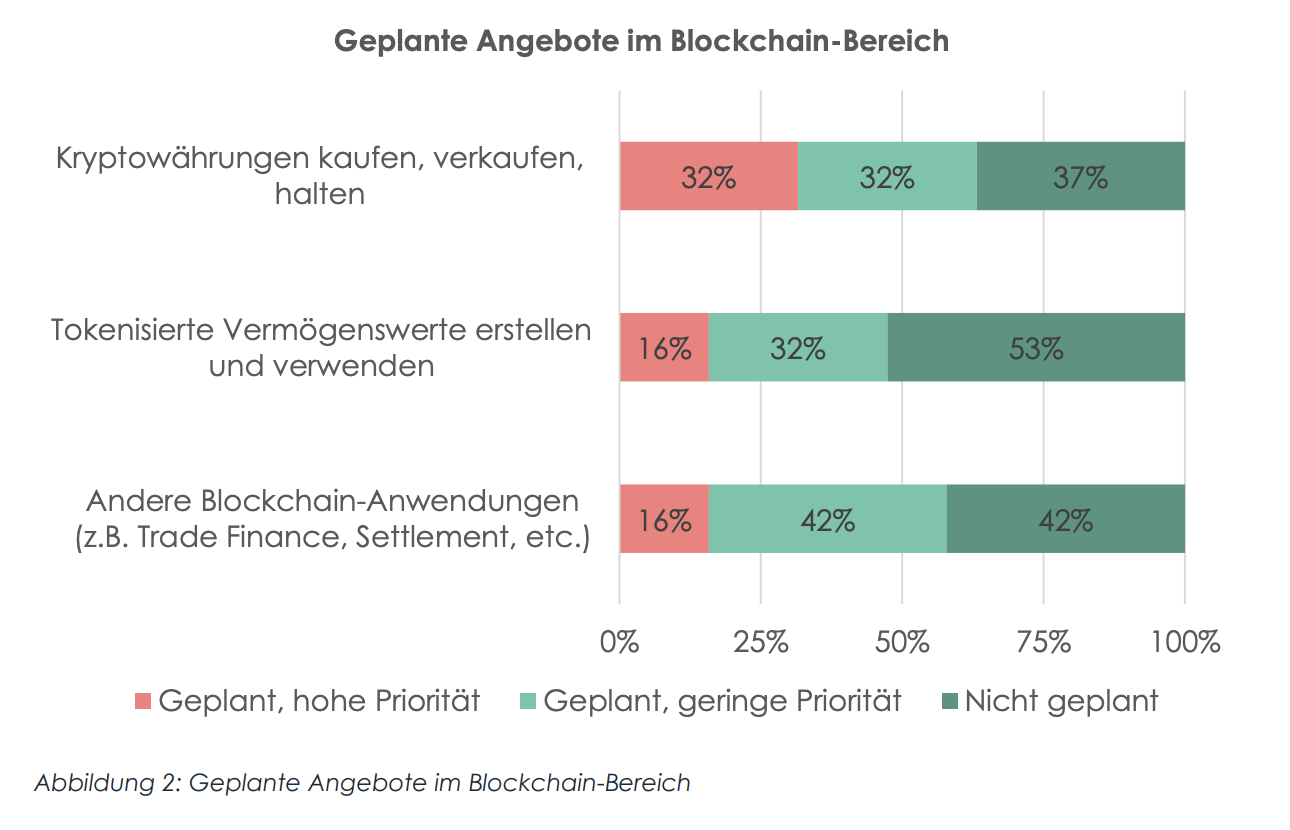

The research found that over 60% of banks in Switzerland are pursuing concrete plans related to cryptocurrencies, with half of these institutions considering the development and expansion of their crypto offerings as highly prioritized. This underscores growing interest and acceptance of cryptocurrencies within the traditional banking sector, the report says.

A focus on crypto custodian, trading and ETP products

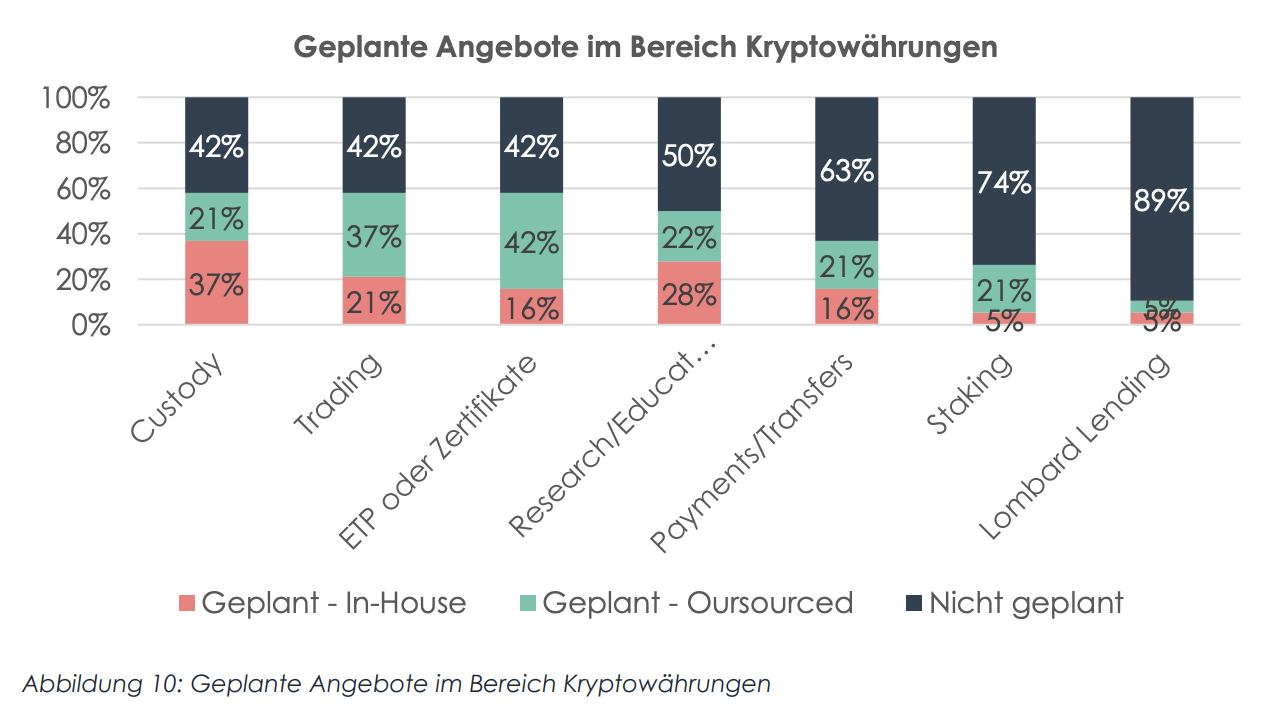

When looking at planned crypto offerings, the study found that approximately 60% of banks are either looking to implement or have already implemented custodial services, underscoring the importance of these offerings in the crypto space.

Trading services, which allow for the buying and selling for cryptocurrencies, are another critical component of the crypto industry, prioritized by around 60% of banks.

Exchange-traded products (ETPs) and certificates, which are financial instruments that track the value of cryptocurrencies and which can be traded on traditional stock exchanges, are also perceived by Swiss banks as critical. Around 60% of respondents intend to offer these products, highlighting ETPs as an attractive alternative for investors to participate in the crypto space.

Cryptocurrencies are still in the early stages of market development. Currently, only 0.53% of total assets under management (AuM) are invested in the asset class. While this figure may appear low at first glance, it is significant. Many Swiss banks have only recently introduced their crypto offerings, suggesting substantial interest in the asset class and considerable growth potential, the report says.

The rise of tokenized assets

Swiss banks are also showing strong interest in tokenized assets. These are physical or digital assets that have been converted into digital tokens on a blockchain, making them easier to trade, divide and track.

According to the study, 47% of the Swiss banks polled are planning to develop a tokenized asset offering, reflecting a clear interest and confidence in the future of this technology. However, most banks remain in the nascent stages of implementing tokenized asset offerings, indicating that many institutions are just starting to familiarize themselves with the technology and its application possibilities.

Industry stakeholders are optimistic about the prospects of tokenization due to its transformative benefits, including increased liquidity, transparency, and efficiency. Global consulting firm Boston Consulting Group (BCG) and digital exchange ADDX forecast that asset tokenization will expand into a US$16.1 trillion business opportunity by 2030, driven by greater access to private markets, improved liquidity, and increased recognition by monetary authorities.

Blockchain strategy

The study conducted by the University of St. Gallen revealed that nearly 60% of the banks surveyed have already developed or are working on a blockchain strategy. This includes 16% of institutions that rank blockchain topics as highly prioritized. Almost all banks with an existing strategy have management support and launched their first blockchain offering in 2023 or earlier.

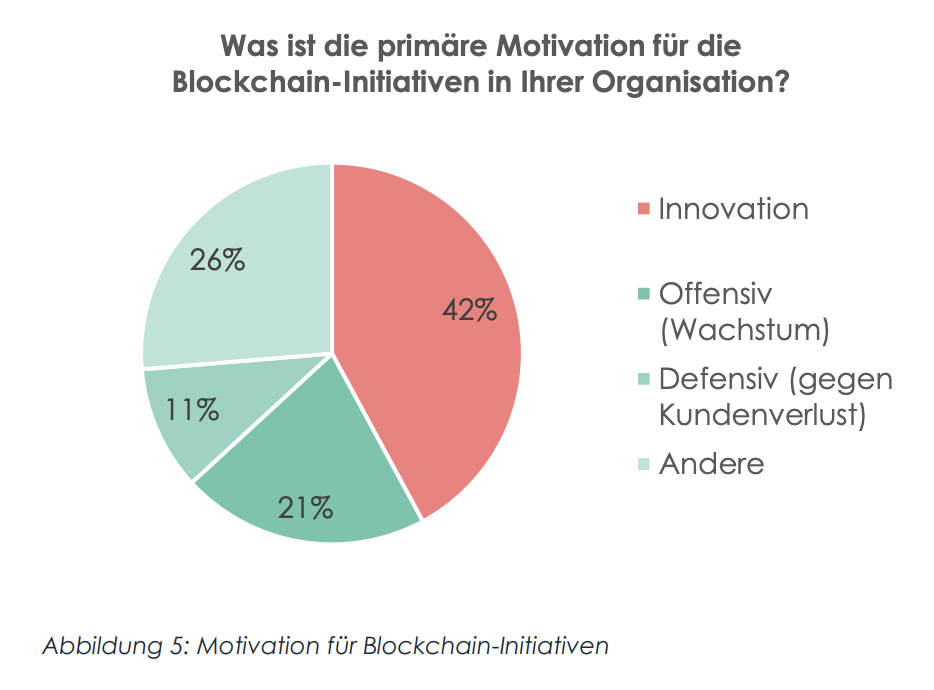

When asked about their motivations for adopting blockchain, more than 40% of the institutions said they viewed the technology primarily as an innovation driver. Additionally, 21% of the institutions are investing in blockchain as a growth driver, pursuing an offensive strategy and expecting strong growth in managed assets and customer numbers. In contrast, nearly 11% of all banks are adopting a defensive approach, investing in blockchain as a means against customer losses and withdrawals of managed assets.

Swiss banks are also exploring more advanced applications of blockchain technology, with 58% reporting active efforts in this area. Their primary motivation is a general willingness to innovate.

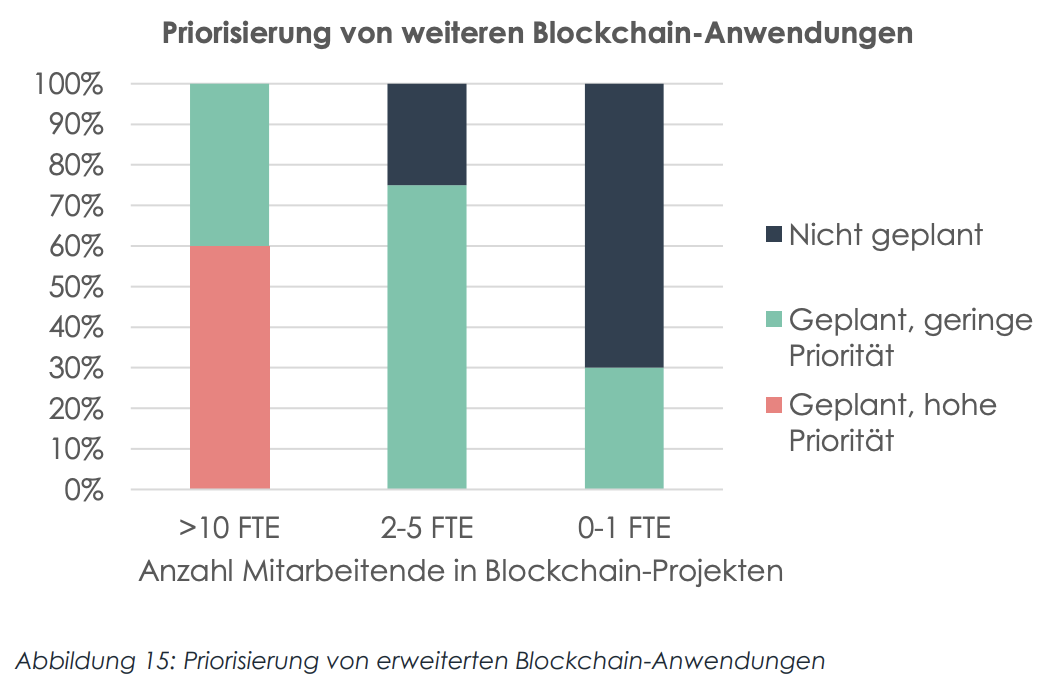

The study also found that larger banks and those with more employees involved in blockchain projects are more likely to integrate advanced blockchain applications into their business strategies. This implies that bigger banks with more resources tend to be further along in implementing blockchain.

Featured image credit: edited from freepik here and here

The post Swiss Banks Embrace Blockchain, Prioritizing Cryptocurrencies, HSG Study Finds appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Cryptocurrencies,Featured,newsletter