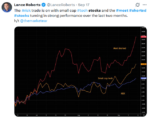

Over the last couple of weeks, we have shared evidence that supports the reflationary narrative and some that defies it. Today, we share the latest ISM Manufacturing data, which lends credence to the reflationary narrative.

The ISM Manufacturing survey showed a big improvement in sentiment, as shown below. The gauge shot up 4.7 to 52.6, well above expectations of 48.5. The increase was the second-largest increase in this century! The survey components were equally promising with new orders, a forward-looking indicator, up to 57.1 from 47.7. The ratio of new orders to inventory stands at 1.19, the highest since 2021. Prices paid ticked up slightly to 59, and employment rose to 48.1. While the gain in employment is good news, the index remains below 50, indicating contractionary conditions. It's worth adding that many foreign ISM manufacturing surveys are also pointing higher. Confidence appears to be growing after last year's tariff turbulence.

Interestingly, despite the sharp improvement in sentiment, numerous comments in the ISM manufacturing survey were less positive than the data suggest. Might there be a "K" shaped recovery within the manufacturing sector?

What To Watch Today

Earnings

Economy

Market Trading Update

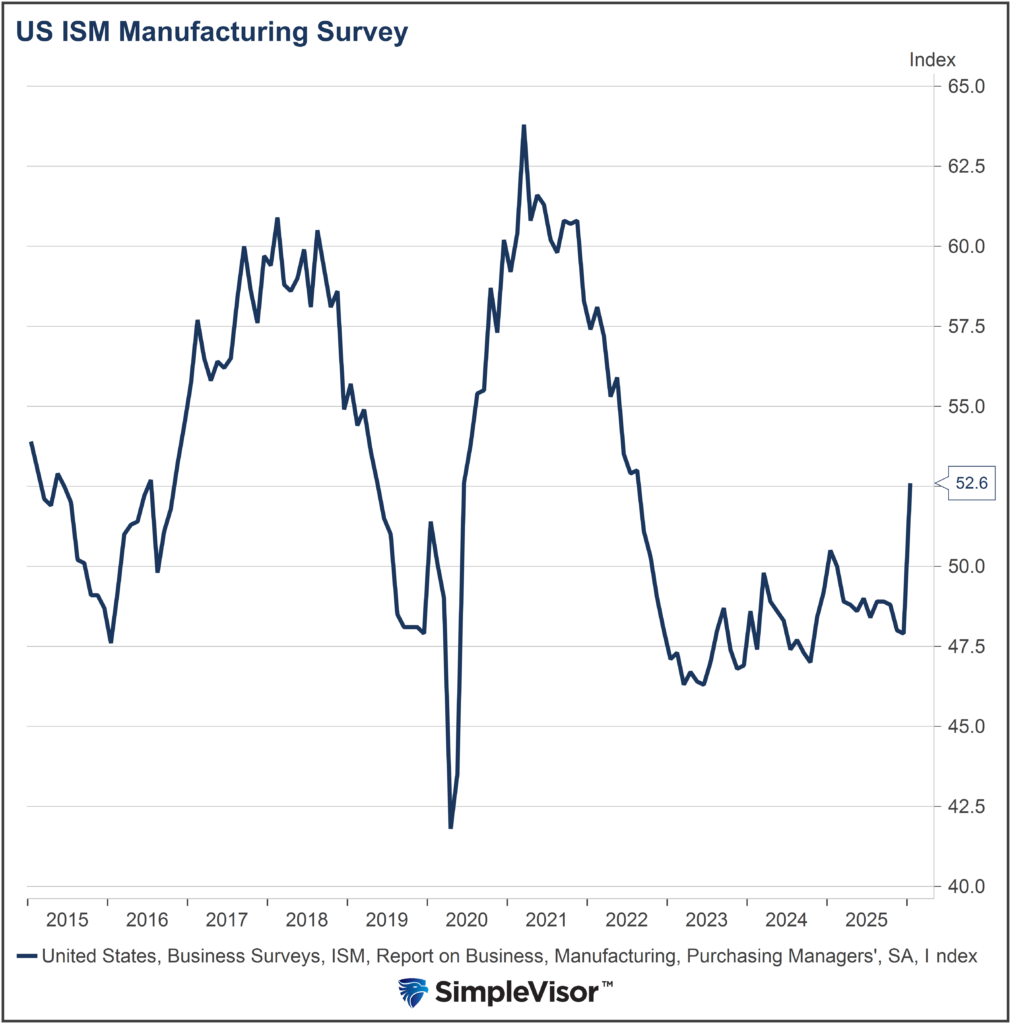

Yesterday, we noted the performance data for the month of February and the market as a whole, which were both positive in January. However, while the bullish bias remains currently, there is a continued breakdown and rotation between growth and value stocks. As shown, value has been outperforming growth since November, and has broken above moving average resistance, suggesting the value trade could last for a while longer.

However, the growth side of the equation is increasingly oversold and unloved, which has historically been a signal of a rotation back from stability to growth. As shown, Technology has moved from very oversold back to more oversold.

You can see this a bit better in the factor analysis, where momentum/growth is now very oversold, while perceived "value" factors are overbought. The exception to that rule is the Microcap factor which is pure speculative trading and is extremely extended and overbought.

While these short-term factors can certainly persist longer than logic would suggest, the eventual rotation from value back to growth is becoming more likely. Such is particularly the case if economic data continues to improve and the AI narrative regains traction, which is likely given the strength of earnings and revenue growth by these companies so far.

What the data suggests is that investors who are long the markets and factors that are overbought and extended take profits, rebalance holdings back to targets, and look for great companies that have been beaten up recently.

After all, isn't the goal of investing to "buy low/sell high?"

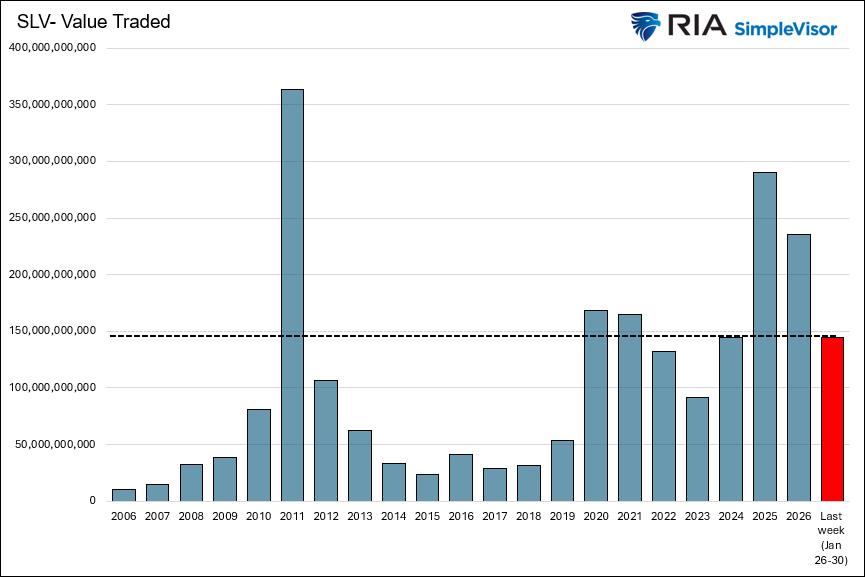

Silver- Did Retail Investors Get Over Their Skis?

While the recent drawdown in silver was not easy predict, there was one omen that it was overdue for a sharp reversal. This warning sign was surging ETF volume. ETFs are predominantly traded by retail investors, who tend to chase trends in their latter innings.

The first graph below shows the dramatic increase in the dollar amount of silver traded in the SLV ETF this year. Consider these facts:

- On January 26, $38.133 billion of SLV traded.

- Dating back to 2006, the amount traded solely on January 26th was more than the annual amounts in seven different years.

- In fact, it is 13% of the total traded in all of 2025.

- Moreover, the dollar value traded last week (January 26-30) was over $144 billion, surpassing all but five of the 21 years shown.

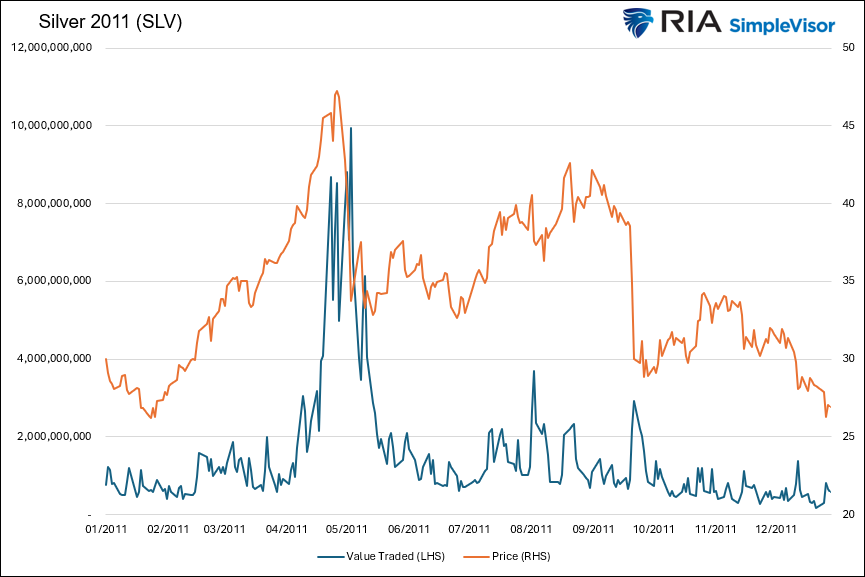

The incredible volumes in the silver ETF (SLV) leave little doubt that retail investors are actively trading silver. To add some context to what this might mean, we share the second graph below, which shows the prior bubble peak in late April 2011. As shown, the price in April 2011 spiked and peaked. During that final surge, the daily volume exploded by about 10x. The price surge and massive increase in SLV trading volume were unsustainable. Is today different?

Walmart Joins The Trillion Dollar Club

On Tuesday, Walmart's market cap eclipsed $1 trillion. In doing so, it joins 9 other S&P 500 stocks with market caps over $1 trillion. The list is almost entirely composed of technology companies, except for Walmart and Berkshire Hathaway. It's worth noting that health care giant Eli Lilly is also teetering on a $1 trillion market cap.

Walmart has quintupled its market cap in the last ten years via the following strategies:

- Building out its online platform

- Broaden appeal to higher-income shoppers

- Same-day delivery offerings

- Invest in AI and other automation to improve efficiency and profit margins

Walmart's decision to move its stock listing from the NYSE to the Nasdaq underscores management’s effort to reframe Walmart not merely as a traditional retailer, but as a technology-enabled distribution and logistics platform. These actions more than paid off, as shown below.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post ISM Manufacturing Supports Reflationary Forecasts appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter