Crypto Leads Large Fintech Equity Rounds; Exit Activity Accelerates

Crypto Leads Large Fintech Equity Rounds; Exit Activity Accelerates

2026-02-19

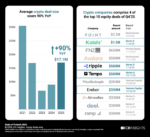

In 2025, the cryptocurrency and blockchain sector attracted some of the largest venture capital (VC) rounds in the fintech industry, reflecting investors’ optimism about the space’s potential to create new financial infrastructure, and deliver high‑growth returns, according to new data released by market intelligence platform CB Insights.

Of the 10 largest VC rounds of Q4 2025, four went to companies operating in digital assets, trading infrastructure, and crypto-enabled financial services, the data show. These transactions involved:

Kalshi, a US-based prediction market platform which secured US$1 billion in a Series E in December to support further consumer adoption, integration with additional brokerages, partnerships with news organizations, and expansion of product offerings;

Ripple,

Klarna Launches Stablecoin KlarnaUSD on Tempo Blockchain

Klarna Launches Stablecoin KlarnaUSD on Tempo Blockchain

2025-11-26

Klarna has announced the launch of its first stablecoin, KlarnaUSD, marking a notable development for the company, whose CEO was previously sceptical about cryptocurrency.

The stablecoin will be issued on Tempo, a new independent blockchain developed by Stripe and Paradigm, which is specifically designed for payments.

Klarna is the first bank to launch a stablecoin on Tempo.

KlarnaUSD aims to streamline cross-border payments, which currently incur an estimated US$120 billion in transaction fees each year.

The company sees stablecoins as a means to reduce costs for both consumers and merchants.

Sebastian Siemiatkowski, co-founder and CEO of Klarna, said:

Sebastian Siemiatkowski

“Crypto is finally at a stage where it is fast, low-cost, secure, and built for scale. This is the beginning of

German Blockchain Funding Falls to Four-Year Low Despite $9.3B Venture Growth

German Blockchain Funding Falls to Four-Year Low Despite $9.3B Venture Growth

2025-11-19

CV VC, together with the Frankfurt School Blockchain Center, has released the German Blockchain Report 2025, analysing venture capital activity in Germany’s blockchain sector from Q3 2024 to Q2 2025.

While overall German venture funding rose, blockchain-specific investment declined, representing the lowest share of national venture activity in four years.

Globally, venture funding reached US$411.9 billion across 21,872 deals, up 19.5% year-on-year, although deal counts fell 14.2%.

North America accounted for 63.1% of global funding.

Europe raised US$59.9 billion across 5,708 deals, down 8.7% in funding and 20.9% in deal volume, with a median deal size of US$2.5 million, below the global median.

Germany attracted US$9.3 billion across 522 deals.

Funding was up 10.4% but deal numbers fell

UBS Completes Tokenised Fund Workflow Using Chainlink DTA Standard

UBS Completes Tokenised Fund Workflow Using Chainlink DTA Standard

2025-11-05

UBS has completed an in-production, end-to-end tokenised fund workflow using the Chainlink Digital Transfer Agent (DTA) technical standard.

The transaction involved an on-chain subscription and redemption request for the UBS USD Money Market Investment Fund Token (uMINT), a money market fund built on Ethereum distributed ledger technology.

DigiFT acted as the on-chain fund distributor, using the DTA standard to process the subscription and redemption order.

The workflow supports all stages of the fund lifecycle, including order taking, execution, settlement, and data synchronisation between on-chain and off-chain systems.

Mike Dargan, Group Chief Operations and Technology Officer at UBS, said:

Mike Dargan

“Through our UBS Tokenize initiative, we are committed to supporting the development

Deutsche Bank Conducts First Euro Cross-Border Payment via Partior Blockchain

Deutsche Bank Conducts First Euro Cross-Border Payment via Partior Blockchain

2025-09-25

Deutsche Bank has conducted its first euro-denominated cross-border payment using Partior’s blockchain platform.

The transaction was carried out in collaboration with DBS, Southeast Asia’s largest bank by assets, with Deutsche Bank acting as the settlement bank and DBS as the beneficiary bank.

Deutsche Bank invested in Partior in 2024 and finalised a platform agreement in May 2025 to provide real-time, secure, and scalable settlement.

This live transaction marks a key step in the development of Deutsche Bank’s cross-border payment solutions for financial institution (FI) clients.

Deutsche Bank and DBS, a founding shareholder of Partior, worked to ensure the blockchain network was interoperable with traditional payment rails, allowing the transaction to be executed across different

US Fed Has Limited Impact on Stablecoin Lending Rates

US Fed Has Limited Impact on Stablecoin Lending Rates

2025-09-05

New research has indicated that the US Federal Reserve’s monetary policy has only a limited effect on stablecoin lending rates, according to a conference at Warwick Business School.

Presenting at Warwick Business School’s Gillmore Centre for Financial Technology Academic Conference on DeFi and Digital Currencies, Andrea Barbon of the University of St. Gallen analysed 2.5 million transactions of US dollar-backed stablecoins on the DeFi platform Aave.

The conference, held at WBS London in The Shard, was attended by representatives from the European Central Bank, the Bank for International Settlements (BIS), Banque de France, and leading fintech academics worldwide.

Researchers highlighted the growing popularity of stablecoins and Donald Trump’s new Genius Act, which regulates cryptocurrency,

Bitwise Lists 5 Crypto ETPs on SIX Swiss Exchange

Bitwise Lists 5 Crypto ETPs on SIX Swiss Exchange

2025-09-05

Pure-play digital asset manager Bitwise has listed five of its flagship crypto ETPs on the SIX Swiss Exchange this week.

The listings provide investors with additional options to gain exposure to the cryptocurrency market, including staking and index ETPs.

Bitwise’s range of crypto ETPs consists of financial instruments designed to integrate with traditional portfolios, offering exposure to digital assets as an asset class.

In August 2025, Bitwise reported that client assets across its 40 investment products had surpassed US$15 billion, a 200% increase since October 2024.

Switzerland remains a key market for Bitwise in Europe, serving both retail and professional investors.

The country has historically been an early adopter of digital assets, both in terms of market development and