In a blog last week titled Japan Is Normalizing: Risks To The Yen Carry Trade, we discussed Japan's path to economic normalization and how it might affect a great source of global liquidity, the yen carry trade. A week after publishing the article, Japan had a stunning election. As a result, its new Prime Minister, Sanae Takaichi, now controls both the ruling party and the legislative agenda with a supermajority. Her unexpected win and decisive control of its legislature will remove the political gridlock and indecisiveness that have plagued Japan. Japan now has a single decision-maker with both the authority and time to implement policy. Given that Japanese policies have a significant impact on the yen carry trade and global liquidity, Sanae Takaichi's actions will have consequences well beyond Japan.

The Nikkei jumped by more than 5% on the election, while its bond yields rose, as shown below. The market is betting that Sanae Takaichi will follow through on her campaign promises of aggressive fiscal stimulus, including reductions in the consumption tax. Sanae Takaichi also promised strategic investments in technology and infrastructure to boost Japan's global competitiveness, reduce inflation, and raise wages. While her proposals are stock market-friendly, they risk further destabilizing its bond market and the yen. However, there are rumors that she may sell Japanese assets to help fund her fiscal spending plans, thereby not placing the onus for stimulus on the bond market.

It is worth noting that the Prime Minister has much greater influence over the Bank of Japan (BOJ) than the US government has on the Fed. Accordingly, Sanae Takaichi may prompt the BOJ to resume its aggressive actions to stabilize both the yen and yields. Doing so will lessen any impact of changes in Japan's fiscal policies on the yen carry trade. Stay tuned!

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed the technical backdrop of the markets as the market rally on Friday recovered the 20-day moving average, keeping the bullish trend alive. Furthermore, we discussed in this past weekend's newsletter whether Technology stocks were dead or an opportunity. Part of that discussion centered on the very overbought condition of value stocks relative to growth stocks, with the surge in value stock performance leading to a rotation in our Factor Rotation Model back into growth. To wit:

"Conversely, while tech stocks stumbled, capital rotated into value. Energy, Financials, and Industrials outperformed on a relative basis, and even small and mid-caps held up better. However, as we noted in our Daily Market Commentary, that push into value stocks is now grossly extended. Investors should consider taking profits and rebalancing risk."

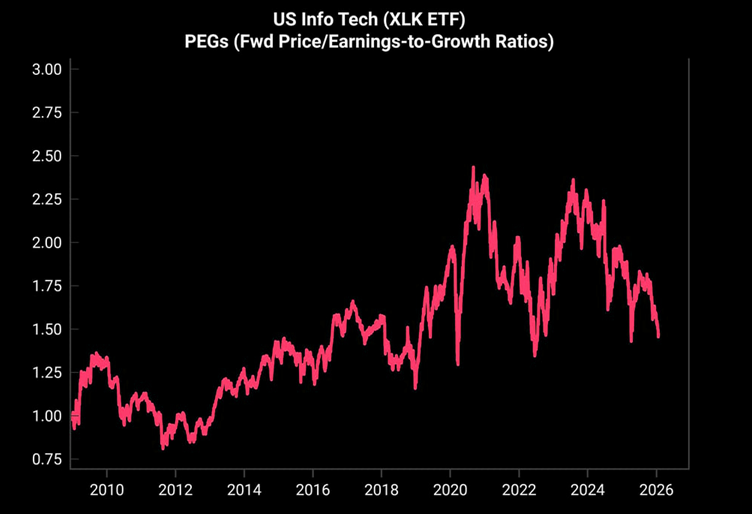

Starting on Friday, the market began a rotation back into technology names, which propelled the market higher on Friday and again yesterday. There are a couple of reasons the market is likely to rotate back into growth stocks, aside from the technical backdrop: US tech stocks have already seen a significant de-rating. With forward PEG ratios now trading near 5-year lows, the "froth" has largely come out of the sector despite the long-term growth story remaining intact.

Ed Yardeni also recently chimed in on the selloff in Technology stocks.

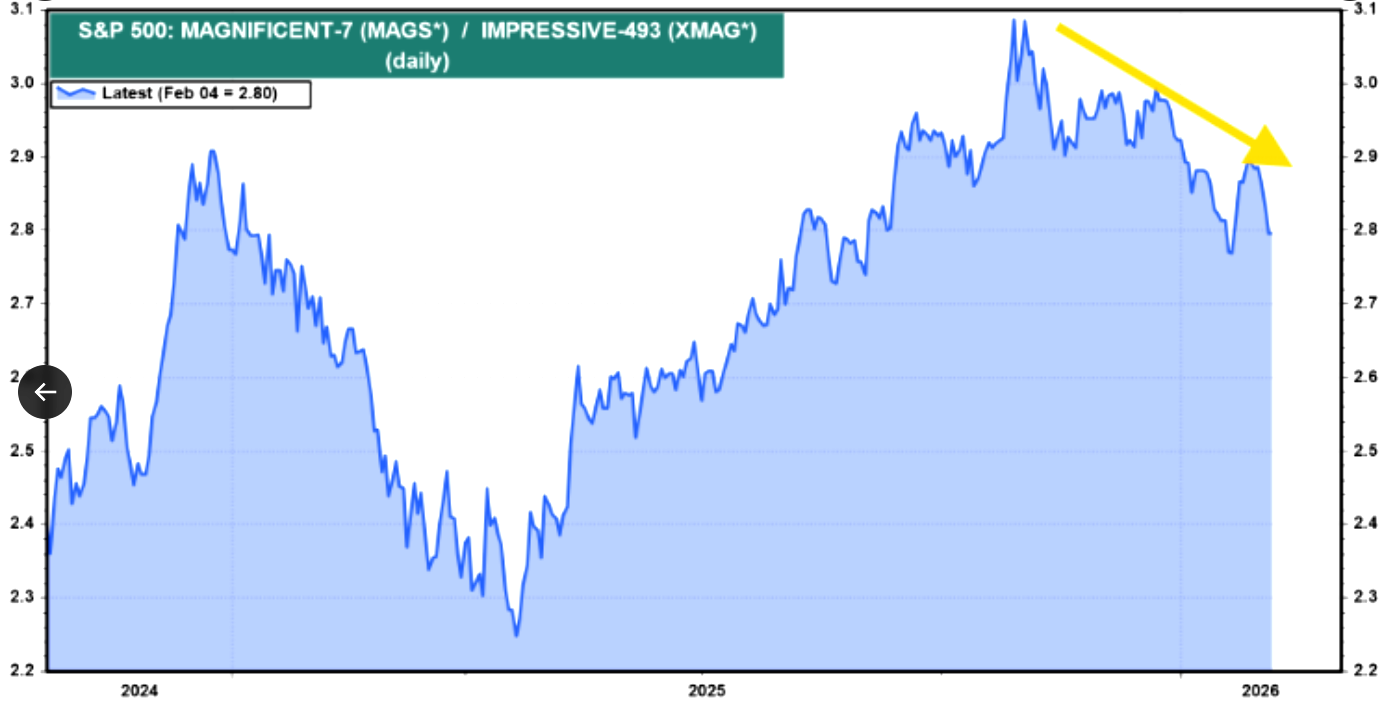

"The ratio of the S&P 500 Magnificent-7 ETF (MAGS) to the Impressive-493 ETF (XMAG) peaked at a record high of 3.09 on November 3, a few days after Michael Burry trashed the AI trade in an October 27 post. It is down to 2.76 around noon Thursday. The selling of both the Mag-7 and, more broadly, the tech sector may be getting a bit overdone. There are certainly AI-related tech stocks that will make lots of money in this space."

Given the heavy selling of technology stocks over the last week, it is not surprising to see capital flowing back into the sector amid better fundamentals. Notably, this does NOT mean the selling risk is over for these stocks; however, after fairly deep declines in stocks like Microsoft, an entry point to add exposure to portfolios is likely nearing.

Continue to manage and monitor risk accordingly.

Utilities Stocks: Waiting On Yield Trend?

Over the last three months, we have seen a strong rotation from technology and communications toward more economically sensitive sectors, such as industrials, materials, and transportation. Moreover, value stocks have well outperformed growth stocks. However, while the rotation has included almost all of the sectors, the utilities sector has largely been left out. As the SimpleVisor graphic below shows, utilities are currently at fair value on our relative analysis basis. Further, the graph on the right side shows the sector has been rotating between oversold (bottom left) and fair value (middle).

This raises the question of what might make utilities outperform on both relative and absolute bases. The answer may likely sit with bond yields. Recently, bond yields have been very stable. Even with good or bad news, the change in yields has been minimal. It might just be that utilities are waiting for a trend in yields to develop. Might the plummeting Truflation data shown in the second graphic precipitate a change?

Speculative Narrative Unwinds

For nearly two years, markets were driven by the same speculative narrative that “this time is different.” Bitcoin, precious metals, and AI-linked equities rose not only because of robust fundamentals, but also because investors clung to powerful narratives about inflation, disruption, and monetary collapse. Those speculative narratives are not only seductive but also contribute to investment behaviors that obscure reality.

Bitcoin was cast as “digital gold,” a hedge against a largely false tale of a weakening dollar and fiscal instability. Gold and silver were likewise falsely elevated as defensive stores of value in a monetary regime supposedly at risk of losing purchasing power. AI stocks became shorthand for a new productivity supercycle where profits would follow indefinitely rising valuations. These speculative narratives are fine and drive bull markets in the near term. As John Maynard Keynes once quipped: “Markets can remain irrational longer than you can remain solvent,” and those narratives are potent as they frame expectations and justify positions.

However, these speculative narratives have little to do with economic or fundamental realities that will ultimately drive outcomes. In markets, stories don’t replace valuation. As I noted previously, when “valuation metrics are excessive… it is a better measure of investor psychology than fundamentals.” That means price becomes more about sentiment than business results, and we see that in the relationship between consumer sentiment about stock prices over the next 12 months and valuations.

“This broad wave of bullish behavior isn’t isolated to sentiment surveys. Positioning data, equity fund inflows, and trading behavior confirm the lack of bears in the market. Markets are rising not because of strong earnings or economic acceleration, but because of optimism about future prices. In this environment, price momentum drives buying, not fundamentals. We see that in the overlay of consumer sentiment about higher prices versus valuations. Simply, investors are willing to overpay on expectations that things will continue to improve.”

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Sanae Takaichi And The Yen Carry Trade appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter