In their Space, Elon Musk spoke with Donald Trump about the cause of inflation being government overspending.

Elon is right about this, that government fiscal and monetary policy causes inflation. So let’s do a walk through how deficit spending causes inflation:

We first have to understand what inflation is. Inflation isn’t just prices going up, otherwise we are cornered into saying every supply shock or price increase is inflationary

Inflation is an increase in the money supply. It is seen through an increase in prices.

Inflation involves the increasing of the cash balances of some, who can spend at the expense of those who receive them later.

Real goods go to the first receivers of this new money. Their spending increases demand and thus prices.

Inflation is always a tax on the population, an expropriation of real resources through counterfeiting by the inflationist.

It just so happens that our counterfeiter is the Federal Government. But how do they do it?

Elon is correct to point at overspending, but it may be more precise to point at deficit spending. The issuing of debt can easily cause inflation

Government finances itself through three taxes: taxation, borrowing, and inflation.

Taxation is direct and quick: the taking of money directly from the people. It’s open and obvious. If people don’t like the trade offs they won’t accept it (and will revolt)

This is why Ludwig von Mises described the power of the people are “the power of the purse.”

Borrowing involves the issuing of bonds—promises to “pay ya back later” to the bond holders.

It defers the taxation to future taxpayers. Current taxpayers benefit at the expense of those who come later.

Inflationism is a tax because, like we said above, it expropriates real goods from later receivers of the money. The first receiver here is the government

The tax is in the smaller supply of good for productive consumers and higher prices.

But government doesn’t literally print money anymore. It does so through deficit spending and the Federal Reserve buying bonds from member banks

When the government overspends, it issues bonds to pay the difference. This is bought by private actors and usually big banks.

The Federal Reserve, through its Open Market Operations, purchases those bonds from big banks. They credit the bank’s account at the Fed with more money and take the bond onto the balance sheet

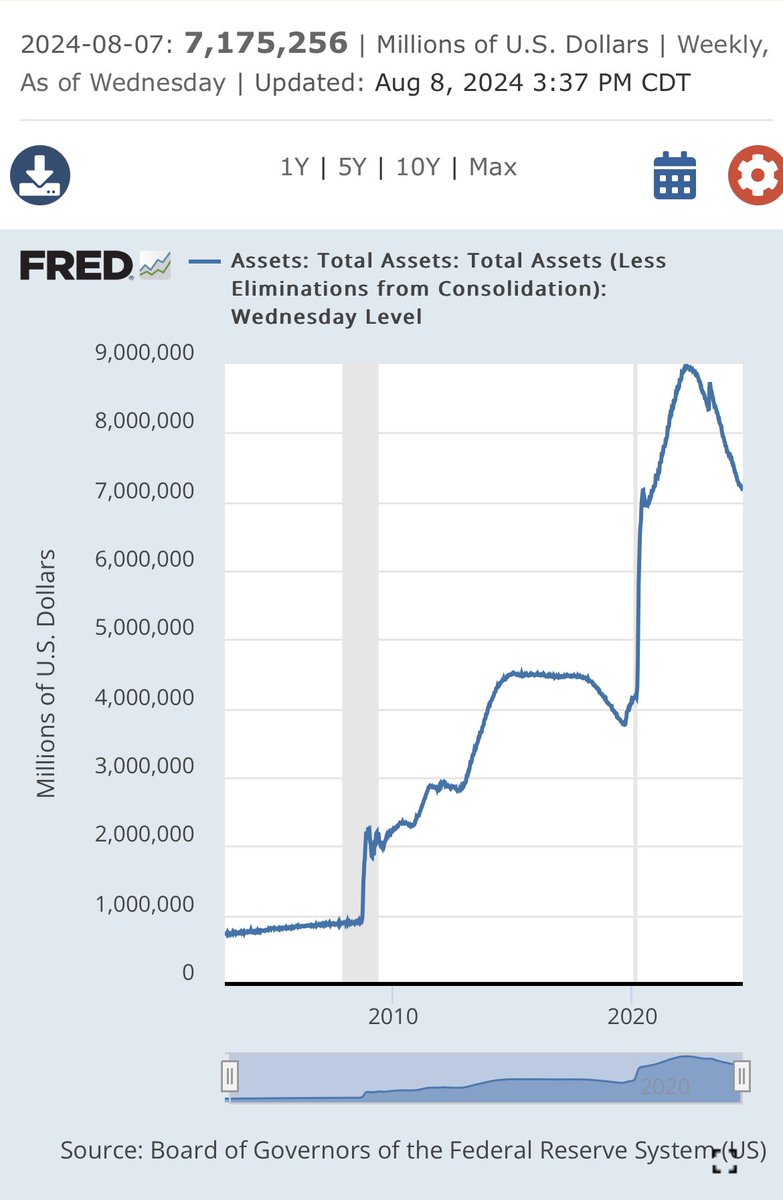

The Fed balance sheet is huge and you can see big jumps during COVID and 2008.

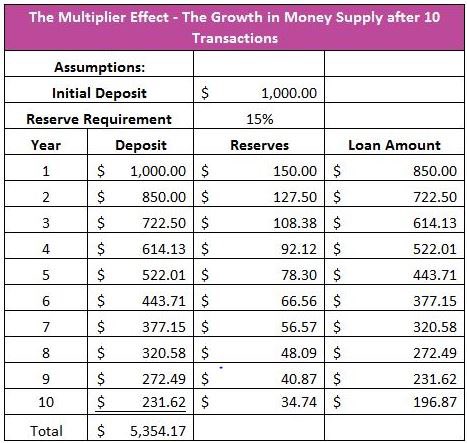

These banks can then act with these new reserves and issue more loans. These loans are what Mises called fiduciary media—unbacked bank notes. They are treated like money and they chase real goods, driving up prices

It increases the money supply indirectly through deficits.

Government and their close friends get real goods right away, driving up demand in those industries. The money supply is increase by the Fed through Open Market Operations, and those in the loan markets (like financiers) get real goods before prices rise

Inflation is a tax.

And inflation is caused by the government overspending in the modern age. Because it won’t live within its means and wants to conceal its overreach, it inflates to finance itself

Deficits cause inflation, just like Elon Musk said: If you want more reading on this topic, you should get a copy of Murray Rothbard’s What Has Government Done to Our Money.

And if you want more reading on money mechanics I suggest Bob Murphy’s Understanding Money Mechanics!

Originally published as a thread on X.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter