The argument over trade is one that has been foisted back onto America by the likes of Bernie Sanders and Donald Trump. While most hold to the notion that Adam Smith ended the debate on trade policy in the 1770s, the issue has always been a prominent one in American history. The Hamiltonian Whigs and Lincoln Republicans have long stood opposed to the Jacksonian Democrats and their policy of laissez-faire capitalism. Perhaps the one shining light of the neoconservative and neoliberal world order was lip service to the idea of free trade across borders, even if that was not quite true. The rise of Trump—as a rejection of this neoliberal order—was not only a rejection of the foreign policy failures of Bill Clinton and Barack Obama, but it was also a resurrection of Hamiltonian protectionism.

The claims in favor of tariffs and other forms of protectionism are most always the same: Free trade has allowed for the outsourcing of American manufacturing! Free trade has resulted in poor, cheap goods! Americans are enslaved to the Chinese with our trade deficits! The list goes on and on, and each of these claims misses key understandings in trade relations, regulation, and the nature of voluntary exchange.

In terms of output, the United States has moved from a ranking of number one in manufacturing output to number two, falling behind China as it rose to dominate manufacturing. China’s rise, from communist isolationism to its pseudomarket economy under Deng Xiaoping, allowed it to become a force for manufacturing in the world. In fact, China made up 20 percent of global manufacturing as compared to the United States’ 18 percent in 2015. If one consults the Bureau of Labor Statistics, the United States has faced a decline of around seven million manufacturing jobs between 1981 and 2011. Protectionists blame this decline on the greed of companies outsourcing manufacturing to other countries like China.

While it is likely true that the cost of Chinese labor was low enough for many companies, that doesn’t unveil the entire story. It’s not simply the outsourcing of jobs that causes the death of manufacturing jobs, it’s also that of regulatory strangleholds. Often, the protectionist view can ignore the advent of regulatory agencies such as the United States Environmental Protection Agency in 1970 and the Occupational Safety and Health Administration (OSHA) in 1971. These regulatory agencies unfurl endless costs on producers, which will in turn be foisted upon the consumers. A journal publication as far back as 1998 estimated the annual cost to companies due to OSHA compliance and enforcement to be between $23 and $47 billion. This, of course, doesn’t take into account the growth in cost as well as inflation since 1998.

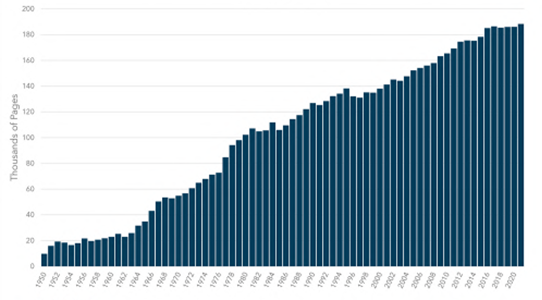

Also, if one observes the total number of pages in the Code of Federal Regulations since 1981, it becomes increasingly clear.

Figure 1: Total pages published in the Code of Federal Regulations, 1950–2021

Source: “Reg Stats,” Regulatory Studies Center, George Washington University, accessed September 12, 2023.

Another large factor for the decline of manufacturing jobs is the over financialization of the American economy. The 2008 recession saw the loss of eight hundred thousand manufacturing jobs as zombie companies and malinvestment were realized. Two of the largest, and apparently inefficient, automotive manufacturers in America—General Motors and Chrysler—were bailed out by the US Treasury. Thus comes the term “the Rust Belt.”

Far-better Austrian economists than this author have provided the proper analysis as to why it was the zero-interest rate policy that created the recession, so that does not need to be rehashed here. The Federal Reserve, through unsound money, has withered away savings and over financialized the economy so much that manufacturing in America has suffered.

Therefore, it is likely not free trade alone that saw the complete collapse of US manufacturing jobs.

However, let us propose that free trade caused the total reduction of all lost US manufacturing jobs. Then, surely, this result must be the most economic.

Austrian economics posits the role of the entrepreneur as an individual who can anticipate the underpricing and undercapitalization in markets. The entrepreneur extends production into an undercapitalized field of production, realizing their competitors have overpaid for factors of production. Entrepreneurs identify factors of production or processes that reduce the discounted marginal value product in order to reap profit. Murray Rothbard perhaps describes this best:

What function has the entrepreneur performed? In his quest for profits he saw that certain factors were underpriced vis-à-vis their potential value products. By recognizing the discrepancy and doing something about it, he shifted factors of production (obviously nonspecific factors) from other productive processes to this one. . . . He has served the consumers better by anticipating where the factors are more valuable.

Nonspecific factors include labor. While humans certainly can specialize, becoming more productive in certain lines of productions than others, much of the labor can performed by any human. In a manufacturing process like Henry Ford’s assembly line, almost any man could perform the work. Thus, by noticing the discounted marginal value product of labor is significantly less expensive abroad, the entrepreneurs in manufacturing shift their capital abroad. Entrepreneurs can thus reap better profits and lower the price of goods significantly. Following the simple laws of the market, entrepreneurs better serve the consumer by allocating capital to where it is most effective.

However, profit attained by one firm is noticed by others. Capital begins to shift toward the factors of production that derives the profit, bidding up their cost. In our scenario with labor, more firms shifting production to this cheap labor will compete over workers. Wages will be bid up, and profits will be eaten up until the only revenue derived is the market rate of interest. Being as prices, including labor, tend to be uniform throughout the economy, eventually the costs of this nonspecific labor would be the same domestically and internationally. Thus, the determining factor will be cost of compliance within a nation. The obvious compliance costs in the United States have already been discussed earlier.

However, are Americans being manipulated by cheap and poorly made goods? Certainly not. Any thinker can easily comprehend the cause of voluntary exchange. An exchange will only occur when the two parties involved both value the good that they are receiving more than the good they give up. Thus, there is a double inequality of value to any voluntary exchange. This applies to cross-border trade. Americans value the goods made abroad more than they value the money they give up. Other factors can impact the “psychic profit” derived from an exchange. If a consumer values goods “Made in the USA,” they may be more inclined to pay a higher monetary price than if they purchased a foreign equivalent. The same is true if they wished for more durable “Made in America” goods as opposed to less-durable goods from abroad. Instead, Americans often demonstrate a preference for these cheaper, possibly less-durable, goods through the act of purchasing them.

Furthermore, through the mere act of purchasing a producer good—or a consumer good that provides continuous use—the purchaser assesses the durability and use of the good. Rothbard calls this process “capitalization,” the process by which actors assign value based upon the expected future rent (value of a unit service) of a good. By purchasing a good at any given price, the purchaser expects to derive a certain amount of value from the good. Through this capitalization process, the consumer decides that the value they derive from the number of uses of the good is greater than what they exchanged it for. These consumers decide that the good they are purchasing has value despite their durability and would demonstrate their preference for more durable goods if that was what they desired. Americans are not being conned by cheap and less-durable goods; they prefer those goods.

Protectionist justifications for tariffs and other Hamiltonian policies lack an understanding of basic human action. Americans determine which goods—of whatever quality and durability—have value, and producers provide those goods. These producers have been shafted by increased regulatory compliance costs, all while trying to provide goods for consumers.

The American government creates a hostile environment for domestic manufacturers, and it is American consumers that consume the goods made by foreigners. The market acts regardless of government interference, still providing as best as it can for consumers. Consumers are kings in capitalism, and those kings demand foreign goods.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter