Bernie Sanders, Elizabeth Warren, and the Congressional Progressive Caucus recently sent an open letter to the chairman of the Federal Reserve, Jerome Powell, demanding lower interest rates.

The letter is full of the economic illiteracy one would expect from progressives, especially those in Congress. For example, it misreads price inflation data and argues that the failure to lower interest rates endangers home affordability and increases income inequality. These assertions are false and easily disproven.

Artificially low interest rates lead to more of the same economic sickness—malinvestment, bloated government and personal debt, and a never-ending cycle of boom and bust that enriches the political class while impoverishing the average American.

Home Affordability

Congressional progressives state that homeownership is becoming unaffordable due to “persistently high interest rates.” This is backward, like saying the overweight got that way by taking too many walks. While focusing on today’s slightly higher mortgage rates, progressives ignore what low interest rates do to home prices in the first place. Artificially low rates increase home prices, and pushing rates near zero, as the Fed did in 2020, increases home prices substantially.

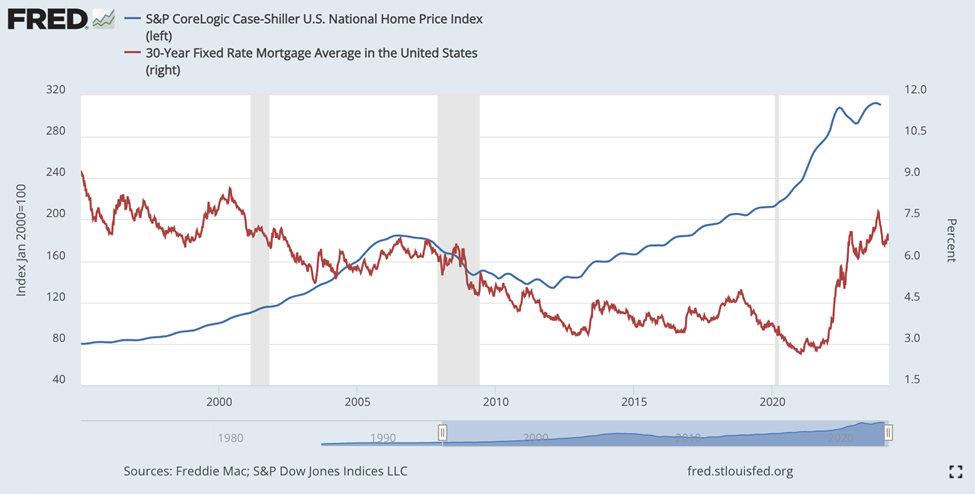

Figure 1: The US National Home Price Index versus the thirty-year fixed rate mortgage average, 1995–2024

Source: FRED.

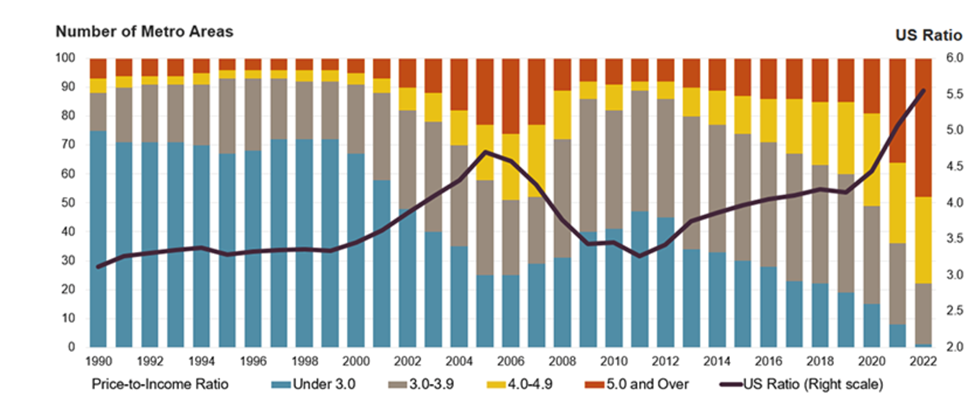

In the last ten years, the Case-Shiller US National Home Price Index has doubled, a 7.2 percent annual rate of increase. Since wages have risen at a much-slower rate, affordability has plummeted. The ratio of the average home price to median household income has increased from roughly 3.5x in 2010 to more than 5.5x today. Both of these factors—slow real wage growth and higher home prices—are a direct result of artificially low interest rates. The progressive caucus has been conspicuously silent about this phenomenon despite their rhetoric in support of the working class.

Figure 2: Price-to-income ratios for the hundred largest metro areas by population, 1990–2022

Source: Data from Moody’s Analytics and the Joint Center for Housing Studies tabulations of data from the National Association of Realtors.

That low interest rates inflate home prices and harm the average American homebuyer is not a controversial position. The progressive caucus knows that and insists on low rates anyway.

Health of the Financial System

In their letter, congressional progressives express their concern with the health of the financial system and assert that an explicit timeline to lower rates would “reassure” markets and provide stability.

This is more bad economics. At a systemic level, unnaturally low interest rates distort asset prices. Since asset prices are determined by future cash flows discounted by prevailing interest rates, excessively low interest rates inflate current values. This has the effect of enriching those with access to capital and credit but making everything less affordable for those without such access. As an illustration of that fact, since the acceleration of ultraloose monetary policy in 2009, stock prices have increased by 600 percent, averaging roughly 14 percent appreciation per year, while nominal wages have risen a paltry 56 percent in the same period, an average annual increase of only 3 percent. Adjusted for inflation, the average American wage is barely higher than it was fifteen years ago during the last financial crisis.

As we’ve seen, artificially low interest rates also imperil bank health. As banks load up their balance sheets with inflated assets—especially bonds and real estate—during the low-interest-rate portion of the boom, the values of those assets are more susceptible to significant revisions downward when the inevitable price corrections occur. When those markdowns happen, banks become insolvent and subject to bank runs, ultimately leading to failure. Widespread bank failure can bring an economy to its knees.

Last, as interest rates are suppressed, finance and adjacent industries crowd out honest endeavors, savings collapse, and psychological energy builds up in speculation as opposed to productive effort. Over time, this results in economic sclerosis—a drastic misallocation of resources marked by a rigid economy unable to grow, innovate, and adapt.

Getting Price Inflation Wrong

In arguing for lower rates, progressives state that “the Federal Reserve’s inflation target of a 2 percent average has largely been achieved.” This is false.

According to the Bureau of Labor Statistics, the Consumer Price Index (CPI) rose 3.2 percent in February, making thirty-six consecutive months where CPI has been above the Fed’s arbitrary 2 percent target. Where the working man is concerned, shelter (rent, essentially) is up 5.7 percent in the latest period. Core CPI, which strips out volatile food and energy prices, is up 3.8 percent.

On a cumulative basis, the numbers are atrocious. Using CPI figures, which undershoot actual price inflation, prices in America are up 20 percent since the beginning of 2020.

German economist Oskar Morgenstern once commented, “The idea that as complex a phenomenon as the change in a ‘price level,’ itself a heroic theoretical abstraction, could . . . be measured to such a degree of accuracy is . . . simply absurd.” CPI as a measure of price change in the United States economy is woefully unfit for purpose. However, even using this government-curated metric, price inflation is nowhere near the Fed’s target, and the progressive argument in favor of low rates is reduced to nothing.

Effect on the Average American

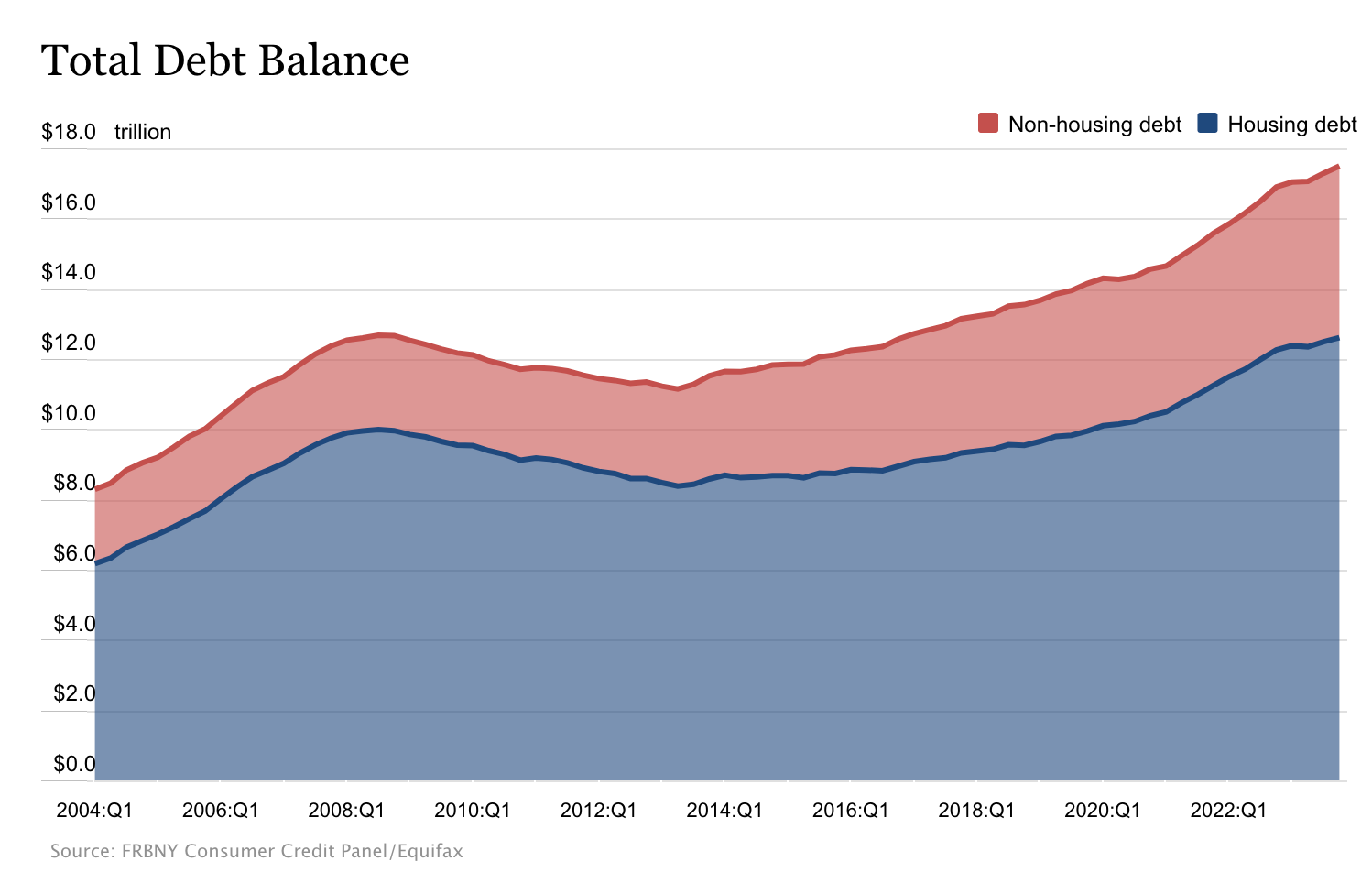

Very low interest rates benefit the wealthy and their financiers, who have access to credit and capital, while harming savers, the proverbial widows and orphans. The average American is thus harmed in two ways—things get more expensive, and earning a return on savings gets more difficult. In order to compensate for this lack of safe interest-bearing options, the average American is forced to “stretch for yield” through speculation. This set of factors increases their risk of capital loss and puts them further into debt. As it stands, Americans are more in debt than ever before and less capable of pulling themselves out of it.

Figure 3: Total debt balance, 2004–24

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax.

In an effort to wave away the ill effects of low interest rates and accompanying price inflation, progressives argue that worker wages have “consistently outpaced inflation,” but this is also false. Even using CPI, which understates true price inflation, real wages are at the same level they were in the first quarter of 2020. The earning power of the average American has not improved in four years. Going back to 2009, the beginning of the ultra-low-rate regime, real wages have grown at an anemic 0.49 percent per year.

Quitting, Cold Turkey

Today’s interest rates are not high. Historically speaking, they’re on the low side. However, as politicians and rent seekers become accustomed to low rates, getting into a normal rate regime is increasingly resisted until enough political pressure is applied to lower them again.

Progressives want low interest rates for the same reasons Republicans want them—to grease the skids for more asset bubbles and greater government spending that enriches them and their donors. As Murray Rothbard pointed out, “There is nothing more important to a bureaucrat and his organization than their income.”

However, low interest rates and asset bubbles don’t make nations richer. They simply move value from the future to the present, thus reducing future investment returns, depressing investment activity, and shifting the motivations of the populace from production to speculation.

Economist Frédéric Bastiat said that bad economists pursue small current benefits for large future disadvantages while good economists pursue large future benefits at the expense of small disadvantages in the near-term. Progressives in Congress are not just bad economists, they’re bad liars too.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter